Summary:

- Altria Group achieved its 55th consecutive year of dividend increases, with quarterly dividends tripling since the 2008 spin-off.

- MO’s high dividend yield of ~8% raises questions about sustainability, but financial metrics indicate strong coverage and potential for growth.

- I am trimming my position in this stock but will remain a loyal shareholder.

krblokhin

Altria Group, Inc. (NYSE:MO) has announced its 55th consecutive year of dividend increase as covered here by Seeking Alpha. The world of investing is filled with adages, repeated ad nauseam at times. But Altria is a living embodiment of “time over timing” as the company’s quarterly dividend has now more than tripled since the spin-off in 2008. And without much fanfare, if not downright skepticism surrounding it.

I have a history of covering dividend increases of my favorite stocks. The article linked here was written after Altria’s 2023 dividend increase. Let’s see how the numbers look after the 2024 increase. To ensure readers can compare the company’s progress (or regress) in dividend metrics, I am retaining more or less the same structure as the 2023 article linked above. Let us get into the details.

Can Altria Continue Paying Its High-Dividend?

55 years of dividend increase sounds great, but what about the future? How good is Altria’s dividend health now in comparison to a year ago? Let’s find out. As a reminder, after last year’s increase, Altria’s yield was ~9%, and I had used the term “junk zone” given the disdain with which the market was treating the stock.

- Altria’s total shares outstanding: 1.706 billion, a 3.60% reduction YoY thanks to the company’s share repurchase programs.

- New quarterly dividend per share: $1.02, which is a 4% increase

- Average quarterly Free Cash Flow [FCF] needed to cover dividends: $1.74 billion (that is, 1.706 billion shares times $1.02/share)

- Altria’s average quarterly FCF over the last 5 years: $2.077 billion, a 5.43% increase in the last year. This is quite remarkable that a company that is constantly under attack (perhaps, with reason) was able to improve its FCF organically by greater than 5%.

- Payout ratio using 5-year quarterly FCF: 83.77% (that is, $1.74 billion divided by $2.077 billion), down from the 88% last year.

- Altria’s forward EPS for FY 2023: $5.10/share, a mere 2% increase in comparison to last year. Food for thought: a 2% increase in earnings but a 5% increase in FCF means the company’s operational efficiency is through the roof as usual.

- Payout ratio based on forward EPS: New annual dividend of $4.08 divided by $5.10, which is 80%, a slight nudge up from the 78% last year. Expanding on forward EPS a little, Altria is expected to grow its EPS at an anemic average of 3%/yr over the next 5 years. This should be fairly easy to accomplish for two reasons: (1) despite operating in a declining industry, Altria’s revenue went up 3% (not per year) in the last 5 years while its cost of revenues went down nearly 12% in the same period. (2) Altria is more than halfway towards its 2028 goal of generating $5 billion in smoke-free revenue, generating $2.7 billion in 2023. Altria’s required growth rate to meet this target is less than the expected Compound Annual Growth Rate [CAGR] of 16% for the U.S. smokeless market through 2030.

Altria EPS Projection (Seekingalpha.com)

Except the EPS based forward payout ratio, Altria’s dividend metrics look better in 2024 in comparison with 2023. Once again, for a company under constant scrutiny, this is remarkable that the numbers are generally improving YoY. It shows that sticking to the basics is not a terrible idea: do what you do best and do it as efficiently as possible. A relentless focus on shareholders is not a bad addition to the mix, either.

Extrapolation & Outlook

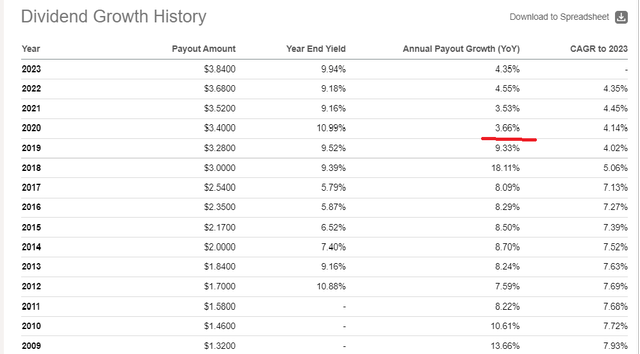

Altria is slowly but surely settling into a new era when it comes to its dividend, as the company is following through on its still new dividend policy of “mid-single digits” dividend increases. As shown in the table below, the last 4 (5 if you include the 2024 increase) have all been around the 4% mark. Unless the company’s smoke-free targets are substantially exceeded, we should expect more of the 4% increases in the near future.

