Summary:

- The Department of Defense awarded Lithium Americas Corp. $11.8 million.

- A Department of Energy loan for over $2 billion is pending.

- If certain conditions are met, General Motors is set to invest $330 million into Thacker Pass.

- Lithium share prices and stocks are in a state of utter and complete despondency. Traders have thrown in the towel; this bodes well for long-term investors.

- EV growth worldwide continues to accelerate.

Olemedia

This will be a rather simplistic article, and you should view it as a general update. Lithium Americas Corp. (NYSE:LAC) and General Motors (GM) were set to sign an agreement potentially for tranche #2 funding via GM by August 16th (after which point either side could pull out of the agreement). This date has passed, and according to LAC, the potential deal has been pushed to the 2nd half of 2024. Let’s engage in some guesswork involving the loan, and then we will look at the general EV market for a long-term view of where things are going. Lithium Americas at $2 and change could be worth your hard-earned money for the patient long-term investor.

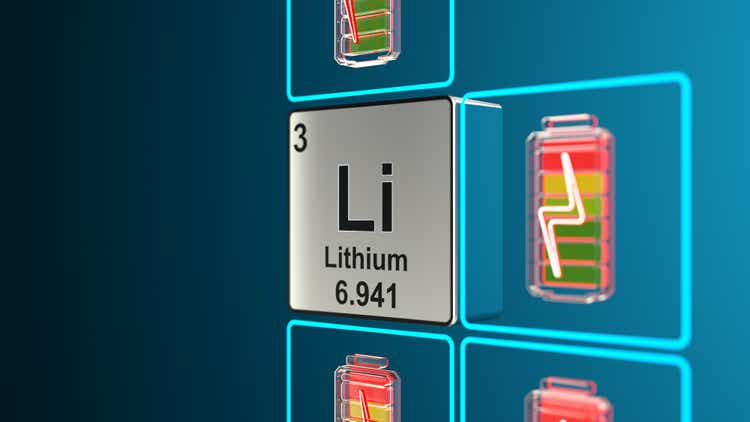

Location of Thacker Pass (Lithium Americas)

What’s Next For Lithium Americas?

We can see below that GM could invest $330 million in LAC, but they require that LAC “secures sufficient funding to complete the development of Phase 1 for Thacker Pass.” Thus, LAC has to close and meet the conditions for the Department of Energy loan, upon which, GM might decide to execute funding of tranche #2. Per the LAC March 31, 2024 MD&A we can see the following (emphasis added):

“Pursuant to the second tranche subscription agreement, GM will purchase common shares of the Company subject to the satisfaction of certain conditions precedent, including the condition that the Company secures sufficient funding to complete the development of Phase 1 for Thacker Pass (the “Funding Condition”). The subscription agreement calls for an aggregate purchase price of up to $330 million, with the number of shares to be determined using a conversion price equal to the lower of (A) the 5-day volume weighted average share price (which is determined as of the date the notice that the Funding Condition has been met) and (B) $17.36 per share. The conditions precedent under the second tranche subscription agreement must be met by August 16, 2024.”

Hence, GM could buy shares in the company at a 5-day average price of the current share price of LAC. Given the market cap is $441 million (at $2.72 USD a share), a cash injection of “up to $330” million could place GM owning a substantial interest in the company (especially if you factor in GM owns a non-controlling percentage of LAC from GM funding tranche #1).

The Department of Energy Loan

Exactly how the DoE loan is set up is murky. We can see the following conditions that LAC has to meet to obtain the loan and presumably trigger GM to invest an additional $330 million into the company (emphasis added).

While this Conditional Commitment represents a significant milestone and demonstrates the DOE’s intent to finance the Project, certain technical, legal and financial conditions, including negotiation of definitive financing documents, must be satisfied before funding of the Loan.

We might also factor in that I doubt LAC ever thought its share price would be $2 and change at this stage in the game. The potential dilution (if they go with equity level financing) could be staggering. Then again the project size (and expansion potential) is staggering. Read our coverage on expansion potential here.

Lithium Americas Might Mimic Standard Lithium

With lithium prices depressed, and lithium companies share prices in a state of despondency, some companies are taking a different approach to funding projects. Recently, Standard Lithium (SLI) entered into a partnership where it sold a 45% stake in two of its three projects via project level financing rather than equity financing. The result was the stock was not diluted.

Given the low market cap of LAC, it could be logical for LAC to mimic Standard Lithium. Now the question is: Will LAC sign GM for project level financing or go with an alternative partner? Meanwhile, we see the Department of Defense is helping push critical mineral independence from China by giving awards to Electra Battery Materials (ELBM) and to Lithium Americas.

