Summary:

- We continue to expect more upside for Taiwan Semiconductor before the AI tailwind gives out.

- We think TSMC is uniquely positioned in the foundry market in terms of share and technological advantage to benefit from high demand for AI and potential end demand rebound in 2025.

- Trump’s comments and the geopolitical concerns about the chip wars between the U.S. and China undermine the potential upside for TSMC.

- We expect TSMC to comfortably outperform expectations and the S&P 500 in 2025.

Blackstation/DigitalVision via Getty Images

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) continues to be one of our semi-favorite picks during the AI rally; the stock is up ~85% since we wrote about it in October of last year. We’re reiterating our positive outlook on TSMC as we see more upside before the AI tailwind gives out. There are a couple of factors to consider in order to realize why TSMC is so uniquely positioned in the AI accelerator market and why we expect this will support the stock’s outperformance against the peer group in 2025.

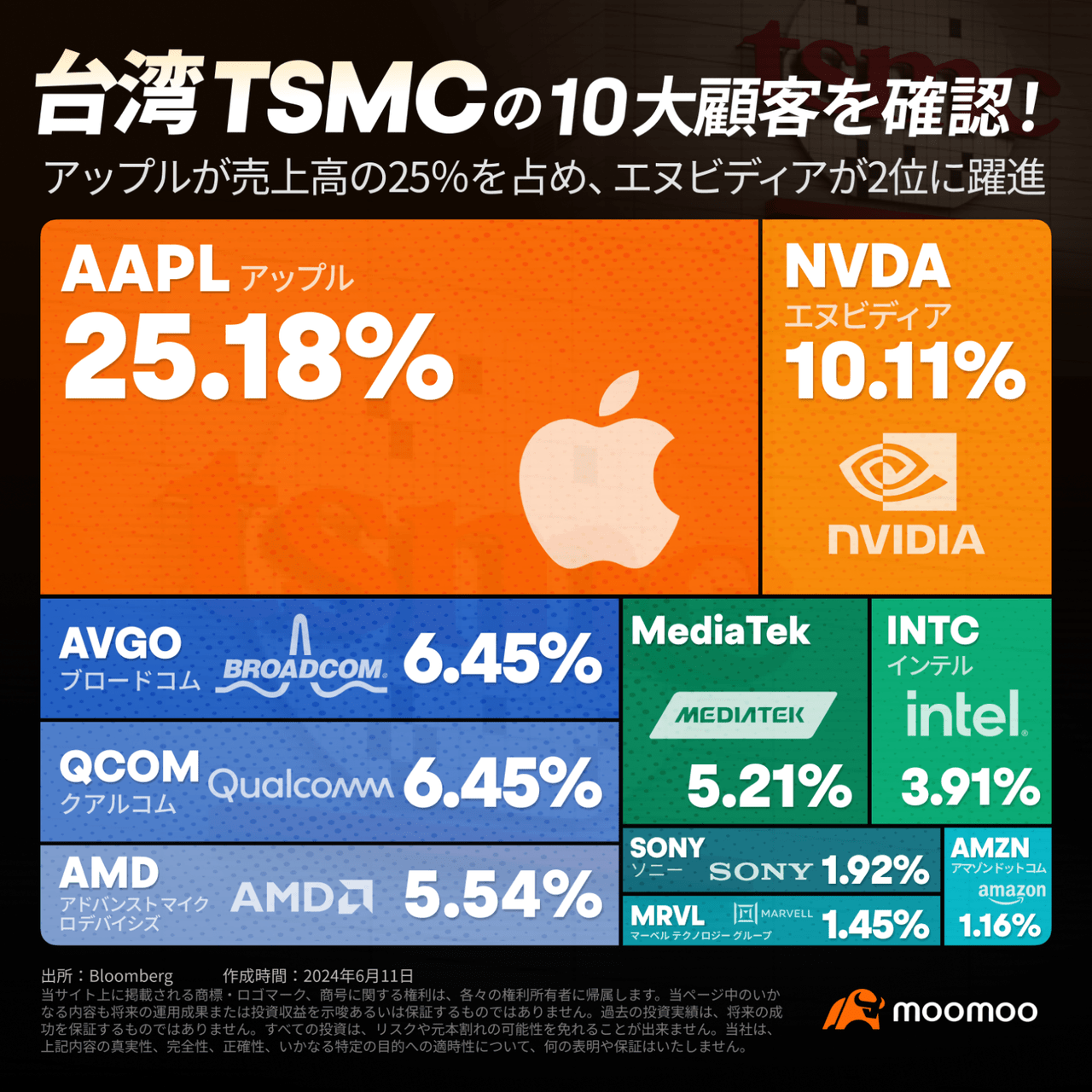

First is the company’s position as reflected by its net revenue by platform and top customers; while TSMC is a fab (chip-maker) and hence has its eggs in multiple end market baskets, the company derives the bulk of revenue from two specific end markets: smartphone and high-performance computing, or HPC, at 33% and 52%, respectively. This breakdown matches TSMC’s largest customers list, which consists of Apple (AAPL), accounting for an estimated 25% of TSMC’s total sales, followed by Nvidia (NVDA) accounting for 10.11% of total sales. These are the two companies that account for more than 10% of total sales, but TSMC still has a lot more semi-players under its belt, including Intel (INTC), Advanced Micro Devices (AMD), Qualcomm (QCOM), MediaTek, and others shown in the image below. TSMC’s impressive customer list is no surprise, considering that the company dominates the foundry market, i.e., the market of chip-making, also known as fabs, with a 61.7% share in 1H24 and the second-largest market share holder being Samsung at only 11%. So, TSMC’s unique position comes from its status as the supplier for Apple and Nvidia.