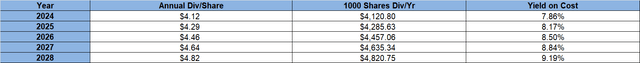

The table below is a quick extrapolation on expected yield on cost, assuming Altria sticks with the 4% dividend increase. The yield on cost for someone buying at $52 will still be more than 9% in 5 years, which is down from the 11% during last year’s review. This is primarily due to the increase in share price, resulting in a lower starting yield.

Please note: 2025 annual dividend is calculated as follows – the current $1.02 for each of the first 3 quarters and a 4% increase in the 4th quarter. Each subsequent year assumes a 4% increase from the previous year’s annual dividend. In short, the table is based on pay date and not ex-dividend date.

Overall, Altria’s dividend seems well covered, and future returns should be satisfactory based on the yield on cost calculated above.

But, I Am Trimming

As good as the numbers above seem, I am trimming my stakes in Altria here. Below are a few reasons.

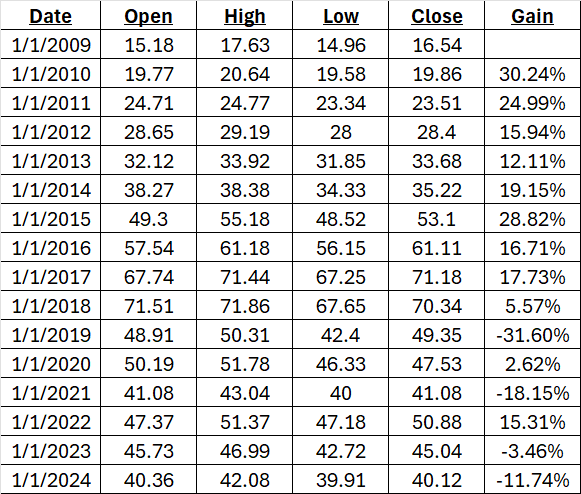

1. Altria is up 30% YTD (excluding dividends) and 30% runs don’t happen too many times for stocks like Altria. In fact, since the 2008 spin-off, Altria has had only one full year with > 30% gain, and that was the first full-year post the spin-off in 2009. In other words, the 30% YTD gain represents nearly 4 years of dividend payments based on current yield and I, personally, find this too good of an opportunity to not trim.

Altria Annual Gains (Author, With Data From Yahoo Finance)

2. As a consequence of the surge in the stock price this year, Altria’s current yield is below the 5-year average of 7.95%. While this is still significantly higher than the market’s average yield, the fact remains that Altria is still operating in a terminally declining industry that is susceptible to political environment risks. Hence, I believe buying Altria should be done when things don’t look too rosy for the stock.

Altria 5-Year Yield (YCharts.com)

3. The last reason is my portfolio related. Thanks to years of reinvesting at lows and accumulating shares in the $30s (and maybe below), Altria was already my highest position (10%) before 2024’s run. As of this writing, Altria’s weightage in my portfolio has gone up to nearly 14%. While I believe in letting winners run, I also believe in reasonable diversification (my definition of reasonable is having enough stocks that I can meaningfully analyze and track around my usual work and personal schedule).

Conclusion

In my 2023 article, I had written that I plan to hold Altria as long as the three factors below remain intact:

- pricing power

- operating discipline

- dividend increasing each year

They do remain intact, but with a 40% (including dividends) return this year alone, I feel compelled to trim my stakes in this wonderful company. However, I am retaining my “Buy” rating on the stock if you don’t have an exposure to it or do not have a full position yet. With interest rates about to fall, a safe, near 8% return is still very attractive. If the stock breaches $60 (like 2015 to 2017), I’d be downgrading it to a “Hold”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.