Summary:

- Nvidia Corporation will probably post a result beat in revenues and margins, simply because it has a phenomenal track record of doing so over the past 78 quarters.

- Instead, I expect the market’s focus to be on the revenue guidance beat/miss. The market’s expectations are sky-high here, as other semi stocks have been punished for in-line guidance.

- Downward revisions in Nvidia’s top clients’ capex spend expectations lead me to have low expectations for Nvidia’s revenue guidance, and a cautious stance for a potential post-earnings stock dip.

- I still think a 43x 1-yr fwd P/E is not excessive for Nvidia, given its rapid growth at high margins.

- Technically, vs. the S&P 500, there are very few reasons to be bearish on Nvidia.

Dilok Klaisataporn

Performance Assessment

My last article on Nvidia Corporation (NASDAQ:NVDA) issued a “Buy” rating as argued for why the stock was not yet in a hype cycle. Since then, the performance has been mostly in-line (a small 0.61% lag) vs the S&P 500 (SPY, SPX):

Performance since Author’s Last Article on NVIDIA (Seeking Alpha, Author’s Last Article on NVIDIA)

My View Ahead of Q2 FY25 Earnings

As we get close to Q2 FY25 earnings on 28 August 2024 (post-market), my view on Nvidia is frankly getting a bit clouded as my bottom-up fundamental signals point to reasons for caution. However, the higher timeframe technicals vs. the S&P 500 are still very bullish:

- Nvidia will probably post a result beat in revenues and margins

- But the focus should be on the revenue guidance beat/miss

- Downward revisions in top clients’ capex spends provide reasons for caution

- Recent price movements are driven by valuation multiple changes not earnings expectations

- Technically, there are very few reasons to be bearish.

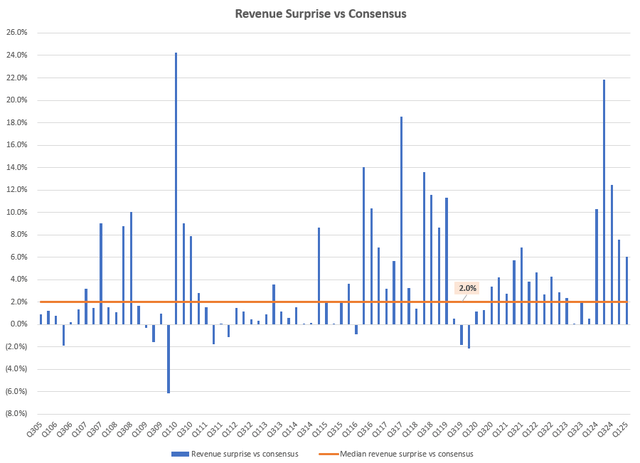

Nvidia will probably post a result beat in revenues and margins

Currently, 43 Wall Street analysts’ consensus revenue estimates for Nvidia stand at $28.71 billion, which corresponds to 113% YoY growth. I am confident that Nvidia will post a revenue beat result vs. consensus expectations simply because it has an excellent track record of doing so; it has had only 9 misses in the past 78 quarters, with a median beat of 2%:

Revenue Surprise vs Consensus (Capital IQ, Author’s Analysis)

On the EBIT margins side, consensus estimates have penciled in 65.7%. Here too, the strong execution track record of Nvidia suggests that a beat is more likely; 17 misses in the past 78 quarters, with a median beat of 148bps:

EBIT Margin Surprise vs Consensus (bps) (Capital IQ, Author’s Analysis)

Hence, I don’t anticipate much disappointment on results delivery.

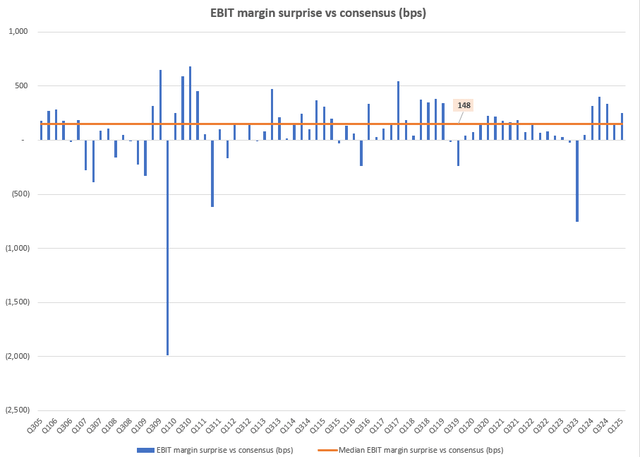

But the focus should be on the revenue guidance beat/miss

I think the market’s reaction will hinge on the revenue guidance delivery. In the current environment, semiconductor stocks such as Micron (MU) have been punished (8% drop after hours reaction upon earnings release, 30% drop since last earnings release on 26 June, 2024) for merely meeting revenue guidance expectations even with better than expected results. I believe this is a clear sign that the market has very high expectations of the semiconductor darlings.

What this could mean for Nvidia is that a strong revenue guidance beat vs. expectations is required, lest the stock be vulnerable to a sharp sell-off. Now, on the revenue guidance too, Nvidia has excelled expectations:

Revenue Guidance Surprise vs Consensus (Capital IQ, Author’s Analysis)

However, note that since the famous 51% beat in Q2 FY24, the degree of revenue beats in subsequent quarters has steadily declined. Perhaps this is a sign of the market pricing getting more “full” on Nvidia.

