Summary:

- Box shares jumped after posting strong Q2 results, with billings growth accelerating to 10% growth after slightly declining in the previous quarter.

- The company raised its FY25 guidance, now expecting 8% higher EPS on a 27.5% operating margin (50bps higher than its prior outlook).

- Box’s revenue growth rates are nearly doubling that of its largest rival, Dropbox.

- BOX stock still trades at a very reasonable ~4x FY26 revenue and ~17x FY26 P/E.

Kenneth Cheung/iStock Unreleased via Getty Images

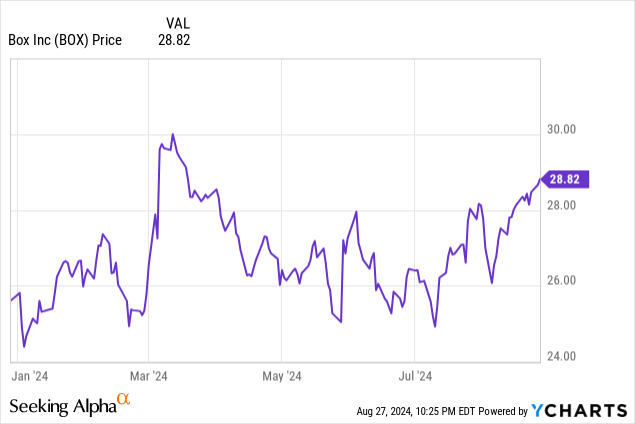

The Q2 earnings season is now nearly complete, and so far, it’s proven to be a great quarter for some forgotten, older tech stocks whose growth trajectories have reached a mature phase. Box (NYSE:BOX) is one of this quarter’s winners: the cloud-based file storage and sharing company saw its shares pop ~7% after reporting Q2 results and boosting its outlook for the full year.

Given the strong trajectory we’ve seen in Box’s billings and its better growth rates versus its primary rival Dropbox (DBX), I think there’s still plenty of upside remaining.

The bull case for Box looks bright amid guidance boost

I last wrote a bullish note on Box in May, when the stock was still trading in the ~$25 range. Despite the rally in the stock since then, Box has justified its higher valuation with its boosted billings growth rates as well as a meaningful expansion in operating margins: as such, I’m reiterating my buy rating on this company.

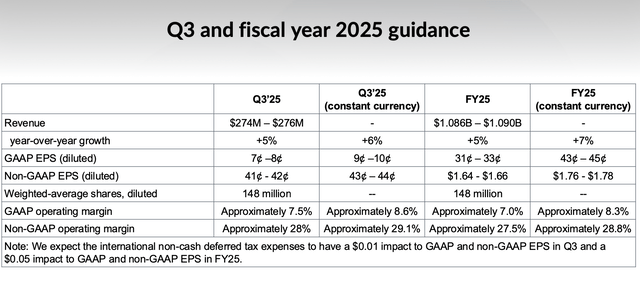

The first highlight to note: Box boosted all metrics for its FY25 guidance. The company is now expecting $1.066-$1.090 billion in revenue, or 5% y/y growth. This is due to a combination of both stronger underlying performance and billings (which accelerated in Q2, as we’ll discuss in the next section) as well as the strengthening of the yen against the dollar (one-third of Box’s revenue is international, and roughly 60% of that is Japan – or in other words, Japanese revenue is roughly 20% of the company’s total).

Box outlook update (Box Q2 earnings deck)

The company also pulled up its operating margin guidance by 50bps to 27.5%, while it’s now also expecting pro forma EPS of $1.64-$1.66, or a 6% increase at the midpoint. And looking ahead to next year FY26 (the year for Box ending in January 2026), Wall Street analysts are expecting $1.15 billion in revenue (+6% y/y) and $1.79 in pro forma EPS (+8% y/y).

We note that Box’s valuation still remains quite reasonable against these raised estimates. At current post-earnings share prices near $31, Box has a market cap of $4.48 billion. After we net off the $482.2 million of cash and $371.8 million of debt on Box’s latest balance sheet, the company’s resulting enterprise value is $4.37 billion.

This puts Box’s valuation at:

- 4.0x EV/FY25 revenue and 3.8x EV/FY26 revenue

- 18.8x FY25 P/E and 17.3x FY26 P/E

With the S&P 500 trading at a ~20x forward P/E (and many tech stocks trading at high single digit multiples of revenue), Box still stands at quite an appealing entry point.

Beyond the near-term guidance boost and the cheap valuation, here are the core long-term fundamental reasons to be bullish on Box:

- Major $74 billion TAM as Box continues to expand its product portfolio. Despite competition, Box cites a massive $74 billion market across storage, content collaboration, and data security. That’s a big enough space for multiple incumbents, and also suggests Box is only currently ~2% penetrated into this overall market. Recent portfolio additions like Box Sign have greatly expanded Box’s potential.

- Multi-product strategy is driving attractive cross-sell. More than two-thirds of Box’s new deal bookings come from Box Suites customers who are purchasing more than one Box product. Additions like Box Sign continue to pave the way for incremental revenue growth.

- Founder-led. Though many Silicon Valley startups have been passed over from their founders to professional CEOs, Box remains led by its co-founders Aaron Levie and Dylan Smith as CEO and CFO, respectively.

- Best-in-breed for enterprise users. Of all of its well-known competitors, Box is the only company that is enterprise-focused. The company touts its security features plus advanced capabilities like Box Skills as a key differentiator versus the likes of Dropbox.

- Steady upward march in profit margins. Box expects to hit a 27.5% pro forma operating margin in FY25, up from 24% in FY24. Cross-sell and current customer expansion will drive top-line efficiencies, while the company’s ongoing move to public cloud servers will drive gross margin expansion.

Stay long here and keep riding the upward rally.

