Summary:

- Walmart’s strategic partnerships and tailored physical and digital strategies have led to its dominance in China’s retail market, defying expectations.

- The decision to sell its JD.com stake marks a new phase for Walmart, focusing on leveraging its strengths for further expansion.

- Sam’s Club’s success in China, driven by the emerging middle class and demand for quality products, has been pivotal for Walmart’s success in recent years.

- Walmart’s China success strategy, which is centered on a few pillars, is now being implemented in other global markets.

SeanWang/iStock Editorial via Getty Images

China is a tough market for foreign companies. Only a very few foreign companies survive the fierce competition from local players in any business vertical, and it’s a rare sight to see a foreign company dominating a high-value market segment in China. Some of the notable American companies that failed to make it big in China include eBay Inc. (EBAY) which exited China after struggling to compete with the likes of Taobao, Amazon.com, Inc. (AMZN) which was forced to shut down the domestic marketplace, The Home Depot (HD) which left China citing a mismatch between its products and consumer preferences, and even Uber Technologies (UBER) which sold its Chinese operations to market leader DiDi Global (OTCPK:DIDIY).

Walmart Inc. (NYSE:WMT) is proving to be an exception, with the company emerging as the leader in the crowded Chinese retail industry. A closer look at the company’s recent decision to sell its stake in JD.com, Inc. (JD) and the company’s China strategy suggests Walmart’s international business is entering a new phase where the company will try to replicate its success in China in other global markets in the long run, opening new doors to grow. The strong momentum behind Walmart stock, which has doubled in the last five years, should continue in the foreseeable future, aided by stellar international sales growth.

Walmart Sends A Strong Message

When Walmart, America’s largest retail company, entered China in 1996, the goal was to benefit from exposure to one of the fastest-growing economies in the world. Many investors, at the time, would not have predicted Walmart to dominate the Chinese retail market by 2023, but this is exactly what happened last year with Walmart, aided by the strength of its wholesale membership business Sam’s Club, rising to the top of the ladder in the Chinese retail sector.

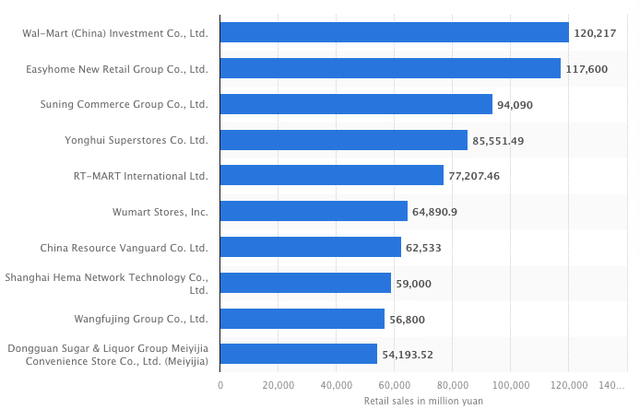

Exhibit 1: Sales of retail companies operating in China, 2023 (in yuan millions)

Statista

Walmart’s impressive performance in China comes down to strategic partnerships with local players. Walmart partnered with JD in June 2016 to tap into the local expertise of JD, its technology, and even its logistics network. As part of this collaboration, Walmart acquired a 5% stake in the company. This partnership proved to be a lucrative one for both parties, but last week, Walmart offloaded its stake in JD for approximately $3.6 billion. Commenting on this decision, a Walmart spokesperson told Seeking Alpha:

This decision allows us to focus on our strong China operations for Walmart China and Sam’s Club, and deploy capital towards other priorities. JD has been a valued partner to us over the past eight years, and we are committed to a continued commercial relationship with them.

Although Walmart and JD will continue to have a commercial relationship, I believe the retail giant’s decision marks the beginning of a new era where Walmart is likely to focus on leveraging its existing strengths in China to aggressively penetrate into new regions within the country without relying on local e-commerce partners.

Great Hill Capital chairman Thomas Hayes agrees with this stance. Commenting on Walmart’s sale of JD stake last week, he said:

Walmart wanted to get exposure in China in 2016 and kind of learned the retail business there. They did it and they expressed that interest through JD and now they have their own exposure and their own interests in China, and they no longer need a minority position in JD when they have a great business themselves.

Given Walmart’s somewhat unexpected decision, I believe interesting times are ahead for investors and Chinese consumers as Walmart tries to gain a permanent edge over its local competitors.

