Summary:

- Canopy Growth Corporation stock rallied to $15 due to the DEA’s proposal to reschedule cannabis, but this timeline has now been extended to 2025.

- CEO David Klein, who oversaw a 97% stock decline, is set to exit in March 2025 and has started selling shares.

- Klein’s share sales were related to tax liabilities from vested restricted stock units, leaving him with 360,829 shares.

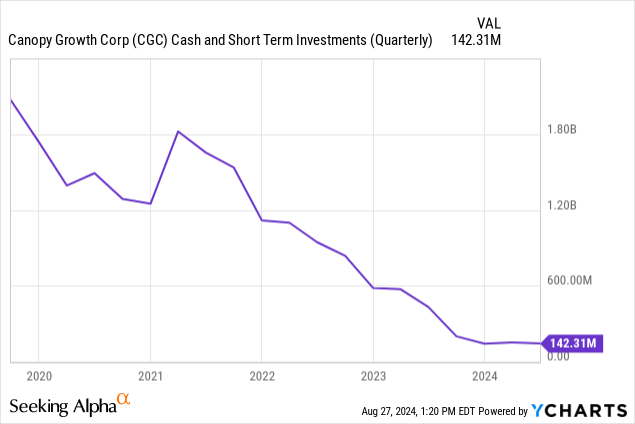

- Canopy Growth faces significant liquidity issues, holding $143 million in cash and short-term investments as of June 30, 2024.

JHVEPhoto

Canopy Growth Corporation (NASDAQ:CGC) would see its commons rally as high as $15 per share in the spring on the back of enthusiasm over the Drug Enforcement Administration (“DEA”) proposal to reschedule cannabis. The uncertainty with the late April report on the proposal to reclassify cannabis to the lower-risk Schedule III grouping was always the timeline. The DEA has now scheduled a public hearing on the potential shift for the 2nd of December, extending the pathway for the bullish reclassification to after the elections and likely further out into 2025. This has come with David Klein, CGC’s CEO since 2020, set to exit in March of calendar 2025. He previously served as CFO for Constellation Brands (STZ), replacing long-time co-founder co-CEO Bruce Linton. Klein oversaw a decline in the commons of roughly 97% from when he embarked on his role and has started selling the CGC shares on the open market, according to a Form 4 filed with the SEC on the 26th of August.

The sale, related to the vesting of restricted stock units, by Klein, leaves the soon-to-be ex-CEO with a still significant 360,829 shares and was made to settle tax liabilities that arose from the vesting of the stock units. Critically, CGC at its current $524 million market cap continues to sit at the confluence of cash burn and an ever-declining liquidity position. The company held total cash, cash equivalents, and short-term investments of $143 million at the end of its fiscal 2025 first quarter. This ended June 30, 2024. All figures in the article are also in US Dollars.

Chasing Reclassification As Liquidity Gaps Erodes Equity Value

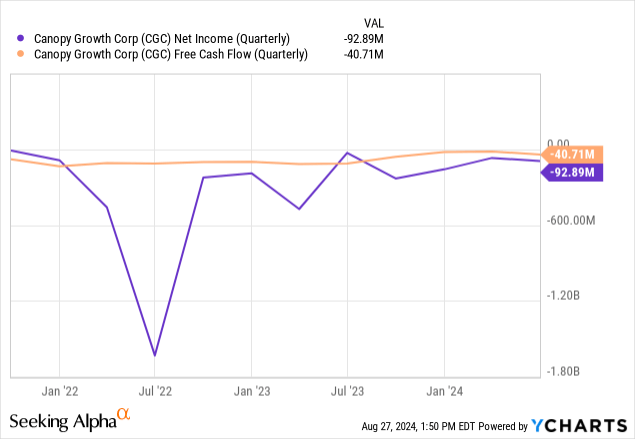

CGC recorded first-quarter revenue of $48.4 million, down from $57.6 million a year ago, with gross profit for the recent first quarter at $16.8 million. This was up from CGC’s year-ago quarter by 62% on the back of a 1700 basis point expansion of gross profit margins to 34.78% from 18.05% a year ago. The gross margin expansion came as CGC built up its transition to a more asset-light model under Klein that has seen the company sell off core production facilities like its iconic Hershey Drive Facility in Smith Falls. However, net income remained negative at $92.9 million, with cash burn from operations still elevated at $38 million. This was down materially from an operational cash burn of $112.2 million a year ago with capital expenditure of roughly $2.9 million placing negative free cash at $41 million during the first quarter.

