Summary:

- Advanced Micro Devices, Inc.’s quarterly earnings were quite good, but the stock has not shown a massive upswing.

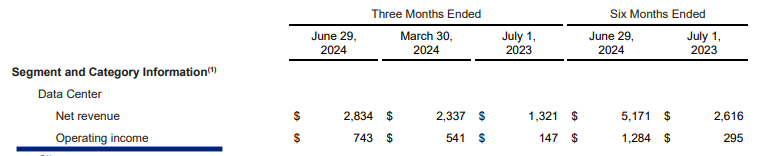

- The most important metric for AMD will be the growth trajectory within its Data Center business.

- AMD’s management has announced an 11% increase in the 2024 estimate of Data Center GPU sales, which shows a further increase in the growth momentum.

- Betting on the second-best option can deliver better long-term returns compared to market leader Nvidia, which has a limited scope of increasing market share.

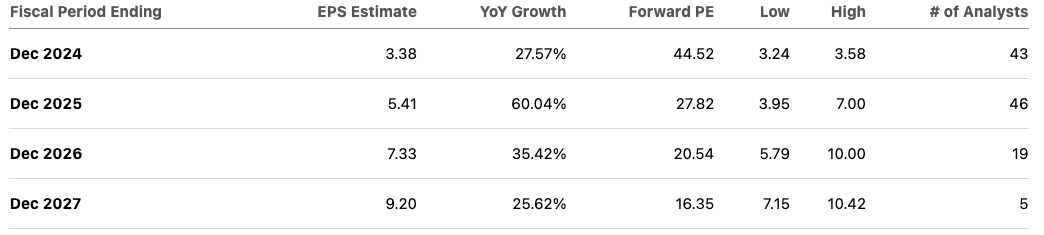

- AMD stock has a robust EPS growth estimate for the next few years, and the stock is trading at 20 times the forward PE ratio for the fiscal year ending 2026, making it a good option.

JHVEPhoto

Advanced Micro Devices, Inc.’s (NASDAQ:AMD) better-than-expected Q2 earnings did not deliver a good bullish run in the stock. The sentiment around the stock has improved, but Wall Street is still waiting to see if the company can deliver on its promises. The company beat revenue estimate by $113 million and EPS estimate by 1 cent in the recent earnings.

However, the bigger news was the announcement of the stronger growth trajectory for Data Center GPUs. AMD has increased the 2024 revenue estimate for Data Center GPU by 11%, from $4 billion to $4.5 billion. The delay in Nvidia Corporation’s (NVDA) next-gen Blackwell chips should also help AMD gain clients in this critical segment. In a previous article, I mentioned that AMD is in a perfect spot to deliver good returns due to rapid investment in AI chips.

AMD is the second-best option in the AI chips, and it is likely that the market share of the company will increase over the coming quarters as new iterations bridge the gap with market leader Nvidia. The forward EPS growth estimate for AMD is strong, and the company is trading at only 20 times the forward P/E ratio for the fiscal year ending 2026. Any further delay in Blackwell or a better growth ramp-up of AMD’s AI chips could deliver a strong bullish sentiment to the stock. Despite modest YTD returns, AMD stock is a good AI option due to industry dynamics and the current price.

Investing in the second-best option

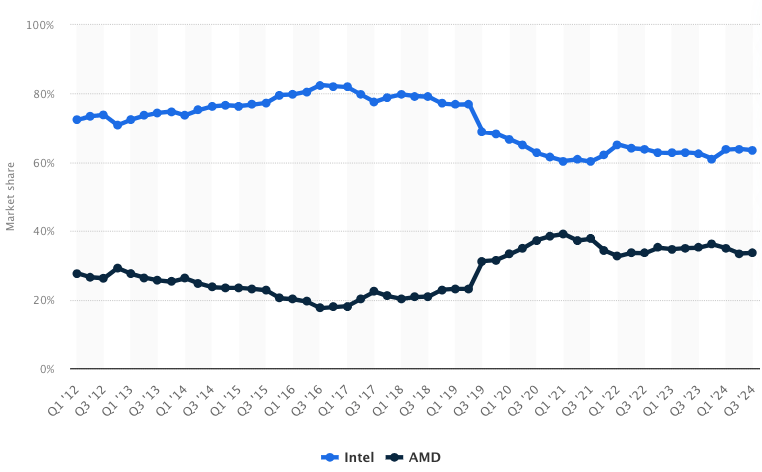

Before the AI boom, AMD was already beating Intel (INTC) in terms of market cap. This was even though Intel continues to be a market leader in CPU chips. The main reason behind this trend was the increase in AMD’s market share within CPU chips. Intel was the market leader, but it is losing market share and delays in product launches reduced the bullish sentiment toward the stock.

Statista

Figure: Market share of x86 CPUs worldwide. Source: Statista.

Before the AI boom in late 2022, AMD’s market cap had already overtaken Intel due to increase in market share.

While Nvidia is not Intel, we could see a similar trend in terms of AI chips. AMD is the second-best option, and many large cloud hyperscalers have partnered with the company. The market share of AMD in this segment is still minimal, but the successful launch of recent iterations increases the potential for AMD. The management has already announced a further increase in Data Center GPU sales estimates for 2024 from $4 billion in the first quarter to $4.5 billion in the recent earnings. This is an 11% growth, and most of the growth is likely to come in the latter half of 2024.

