Summary:

- Lucid Group stock has declined by 36% in the last 12 months and is likely to remain in a downtrend.

- Lucid has disappointed on growth targets and faces challenges in meeting EBITDA breakeven before 2027, leading to potential equity dilution.

- The EV industry is shifting focus to low-cost cars, which may impact Lucid’s premium segment and delay EBITDA breakeven further.

JannHuizenga

Investment Overview

I am initiating coverage on Lucid Group, Inc. (NASDAQ:LCID) stock with a “Sell” rating. In the last 12 months, Lucid stock has declined by 36%, and I believe that the stock is likely to remain in a downtrend. This initiating coverage discusses the reasons to be bearish on this electric vehicle company.

It’s also worth noting that the correction in Lucid stock has been for an extended period. The stock was listed during the meme euphoria of early 2021  and went ballistic. The excitement was however short-lived and Lucid stock started trending lower from December 2021.

and went ballistic. The excitement was however short-lived and Lucid stock started trending lower from December 2021.

An extended period of decline does not make Lucid stock attractive. In my view, the stock will continues to remain in a downtrend amidst intermediate rallies from oversold levels. Lucid can be a stock that’s worth considering for trading, but not as an investment.

I must also mention that when Lucid was listed in 2021, the company was being touted as a Tesla, Inc. (TSLA) killer. A few years down the line, robust deliveries growth remains elusive for Lucid while Tesla maintains its position among the top EV companies globally.

Big on Promises and Disappointment on Execution

The quality of the management is one of the key factors in determining winners. A good management in an industry with challenges can create value. On the other hand, a bad management in an industry with tailwinds can erode value.

I am not exactly suggesting that the management team of Lucid Group is poor. However, I dislike the point of overpromising and significantly under-delivering. It’s better to remain conservative and beat expectations.

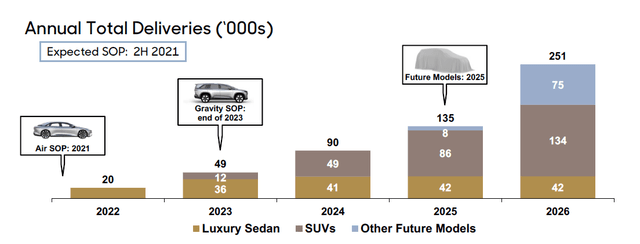

To elaborate, let’s go back to what Lucid Group targeted in 2021. In their first presentation (July 2021), Lucid Group targeted to deliver 49,000 cars in 2023. Further, for the next two years, the delivery target was 90,000 and 135,000 respectively.

Lucid Group Investor Presentation July 2021

Let’s compare this with the actuals. For 2023, Lucid delivered 6,001 vehicles. Further, for the first half of 2024, Lucid delivered 4,358 vehicles. Even if we consider an aggressive estimate, the company is likely to deliver 10,000 to 12,000 vehicles for the year.

Actuals are disappointing and nowhere close to the initial estimates. Additionally, the deliveries of Lucid Gravity were planned to start at the end of 2023. Currently, production is expected to commence in late 2024 with deliveries likely in 2025.

The key point is that Lucid is significantly lagging when it comes to initial targets. There is no doubt in my mind that the company scores high on technology. However, the bottom line is to attract consumers. While Tesla or BYD Company Limited (OTCPK:BYDDF) has the brand pull, it seems to be completely absent for Lucid.

The initial years are critical in terms of growth even if the cash burn is significant. Lucid has disappointed on the growth front. Li Auto Inc. (LI) is a good example from China. The company commenced delivery of NEVs in November 2019. Currently, Li Auto commands the third position in China’s NEV market.

Can Lucid make a big comeback in a market characterized by intense competition? I have my doubts even after considering the technological superiority of Lucid.

More Cash Burn and Equity Dilution

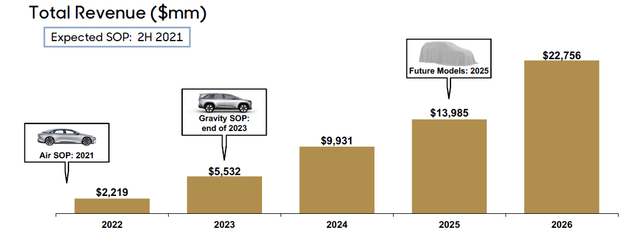

Before talking about the current cash burn, let’s revisit Lucid’s estimate of revenue and EBITDA breakeven. As the chart below shows, Lucid expected revenue to increase to $9.9 billion in 2024 on the back of 90,000 vehicle deliveries.

