Summary:

- Dell Technologies is rated “Hold” due to short-term struggles, despite long-term opportunities in AI and data, with declining consumer strength as a key factor.

- The weakness of the U.S. consumer is impacting Dell’s Client Solutions Group, leading to declining sales and postponed purchases, which is affecting short-term performance.

- The Infrastructure Solutions Group faces competitive pressures and postponed investments, limiting the benefits from AI advancements, despite potential growth in the data era.

- Dell’s stock appears fairly priced, with the market factoring in declining sales alongside future growth opportunities, justifying a “Hold” rating until performance improves.

Thinglass

Introduction

I have mentioned in most of my recent analyses that the US consumer is struggling. While this affects certain businesses negatively, others stand to benefit.

Figuring out which companies benefit, and which ones struggle, isn’t easy. Even companies in the same industry may be affected in different ways. Company analyses I read don’t always incorporate this consumer analysis, which, I believe, is an integral part of research, especially now, as we approach the first rate cuts over a long time.

Another company that is affected a lot by consumer weakness and overall economic slowdown is Dell Technologies (NYSE:DELL). Although the artificial intelligence narrative seems strong, which drives expectations higher, Dell has failed to use this technological advancement to its advantage so far, resulting in a contraction in earnings.

While analyses are doing a great job of trying to understand the company’s future, I believe the study of recent history is lacking, which could provide insights into the short-term future. That is what we are going to uncover with this article.

Although long-term drivers persist and the stock doesn’t appear overvalued, Dell receives a “Hold” rating, indicating investors should stay away from this idea. I will wait until Dell secures solid wins from artificial intelligence and the consumer outlook is better for the company.

Business Description

Dell might not need an extensive introduction. However, understanding its segments is key for the rest of the article. So, I will go over them briefly.

Dell Technologies is a diversified information technology business. It provides IT and AI solutions to enterprises and data centers, as well as consumer electronics, which is arguably the better known business. These businesses are structured into the Client Solutions Group (“CSG”) and Infrastructure Solutions Group (“ISG”).

Client Solutions Group is, and always has been, the largest business of the company. Under this segment, Dell sells branded laptops, desktops, workstations, and displays, keyboards, mice, and other peripherals. The segment also includes various service offerings such as configuration and support and deployment.

This is the consumer side of the company. Although commercial customers demand these products as well, the strength of the average end-consumer has a huge impact on sales. As we’ll discuss later, this has been a huge driver of sales.

The second-largest segment is called Infrastructure Solutions Group, which focuses on solutions that address AI, machine learning, data analytics, and multi-cloud environments. These solutions include servers, storage devices, and other networking offerings.

Reading the description of this segment, one can tell this is the more interesting and possibly the higher-growth business. We have been seeing rapid advancements in AI and data, which could be significant drivers of this business. These offerings have the capability to enable further advancements and therefore may be demanded by data centers and enterprises.

Finally, Dell Technologies reports an Other Businesses segment. For fiscal year 2024, this segment included the resale of VMware and SecureWorks (SCWX) offerings. As Broadcom (AVGO) acquired VMware, the commercial framework agreement is terminated, and we should not expect meaningful contributions from this business anymore. Dell still owns nearly 80% of SecureWorks, which is a cybersecurity provider. Those sales will probably continue.

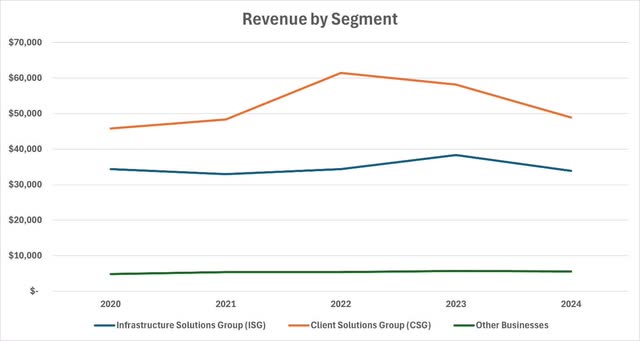

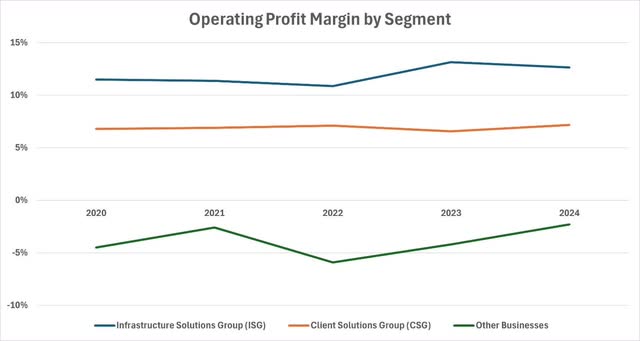

Below are the revenue and operating profit by segment charts for individual segments.

The charts above clearly show that the infrastructure business has been more profitable compared to client solutions and other businesses. Although that business benefited from artificial intelligence in 2023, revenue declined significantly in FY2024.

Similarly, Client Solutions Group revenue increased significantly in 2022 but has been on a declining trend since.

Long-Term Drivers Persist

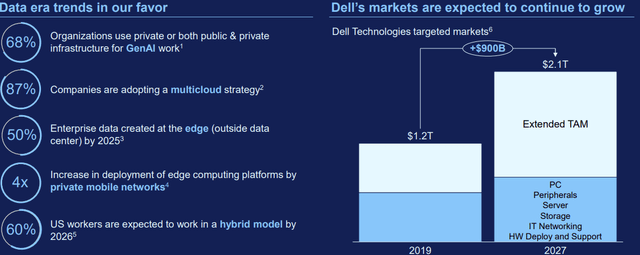

As briefly discussed, Dell Technologies has a large opportunity to benefit from advancements in AI and data. When talking about business trends and challenges, management stated that the ISG business benefited from demand for AI-optimized solutions as advancements in AI influenced customer spending behavior.

