Summary:

- Amazon’s strong competitive moat and undervalued status based on DCF and PEG make it a buy at current prices.

- Retail sales remain weak but should regain ground with improving consumer sentiments and future rate cuts.

- AWS continues to impress with re-accelerated revenue growth and expanding margins on the back of cost optimization attenuation by enterprises.

- Decelerating growth in third-party seller services and advertising services is a major concern that can erode Amazon’s network effects.

4kodiak/iStock Unreleased via Getty Images

Executive summary

Amazon (NASDAQ:AMZN) share price fell ~9% after it reported mixed 2Q24 results on 01 Aug 2024. While earnings per share outperformed at $1.26 vs. $1.03, revenue came in lower than expected at $147.98 billion vs. $148.76 billion forecasted. It also guided its 3Q24 revenue to be between $154 billion to $158.5 billion, lower than analysts’ forecast of $158.2 billion. However, the dip has been fairly short-lived as major indices such as the S&P 500 (SP500) and Nasdaq (NDX) rallied strongly in recent weeks due to a rebound in retail sales, a decline in jobless claims and most recently, interest rate cuts signaled by Fed Chair Powell on 23 Aug 2024.

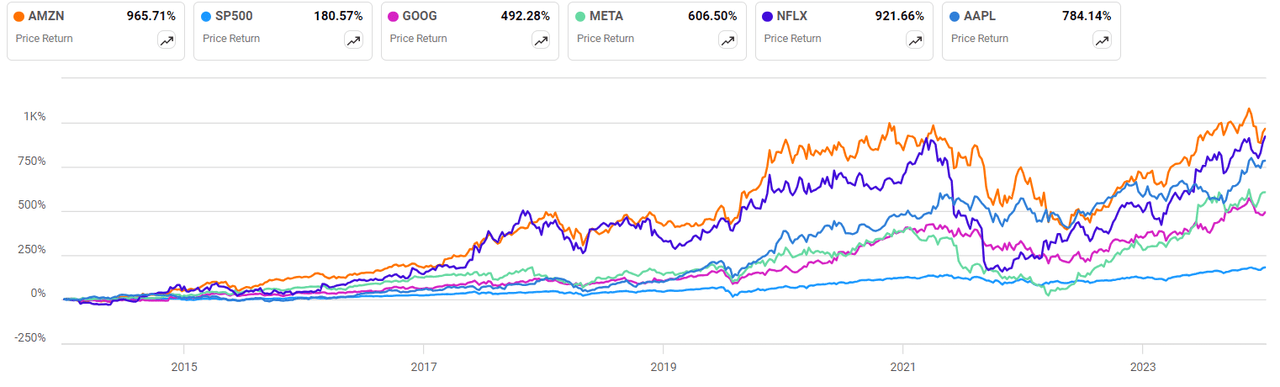

I have always regarded Amazon as a high quality company with strong competitive moats. Its synonymity with online shopping, economies of scale and market leading position in cloud computing are key reasons why I have been a shareholder in Amazon since 2016. In fact, I have been adding positions whenever there is a dip and this includes the most recent drop where Amazon’s share price briefly touched the $155-$160 range. After all, Amazon has been a strong compounder and has outperformed the S&P500, as well as, other respectable FAANG stocks like Google (GOOG), Meta (META), Netflix (NFLX) and Apple (AAPL) by a fairly wide margin over the last 10 years.

Seeking Alpha

However, Amazon’s evolution into a global technology powerhouse has also come with increased complexity, higher competitive intensity and greater operational risks in the various markets and segments that it now operates in. In this article, I wanted to examine if Amazon can continue to sustain its competitive advantage and whether it’s a buy, hold or sell at current prices.

Segment performance

Amazon’s businesses comprise the following segments

-

Online stores: Ecommerce sales and digital products sold on transactional basis

-

Physical stores: Product sales from physical stores

-

Third-party seller services: Commissions, fulfillment and shipping fees from third-party seller services

-

Advertising services: Sale of advertising services to sellers, vendors, publishers, authors, and others, through programs such as sponsored ads, display, and video advertising

-

Subscription services: Recurring fees collected from Amazon Prime Memberships and other digital products

-

Amazon Web Services: Provides cloud computing services such as machine learning, compute, storage, databases, networking and more

-

Others: Sales from certain licensing, distribution of video content, healthcare services, and shipping services, and co-branded credit card agreements

