Summary:

- Shares of Acadia trended lower this year due to Daybue’s poor quarterly sales performance, and also due to Nuplazid’s failure in the phase 3 trial in schizophrenia patients.

- The full-year guidance on Daybue was reduced as Acadia is finding fewer new patients, not because of higher patient churn.

- With most of the headwinds in the rearview mirror, I expect better performance of Daybue going forward.

- Nuplazid’s strong performance remained largely unnoticed given the investor focus on Daybue.

- Other key pipeline projects are on track with ACP-204, and ACP-101 progressing in phase 2/3 and phase 3 trials, respectively.

Spencer Platt/Getty Images News

ACADIA Pharmaceuticals Inc.’s (NASDAQ:ACAD) stock has underperformed significantly this year as investor concerns about Daybue’s uptake persist, and Nuplazid’s failure in the phase 3 trial as adjunctive treatment of schizophrenia was another contributing factor.

I acknowledged the realistic possibility of Nuplazid (pimavanserin) failing in the schizophrenia trial in my February article as previous trial’s results were not convincing, and I did not consider it crucial for Acadia’s long-term success.

On the other hand, Daybue represents a significant part of Acadia’s valuation and needs to perform better if we are to see the share price trend higher in the following quarters. The performance in the last three quarters was disappointing, and while management was warning about the bolus effect from last year becoming a headwind this year, they were forced to reduce the full-year guidance range, albeit for a different reason – lower-than-expected new patient starts.

However, Daybue’s underlying growth trends are not as bad as Acadia’s valuation suggests, and I still see it as a product capable of generating more than $800 million in global annual sales before the end of the decade. My optimism is based on the impact of last year’s bolus of patients being fully in the rearview mirror and the underlying real world retention metrics looking better than the open-label extension data from the clinical trial.

Nuplazid delivered a positive surprise in the second quarter and the company increased the full-year guidance range and announced plans for increased promotional efforts in the following months with an expected impact on sales in 2025. This part was neglected by investors, but rightly so because Nuplazid is now a mature product with not nearly as much room for growth as Daybue is perceived to have.

With positive cash flows, good long-term top and bottom-line growth prospects, and a maturing and expanding pipeline, I continue to see Acadia as well-positioned for long-term growth.

Daybue disappoints again – but not for reasons stated by Acadia bears

The ongoing bearish theme since the launch of Daybue was that its adverse event profile (mainly gastrointestinal side effects such as diarrhea) will lead to discontinuation of treatment by the majority of Rett syndrome patients. This is, indeed, a problem for the drug, but its severity has been overstated by Acadia bears, and gastrointestinal side effect management was not part of the phase 3 clinical program.

Management was also warning about the bolus of patients waiting to start treatment when Daybue was launched last year and their warnings materialized in the form of increased numerical discontinuation rates that the company was unable to counteract with new patient growth since the fourth quarter of 2023.

However, the reason Daybue is underperforming this year is not the higher-than-expected discontinuation rates due to the mentioned bolus as management has included the estimated impact in the full-year guidance range. The reason is the lower number of new patient starts and management lowered the full-year net sales guidance range for Daybue from $370-$420 million to $340-$370 million.

Daybue’s performance in the last three quarters is certainly disappointing relative to expectations, but I believe the major headwinds are now behind it and there are some tailwinds as well:

- The lingering effects of last year’s bolus are now over.

- Acadia now has plenty of experience throughout the calendar year and will be better prepared to weather the seasonal headwinds such as those seen at the start of the year when the number of Rett clinic days substantially decreased.

- The gastrointestinal side effect management is becoming better and real world data point to better retention of patients than in the open-label extension trial. As a reminder, Acadia shared that approximately 40% of patients in the long-term open-label extension trial remained on Daybue for several years now and that the 9-month retention rate in the real world is 58% versus 47% in the long-term open-label extension trial.

The initial demand for Daybue was coming from the centers of excellence for Rett syndrome patients and the company estimates approximately one-quarter of diagnosed patients are going to those centers. This means there is significant additional demand to be unlocked outside of these centers – in community practices, and this is where the company’s focus has turned. This will take time as the volume of patients is much lower in each community practice. And as mentioned, this is the primary reason for the lowered guidance this year – the company not finding enough new patients to reach the initial full-year net sales guidance range.

There were approximately 900 patients on Daybue in early August and approximately 1,500 have tried Daybue since last year’s launch. This leaves about two-thirds of diagnosed 5,000 patients in the United States, and the company estimates that the prevalent population is between 6,000 and 9,000, leaving additional room for patient identification.