The Apple side of the business, in which TSM supplies the most advanced nodes for the company’s A-series chips in iPhones and M-series in Macs, has been slower than expected due to muted smartphone demand in 2024. This is actually reflected in the percentage of total sales made up by smartphone sales over the past four quarters at 39% in 3Q23, 43% in 4Q23, 38% in 1Q24, and 33% in 2Q24. Management was more positive in its outlook on smartphones this quarter, but we think the overarching narrative for 2024 is more accurately depicted in their 1Q24 earnings call, when they revised down the forecast for the overall semi-market growth for the year. Then, management stated the following:

“…macroeconomic and geopolitical uncertainty persists, potentially further weighing on consumer sentiment and end-market demand. We thus expect the overall semiconductor market, excluding memory, to experience a more mild and gradual recovery in 2024. We lowered our forecast for the 2024 overall semiconductor market, excluding memory, to increase by approximately 10% year-over-year, while foundry industry growth is now forecast to be mid-to high-teens percent; both are coming off the steep inventory correction and/or base of 2023.”

We agree with management’s sentiment on 2024 regarding end demand recovery; we had forecasted in our October thesis “mixed data points for the smartphone market” and expected “PC and the Server end markets to recover in 2024.” While we did see strength from AI servers, the PC forecast didn’t come through, as there was no real catalyst to cause that rebound this year. We think there is a higher likelihood of seeing PC recovery materialize next year as AI PC use case through Copilot for commercial customers, i.e., corporate and enterprise, coupled with the Microsoft Windows End of Life or EOL, could lead to AI PC adoption, especially in a more favorable interest rate environment. So, this tells us that TSMC’s outperformance over the past four quarters has been predominantly driven by hyper AI server demand and its position with Nvidia to supply fabrication services for its AI processors, H100, A100, and now the next-gen Blackwell series.