Michael Dell, the CEO and Chairman of Dell Technologies said, “we could need 100x more data centers in 10 years”. Although I believe this is wishful thinking, it is true that AI infrastructure investments continue. Dell needs to show it can take a share of this growing pie, which I think it failed to do so far.

Additionally, the company is positioned well to benefit from the rest of the “data era,” including investments in multi-cloud, edge, and private mobile networks. The increased need for these technologies means there is now a bigger market to capture share from, as highlighted in the investor presentation.

Similarly, management expects the CSG segment to benefit from advances in AI, as more customers demand AI-ready computers and other electronics.

Dell Is Likely To Struggle In The Short Term

Although I do believe the long-term value is there, in the shorter term, I expect the company will continue to struggle. This short-term performance is crucial for there to be a catalyst for the stock price. Let’s analyze the two large segments separately, diving deeper into what has been happening recently.

The larger one, CSG, is how people usually come to know about Dell. Its computers and other electronics are popular in all parts of the world. Although quality and availability are important factors for demand, right now, I believe the largest driver of demand is consumer strength.

I have been discussing the state of the consumer in my recent articles. For example, consumer weakness is one of the main concerns for Starbucks (SBUX) as well, which I explain based on my broader article focused on the US consumer.

I will not repeat that analysis, but essentially, consumers are not doing well. Pandemic savings are spent, real wages are down, consumer confidence is significantly lower, delinquencies on certain obligations are rising, and savings rates are down. As a response, consumers trade down. This trading down is not necessarily cutting all the costs. It includes postponing purchases, adjusting the quantity, and finding cheaper alternatives.

Unfortunately, I believe this is already affecting Dell’s consumer electronics business, as sales have been declining for the last two years. As we approach the first rate cut by the Fed in September, my view of the consumer is unchanged. Recessions typically occur after the Fed starts cutting rates, as the Fed is determined to wait until the economy has slowed down enough. With this view, the demand for Dell’s electronics is likely to remain low, both from end consumers and commercial customers.

The story has been slightly different for Infrastructure Solutions Group. Advancements in AI and investments in infrastructure have been strong, and I cannot deny that. However, Dell doesn’t benefit from this to the extent that the annual report makes it sound. The company has been facing competitive pressures, contributing to the decline of revenue in the segment.

Additionally, enterprises that want to invest in their IT capabilities seem to postpone these investments due to economic conditions, just like the end consumers. Declining rates may help with this, but it is difficult to predict how much rates need to fall before these customers start spending again.

I believe both of these segments may continue to struggle in the short term.

A Look Into Q2 2024 Earnings Call

Dell will release its Q2 2024 earnings in a few days, on the 29th of August. Following this, earnings call will be important to validate this thesis and change direction if needed.

Last time, in Q1 2024, Dell missed EPS estimates but beat revenue, with Client Solutions Group revenue increasing quarter over quarter. Shares tumbled 18% within a day as a result. However, Wall Street kept expectations and ratings high. Bank of America, for example, reiterated Buy due to the AI adoption and continued strong pipeline.

I believe it is apparent that AI adoption is not the only factor the market cares about in this story. Investors want to see both businesses strong. With the current environment, that seems challenging.

I will be waiting for sales and bottom line numbers in Q2. My expectation is a decline in sales in the consumer electronics business and a low single-digit growth in the infrastructure business. As long as there is no solid short-term earnings news around artificial intelligence, I doubt the discussion around AI will be enough to change the market’s mind.

Valuation

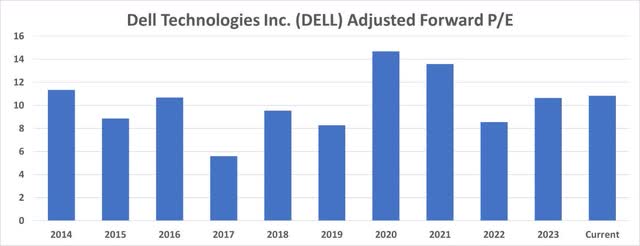

I will be using a multiples approach to determine if the Dell stock is undervalued, overvalued, or fairly priced. You can find the adjusted forward price-to-earnings (“P/E”) multiple of Dell since 2014 below.

Since 2014, the stock has traded with an adjusted fwd. P/E between 5.6x and 14.7x. The average was 10.2x. Currently, the multiple stands at 10.8x. The stock is trading slightly above the historical average.

I believe this is completely fair. Yes, the company has a significant opportunity to grow, but this has not yet materialized. The market prices in the declining trend in sales and profitability, while also recognizing future opportunities, resulting in a balanced multiple in line with historical numbers.

By this measure, the stock appears fairly priced.

Conclusion

As one of the largest consumer electronics and server solutions companies, Dell has many opportunities in the long term. It may benefit from the advancements in AI both in infrastructure and consumer electronics business. However, so far, it has failed to capitalize on these opportunities.

Revenue has been declining together with the company’s earnings margin. Although long-term drivers persist, the company struggles in the short term due to customers postponing purchases. I expect this to continue for a longer period.

With a stock price that appears accurately priced, I rate Dell “Hold.” This means investors should stay away from this company until the story changes.

I will be following the earnings call, which will be good to confirm or reject my arguments in this article. I may publish another article on Dell accordingly.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.