Going forward, we should also see some of the patients who discontinued Daybue restart treatment, especially now that physicians are more familiar with how to deal with the gastrointestinal side effects. Overall, I see more tailwinds than headwinds for Daybue going forward.

Going back to the recent growth trends, management says that sales are tracking slightly below the mid-point of the reduced full-year guidance range and that we should see sequential growth in both Q3 and Q4. If these trends hold up, Q3 sales should be around $89-$91 million and Q4 sales should be in the $96-$98 million range. If sales are within those ranges, I believe market confidence in Daybue’s long-term growth trajectory will start to improve and that Daybue’s net sales can be at least $430 million in 2025, and possibly somewhat higher if we include some modest contribution from Canada.

Given the long-term retention trends in the open-label extension trial and Daybue so far outperforming those retention rates in the real world, I am still fairly confident Daybue can at least reach the low end of my $800 million to $1 billion global net sales range in 2028. Daybue would need to have a steady state treatment rate of 1,500-1,700 patients in the U.S. to reach $600-$700 million in annual net sales in the United States, based on an estimated net price per patient per year of approximately $400,000, and the rest should come from ex-U.S. territories.

The approval in Canada is expected in the fourth quarter and a launch should follow in the first quarter of 2025, and the submission in Europe is expected in the first quarter of 2025, and if approved, the launch is expected in the first half of 2026. The discussions with regulatory authorities in Japan are ongoing, but Acadia will need to conduct some clinical work there before it can get approved. This means material ex-U.S. sales will not come before the second half of 2026.

Acadia estimates that there are 600 to 900 Rett syndrome patients in Canada, 1,000 to 2,000 in Japan, and between 9,000 and 14,000 in Europe. Daybue will be eligible for orphan pricing in all territories, and I believe it is not a stretch to expect Daybue to generate at least $200 million in ex-U.S. net sales by 2028.

Acadia is putting some money back into Nuplazid after outperformance in the first half of the year

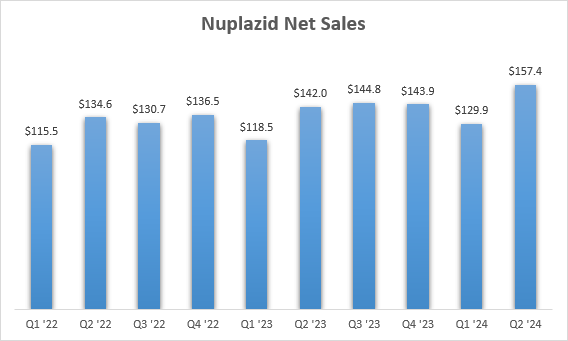

Acadia exceeded the Q2 analyst consensus despite Daybue missing growth expectations. This was due to Nuplazid’s outperformance. Nuplazid net sales grew 11% Y/Y to $157 million in the second quarter. This was its third double-digit Y/Y growth quarter in the last four quarters.

Acadia Pharmaceuticals earnings reports

The growth was driven by the stabilization of the Parkinson’s disease market following the COVID-19 pandemic, the real world data published last year showing decreased mortality risk of patients taking Nuplazid compared to other antipsychotics, and the September 2023 label change that clarified that Nuplazid can be used in Parkinson’s disease patients who also have dementia.

The company raised the full-year guidance range for Nuplazid from $560-$590 million to $590-$610 million and management also said it will be putting more money to work to promote Nuplazid due to the improved outlook in the Parkinson’s disease psychosis market, the effects of which are expected to be seen in 2025.

Given the near complete focus of investors on Daybue, this positive development either went unnoticed or was largely neglected, and I am pleased to see Nuplazid delivering growth again. That said, it is still primarily a source of significant cash flow for Acadia (more than $300 million of “fully burdened” cash flow a year, according to management) and I would still treat it as that – a source of cash flow the company is reinvesting in the pipeline.

After Nuplazid’s failure in schizophrenia, the focus turns to two other mid- and late-stage pipeline projects

Nuplazid’s failure in the phase 3 trial in negative symptoms in schizophrenia earlier this year was disappointing but not very surprising. My probability of success estimate that I shared in my February article was slightly better than a coin toss at 55% and the lack of confidence was based on the previous data where Nuplazid barely met the primary endpoint in the combined population. The reason for optimism ahead of the readout was the higher efficacy of the higher dose in the previous trial.

