Summary:

- Bob Iger’s turnaround strategies have been highly effective and are already rekindling growth, judging by recent results released in FY Q3.

- His key strategies include cost control and the emphasis on content quality over quantity.

- I expect many of his strategies to be institutionalized after his succession.

- Recent price corrections have brought its valuation to the most attractive levels in a decade.

popovaphoto/iStock Editorial via Getty Images

DIS stock: Previous thesis and new developments

My last article on the Walt Disney Company (NYSE:DIS) was published on Seeking Alpha back in April 2024. That article was titled “Disney Stock: I Expect More Upside.” As you can already guess from the title, I argued for a bullish thesis then based on the following considerations:

The Walt Disney Company stock is still a buy despite recent price rallies. Its current P/E is still reasonable and is expected to shrink quickly due to EPS growth. Analysts expect Disney’s EPS to grow at a CAGR of over 10% over the next five years. I see good catalysts to support such projections, including Disney+, cost-cutting initiatives, and asset utilization recovery.

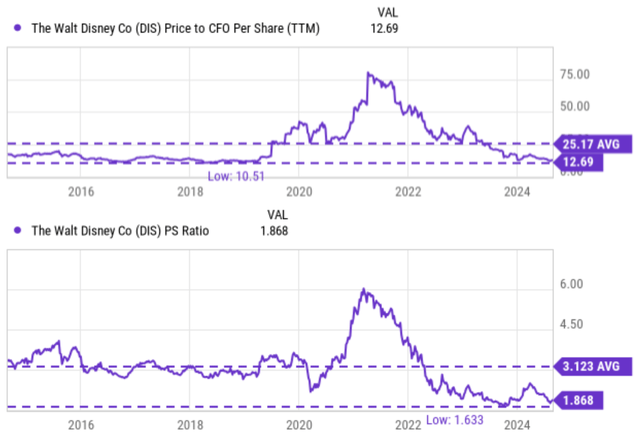

Since that writing, there have been several key developments surrounding the company. First and foremost, DIS has released its 2024 FY Q3 earnings report. The company reported strong financials for the quarter, in my view. More importantly, I consider Bob Iger’s turnaround strategy to be highly effective, judging by the progress the company has made since my last writing. Yet, the stock price has suffered a correction since my last writing, as you can tell from the shrinkage of its valuation multiples, as shown in the chart below. The price correction, combined with improved fundamentals, has led to some of the most attractive valuation multiples in at least 10 years. Its price to cash flow ratio is only 12.69, less than ½ of its 10-year average and close to the lowest level in at least a decade. Topline-oriented metrics show the same picture. For example, its price-to-sales ratio currently stands at 1.86 only, again substantially discounted from its historical average of 3.12.

In the remainder of this article, I will argue for a reiteration of my previous buy rating based on the above developments. Specifically, I will focus my argument on two areas. First, I will argue that Iger’s turnaround efforts have been highly effective. And secondly, I will explain why I expect Iger’s succession plan to proceed smoothly and his efforts to be institutionalized after the succession.

DIS stock: Bob Iger’s turnaround strategy and results

For readers unfamiliar with the background, Bob Iger was/is often referred to as the legendary CEO of Disney. He led the company from 2005 to 2020, during which time DIS made a series of significant and strategic acquisitions, including Pixar, Marvel, Lucas Film, and 21st Century Fox. DIS’s market capitalization nearly quadrupled during that period. After he stepped down, Bob Chapek took the CEO role. The board quickly became disappointed with Chapek’s leadership, and Iger returned to DIS as the CEO in November 2022 on a two-year contract.

Iger faced a pretty dire situation, with the aftermath of the COVID pandemic persisting, the competition intensifying from every front, and the DTC segment (Direct to Consumer) bleeding cash with no sight of turning a profit. He took many measures to turn the situation around, which have been highly effective judging by the results so far in my view. For example, its ER for fiscal Q3 2024 showed that its combined streaming business finally turned a profit for the first time, better than the company’s earlier guidance of turning a profit in fiscal Q4.

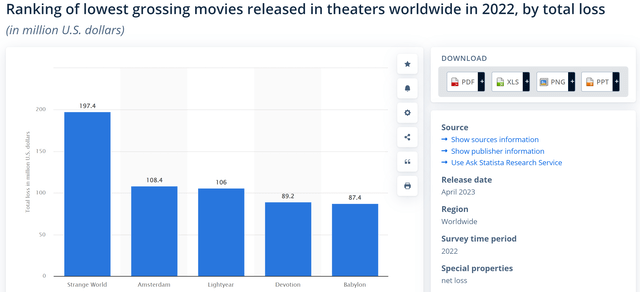

Out of all his turnaround strategies, the top two on my mind were A) focusing on the quality, rather than quantity, of the content, and B) cost control. During the pandemic, the previous CEO sensed the demand for in-home entertainment but made the wrong call to increase the quantity of its content. This move not only failed to grab market share but also caused heavy financial losses for the company. As an example, in the 2022 ranking of the world’s most financially unsuccessful films, DIS’ Strange World, Amsterdam, and Lightyear claimed all the top three spots (see the next chart below).