Downward revisions in top clients’ capex spends provide reasons for caution

I believe one approach to get a sense of the puts and takes behind Nvidia’s guide is to simply look at the key revenue drivers. According to Bloomberg and Barclays Research, 40% of Nvidia’s revenues come from 4 main companies:

| Company | NVIDIA Revenue Contribution |

| Microsoft (MSFT) | 15% |

| META (META) | 13% |

| Amazon (AMZN) | 6.2% |

| Alphabet (GOOG) (GOOGL) | 5.8% |

| Total | 40% |

Hence, the capex spends of these 4 companies are a key monitorable. And to be precise, for the purposes of Nvidia’s revenue guidance beat vs. miss anticipation, I contend that the delta (change) in capex revisions is the key variable that matters:

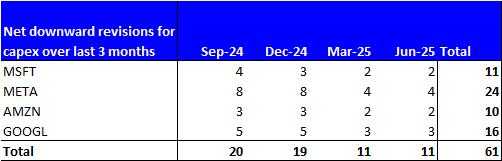

Net Downward Revisions in Capex for Hyperscalers over last 3 months (Company Filings, Author’s Analysis)

Over the past 3 months, consensus estimates for capex spends for all 4 of Nvidia’s top customers have all seen a net downward revision for each of the next 4 quarters. For the upcoming quarter for which Nvidia’s guidance will be based upon, there are a total of 20 downward revisions.

After looking at this data, I have low expectations of a revenue guidance beat for Nvidia in the upcoming quarterly results. And after what we’ve seen with Micron’s (MU) stock reaction for a merely in-line guidance, I wouldn’t be surprised if there is a similar sell-off in Nvidia stock.

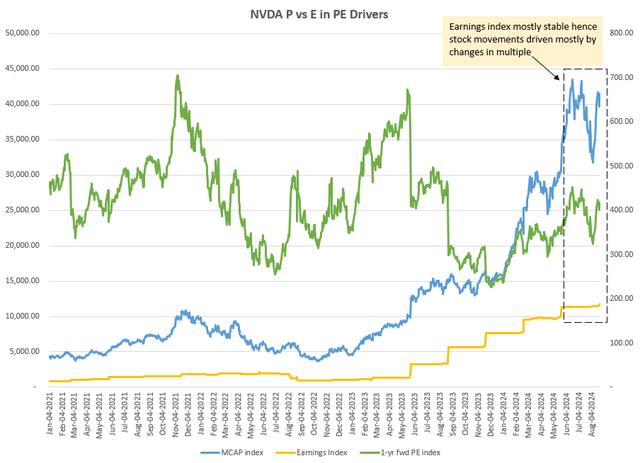

Recent price movements are driven by valuation multiple changes not earnings expectations

Nvidia’s 1-yr fwd P/E is at 43.2x, which is virtually unchanged from what it was in my last piece on Nvidia. Please revisit that article to understand my reasoning for why I believe this PE level is not at extreme levels given Nvidia’s strong growth prospects and high margin delivery.

For a couple of quarters now, it looks like Nvidia’s stock value as measured by market capitalization movements is driven mostly by changes in the implied valuation multiples since the earnings expectations have not materially changed:

NVDA P vs E in PE Drivers (Capital IQ, Author’s Analysis)

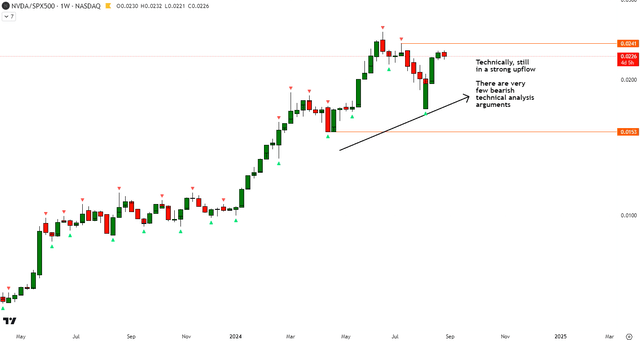

Technically, there are very few reasons to be bearish

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of NVDA vs. SPX500

NVDA vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

From a relative technical analysis perspective vs. the S&P 500 (SP500), Nvidia remains in a powerful uptrend. There is no sign of an equal low, let alone a lower low, to signify slowing buyer momentum or bearish pressure. Indeed, I see very few bearish technical analysis arguments.

Options market is pricing in positives but no blowout earnings

According to Susquehanna analyst Christopher Jacobson, the option pricing for Nvidia ahead of earnings implies an upward skew but does not deem a blowout earnings result as likely. From a volatility risk perspective, the market is anticipating a 9.35% swing.

Takeaway & Positioning

I think Nvidia is likely to post a revenue and margins result beat for Q2 FY25 earnings, simply because it has a phenomenal track record of doing so over the past 78 quarters. Instead, for the earnings reaction, I expect the market’s focus to be on Nvidia’s revenue guidance vs. consensus expectations. Here too, Nvidia has a good record of issuing beats, however the degree of exceeding expectations has gradually narrowed in recent quarters.

Data on net downward revisions on the market’s capex expectations for Nvidia’s 4 top customers (Microsoft, Meta, Amazon, and Alphabet) makes me have low expectations for Nvidia’s upcoming revenue guide for Q3 FY25. Given signs that the stock market is leaving no room for even a pass-score on the hot semiconductor names (as evidenced by Micron’s 8% post-earnings drop following a better than expected results and merely in-line guidance combination), this makes me cautious about a negative reaction in the case of a weaker or even in-line revenue guide.

To offset that caution, however, I note that the stock continues to trade at the same valuation as it was in June 2024 when I last covered the stock. At that time, I argued for why given Nvidia’s absolute growth prospects and high margins, the 43x 1-yr fwd P/E level was not excessive. I still believe that today. Finally, I note that the relative technicals of NVDA vs. the S&P 500 are strongly bullish.

After weighing these puts and takes, I am rating the stock a “Neutral/Hold” ahead of Q2 FY25 earnings.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.