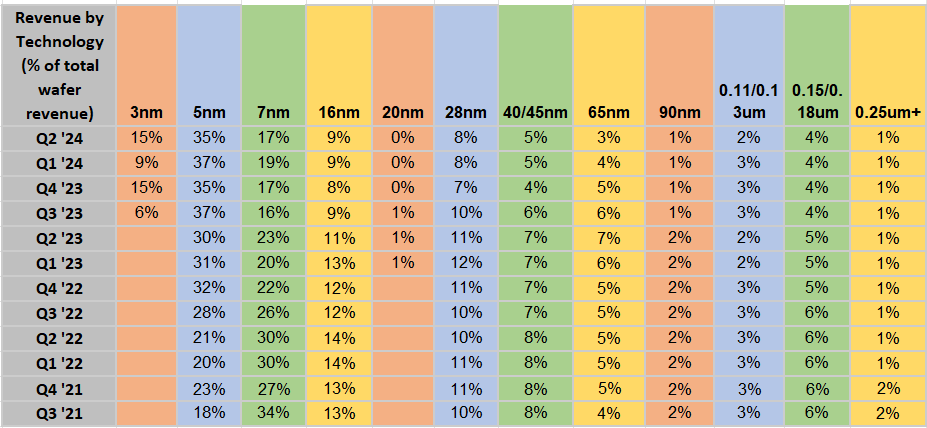

This brings us to the second factor to consider when it comes to TSMC: the company’s competitive advantage in the production of advanced nodes, i.e., 3nm and 5nm. This advantage is crucial as smartphones move to small nodes, and AI is expected to follow next year. The chart below showcases TSMC’s revenue by technology; the 3nm and 5nm wafer revenue make up an increasingly larger amount of total revenue. Part of TSMC’s dominant position in the foundry market is its status as the manufacturer of the “world’s most advanced chips, designated by node size,” particularly the 3nm, which is the most advanced node in production and is used for the smartphone end market in iPhones and Macs followed by the 4nm/5nm ones used by Nvidia in AI accelerators. Nvidia’s AI accelerators are anticipated to move to 3nm and possibly 2nm down the road, keeping up with Moore’s Law, which makes TSMC the go-to chipmaker for advanced chips all the more well-positioned. Reports from Nikkei Asia also note that TSMC intends to “start production of ultra-advanced 1.6-nanometer chips by 2026,” which would help secure its position for the decade.

TechStockPros

Why Trump’s comments won’t stick?

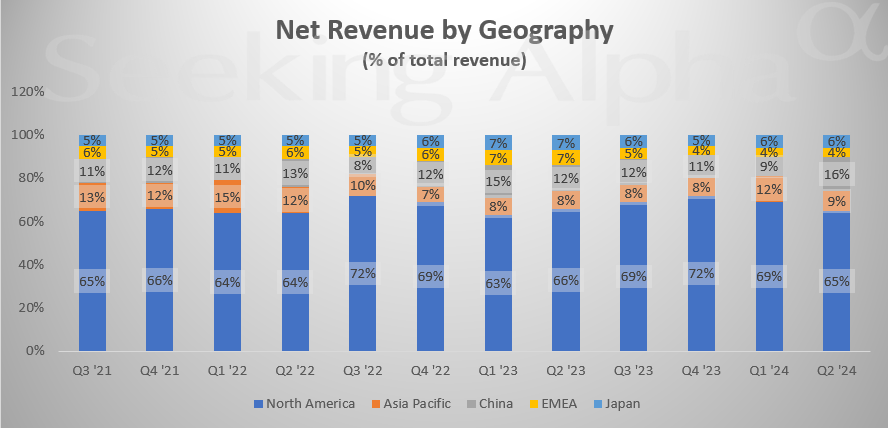

Former U.S. president and current Republican presidential candidate Donald J. Trump made some triggering comments about Taiwan and TSMC around mid-July, adding to the broader semi-downturn that month. Trump emphasized in an interview with Bloomberg Businessweek that “Taiwan should pay us for defense… You know, we’re no different than an insurance company.” The logic behind his comments matches the broader tensions between the U.S. and China’s chip wars but takes it to another extreme by seemingly detaching the U.S. from Taiwan, an ally of the U.S. against China, plus (more importantly for our discussion) the world’s largest chip-maker that fuels the U.S. chip market. North America has historically accounted for a high double-digit percentage of TSMC’s total sales and continues to be the main geographic market for TSMC’s chip, making up ~65% of total revenues by geography, as shown below. This goes to say that the U.S. needs TSMC and vice versa. The potential of the U.S. demanding that Taiwan pay for defense is baseless, in our opinion.

SeekingAlpha

Not only would that kind of arrangement make no sense in terms of maintaining the friendly relations between the U.S. and the Island that houses TSMC, but it would also make little sense because it would hinder the U.S.’s efforts to bring chip-making to U.S. soil; efforts that TSMC is very much a part of. For reference, the Creating Helpful Incentives to Produce Semiconductors or CHIPS and Science Act was signed in August 2022 and intentionally works to “lure microchip manufacturing back to the United States after several decades of individual companies offshoring the technology.” What most people don’t realize is that TSMC is crucial to making the CHIPS act work and has been a part of setting up fabs in the U.S. Hence, it is no one’s benefit to milk the Island for defense fees now.

There’s also a lot of market noise around the assumed higher risk profile held by TSMC due to a potential invasion from China. We think this is highly unlikely to happen over the next 1-2 years and would warn investors about feeding into this narrative, particularly considering TSMC’s unique position in the AI market. Looking back to the chart above, China also benefits from TSMC, accounting for a double-digit percentage of revenue by geography at 16% in the most recent quarter. Taking into account that China needs TSMC’s chips and knows that in the case of an invasion, ASML (ASML), the company that makes the lithography machines that TSMC uses to make chips, can remotely turn off the machines, there is little to no grounds for a potential invasion in the near-term, unless one of these factors changes. This does not even account for China’s internal struggles with a massive economic slowdown that has the country’s hands full for the near term trying to stimulate its economy after a draining COVID restriction period.

