Summary:

- Nvidia Corporation Q2 earnings beat expectations, highlighted by continued demand for AI chips.

- Guidance was mixed with some uncertainties related to the launch timing of the next-generation Blackwell architecture systems.

- A realization the company is past its peak growth stage may keep shares volatile going forward.

BING-JHEN HONG

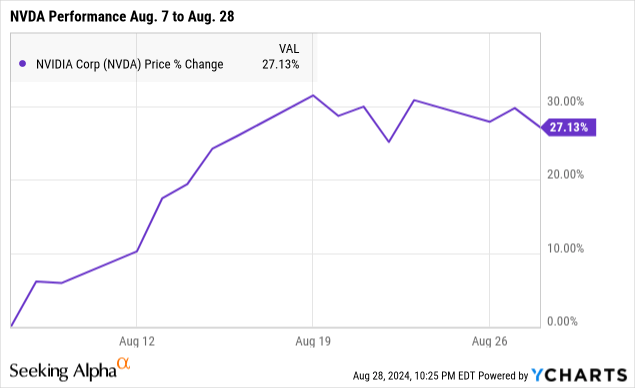

The initial market reaction to the second-quarter earnings report from Nvidia Corporation (NASDAQ:NVDA) was underwhelming. Despite a top and bottom-line beat to Wall Street estimates from the AI chip juggernaut, the stock fell by as much as 7% in after-hours trading.

Beyond the headline numbers, the sense is that the market needed a bit more, which becomes a problem when thinking about how the stock will reclaim its all-time high above $140 anytime soon.

Following several bullish calls in 2023, we last covered NVDA with a hold rating earlier this year. Between parts of the growth story losing its shine and a lofty valuation, we now see room to turn more bearish with a belief that increasing volatility will be the story going forward.

A Classic Sell-The-News Event

For what has been described as the most important stock in the world as a bellwether for the artificial intelligence revolution and sentiment towards the technology sector in general, all eyes were on Nvidia earnings.

Fiscal 2025 Q2 EPS of $0.68 came in $0.04 ahead of consensus, marking a 152% increase from the period last year. Revenue of $30.0 billion increased by 122% year-over-year and was also $1.3 billion above estimates.

At face value, this was a solid report. Growth was led by the core data center segment, capturing the global demand for the Hopper GPU computing platform, critical for training large language models and running generative AI applications. Smaller segments like gaming, visualization, and automotive solutions are also strong, even accelerating in recent quarters.

That being said, nothing in the market occurs within a bubble. It’s important to recognize that shares of NVDA had already climbed nearly 30% in the past three weeks, going back to the period of tech sector weakness in early August. That was a massive move, likely anticipating this Nvidia report, effectively pricing in the potential good news. By this measure, the selloff likely represented a sell-the-news dynamic, where the stock had already been bought on the rumor.

If anything, the immediate pullback serves as a good lesson for investors that earnings are always high-risk events where any scenario is on the table.

Diminishing Beats

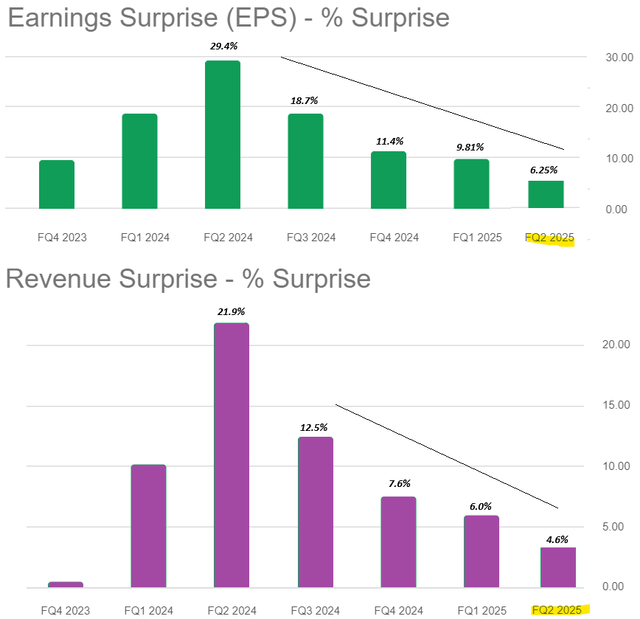

What can’t be overlooked is that even as Nvidia once again exceeded expectations for sales and earnings this quarter, it’s clear the size of those beats has narrowed over the past.