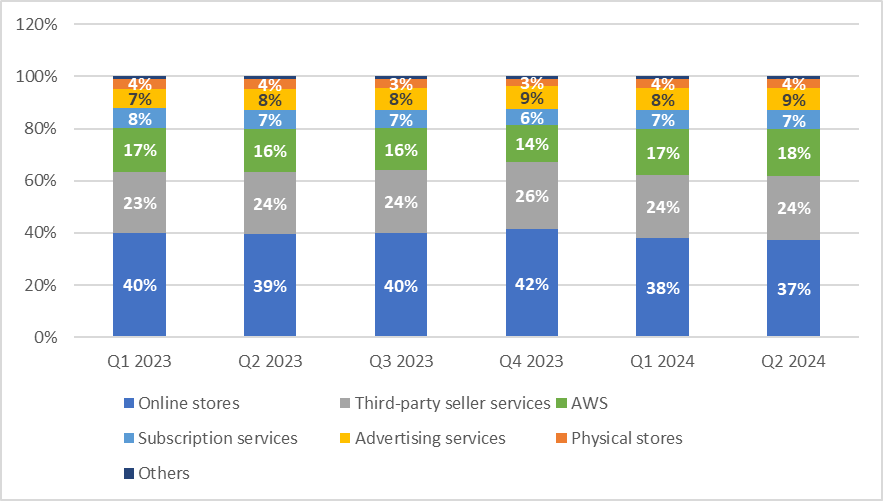

Author’s representation based on data from Amazon’s filings

From a revenue contribution perspective, Amazon’s online stores accounted for the largest revenue % for Amazon at 37%, followed by third-party seller services at 24% and AWS at 18% in Q2-2024.

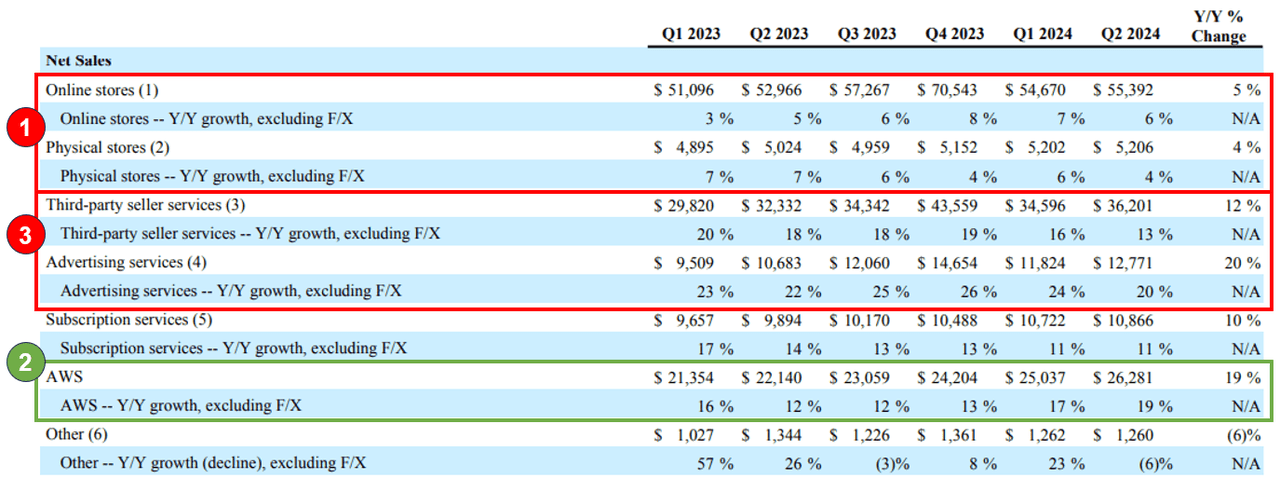

Amazon’s Q2-2024 earnings release

Retail sales remain weak

Amazon’s performance for its online and physical stores segments were unsurprisingly poor. Amazon’s online sales grew 6% YoY and 1% QoQ while physical store sales grew 4% YoY and was flat QoQ vs Q1-2024. This is echoed by Amazon’s CEO Andy Jassy who states that “we’re seeing lower average selling prices, or ASPs, right now because customers continue to trade down on price when they can. More discretionary higher ticket items, like computers or electronics or TVs, are growing faster for us than what we see elsewhere in the industry, but more slowly than we see in a more robust economy”. Multiple large retail players such as Home Depot (HD) and Lowe’s (LOW) have also reported slower consumer demand and cautious sales outlook due to anxiety about the economy. Personally, I consider consumer cyclicality and muted spending due to recession fears to be short-term events that may affect Amazon in the next few quarters but are unlikely to have any long-term repercussions on the company. As such, I would not be too concerned if the slowing growth is primarily attributable to the slowdown in the entire retail industry.

