Summary:

- Amazon’s shares have been depreciating due to market correction and mixed earnings report, but have started to recover near $160 per share.

- Amazon has growth catalysts across the world, but faces macro risks and competition from Chinese marketplaces.

- Despite potential for growth, Amazon’s stock offers little margin of safety, making it a HOLD at best for investors.

HJBC

After briefly reaching the $200 per share level, Amazon’s (NASDAQ:AMZN) shares have been mostly depreciating since the middle of July, primarily due to the overall market correction and the mixed earnings report that the company released a few weeks ago. While shares have recently started to gradually recover after finding a support level of around $160 per share, they are still far away from reaching the all-time levels anytime soon. Even though the company has several major growth catalysts going for it, the rising macro and China-related risks coupled with the minimal margin of safety make Amazon only a HOLD at this stage.

The Growth Story Is Not Over Yet

Last month before the earnings report for Q2 came in, I published an article about Amazon with a HOLD rating where I noted that even though the company is likely to continue to perform well in the foreseeable future, the rising macro risks could suppress the business’s overall upside. Since that time, Amazon’s shares have slightly depreciated and underperformed the broader market.

The poor performance of the company’s shares could be attributed to the overall market selloff that happened a few weeks ago due to the rising recession fears and also due to a mixed earnings report that Amazon released earlier this month. While the company managed to increase its revenues by 10.2% Y/Y to $148 billion in Q2, they were below the expectations by $760 million. At the same time, the guidance was weaker than expected and resulted in a major drop in Amazon’s share price earlier this month.

The good news, though, is that Amazon has several growth catalysts, which should make it possible for the company to continue to grow its business at a decent rate. In Q2, Amazon’s North America segment sales were up 9% Y/Y to $90 billion, and given the fact that the U.S. retail sales were up in July, it’s likely that we’ll see further growth in Q3 as well. At the same time, the improving macro environment should also help Amazon deliver a decent performance beyond Q3.

If we look at the recent CPI report, we’ll see that the headline inflation increased only by 2.9% Y/Y last month, which indicates that a return to normalcy is likely around the corner. The Federal Reserve is already planning to cut interest rates next month, while Goldman Sachs (GS) recently decreased the odds of the American recession, which signals that the U.S. economy remains robust. All of this should help Amazon perform well in North America in the foreseeable future.

On top of that, Amazon also has a chance to continue to perform well in foreign markets. In Q2, the company’s international segment sales were already up 7% Y/Y to $31.7 billion. Given the fact the GDP of the euro area and the GDP of the countries that are part of the OECD were on the rise in recent quarters, it makes sense to assume that the global economy also remains healthy and should help Amazon grow its international sales in the future as consumer confidence is slowly being restored.

In addition to all of that, Amazon’s businesses that are not related to eCommerce have everything going for them to create additional shareholder value as well. In Q2, Amazon’s AWS segment sales were up 19% Y/Y to $26.3 billion. Given the fact that the cloud market is expected to grow at a double-digit CAGR, it makes sense to assume that the company’s cloud revenues are likely to increase in Q3 and beyond.

At the same time, Amazon’s advertising services revenue was up 20% Y/Y to $12.8 billion. Since the digital advertising market is expected to grow at a double-digit rate as well, it would be safe to say that Amazon’s advertising revenues will be on the rise as well.

Considering all of this, it makes sense to assume that Amazon’s growth story is not over yet. While the guidance for Q3 was below expectations, the company nevertheless is forecasted to grow its sales at a double-digit rate in the upcoming years, which indicates that there are plenty of opportunities for Amazon to improve its performance in the future.

Major Macro Risks Still Remain

Although Amazon has several macro tailwinds going for it, it nevertheless faces numerous challenges that could undermine its growth story. First of all, even though the stock market has recovered from the selloff that happened earlier this month due to the higher unemployment numbers, there are fears that the Federal Reserve could be too late in changing its policy. There’s a possibility that the central bank held rates high for too long, which could have negative near-term consequences for the economy and undermine Amazon’s growth story in the future.