With no way forward for Nuplazid in schizophrenia, the company’s focus is shifting towards the two late-stage candidates – the next-generation version of Nuplazid called ACP-204 and ACP-101 for the treatment of hyperphagia in patients with Prader-Willi syndrome (‘PWS’).

ACP-204 is now enrolling patients in the phase 2 portion of the potentially registrational phase 2/3 trial, and ACP-101 is actively enrolling PWS patients in the phase 3 trial. Management did not provide a timeline for the completion of the two trials other than suggesting that ACP-101 is likely to be the first to deliver data. My assumption is that we will have to wait for the first half of 2026 to see updates from either trial. The ClinicalTrials.gov pages show estimated completion dates and ACP-101’s estimated completion date is May 2026 and the date for ACP-204 is January 2028, but ACP-204’s estimate includes the phase 3 portion of the trial and I expect the phase 2 data to be available in the first half of 2026.

Valuation looks very attractive at current levels, positive cash flow allows for pipeline expansion

I continue to like Acadia’s long-term growth prospects. Daybue still looks on track to become a larger product than Nuplazid, and Nuplazid itself is growing again and outperforming expectations. I believe these products leave plenty of room for an upward movement in the share price and that the pipeline gets no credit at all.

The market cap is $2.6 billion, the enterprise value is $2.1 billion as Acadia had $501 million in cash and equivalents and no debt at the end of June. At an enterprise value/revenue ratio of around 2.4, good annual cash flows (between $135 million and $185 million expected this year), decent long-term growth prospects for Daybue, and as of recently even Nuplazid, and a healthy and expanding pipeline, I see Acadia as well-positioned to deliver long-term shareholder value.

Risks

The main risk in the near term is the poor sentiment around Daybue continuing to pressure the stock and Daybue continuing to underperform Street expectations and even the company’s reduced guidance range. I am fully acknowledging these risks even though I believe the current valuation assumes a far worse future for Daybue compared to what is it delivering.

I see no major downside risks for Nuplazid on the revenue expectations side, but it still has residual intellectual property risk. The major legal win against MSN Pharmaceuticals from last year needs to be confirmed in the appeal which is awaiting oral arguments which are not yet scheduled. As a reminder, MSN sought to invalidate Nuplazid’s composition of matter patent and Acadia only needed to win on one of the two arguments and it won on both.

There is also the ongoing second case relating to Nuplazid against Aurobindo and (again) MSN. This is the “classic” case where Aurobindo and MSN are seeking to market a generic version of Nuplazid, not the case I covered in my December 2023 article. The trial is scheduled for December 2024 with a court decision expected in the weeks or months after the trial. I believe it is unlikely Nuplazid will go generic before 2030, the time of the expiry of its successfully defended composition of matter patent (unless the court’s decision is very surprisingly reversed on appeal), and Acadia also has other patents which it intends to defend against these generic manufacturers. In December 2023, the court issued a claim construction order finding that Acadia says was in its favor on all disputed terms of the patent-in-suit.

There are no certain outcomes here, but I expect Acadia to successfully defend its IP on Nuplazid and that it will retain exclusivity until the settled date with other generic manufacturers, and this means a launch of a generic 10mg tablet of Nuplazid in September 2036, and of the 34mg capsule in February 2038.

The pipeline failure risks are ever-present for biotech companies, and they could put additional pressure on the stock if late-stage trials of ACP-204 and ACP-101 fail to meet the primary endpoint, but we should see no readouts between now and the first half of 2026 which leaves the Daybue growth risks and legal updates on Nuplazid as downside risks for the stock in the next 5-6 quarters.

Conclusion

So far, 2024 is not going in Acadia’s favor, but I believe the situation is not nearly as bad as the share price performance suggests. I continue to see Daybue as a product with good growth prospects, capable of generating at least $800 million in global sales by 2028, while Nuplazid remains a source of significant cash flows with improved growth prospects compared to the market’s previous expectations.

The pipeline is also progressing and getting little to no credit and I also expect it to expand in the following quarters through internal and external efforts.

Acadia is also in great financial shape with $501 million in cash and equivalents at the end of June and will likely end the year with close to or slightly more than $600 million.

The main events and catalysts in the next few quarters are primarily Daybue’s quarterly sales performance, legal updates on Nuplazid, and then Nuplazid’s quarterly sales and potential pipeline expansion through the promotion and advancement of internal candidates or externally through in-licensing deals or acquisitions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACAD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.