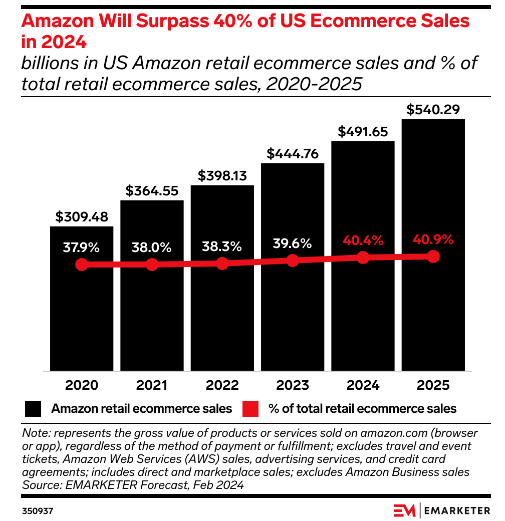

The bigger question now is whether Amazon is losing market share and competitive edge to other retailers. The retail space is fiercely competitive with large retailers like Walmart (WMT), Amazon, Costco (COST), Home Depot and e-commerce players like eBAY (EBAY), Temu and Shein. If we were to look at overall retail sales, Amazon is the second-largest retail player behind Walmart. In terms of ecommerce sales, it is the clear number 1 player in the United States with a dominant market share of ~40% in 2023 (closest competitor is Walmart at 6%) and is expected to grow this market share further in 2024 and 2025. Even if we were to include international players like Pinduoduo, Taobao, Amazon is still among the market leaders for e-commerce sales by GMV.

emarketer

Given Walmart’s legacy dominance in the retail space and aggressive expansion efforts of Temu and Shein in the US, it is prudent to consider if Amazon will lose its market share to these competitors in the future. Temu, in particular, has managed to capture $9 billion GMV and attracted 100 million users to its platform by positioning itself as the e-commerce platform for budget-conscious shoppers in a period of economic uncertainty. Personally, I consider these fears to be overdone, and I have confidence in Amazon’s ability to defend its market position effectively. Firstly, Amazon’s extensive logistics platform is unmatched by its competitors. Efficient and fast delivery times is one of the key requirements for customers and Amazon has been able to deliver goods swiftly, some of which are done within the same day or next day. While Walmart has been trying to do the same, Walmart’s delivery capabilities and infrastructure are largely limited to deliveries in the United States. On the other hand, Temu and Shein require 6-22 days and 1-4 weeks respectively because they primarily rely on cross-border shipping from China. Such fulfillment and delivery infrastructure requires significant time and CAPEX to build up, and I just do not see how its competitors are able to catch up, especially with Amazon committing $50-60 billion annual CAPEX for the last 3 years.

Secondly, we should not underestimate the loyalty program by Amazon. Amazon Prime currently boasts more than 200 million members, as compared to the 59+ million members that Walmart has for its Walmart+ program. These membership programs are strong drivers for customer loyalty and increase switching costs on Amazon’s platform. Amazon has grown its Amazon Prime members from 46 million in 2015 to 200+ million members today. Lastly and more importantly, Amazon’s third-party marketplace is highly complementary to its own retail channels as it continues to attract more buyers and sellers on its platform, thereby reinforcing the network effect of the overall Amazon’s platform. While other e-commerce competitors like Temu and Shein are also realizing the network effects on their platform, their current scale is nowhere near that of Amazon.

AWS continues to impress

AWS is perhaps the brightest spot for Amazon in this earnings report. The 2 biggest positive takeaways for me are the re-acceleration of top-line growth for AWS and its expanding margins.

