Summary:

- Nvidia Corporation’s Q2 FY25 results and outlook for the October quarter confirm our negative thesis of a high risk from the product transition.

- We think this to be an execution issue rather than a demand issue, and will be reflected in the pace of top-line growth and margins over the next two quarters.

- We think investors should be patient for more attractive entry points into the stock before outperformance in its data center business re-ignites for FY26.

Emanuel M Schwermer/DigitalVision via Getty Images

Nvidia Corporation (NASDAQ:NVDA) just reported its second quarter of FY25 earnings results and outlook. The release confirmed our negative thesis, including with the management’s commentary and outlook on the October quarter during the earnings call, causing the stock to pull back up to 7% in extended trading.

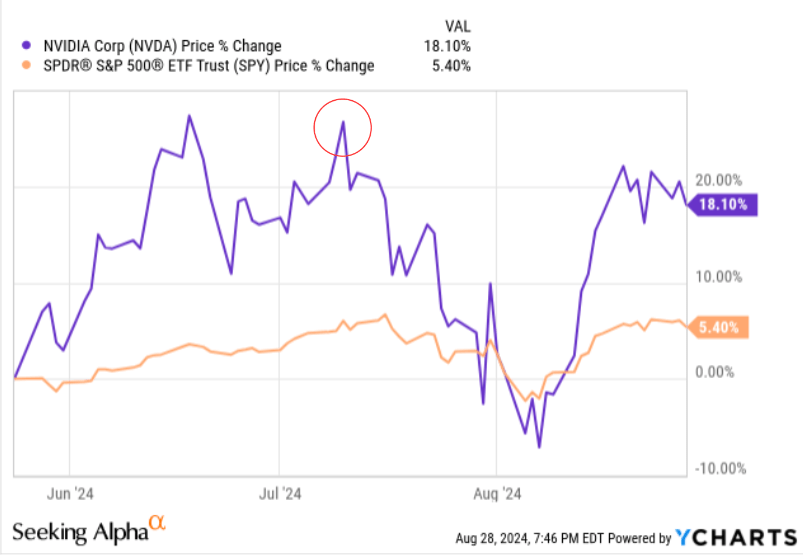

We downgraded NVDA in early July before the stock sold off towards the end of the month with a semi-wide pullback, as shown in the image below with the circle indicating our downgrade. Our thesis was based on our tracking of three factors: lead times/double-ordering on the Hopper series, high market expectations, and industry product transition risk. We forecasted a sales beat for the July quarter, but a product transition risk for the October quarter that could potentially weigh on top-line growth. This quarter’s commentary and outlook lead us to believe this is an execution issue, not a demand issue, that will impact top-line growth and gross margins.

We maintain our hold rating and recommend investors stay on the sidelines for the full downside to get priced in. In other words, the market needs to catch up to the fact that this is an execution issue and incorporate the higher risk profile this product transition presented due to said execution. We don’t expect NVDA’s raise and beat supported outperformance to re-accelerate over the next two quarters, i.e., in 2HFY25.

What’s important to keep in mind here is that NVDA is an industry leader now, and it’s preparing an entire supply chain for the next-gen Blackwell series and trading at premium multiples; hence, the company cannot afford an execution problem. We’re still not comfortable upgrading the stock now because we’re fundamental first analysts, so we’re going to look for data points to support a change in our rating to a buy ahead of FY26.

YCharts

2Q25 Review & 2HFY25 Preview

For the quarter, NVDA reported sales up 15% Q/Q to $30.0B, obviously ahead of consensus expectations of $28.42B but in line with whisper numbers that sat at around $30B. For reference, NVDA only crossed the $20B in sales threshold two quarters ago, not counting today’s results. So the fact that the whisper number was for the $30B threshold is already telling about how high expectations are for NVDA and its position in the AI market. This quarter and the cloud capex investment on AI we’ve seen from hyperscalers confirm that the demand is there, but there is a risk on execution with this product transition.

While this doesn’t look that bad at face value, it really is. NVDA isn’t priced like other tech companies; in fact, NVDA is

“valued at about 37 times its forward earnings, compared with an average of around 29 for the top six tech companies on the benchmark index that includes the chipmaker.”

So, missteps here are expensive.

Here’s the breakdown for its top-line growth this quarter by business segments: data center sales grew 16% Q/Q to $26.27B due to higher demand for AI accelerators, gaming sales grew 9% Q/Q to $2.88B due to higher demand from seasonality, and professional graphic sales and auto-related sales grew 6% and 5% Q/Q to $454M and $346M, respectively. Management continues to expect sales to outperform due to sequential growth in its data center business. The company is guiding for Q3 sales to grow 8% Q/Q to $32.5B, again beating consensus of $31.24B but coming in on the lower range of Wall Street’s whisper estimates.