For Q2, the EPS result was a modest 6.25% above the consensus, far from the breakthrough “mic drop” moment the company delivered last year when it blew away earnings estimates by 29%. Similarly, even as revenue this quarter was $1.3 billion ahead of what the market was forecasting, the 4.6% surprise was far less impressive than what was achieved in recent quarters.

This dynamic can be extended to critique the Q3 guidance, where Nvidia expects revenue of $32.5 billion, modestly 2.5% higher than the current market consensus of $31.7 billion. Not to downplay the implied 79% y/y revenue growth which any other company would be envious of, this is a case where good may not be good enough for Nvidia, which had appeared unstoppable thus far.

Tough Comps and Margins Uncertainty

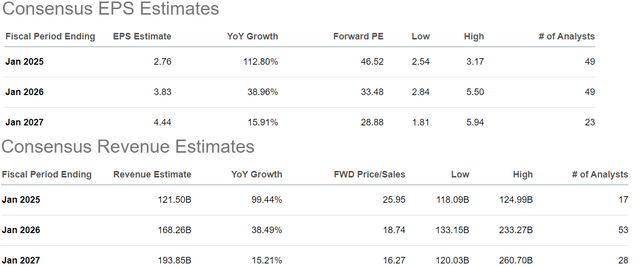

The problem for Nvidia becomes managing expectations. Looking out over the next two years, growth is set to dramatically decelerate from the forecast 99% annual revenue increase this year towards 15% by fiscal 2027 against the high baseline of comparison.

This type of normalization is completely normal for a company transitioning from an ultra-high growth phase but also introduces several risks trading at a forward price to a sales multiple of 26x.

One scenario we envision is where Nvidia falls victim to its success, as it is set to launch the next-generation Blackwell architecture AI systems. Beyond any temporary timing delays or the cadence of the rollout, what is more uncertain is the demand tailwind long-term, with forecasts related to data center builds and computing power generally highly speculative.

It’s possible that major customers, including mega-cap tech sector leaders that have already invested Billions in Hopper clusters, may find that an immediate upgrade to Blackwell is unnecessary. They may at least choose to be much more efficient in their next wave of investments.

There is also a concern with how margins for Nvidia will evolve long-term in consideration of average pricing and gradually rising competition. Notably, the Q2 adjusted gross margin at 75.7% already ticked lower from the record 78.9% in Q1. Comments in the earnings conference call suggest a “mid-70s” target for the full year, which will be a key metric to watch going forward.

So if there is a bearish case for Nvidia, it starts with a belief that consensus estimates into fiscal 2026 and 2027 have some downside. That doesn’t mean sales will collapse or that “AI is a bubble,” but the market may still be too optimistic about how the industry will transform and where Nvidia fits in.

The Big Picture for Investors

We rate NVDA stock as a sell under the assumption that the company has passed its peak growth stage and near-term risks are tilted to the downside. For long-time shareholders with a low-cost basis, defensive strategies such as writing covered calls could make sense.

Down more than 20% from its all-time high, NVDA is already in a bear market, with an extreme range of volatility likely to continue in both directions. Shares were trading near $90 just a few weeks ago, with a return to that level well in the realm of possibilities. Investors looking at the stock for the first time may find a more attractive entry point down the line as the dust settles.

On the upside, bulls will be rooting for NVDA to rebound quickly towards its record high of $140.76 as a first step to rebuilding positive momentum. A close above that level would force us to reassess our bearish outlook.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein represents the personal opinions and views of Dan Victor only and is intended for informational and/or educational purposes. It should not be construed as a specific recommendation or solicitation to buy or sell any security or follow any particular investment strategy. Please consult with your financial advisor before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.