Department Of Defense Funds Lithium Americas

While the Department of Energy is potentially funding LAC, Lithium Americas received (through its subsidiary Lithium Nevada) $11.8 million from the Department of Defense (DoD) on August 4th, 2024. This announcement flew under most radars, but it is very intriguing to see various parts of the government supporting LAC and lithium Chinese independence in these difficult times for the lithium sector.

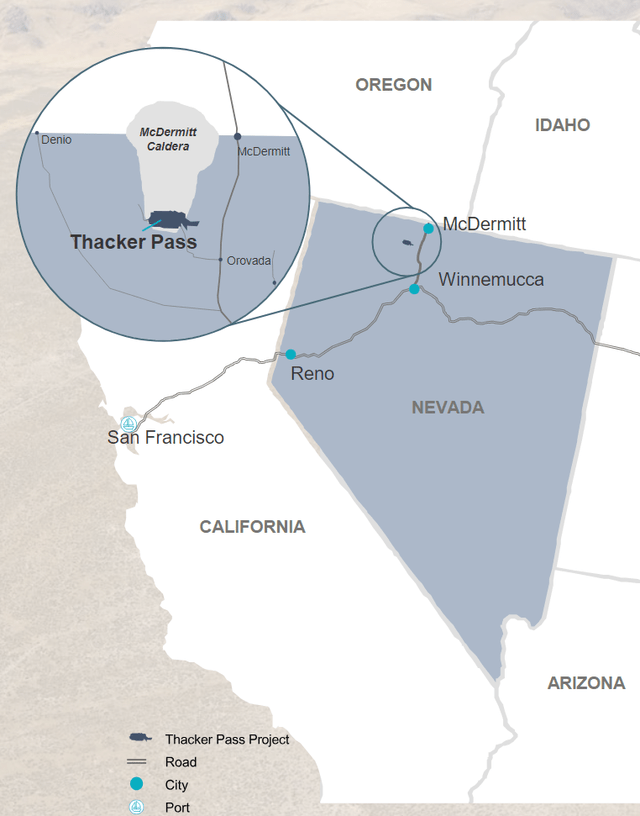

Earthworks Progress at Thacker Pass (Lithium Americas)

What will the DoD award be used for? Per LAC:

“These upgrades will enable Lithium Nevada to test, demonstrate, accelerate, and scale up its lithium carbonate extraction process and produce commercial-scale levels of battery-grade lithium carbonate.”

This sounds like it will enable LAC to fund additional tests on how to extract lithium from clay more efficiently via LAC’s pilot plant facility. It is also a vote of confidence in Lithium Americas by the Department of Defense. One might surmise they conducted some degree of project due diligence before pushing out an award.

European Demand For Electric Cars Is Growing

Much has been written about the EV and its impending demise. Are the opinions grounded in reality? I would say no. Some of it is just good old-fashioned sensationalism, and some is election related. Something of note to observe, but EV adoption in Europe is increasing (along with China and North America). It is one thing to read about how the overall EV share in Europe is around 19% adoption, but it is another to be able to visualize it by country.

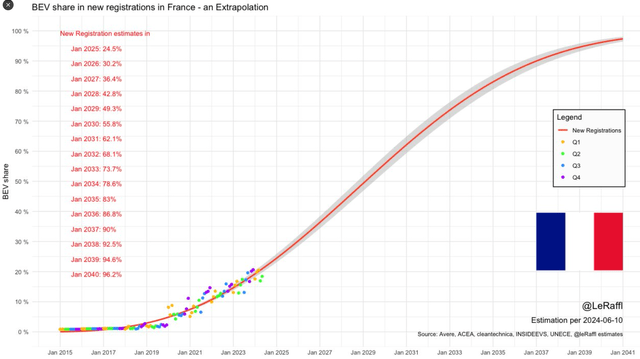

Let’s look at France, for example (click to expand the images).

BEV growth in France (x.com/leRaffl)

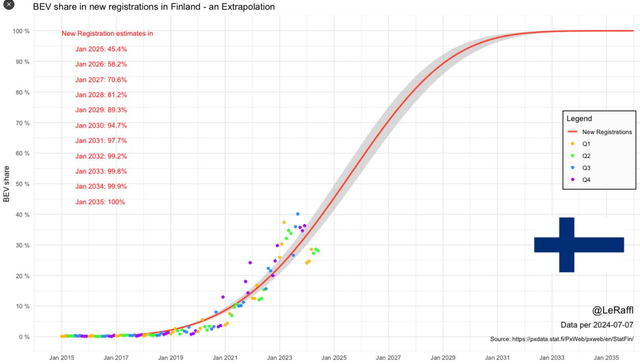

What does Finland yield?

