Summary:

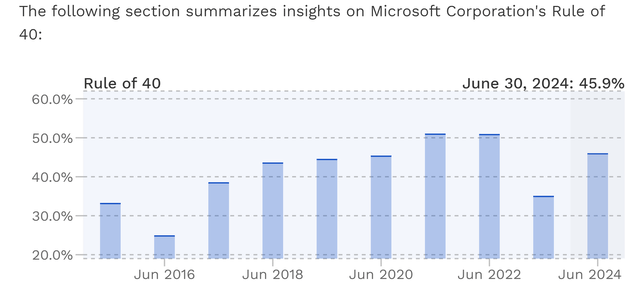

- Assessed by the rule of 40, Microsoft Corporation is a strong buy opportunity under current conditions.

- It offers an excellent balance of growth and profitability with a combined score of 45.9%, surpassing the 40% threshold of the rule.

- I also find discussion surrounding Microsoft’s valuation misleading.

- Its valuation multiple should be benchmarked against other companies that also pass this rule, not just the sector in general.

amgun

MSFT stock and the rule of 40

I last wrote on Microsoft Corporation (NASDAQ:MSFT) stock about a month ago, in July 2024. The article was titled “Microsoft Q4: Buy The Correction.” As you can already guess from the title, the article was a review of its FY 2024 Q4 earnings report (“ER”) and argued for a buy thesis based on the developments described in the ER. More specifically, my main argument was that:

Microsoft Corporation’s fiscal Q4 results, quite solid in my view, met with a market correction. New catalysts afoot point to both continued growth and the potential for margin expansion, with the latter underestimated by consensus. The stock price correction has also brought the valuation to a quite attractive level for long-term investors.

Today, I want to look past the quarterly results and examine the buy rating from a different perspective. In particular, I would like to argue that the stock is a rare case that strikes an excellent balance among growth, profitability, and also valuation judging by the so-called rule of 40 (referred to as the rule hereafter). For readers new to the rule, here are the key points needed for the remainder of the analysis (quoted from Wall Street Prep with slight edits from me):

The management teams of high-growth SaaS startups are often required to choose between rapid growth and expansion, or improving profitability – for which, the Rule of 40 has become a practical framework to balance the two concepts. The Rule of 40 – popularized by Brad Feld – states that a SaaS company’s revenue growth rate plus profit margin should be equal to or exceed 40%. Thus, the Rule of 40 measures the balance between a SaaS company’s growth rate and profitability. Profitability is typically measured by levered free cash flow (FCF) margin or EBITDA margin.

Against this background, you can see that MSFT has a strong scorecard following this rule in the following chart. Based on the financials from its latest quarter, its sum of growth and FCF margin is 45.9%, well above the 40% threshold. The score consists of a levered FCF margin of 30.2% and a revenue growth rate of 15.7%.

Next, I will examine the implications of the scorecard in more depth.

MSFT stock: Profit Margin and Growth

As just mentioned, the rule aims at measuring how well a balance the company strikes between growth and profitability. So here I will examine these factors individually in more depth.

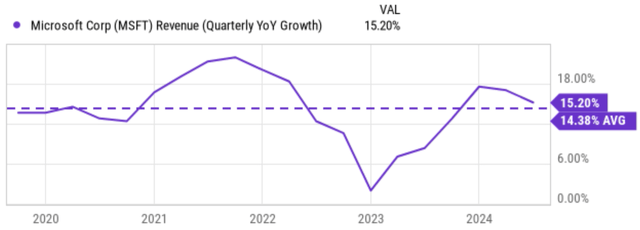

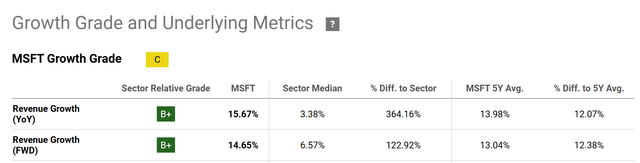

Let me start with growth. The chart below shows the quarterly YOY revenue growth for MSFT stock. It’s an impressive growth in my view for such a giant, with many quarters experiencing double-digit growth rates as seen. The average revenue growth over the past 5 years is 14.38%, and its TTM growth rate is 15.2%, in close agreement with the 15.7% quoted by the above source.

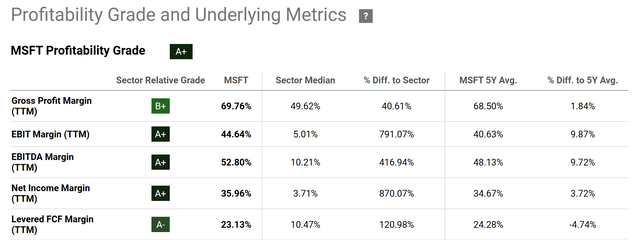

Moving onto profitability. The chart below shows MSFT’s profitability in comparison with the sector. As seen, MSFT’s profitability grades are consistently above the sector median and demonstrate superior financial performance across almost all metrics. Its EBIT Margin, EBITDA Margin, and Net Income Margin are significantly higher than the sector average, with percentage differences in the triple digits by most metrics. Since the rule typically uses levered FCF and EBITDA margins, let’s focus on these two metrics. As seen, its levered FCF margin is about 23%, lower but in reasonable agreement with the 30.2% quoted above.