The real focus (and concern) should be on gross margins. For the quarter, NVDA’s non-GAAP gross margin was 75.7% compared to a gross margin of 78.9% last quarter because of a lower Blackwell yield. Management is guiding for a sequential decline in gross margin for the next quarter and potentially the one after, which is bad. And the market realizes it is bad, with some interest questions about margins in the Q&A section of the call. NVDA expects gross margins to decline to a 75% level in the October quarter and then again in the January quarter.

The reason the forecast is for a decline falls under the umbrella of the product transition risk we pitched back in July. NVDA is anticipating lower margins because they’ll be shipping billions of lower-margin Blackwell GPUs. This quarter’s call told us that we should be expecting gross margin pressure for the next two quarters as the product transitions from Hopper to the new mask step, Blackwell, is wrinkled out. Hence, our belief is that NVDA’s outperformance pace should re-accelerate in FY26, as management is only expecting some growth from existing Blackwell sample revenue. The new Blackwell will start production in 4Q25, which is NVDA’s January quarter.

Valuation & Word on Wall Street

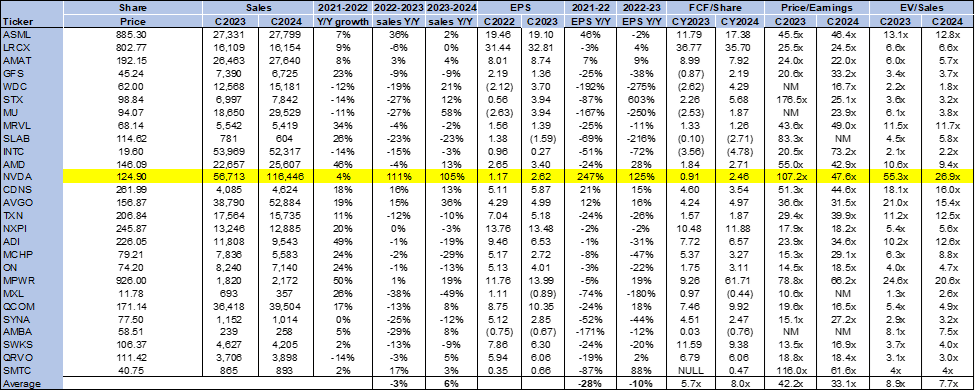

The stock’s valuation hasn’t changed much since our note in early July; NVDA continues to trade at a premium multiple. On a P/E basis, the stock is trading 47.6x C2024, compared to 47.0x in early July, comfortably outpacing the semi-peer group average of 33.1x. The stock’s EV/Sales ratio shows the same premium multiple relative to the group average, trading 26.9x C2024, not too far from the 26.0x in early July, compared to a semi-peer group average of 7.7x. We think the valuation is too high for the near-term risks present at current levels.

The following chart outlines NVDA’s valuation against the peer group average.

Tech Stock Pros

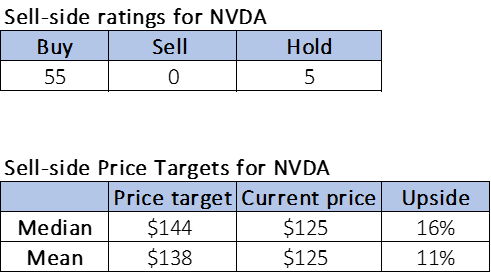

Wall Street continues to be mostly bullish on the AI darling. Of the 60 analysts covering the stock, 55 are buy-rated, and the remaining five are hold-rated. Again, not too different from the sentiment we saw in early July before the sell-off and current bad news.

It is our belief that most sell-side guys didn’t understand the potential scale of risk the product transition could present. Many expected the stock to have been de-risked after it lost its Computex highs when it dropped from around $136 per share at the time of our downgrade to $98.81, a 26% pullback. We doubt that was the case, and believe the weakness will be priced in over the coming days. In our opinion, the sell-side price targets for NVDA don’t tell much. The stock is trading at $125 per share, with a median price target of $144 and a mean of $138. We don’t expect substantial near-term outperformance.

The following charts outline NVDA’s sell-side ratings and price targets.

Tech Stock Pros

What to do with the stock

We’re maintaining our Nvidia Corporation hold despite our thesis of a pullback on the October quarter outlook playing out. We think this is an execution issue related to the product transition and expect there to be some more downsides to the stock before favorable entry points appear.

Furthermore, we think there isn’t enough support in the data points now to upgrade to a buy, and Nvidia Corporation stock remains too highly valued for the disappointing gross margin outlook. We’re watching the top line and margins to see how this negative stretches out, but we do see substantial outperformance again in early to mid-2025. There are some concerns that it is a slippery slope with an execution problem potentially turning into a demand problem, but we still don’t have proof of this. We recommend investors stay on the sideline for now, as we expect Nvidia Corporation outperformance to re-ignite in FY26 once the product transition issues are resolved and next-gen demand can kick in.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.