Lucid Group Investor Presentation July 2021

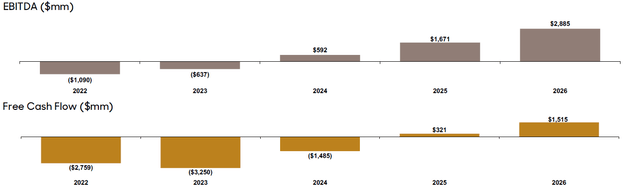

The company further indicated that EBITDA breakeven is likely 2024. I must mention that these are relatively optimistic projections. However, as a ballpark estimate, EBITDA breakeven is likely to come when deliveries are around 90,000.

Lucid Group Investor Presentation 2021

I mentioned earlier that for 2024, the best-case scenario might be 12,000 vehicle deliveries. Let’s assume that Lucid reports 100% deliveries growth in 2025 and beyond. It would imply 24,000 vehicle deliveries in 2025. Further, for 2026 and 2027, the deliveries can be estimated at 48,000 and 96,000 vehicles.

Therefore, it’s unlikely that Lucid Group will breakeven at the EBITDA level before 2027. Further, these estimates are optimistic considering the challenges the EV industry faces.

As of Q2 2024, Lucid reported a liquidity buffer of $4.28 billion. This is exclusive of a commitment of $1.5 billion today from an affiliate of the Public Investment Fund. Therefore, there is ample buffer to sustain the cash burn. Having said that, if EBITDA breakeven is likely in 2027, I expect further dilution of equity.

I would also like to mention that for the first half of 2024, Lucid Group reported an operating loss of $1.5 billion. For the comparable period in 2023, operating loss was $1.6 billion. My concern is that cost-cutting initiatives have not been enough to significantly narrow the losses.

A second point to note is that in an intensely competitive environment, prices must be lowered as an incentive. This will put additional pressure on key margins. Lucid stock might trend higher in the near term on the commitment for additional funding, but I don’t see this as a reason to celebrate.

Industry Shifting Focus to Low-Cost Cars

The electric vehicle industry has faced multiple challenges in the last 12 to 18 months. This includes macroeconomic headwinds and intense competition. Margins have been under pressure and EV stocks have underperformed.

My sense is that the industry has two focus points. First, the advancement of autonomous driving technology. Second, the manufacturing of low-cost cars that can boost delivery volumes and support growth in emerging markets.

As an example, Tesla is working on an unboxed manufacturing process that could reduce manufacturing costs by half. Similarly, Li Auto launched its lowest price model, Li L6, at $41,470. BYD’s low-cost EV Seagull is already having an impact in international markets.

This discussion is relevant because Lucid Group is focused on the premium EV segment. Lucid Pure has a starting price of $69,900 with Lucid Sapphire priced at $249,000. Project Gravity SUV that’s due for launch is likely to be priced under $80,000. Amidst macroeconomic headwinds, I don’t see deliveries accelerating meaningfully.

Lucid CEO Peter Rawlinson commented last year that “I am not here to build an expensive car that only rich people can afford.”

This is however few years away, and I believe that Lucid might be behind the curve when it comes to mass production of low-cost cars that potentially boost delivery growth.

Concluding Views

It’s worth noting that Lucid has 42 studios and service centers in North America, 8 in Europe, and 3 in the Middle East. The company is therefore well diversified from a geographic perspective.

However, the customer deliveries per studio are weak. As Lucid continues to expand its studio network, the cost is likely to escalate. It remains to be seen if Lucid Gravity will have a significant impact on growth in 2025 and beyond.

As I discussed, even if sales surge, EBITDA breakeven is unlikely before 2027. This is, in my view, an optimistic-case scenario. The implication will be in terms of equity dilution or leveraging. I therefore believe that the recent rally in Lucid stock is a good time to exit. The focus now is on the latest capital raise of $1.5 billion. In the next few quarters, the focus will shift back to deliveries growth and cash burn. There is unlikely to be good news on that front.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.