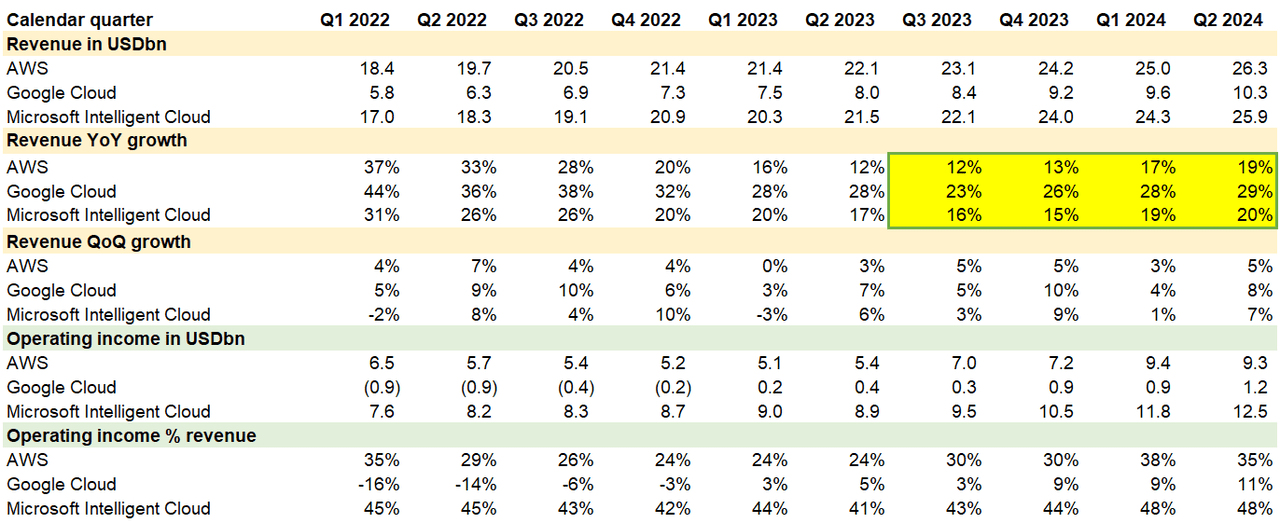

On top-line, AWS grew its revenue 19% YoY and 8% QoQ. This is impressive considering that it has an annualized revenue run-rate of ~$105 billion and is still the dominant market leader in the highly competitive market with Microsoft Azure and Google Cloud in the mix. As of 2Q-2024, AWS captured 32% of the cloud market, vs 23% for Microsoft Azure and 12% for Google Cloud. The re-acceleration of revenue is driven by the growth of both generative AI and non-generative AI workloads after over a year of customer workload optimization, as well as, the large new cloud contracts signed by Amazon. Besides the large enterprise contracts signed with Salesforce (CRM), Nvidia (NVDA), BMW (OTCPK:BMWYY), Amazon has also recently secured a $2 billion contract with the Australian government to establish a top-secret data cloud infrastructure. The re-acceleration of revenue growth is consistent across all 3 hyperscalers when we look at all their YoY revenue growth. This is a welcoming change after several quarters of slower growth, and likely marks the end of post-pandemic IT cost optimization efforts for enterprises.

Author’s representation based on data from Amazon, Google and Microsoft filings

Note that Microsoft (MSFT) does not break out Microsoft Azure’s results independently, so I opted to use Microsoft Intelligent Cloud results here.

Notwithstanding the strong top-line growth, I think there is further upside for Amazon because we are likely going to see an increase in contribution from AI workloads towards the overall cloud spend. Personally, I believe that generative AI applications are still in a nascent stage and could evolve into multi-billion industries in the coming years. Furthermore, unlike Microsoft, Amazon does not have the benefit of GitHub and OpenAI that can meaningfully drive generative AI applications at scale from the get-go. That said, Amazon has been investing heavily in AI applications and use cases, as outlined in CEO Andy Jassy’s 2023 Letter to Shareholders. Notably, Amazon announced an $4 billion investment in Anthropic, a competitor of OpenAI to bring generative AI applications to AWS customers.

On the bottom-line, AWS has also expanded its margins meaningfully from 24% in Q2-2023 to 35% in Q2-2024. While management has mentioned that AWS operating margins should fluctuate over time due to the level of investments made, I am still impressed by the level of consistency in the margins since 2022 and the meaningful expansion in operating margins from mid-20% to mid-30% in the span of a year.