Finland BEV growth (x.com/leRaffl)

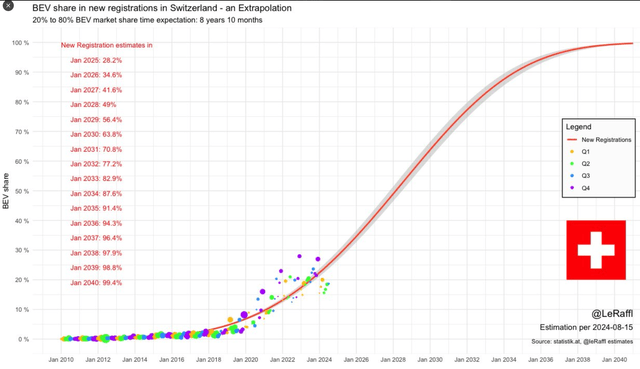

And the land of Ricola (aka Switzerland)

Switzerland BEV Growth (x.com/leRaffl)

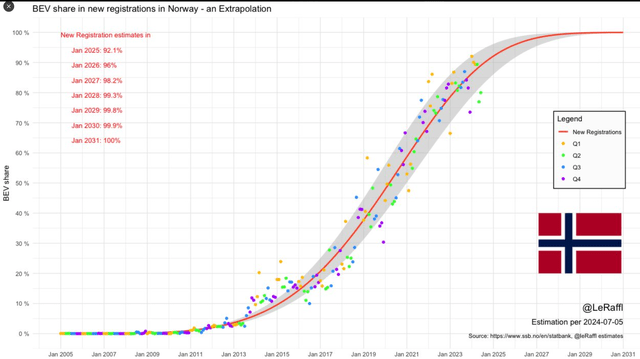

Now, Norway is a bit of an outlier, as they are so far ahead of the rest of the world in EV, but it might show the shape of things to come.

Norway BEV Growth (x.com/leRaffl)

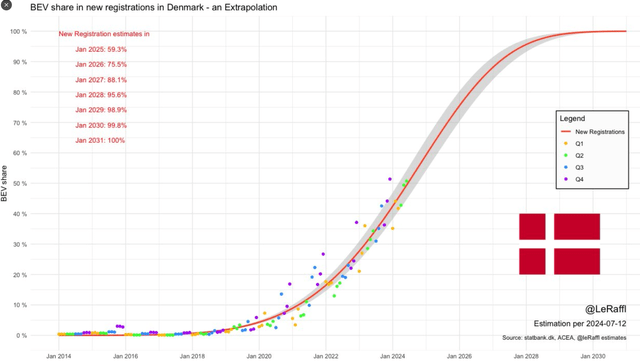

Denmark.

Denmark BEV Growth (x.com/leRaffl)

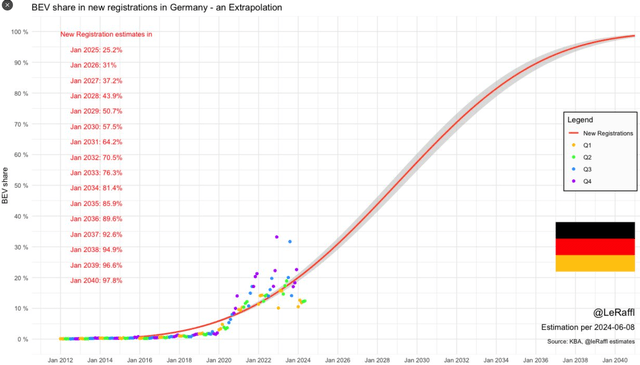

Ze Germans.

Germany BEV Growth (x.com/leRaffl)

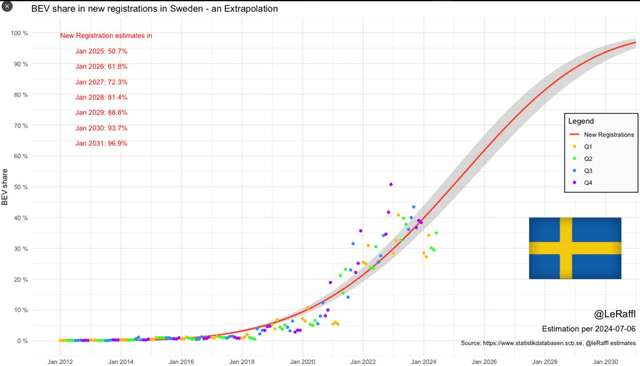

Sweden.

Sweden BEV Growth (x.com/leRaffl)

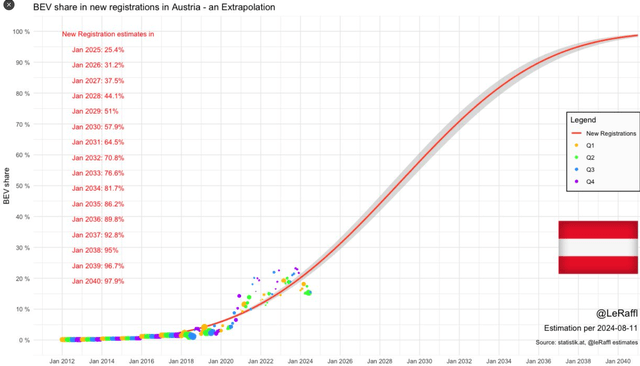

Austria.