In addition to that, Amazon faces tougher competition within the eCommerce market as Chinese marketplaces such as Temu (PDD), Shein, AliExpress (BABA), and others have been actively penetrating North America. At the same time, TikTok (BDNCE) is also aiming to capture a portion of the market share thanks to its TikTok Shop features, which give merchants the ability to sell their goods directly to consumers via the platform.

To counter the rise of its Chinese counterparts, Amazon is now planning on directly shipping goods from China, which should undermine the advantage that its foreign peers have. However, the potential escalation of the Sino-American trade war and the potential worsening of relationships between the two biggest economies in the world could make it harder for Amazon to properly monetize its China-related initiatives.

On top of all of that, it also appears that Amazon offers little margin of safety at this stage. Last month before the Q2 earnings results came in, my DCF model showed that Amazon’s fair value was $173.35 per share, which at that time meant that the stock was relatively overvalued. That’s why when the overall market tumbled earlier this month, it was no surprise that the shares depreciated as well.

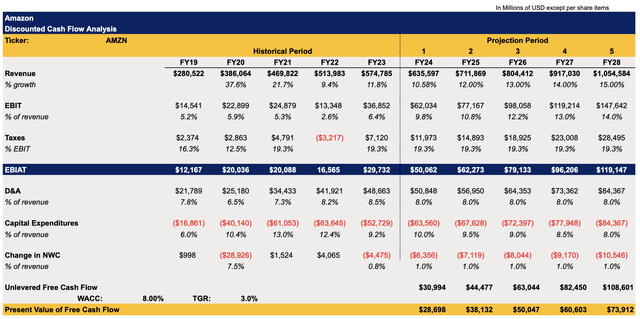

Since the new earnings report came out and new numbers were revealed, I decided to update my model, which can be seen below. Considering that Amazon’s revenue in Q2 came in below the consensus and the company itself received dozens of revenue downward revisions recently, I have slightly decreased the revenue growth rate in FY24 in the updated model. This is in-line with the overall consensus for the year right now, but I also did not change the revenue growth rate for FY25 and beyond, since the favorable environment coupled with numerous growth catalysts make it possible for Amazon to continue to scale its business at a double-digit rate.

The EBIT assumptions are also closely correlated with the overall expectations and are expected to gradually increase thanks to the potential improvement of margins as a result of the utilization of the company’s dominant position in the eCommerce and cloud fields. The CapEx is also expected to significantly increase in the following years, primarily to support the AWS infrastructure and the company’s generative AI projects. During the recent earnings call, Amazon’s management said that the expenditures in the first half of the year were $30.5 billion and are expected to be higher in the second half of the year. This has been reflected in the updated model. The assumptions for all the other main metrics mostly remained the same, and they closely mirror Amazon’s historical performance.

Amazon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

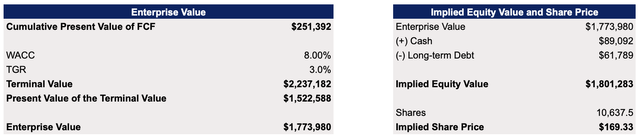

The updated model shows that Amazon’s fair value is $169.33 per share. It’s slightly below the previous calculations, but not that significant.

Amazon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The most important thing to understand here is that the company’s shares offer little margin of safety for investors. While it’s likely that if the macro environment continues to improve and positively affects the broader market, then Amazon’s shares will be able to regain their momentum and appreciate further. However, if we see a potential repeat of the situation that happened at the beginning of this month when the overall market tumbled, then the depreciation of Amazon’s shares could lose significant value as there would be no fundamental reasons for it to trade higher from the current levels.

The Bottom Line

Amazon remains a decent company that is likely going to continue to grow at a double-digit rate if the macro environment remains stable. However, the rising macro and China-related risks could nevertheless diminish its upside, while the relatively non-existent margin of safety makes its stock a HOLD at best.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.