Decelerating growth in third-party sales services and advertising

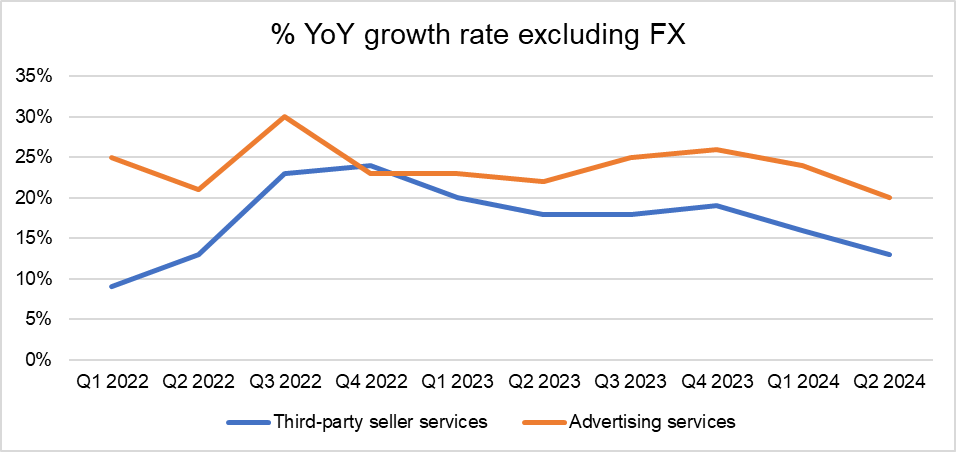

Author’s representation based on data from Amazon’s filings

Decelerating growth in third-party sales services and advertising is perhaps the most concerning thing I have seen from Amazon’s earnings report. From a revenue contribution perspective, third-party seller services and advertising services are the 2nd largest revenue and 4th largest contributor and make up 24% and 9% of Amazon’s Q2 2024 revenue respectively. Given the scale, I was surprised that analysts did not probe further on these segments during the earnings call.

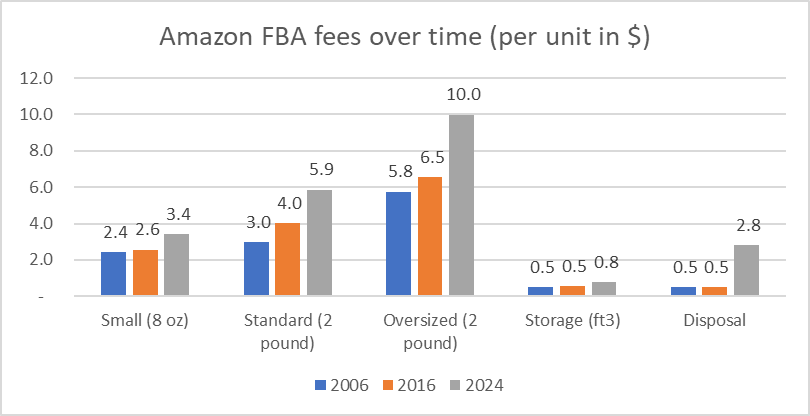

Starting with third-party seller services, its YoY revenue growth has fallen from 18% in Q2 2024 to 13% in the most recent quarter. As a third-party seller on Amazon myself, I have always considered this to be a great business because Amazon does not assume any inventory risk and simply collects fees from storage, delivery and fulfillment of third-party seller orders. Amazon does not disclose the margins on its third-party seller services, but it should be making a good margin given its economies of scale. To figure out why third-party seller services revenue growth is declining, I wanted to see what third-party sellers are saying as the fall is likely due to a decline in volume rather than price since Amazon has been raising prices since it launched its Fulfillment by Amazon (“FBA”) services in 2006. I went through multiple forums, including Amazon’s own seller discussion group, and the complaints from third-party sellers were primarily due to price hikes. Indeed, if we were to examine Amazon’s history of FBA price increases, we can see that delivery prices for standard 2 pound packages, storage fees and disposal fee per unit have increased 96%, 63% and 460% respectively. There have been fairly consistent yearly price revisions since 2014 and this has greatly impacted small sellers who are already running on tight margins. Consequently, some of them are forced to switch to competitors like eBay managed delivery, Shopify fulfillment network, ShipBob, etc. This is a concerning trend because it can erode Amazon’s platform network effects over time.

Author’s representation based on data from Smartscout

Equally, we see a similar trend for its advertising business. Its advertising services YoY revenue growth has fallen from mid 20% in 2022 and 2023 to 20% in the most recent quarter. While the decline is less obvious than what we see for third-party seller services, I am concerned that advertising is a lagging figure, and we may see further deceleration in upcoming quarters. This is because one of the largest clientele base for Amazon’s advertising services are the third-party sellers who use sponsored products, brands, display and TV to advertise their products. If more third-party sellers leave the Amazon platform for competitors, we are likely going to see a double whammy on Amazon’s financials, as both third-party seller services and advertising services would decline.