With Iger’s emphasis on quantity over quality (and his uncanny ability to identify good content), the situation has taken a 180-degree turn. As an example, according to recent movie box office data,

“Deadpool & Wolverine” this weekend returned to first place at the North American box office, grossing an estimated $18.3 million in its fifth weekend of wide release. The superhero movie from Walt Disney’s (DIS) 20th Century Studios has generated $1.2 billion globally, according to data compiled by Comscore. “Alien: Romulus,” the sci-fi horror sequel also from 20th Century, was in second place with a box-office haul of $16.2 million in its second weekend.

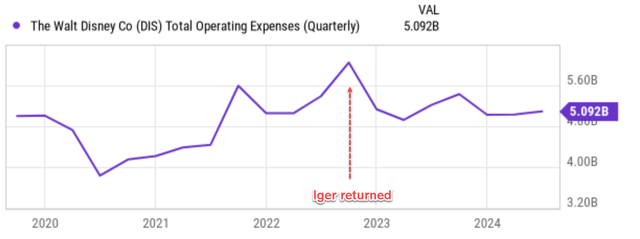

In the meantime, Iger was (has always been, in my view) extremely instrumental at slashing spending and controlling costs. Among the first things he did after returning was to announce sizable layoffs and aggressive cost-cutting targets. As you can see from the chart below, these efforts indeed worked. The chart shows the quarterly operating expenses for DIS before and after Iger returned. As seen, the costs have been rising rapidly under Chapek’s leadership (and the pandemic and inflation were also to blame) from about $4B in mid-2020 to a peak of almost $6B in late 2022. The return of Iger as CEO in late 2022 put a stop to this surge and reduced the costs to the ~$5B level currently.

DIS stock: Iger’s succession plan and legacy

For DIS investors, the good news is that Iger’s turnaround strategies are working. But the bad news is that he’s only on a two-year contract and may be leaving soon. A search committee has already been formed to find his successor as we speak (see the following news for more details).

Disney’s (DIS) board has chosen James Gorman to chair the committee that will find a successor for current top boss Bob Iger, the company said in a statement Wednesday. The move marks a significant step forward in the succession process for Iger since the time the company expanded its search with the committee formation in January last year.

However, I expect an orderly succession and many of Iger’s strategies to be institutionalized after the succession. Iger and DIS took the succession plan very seriously. For example, for the internal candidates, Iger took the effort to mentor them himself. These candidates are also working with external executive coaches and all the board members for better engagement.

The focus on quality over quantity and the cost-control measures are obviously good ideas, and I expect these strategies to be continued. Another good strategy that I expect to be institutionalized is the strategic collaborations that Iger has initiated recently.

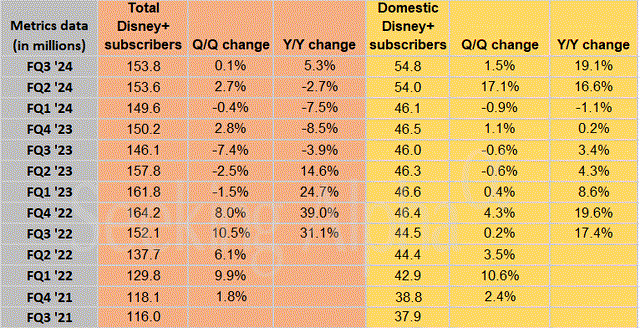

Disney’s strength is in family-friendly entertainment, while many subscribers prefer more mature genres (such as horror, thriller, etc.). To address this issue, Disney has recently started acquiring content from other platforms and also seeking partnerships. For example, a potential partnership with Warner Bros. Max (formerly HBO Max) has the potential to bundle three streaming services (Disney+, Max, and Hulu) and cater to a much wider range of audiences. HBO is well-known for its mature content and has recently produced highly popular series such as “Game of Thrones” and “Euphoria.” Disney+ has been growing its subscribers at healthy rates in the past few quarters thanks to Iger’s strategies mentioned above (see the chart below). I expect these collaborative initiatives to effectively expand its content library without too much additional cost, add further appeal to potential subscribers, and better support its further growth.

Other risks and final thoughts

In terms of downside risks, DIS faces both the risks common to its other discretionary stocks (and/or communication stocks) and also some unique risks associated with its exposure to movies and entertainment. These exposures make its business sensitive to consumer spending, macroeconomics like the rest of the sector, and the competition pressure from the streaming sector. However, DIS also faces unique risks that distinguish it from other peers in the sector. One such peculiarity is its heavy reliance on theme parks. These physical assets can be significantly impacted by factors like pandemics, natural disasters, or geopolitical events. Finally, its reliance on films also makes it sensitive to labor disputes with writers and actors. The recent Hollywood Writer Strike serves as an illustration of how these disputes could interrupt its operations and increase its costs.

All told, my overall conclusion is that the positives outweigh the negatives under current conditions. Thus, this article reiterates my previous buy rating on the stock. To recap, the key considerations are threefold. First, I consider Iger’s turnaround strategy to be highly effective and is already rekindling growth, judging by recent results released in FY Q3. Second, I expect many of his strategies to be institutionalized after he leaves. And finally, the recent price correction, combined with its improving fundamentals, has brought DIS valuation to the most attractive levels in a decade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.