Austria BEV Growth (x.com/leRaffl)

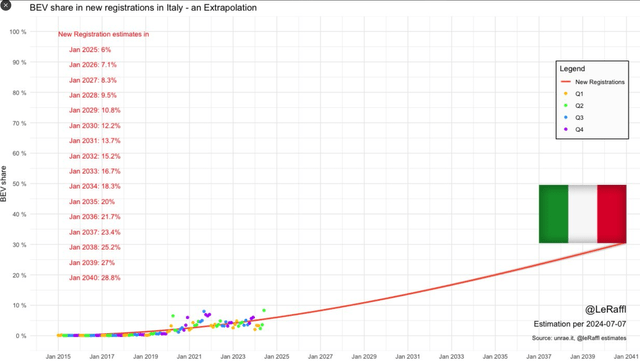

Italy.

At 8.3% penetration, Italy is going slow, but it is rising.

Italy BEV Growth (x.com/leRaffl)

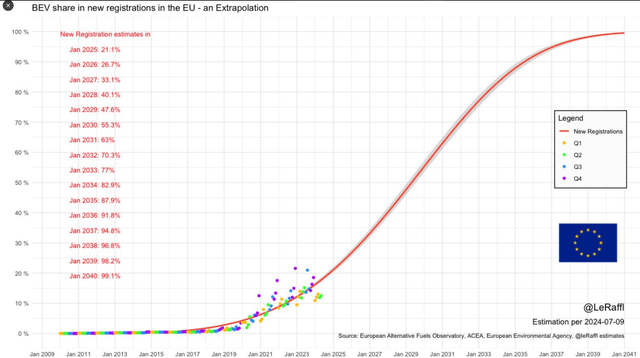

European Union.

Lastly, we can see the overall picture if we look at all the European Union.

BEV Growth in the European Union (x.com/leRaffl)

Geopolitical View of Critical Elements

Geopolitics also comes into play. The USA is restricting semiconductor technology and chemicals to China to keep Chinese dependence upon the semiconductor industry. In response, China is restricting key minerals such as antimony. These economic games are not new, but how the pieces move on the chessboard in response is what we should be concerned with. Hence, I think this gives weight to the DoD funding additional lithium projects (SLI, CYDVF, ALB are but a few) and I think we will see a combination of DoE / GM / or a 3rd party fund Thacker Pass. Thacker Pass was approved during the last part of the Trump Administration and continued during the Biden administration. Too much economically is on the line for it not to be funded from a Federal, State, and geopolitical view point.

Lithium Americas Risk Factors

My risk assessment has not changed. Hence, I am going to borrow my prior Lithium Americas articles risk assessment. Risk can be broken down into a few factors: Company specific risk such as the DOE loan and the GM tranche 2 loan not closing. We could also ponder macro risk factors, such as the general economy continuing to deteriorate under high inflation and high interest rates. This economic hardship and uncertainty must impact EV sales as consumers simply have less income. Another uncertainty hanging over the stock is how will the GM loan impact the stock? Dilution for a massive cash injection of $330 million could occur, but how will the stock react? That is an unknown, and the stock market does not like unknowns.

We also have election unknowns adding murk to the water. On one hand, President Trump did push the critical elements list and Thacker Pass during his tenure. On the other, he is a wild card if anything. I would venture that his business leanings and anti-China stance would put him in a balanced camp of being pro oil while supporting independence from foreign countries dominating lithium production and refining. We will see how the elections play out. It should be interesting.

Presently, we are in the perfect storm that is rattling the lithium market, but these things also have a way of reversing much like the tides of the sea. If we eliminate election uncertainty and somehow manage to improve the macro picture, things might reverse quickly for lithium in general.

Takeaway

I want you to ponder the future, and occasionally when we ponder futures we come up with results that frankly are not optimal (because they represent change). Sometimes the change is good, though. If we ignore the politics behind EV and simply look at the science of energy efficiency, superior acceleration, and reduced noise, I do believe EV is a good change. I also see the long-term geopolitical implications.

The White House (irrespective of who is in charge) is not about to let China continue its lithium dominance and surrender the US automotive industry to cheap Chinese EV imports. Hence, we circle back to where to invest money in lithium to tap into this potential EV future. Lithium Americas is one potential answer among many good companies, but it will take time, and it will require patience.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LAC, SLI, CYDVF, ELBM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.