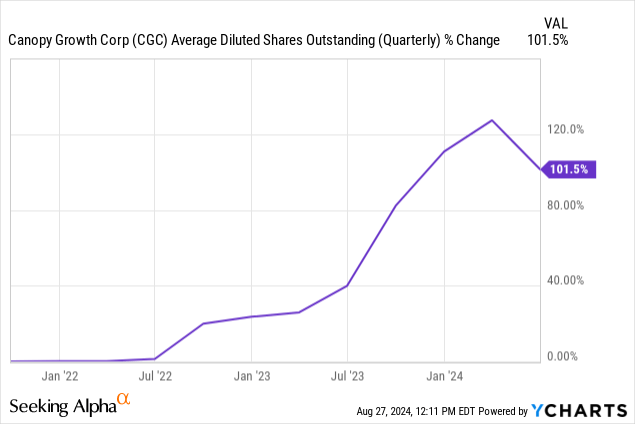

The company launched a $250 million equity sales program in June to help plug this gap and further expand a balance sheet that has seen dilution run at roughly 33% per year for the last three years. CGC issued 4.7 million shares during the first quarter under the program and sold another 3.7 million shares post-period end. Selling pressure from the ATM, the exiting CEO and a disrupted timeline for the core catalyst for the industry will likely see the common shares compound the 10% intraday dip seen after Klein’s Form 4 document was filed with the SEC.

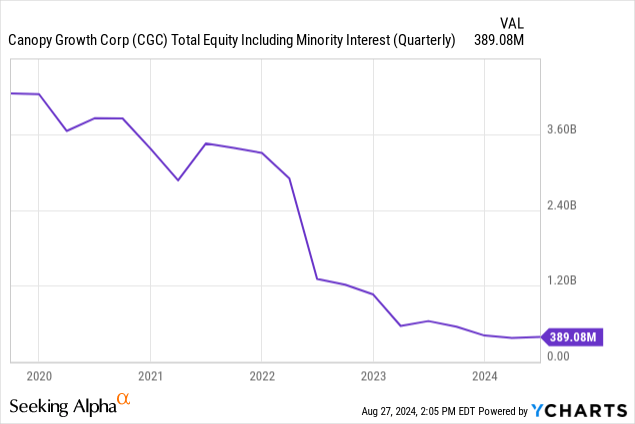

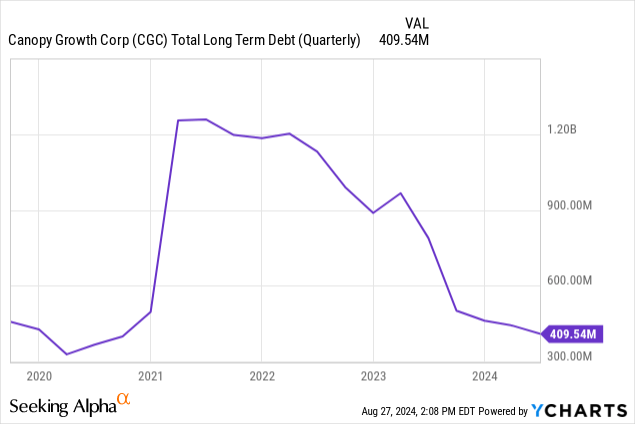

So what’s the value here? CGC’s market cap still sits above total equity of $390 million. Further, the company’s total assets were roughly bulked up by $100 million of goodwill and intangible assets during the first quarter, with long-term debt ending the quarter at $409 million. It’s bullish that CGC has brought down this figure materially from a peak north of $1.2 billion as of early 2021. The company is set to further pay down its senior secured term loan by $97.5 million by the end of this calendar year and could pay down an additional $97.5 million by the end of March 2025. This will extend the maturity of the loan to December 2026 on the first tranche of payment.

Leverage, Fed Rate Cuts, And Investor Sentiment

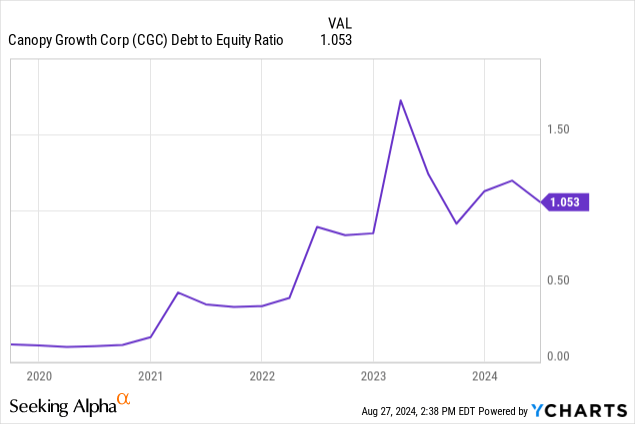

While CGC has paid down its debt aggressively, the company’s leverage ratio has remained elevated versus its 5-year trend line. It has dipped from an all-time high north of 1.6x in early 2023, but the current debt-to-equity ratio at 1.05x reflects total equity that has declined at a faster pace than the company’s debt paydown.

With both the US and Canada currently set to embark on a series of rate cuts, CGC might benefit from greater investor sentiment in its common shares even as the timeline for rescheduling cannabis remains uncertain. This forms the core risk for bears against the sustained dilution of common shareholders.

Canopy Growth Corporation offers a conundrum where no one really wins. The common equity could instantly explode higher on perceived catalysts from the DEA or positive momentum with the passage of the stalled SAFER Banking Act. This is as continued cash burn and dilution leave common shareholders with a company losing equity value every quarter.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.