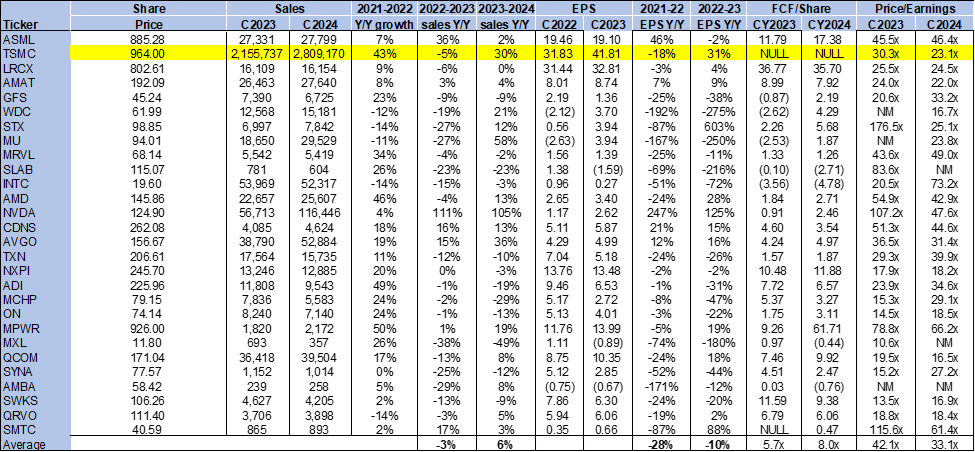

Valuation & Word on Wall Street

TSMC is cheap relative to the semi-peer group for its position in the AI market. On a P/E basis, the stock is trading at 23.1x C2024, compared to the peer group average of 33.1x. The stock’s P/E ratio is understandably higher than it was last October when it was around 17.7x compared to a peer group average of 32.0x. Looking to other semi-names with less of a strategic position in the AI accelerator market, like AMD, for example, which didn’t experience the AI-led upside in sales that TSMC enjoyed, we see a much higher multiple at 42.9x close to the industry leader, NVDA, whose ratio is 47.6x. We think TSMC is undervalued for its growth potential into 2025, and we believe this makes it all the more attractive for 2025. We think the company will see a boost from NVDA’s next-gen ramp and the end market demand recovery as macro headwinds are expected to ease.

TechStockPros

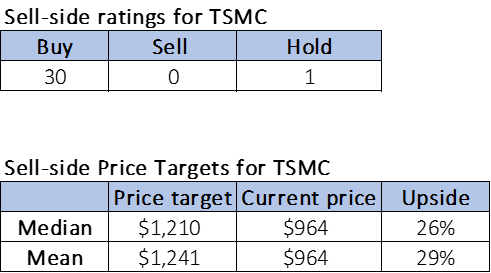

Wall Street has shifted to share a more positive sentiment on the stock since our last article in October. Of the 31 analysts covering the stock, 30 are buy-rated, and one is hold-rated. Sell-side price targets confirm more of the same, with the median sell-side price target set for $1,210 and the mean for $1,241 with a potential 26% to 29% upside, outpacing the estimated upside when we covered the stock in October, which stood at 22% to 25%. TSMC easily surpassed sell-side price targets last October, and we see a similar trend in stock pricing into 2025. Again, we emphasize that there is a lot of market noise around this stock that undermines its position in the AI market. We expect TSMC to show an upside surprise to the forecasted 26%-29%. The following charts outline TSMC’s sell-side ratings and price-targets.

TechStockPros

What to do with the stock

We continue to be buy-rated on TSMC for 2025 as we see a clear growth runway supported by AI tailwinds from +10% customer Nvidia. We also think TSMC has secular tailwinds working in its favor next year, with a higher likelihood of a rebound on PC end demand next year. Management also emphasized strong momentum from the smartphone market more this quarter, confirming our optimistic outlook there in spite of muted near-term demand. TSMC is also owning the longer-term game of advanced tech with smaller nodes through its tech positioning and market share with Apple and Nvidia. We think there is more upside surprise to come and would recommend investors explore entry points on a potential pullback this week after Nvidia prints, as we expect to see a pullback in the semi space on Nvidia’s potential mixed outlook/commentary about the October quarter.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.