My estimate points to a levered FCF margin of around 27%, somewhere in between these two numbers. My estimates were based on a projection of an FCF of $8.8 and revenues of $33 for FY 2024 on a per-share basis. With my estimate, the sum of its FCF margin and topline growth would be about 42%, still above the threshold of 40%. If we apply the EBITDA margin, then the margin itself (52.8%) would already surpass the threshold.

Finally, note that I mentioned MSFT is a rare species that strikes an excellent balance among growth, profitability, and also valuation by rule. The data here helps to justify the first part of the argument – the balance between growth and profitability. As seen in the above chart, the sector median FCF margin is only about 10.4%. Thus, for an average company in the sector to meet the rule, its growth rate must be about 30% YOY. To my knowledge, there are only a few companies in the sector that can maintain such growth rates. As illustrated by the next chart below, the average top-line growth rate is only between ~3% on a TTM basis and 6% on an FWD basis for the sector.

Next, let me justify the second part of my above argument – the valuation part.

MSFT stock: valuation

The rule does not involve valuation. I think the underlying thinking here is a notion that is shared by many growth investors: a good growth stock can always catch up with the valuation multiple. If you share this notion, then the case is just about closed for MSFT already with its excellent combination of profitability and growth as argued above.

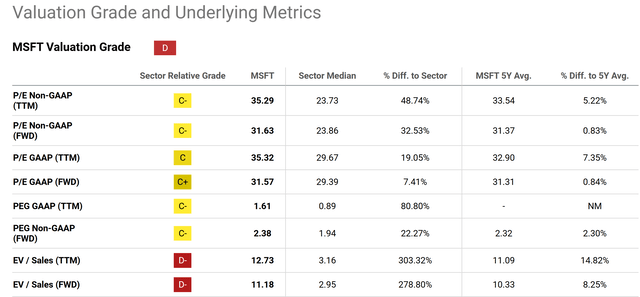

But in case you find MSFT’s valuation offsetting, no matter how much you love its business, you are in good company too. The chart below summarizes MSFT stock’s valuation grade. As illustrated by the comparison here, MSFT’s valuation metrics are substantially higher than the sector median (and also slightly higher than its own historical averages).

My view is that valuation ratios have always to be contextualized by growth potential and profitability. In this case, comparing MSFT’s valuation to the sector does not mean too much. A proper comparison would be to compare MSFT to other companies that also meet the rule. Fortunately, the following McKinsey report just did that. Quote:

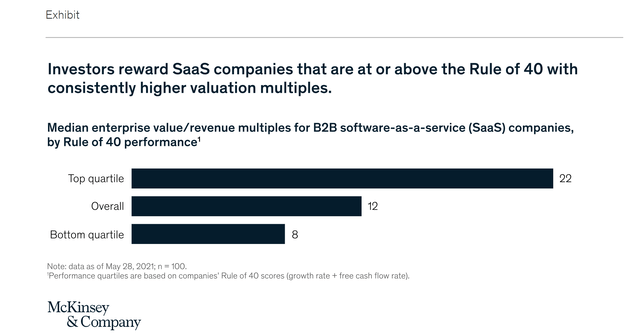

That’s a staggeringly small number and a major missed opportunity. Data show that investors reward companies that are at or above the Rule of 40 with consistently higher enterprise value (EV) to revenue multiples. Moreover, the higher the number, the greater the gain. Top-quartile SaaS companies generate nearly three times the multiples of those in the bottom (exhibit).

As seen, for SaaS companies that meet or exceed the rule, the overall EV/sales multiple is 12x and the multiple is as high as 22x for those in the top quartile. If you recall from the chart above, MSFT’s EV/sales ratio is 11x on an FWD basis and 12.7x on a TTM basis, just on average when compared to stocks that can meet the rule.

Other risks and final thoughts

As a popular stock on the Seeking Alpha site, most of the downside risks facing MSFT have been detailed by other Seeking Alpha authors already. These issues include macroeconomic risks, geopolitical risks, regulatory risks, competition risks, etc. I see little need to further elaborate on these risks here anymore. Instead, I will point a limit to the particular approach I used in the analysis. The Rule of 40 is a metric designed to assess the growth and profitability of software companies, particularly SaaS businesses. As such, it may not apply perfectly to a large-cap company like MSFT with diversified revenue streams. Unlike a pure-play SaaS company, MSFT has other revenue streams too, including hardware exposure.

Despite this deviation, I believe the rule still provides valuable insights as MSFT certainly derives a substantial part of its revenues from recurring subscription revenue, the typical SaaS model. Furthermore, my view is that much of its valuation multiple is based on the segments with a strong SaaS flavor (such as AI integration, cloud, etc.). Judging by this rule, MSFT is a strong buy candidate combining robust growth, superb profitability, and reasonable valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.