Walmart’s China Strategy: A Two-Pronged Approach

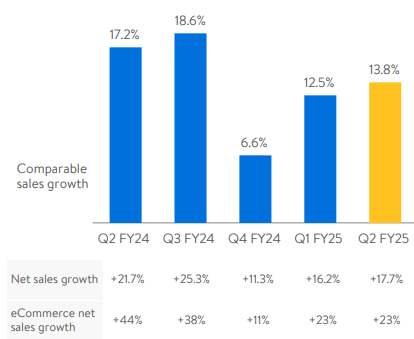

Walmart’s China operations represent a combination of physical and digital strategies geared to satisfy Chinese consumers’ unique preferences. In terms of physical presence, Walmart China has adapted to China by offering smaller stores that focus on fresh food, especially given the constraints of urban land availability and consumer tastes. This has seen membership-only bulk retailer Sam’s Club perform extremely well and gain traction, helped by an emerging middle class that appreciates higher-quality imported products. Walmart China’s second-quarter revenue increase of 17.7% was mirrored by a remarkable 13.8% increase in comparable store sales.

Exhibit 2: Walmart’s Q2 performance in China

Q2 presentation

In addition to expanding its physical footprint, Walmart is focused on providing Chinese consumers with a satisfactory omnichannel experience with a local flavor. A classic example is Walmart Mini, which is a WeChat mini program that enables Chinese consumers to order from a Walmart store within a 3-5 km radius. Walmart offers 1-hour delivery or next-day delivery for these orders. As many Seeking Alpha readers may know, WeChat is the most popular instant messaging app in China, with more than one billion monthly active users.

Walmart’s digital strategy also includes the flagship Walmart store launched on JD.com, the Walmart store on JD-Daojia, the official global store on JD.com, and Walmart Global E-Sourcing which helps Chinese businesses sell their products on other global stores operated by Walmart.

This two-pronged approach where Walmart is focused on catering to both in-store and online customers, in my opinion, has been the recipe for its success in the last decade as it has led to more brand visibility.

Sam’s Club Benefits From Industry Tailwinds

The growing popularity of Sam’s Club in China has been a key ingredient of Walmart’s success in this tough market. Although membership warehouse clubs are wildly popular in the U.S., it is not the same in many international markets. Even in Dubai, where I reside, people don’t even realize the attractiveness of such a business model. In China, however, membership warehouse clubs are gaining popularity after many years of careful expansion by Sam’s Club and even Costco Wholesale Corporation (COST).

Today, Sam’s Club is the leader in this space in China, with the company operating 47 stores in 25 cities at the end of last year. Costco, in comparison, operates only seven stores in China. There is increasing competition from local players, including Freshippo owned by Alibaba Group Holding (BABA) and Yonghui Superstores. According to Reuters data, there are at least 11 membership warehouse clubs in China today.