Q2 download

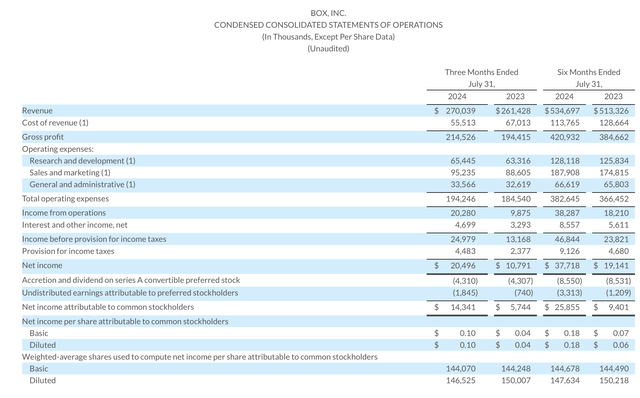

Let’s now go through Box’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Box Q2 results (Box Q2 earnings deck)

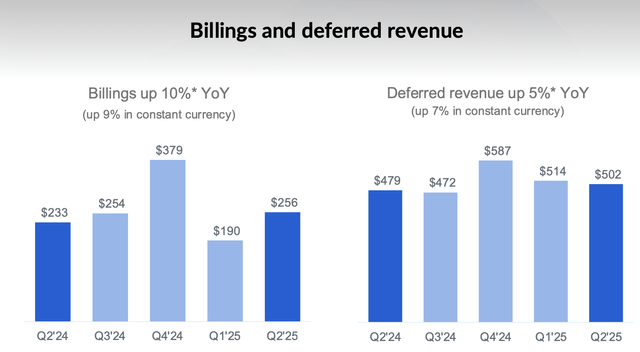

Box’s revenue grew 3.3% y/y to $270.0 million. But perhaps more importantly, Box’s billings growth rates showed a healthy acceleration, with growth of 10% y/y following a weak Q1 billings quarter with -1% y/y growth.

Box billings (Box Q2 earnings deck)

As routine investors in enterprise software companies are aware, billings represents the best picture of a subscription software company’s longer-term growth trajectory, as it captures deals signed in the quarter that will be recognized as revenue in future quarters.

It’s worth keeping in mind that rival Dropbox grew revenue at only a 1.7% y/y pace in Q2, so Box’s growth is approximately doubling that of its biggest rival.

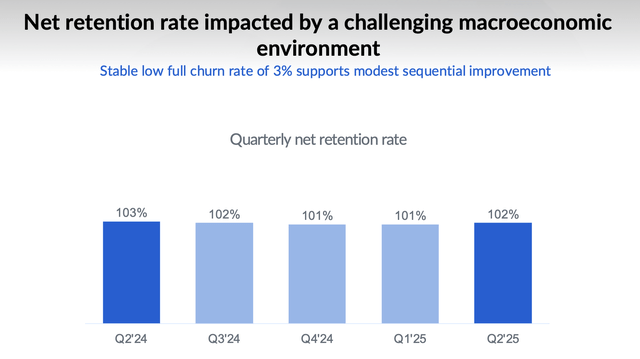

We note as well that Box has been managing to keep churn steady, while net revenue retention rates improved sequentially to 102%, indicating a 2% upsell net of churn.

Box retention rates (Box Q2 earnings deck)

Per co-founder and CFO Dylan Smith’s remarks on the Q2 earnings call on the drivers for the improved billings and retention performance:

Q2 billings of $256 million were up 10% year-over-year and up 9% year-over-year in constant currency, above our expectations for low to mid-single-digit growth. Roughly half of this outperformance was driven by strong bookings, particularly in Japan and our public sector business. Q2 billings also benefited from roughly $3 million in early renewals as well as a roughly $4 million tailwind from FX versus our prior expectations.

Our net retention rate for Q2 was 102%, up from last quarter’s net retention rate of 101%, and driven by improving price per seat trends. Our annualized full churn rate continues to remain stable at 3%, demonstrating best-in-class product stickiness with our customers. We now anticipate exiting FY ’25 with a net retention rate of roughly 102%, an improvement from our prior expectations of at least 101%.”

The company notes that attach rates for the company’s Suite sales (which include multiple products) reached a record of 87% of large deals. Box also announced a new integration with Salesforce’s Slack (CRM), which allows users to access Box AI queries and search through their Box content directly from the Slack interface – a powerful new release for collaborating teams.

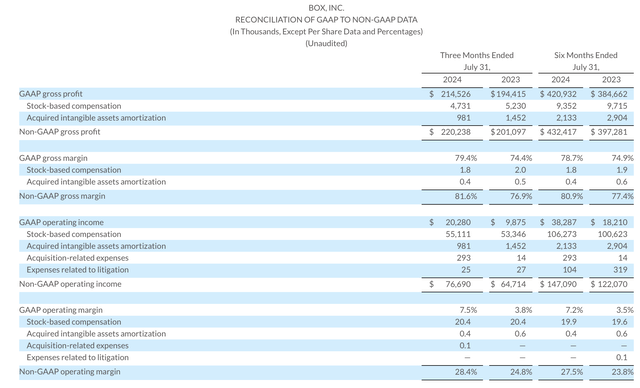

On the profitability front, Box also pushed its pro forma operating margins up 360bps y/y to 28.4%:

Box pro forma operating margins (Box Q2 earnings deck)

The company’s pro forma EPS of $0.44 also beat Wall Street’s expectations of $0.40 with 10% upside.

Key takeaways

Box isn’t a bastion of hypergrowth and excitement anymore, but it’s incredibly consistent: with healthy billings growth, steady net expansion rates, and improving profitability – all at a very reasonable valuation. Stay long here as Box continues to deliver dependable upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BOX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.