Summary:

- Affirm’s strong growth trajectory, driven by expanding merchant network and effective risk management, now makes it a compelling buy despite previous neutral stance.

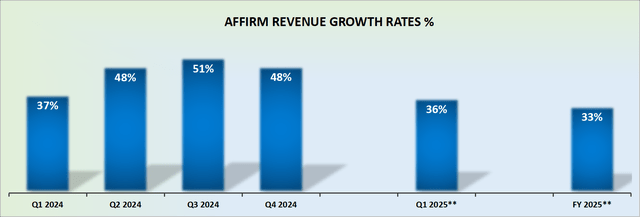

- Impressive 33% y/y revenue growth expected in fiscal 2025, surpassing analyst expectations and showcasing Affirm’s ability to grow both rapidly and profitably.

- Valuation at 17x forward non-GAAP operating profits, with potential for 19% adjusted operating margins and $600 million non-GAAP profits in the next 12 months.

- Key risks include managing profitability in a competitive BNPL market, navigating volatile credit environments, and differentiating from giants like Apple Pay and smaller players like Sezzle.

hapabapa

Investment Thesis

Affirm (NASDAQ:AFRM) delivered impressive fiscal Q4 2024 results and fiscal 2025 guidance.

More specifically, it appears that Affirm is demonstrably a growth company. And while it continues to grow its top line, it’s also carving out a path towards clean GAAP profitability.

In sum, I make the case that AFRM is attractively priced at 17x forward non-GAAP operating profits. As such, I rate this stock a buy.

Rapid Recap

On 23 May, I said in a neutral AFRM article,

[…] You may argue that [AFRM] isn’t all that expensive, for one of the leading BNPL companies. Perhaps.

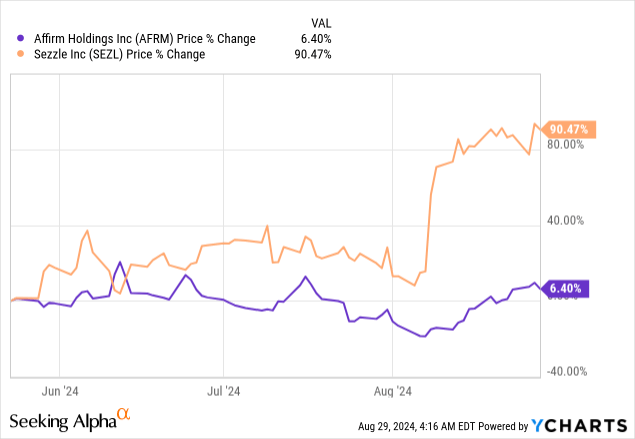

But what if I made the case that Sezzle Inc. (SEZL) is priced at 9x clean GAAP net income?

At the time, I had recommended SEZL to DVR subscribers. And now we successfully sold SEZL very recently.

Meanwhile, during this period, I had been neutral on AFRM, as I didn’t believe the stock offered investors a compelling risk-reward. However, on the back of this earnings report, I now rate AFRM as a buy. Here’s why.

Why Affirm? Why Now?

Affirm is a fintech that connects buyers and sellers through its payment network, offering a variety of financial products, including buy-now-pay-later services.

The company’s business model focuses on creating individualized payment plans for consumers while helping merchants increase sales through incremental transactions. Affirm’s growth has been driven by the continued expansion of its merchant network, improvements in its product offerings, and effective risk management strategies. In fiscal year 2024, Affirm saw significant growth in gross merchandise volume and revenue, with transactions on its network rising by 42% year-over-year.

Looking at Affirm’s near-term prospects, the company is, as often with Affirm, demonstrably bullish about maintaining its growth trajectory, having reported a strong increase in adjusted operating income in fiscal year 2024.

The company’s ability to rapidly scale and its partnerships with top digital wallets and e-commerce platforms position it well for strong growth.

Revenue Growth Rates Impress

“Growth is always the answer”. That’s what Affirm declares in its shareholder letter. And true to form, Affirm’s topline is expected to grow in fiscal 2025 by a whopping 33% y/y. This is astonishing.

Not only is this massively stronger growth than analysts were expecting, but you have to put this in the context of this growth coming on the back of its mighty strong year.

Affirm is a company that investors had long ago believed it was overpriced and got disenchanted with its prospects.

But it turns out that there was a plan after all. And Affirm shows to all that this company has what it takes to not only grow rapidly but also to grow profitability, which is what we discuss next.

AFRM Stock Valuation — 17x Forward Non-GAAP Operating Profits

Before we discuss its valuation, let me get into what, I believe, is key when it comes to Inflection Investing. Affirm holds just over $700 million of net cash. For this figure, I included its convertible senior notes but did not include its notes issued by securitization trusts or its funding debt, since those sums are matched by the loans held for investment (which are assets).

In short, nearly 6% of Affirm’s market cap is made up of net cash, providing Affirm with ample flexibility to continue on its path of “growth being the answer”.

With this backdrop in mind, let’s now discuss the icing on the cake for this thesis.

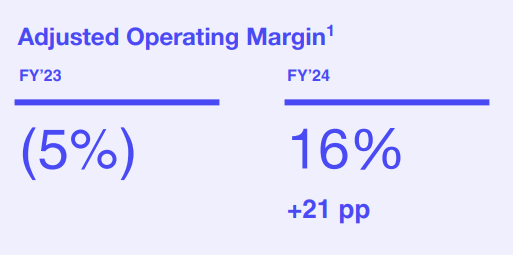

AFRM fiscal Q4 2024

Not only did Affirm’s adjusted operating margin improve by an impressive 21 percentage points y/y, but also, looking ahead, Affirm makes the case that it could potentially expand its adjusted operating margins by close to 300 basis points to 19% adjusted non-GAAP operating margins.

And on top of that, Affirm makes the case that it’s on a path to clean GAAP profitability within the next 4 quarters.

This means that it’s possible that Affirm could reach $600 million of non-GAAP adjusted operating profits in the next twelve months, leaving the stock priced at 17x forward non-GAAP operating profits.

Risks to the Bull Case

Affirm faces significant challenges, including the pressures of managing profitability in a highly competitive market. Despite strong revenue growth, the company’s profitability remains meek, with GAAP operating income just beginning to turn positive at the back end of this fiscal year.

The company must navigate a potentially volatile credit environment while maintaining strict risk management practices. Additionally, Affirm’s profitability is closely tied to external factors, such as funding costs, and the broader economic environment, and interest rates which can impact consumer spending and approval rates and its underlying capital funding.

Competition is another major hurdle for Affirm, as it must contend with other BNPL providers and established financial giants like Apple Pay (AAPL). The entry of large tech companies into the BNPL space poses a threat to Affirm’s market share, as these competitors have extensive user bases and significant financial resources, as well as smaller players like Sezzle.

To stay competitive, Affirm must differentiate itself from competitors through its pricing model, where the consumer will be consistently picking and choosing the cheapest platform.

The Bottom Line

Given Affirm’s impressive growth trajectory, expanding market presence, and significant improvements in profitability, paying 17x forward non-GAAP operating profits appears to be a worthwhile investment. The company’s robust revenue growth and path to GAAP profitability within the next year further solidify its potential for delivering strong returns.

Despite the challenges posed by a competitive landscape and macroeconomic factors, Affirm’s strategic positioning and ability to scale effectively make it a compelling buy.

So, in the end, Affirmatively, this stock could be a firm addition to your portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.