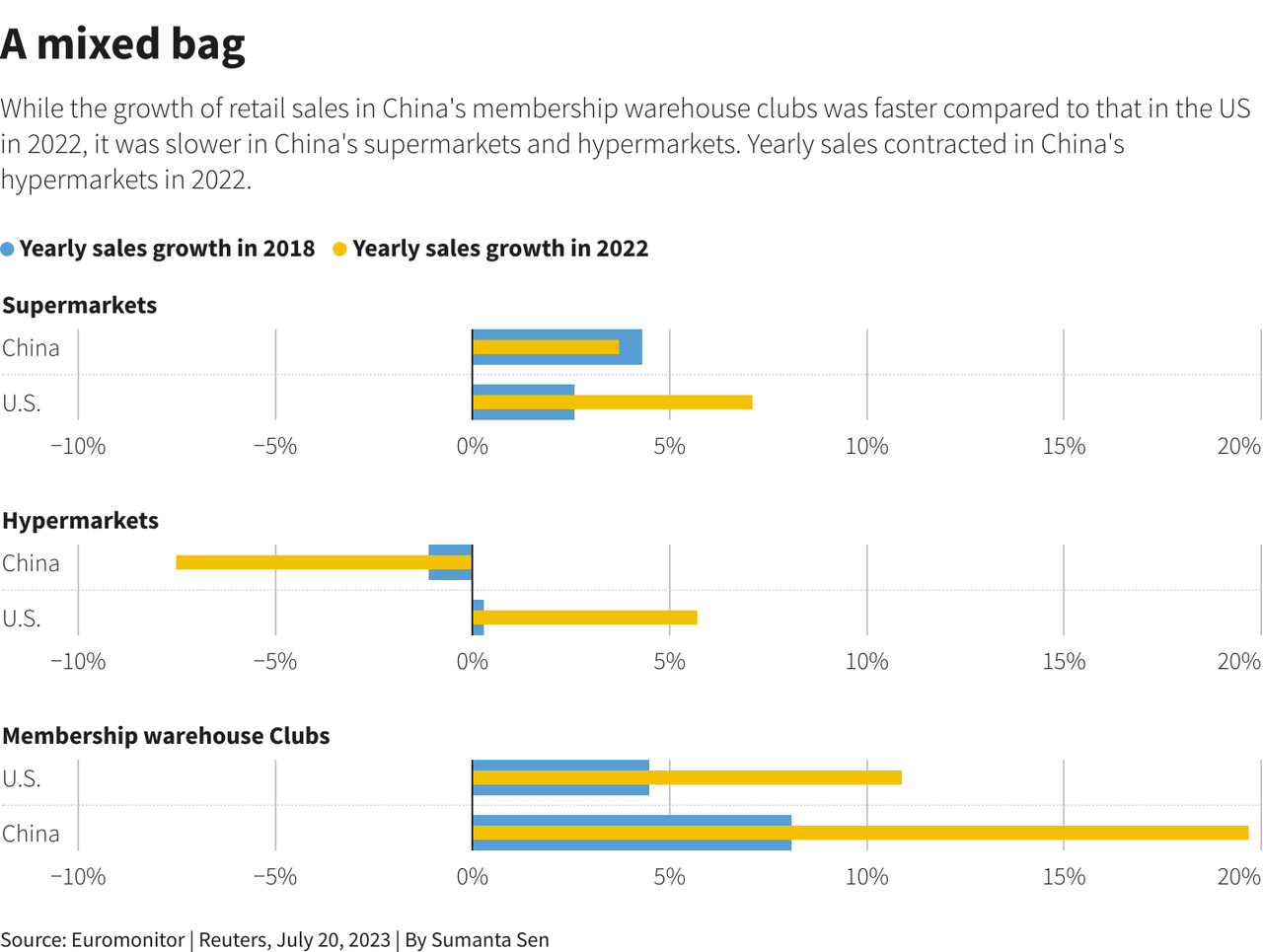

As illustrated below, 2022 turned out to be a transformative year for membership warehouse clubs in China as pandemic-induced purchasing habits continued, leading to strong sales growth compared to supermarkets and hypermarkets.

Exhibit 3: Retail sales in China and the U.S. (2018 vs 2022)

Reuters

Despite rising competition, Sam’s Club remains uniquely positioned to benefit from the expected growth in foot traffic to membership clubs as the company offers global products that are in high demand. In addition, the company’s first-mover advantages will also come in handy.

Replicating China Success In Other Markets

Walmart’s success in China in the last few years, which has instilled confidence among company executives to move into the future as a standalone entity, comes on the back of a few key reasons.

- Strategic partnerships with local partners to gain an understanding of the market.

- Catering the shopping experience – both physical and digital – to address the unique requirements and expectations of the local consumer.

- Avoiding investments in small, unprofitable local businesses just for the sake of gaining exposure to the local market.

- Prioritizing the service quality and offering seasonal discounts that appeal to the local market, rather than trying to replicate strategies that have been successful in the United States.

If you take a look at markets where Walmart failed, such as Germany and South Korea, it is evident that the company failed to understand local regulations, local consumer preferences, and thought bringing its blueprint from the U.S. would work anywhere in the world.

The U.S. still accounts for the bulk of Walmart’s revenue, contributing more than 80% of total revenue in the last two financial years. However, the company’s business in Mexico, Central America, and China grew at a faster clip than the domestic market in the last financial year.

| Market | Revenue growth in 2023 | Revenue growth in 2024 |

| The United States | 6.9% | 5.05% |

| Mexico and Central America | 12.6% | 22.7% |

| China | 6.2% | 15.6% |

Source: Company filings

The strong comeback of the Chinese market in 2024 signifies the success of Sam’s Club and the promising results of Walmart’s digital innovation in China.

I believe China is one of the hardest markets to tackle for a foreign company, and with Walmart achieving the impossible, the company is now well-positioned to finally make the most of its international expansion. For many years, investors have been concerned that Walmart’s growth will saturate in the coming years, but I believe the opposite will happen with the company finally beginning to understand the strategies that work in different markets.

When growth finally seemed to stall, modern-day corporate behemoths such as Apple Inc. (AAPL), Tesla, Inc. (TSLA), Starbucks Corporation (SBUX), and Nike, Inc. (NKE) followed a similar strategy – after trial and error – to drive earnings growth. Today, Walmart is poised to follow in the footsteps of these companies. I believe Walmart, in the coming years, will try to expand into neighboring markets of China as well, which should open new doors to growth.

Risks To The Thesis

Walmart faces stiff competition in China from both international and local players. Failure to mitigate competitive threats may prove to be fatal, given that the company is now trying to make its mark in the country by potentially expanding aggressively into regional markets. Investors will have to keep a close eye on this competitive landscape to monitor Walmart’s progress.

The complex regulatory environment in some of Walmart’s key international markets such as China and Mexico brings unique risks as well, which need to be monitored closely.

Takeaway

Conquering China is not an easy task. Last year, Walmart rose to the top of the retail ladder in China, a feat many investors thought was impossible when the company expanded into China in the late ’90s. Walmart’s China success has come on the back of a few strategies that the company is now implementing in many of its other target markets, enabling Walmart to gain a strong foothold in a few fast-growing markets. I believe exciting times are ahead for the company, with a potential acceleration in revenue growth back into the double-digits.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UBER either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.