At the end of January, AMD CEO Lisa Su announced a Data Center GPU sales estimate of $3.5 billion. Hence, in less than six months, the revenue estimate for Data Center GPU chips has increased by 30%. It is highly likely that the company will be able to significantly beat its estimates by the end of the year as new clients are announced. This should be a strong bullish factor for AMD stock.

AMD’s forward earnings estimates are very strong

A lot depends on the growth trajectory of AI chips. Wall Street is very bullish over the ability of AMD to gain a good chunk of market share in this segment. This has led to higher forward EPS growth estimates. The EPS estimate for next year is $5.41 which gives AMD stock a forward P/E ratio of 27.82. For the fiscal year ending 2027, the EPS estimate is $9.20 and the forward P/E ratio is only 16.35.

Seeking Alpha

Figure: Earnings estimate for AMD over the coming years. Source: Seeking Alpha.

It should be noted that the low EPS estimate for fiscal year ending 2027 is $7.15 while the high EPS estimate is $10.42. The gap between low and high estimates is tiny, showing a general optimism over the ability of AMD to ramp up earnings in the upcoming years.

We could also see an increase in these projections if AMD can gain a higher market share due to delays by Nvidia.

AMD Filings

Figure: Increase in operating income of AMD in Data Center segment. Source: AMD filings.

There are early signs that AMD is following Nvidia’s path in showing a rapid increase in operating income within the Data Center segment. The operating income for AMD for Data Center business increased from $147 million in the year-ago quarter to $743 million in the recent quarter. The QoQ growth has also been strong, which shows there is an increase in sales momentum in this segment.

Risk to the thesis

AMD is facing a Goliath in Nvidia. The market share of Nvidia in the AI segment is very high, and the company has built a strong platform that prevents clients from moving to other chips. AMD will also need to manage its core business. In the recent quarter, most of the operating income growth came from the Data Center segment, while other businesses did not perform that well. Being the smaller player, AMD could also see lower margins from the AI chips as the clients bargain hard to shift to AMD’s chips.

Despite the above risks, the return potential for AMD is much higher. We have already seen how a few quarters of strong AI chip sales change the stock trajectory for Nvidia. This could happen for AMD in the upcoming quarters, making it a good AI play.

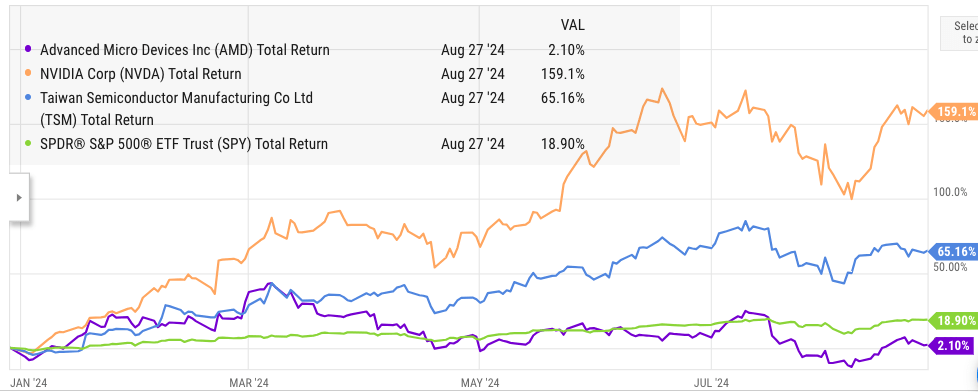

Future stock trajectory

AMD’s YTD performance has been disappointing compared to Nvidia and many chip stocks. AMD has shown only 2% YTD growth, compared to 160% for Nvidia and 65% for TSMC (TSM). Even the S&P 500 has been a much better investment, with close to 20% YTD returns.

YCharts

Figure: AMD’s performance compared to other peers. Source: YCharts.

However, this also gives AMD stock a good entry point for investors willing to bet on the long-term potential. As shown above, AMD’s forward P/E ratio is only 20 times the EPS for the fiscal year ending 2026. Any upward EPS revisions due to the faster rollout of AI chips should be a massive bullish tailwind for the stock. Nvidia has a market cap of over $3 trillion, and it is difficult to see if the stock can deliver excellent returns, even if it can retain a big lead and good market share for AI chips. On the other hand, AMD’s market cap of less than $250 billion is a fraction of Nvidia’s. Any missteps by Nvidia or a faster increase in market share by AMD could close the valuation gap between these two companies.

Investor Takeaway

AMD stock has not delivered good returns in YTD. But it is trading at a reasonable valuation when we look at forward EPS estimates. The company is already showing massive growth in operating income as the growth momentum in Data Center GPU chips increases. The management increased the sales target for 2024 in Data Center GPU chips to $4.5 billion, compared to $3.5 billion earlier this year. The final number could easily beat this estimate, as recent Blackwell delays might force more clients to hedge their AI chip purchases.

AMD stock has earlier shown a good performance compared to Intel, despite having a lower market share in the CPU segment. This shows that Wall Street will likely give a higher multiple to the company eventually, increasing its market share. Currently, Nvidia is the market leader in the AI segment, with an overwhelming market share. It is very likely that AMD will carve a good chunk within this segment over the coming quarters. The increase in market share of AMD’s AI chips could deliver a strong bullish sentiment to the stock. This should allow the stock to outperform Nvidia and other rivals.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.