Valuation

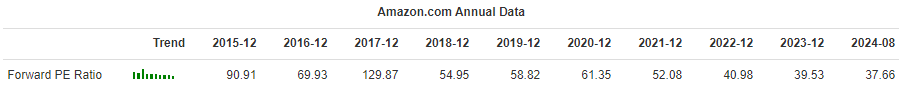

At 31x forward P/E, Amazon is certainly not considered cheap when compared with the key players in the retail industry – Walmart is trading at 32x, eBAY at 19x, MercadoLibre at 55x, Alibaba at 14x, JD.com at 9x. However, I would argue that Amazon is superior to the majority of the names listed in terms of growth, profitability, competitive advantage and investment risk. If we were to look at it from a PEG perspective, Amazon only trades at 1.6x forward PEG, which puts it lower than Walmart at 3.5x and eBay at 2.4x. If we were to extend the universe to include some of the Magnificent 7 stocks given that Amazon is constantly compared to the best-in-class names, we would also see that Amazon’s PEG is lower or comparable to Microsoft at 2.4x, Google at 1.3x and Apple at 3.4x. If we were to compare Amazon’s forward P/E ratio with its own historical, we can also see that it is trading near its 10-year low.

Gurufocus

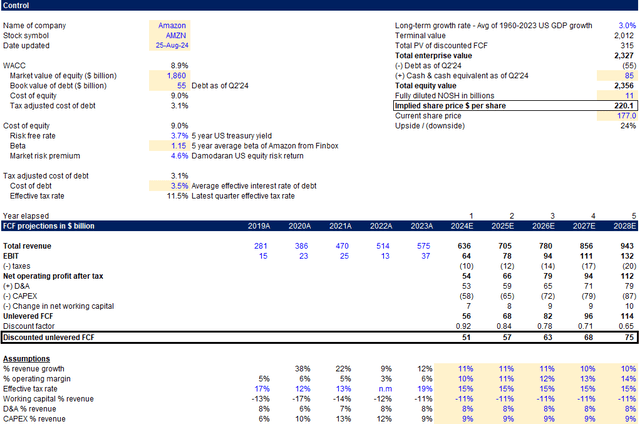

I also ran a discounted cash analysis on Amazon and below is a summary of my output and key assumptions

-

WACC of 8.9%: Based on latest market inputs and Amazon’s capital structure (see screenshot for references)

-

Beta of 1.15: 5-year average Beta of Amazon from Finbox

-

Long-term growth rate of 3%: Based on US average GDP growth rate from 1960 to 2023 from Worldbank

-

% revenue growth: Based on Seeking Alpha’s analyst estimates

-

% operating margins: For 2024, I used the average Q1-2024 and Q2-2024 operating margin of 10%. Assumed 1% annual increase subsequently

-

Other assumptions like working capital, D&A, CAPEX: Assumed flat vs 2023

-

Effective tax rate: 5-year historical average due to volatility

Author’s calculation

With the above DCF, I arrived at an implied share price of $220.1 per share for Amazon, implying a 24% upside from its current price of $177. The major risk here is whether management can continue to deliver on operating margin expansion, as I have assumed a 10% operating margin for Amazon in 2024 (based on its Q1-2024 and Q2-2024 average) and baked in a 1% increase yearly thereafter. I believe this is reasonable because Amazon has successfully increased its operating margins by ~1% every quarter since Q1-2023 (Amazon’s operating margin has increased from 4% in Q1-2023 to 10% in Q2-2024). At the same time, management is also pursuing aggressive cost cuts, as outlined in their 2023 shareholders letter. On the flip side, I am not sure if we are being too conservative on the revenue growth. A 10% YoY growth pretty much assumes that we have reached a steady state in terms of growth for the next 5 years, since Amazon has grown at 9.4% and 11.8% over the last 2 years. I am generally bullish on a re-acceleration of Amazon’s retail sales, as well as, continued growth for AWS that is driven by cost optimization attenuating, bigger deals and larger AI workload requirements. That said, I have kept revenue growth % flat, in line with analysts’ estimates to be conservative.

Conclusion

All things considered, I would rate Amazon a BUY at current levels. While I would have loved to pick up more Amazon shares at the $155-$160 range a few weeks ago, I believed that Amazon is still relatively undervalued today based on forward PEG multiples and DCF. Amazon’s strength in AWS and dominance in retail sales should continue to generate significant free cash flow for the business. Macro tailwinds in the form of improving consumer sentiments, future rate cuts and attenuation of cost optimization for enterprise customers should also be beneficial for Amazon as it gears up for its next leg of growth. That said, I would be cautious about the decelerating growth for third-party seller services and advertising services. For now, those segments are still growing, but Amazon needs to be especially careful to not force third-party sellers away from its platform and erode its network effects. This was a key competitive advantage that made Amazon what it is today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.