Summary:

- I’m downgrading Disney to a hold.

- I see more near-term headwinds weighing on its experiences business, and I don’t think entertainment will be able to offset the weakness for 4Q24.

- I like price hikes, and password-sharing initiatives as midterm catalysts but don’t see any near-term impact from them for no other reason than timing.

- I share my thoughts on Disney stock here and why I don’t see the stock substantially outperforming in the 2H24.

Volodymyr Ivanenko/iStock via Getty Images

Investment thesis:

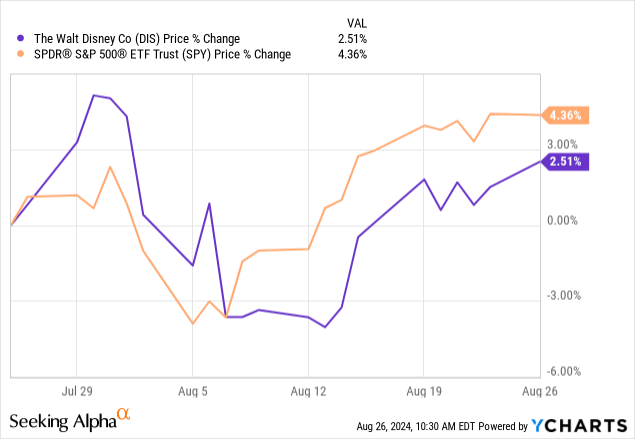

I’m downgrading Disney (NYSE:DIS) (NEOE:DIS:CA) to hold from buy post-3Q24 earnings, despite a double beat on the top and bottom lines. Management reported revenue up 4% from a year ago quarter to $23.16 billion, higher than consensus of $23.07 billion, and EPS at $1.29, higher than consensus at $1.19 per share. The stock traded lower into print and flat after; the stock is up 2.5% against the S&P500, which is up 4.3% on the one-month mark, as seen below. I’m less optimistic about Disney in the near term due to the uncertainty around the Experiences business shown by 1. management’s “flattish” revenue outlook and 2. headwinds from lower consumer spend due to recession fears. Management’s commentary on the call this quarter was guarded, and I think this is in big part due to more potential downside for its Experiences business. I also don’t think entertainment will necessarily save the day, in spite of streaming achieving its first profitable quarter. I think the bundling, price hikes, and password-sharing initiatives will serve as midterm tailwinds for no other reason than timing: password-sharing will kick in this September, and price hikes will occur in mid-October. This leads me to believe Disney has no real near-term catalyst to support Q4 outperformance and to offset the negatives from the experiences segment.

YCharts

General overview of this quarter’s finances:

The company reported income of $3.1 billion this quarter, an improvement from a loss of $0.1 billion in a year ago quarter. EPS also witnessed an improvement and came in at $1.43 this quarter versus a loss of $0.25 in a year-ago quarter, resembling double-digit growth of 35%.

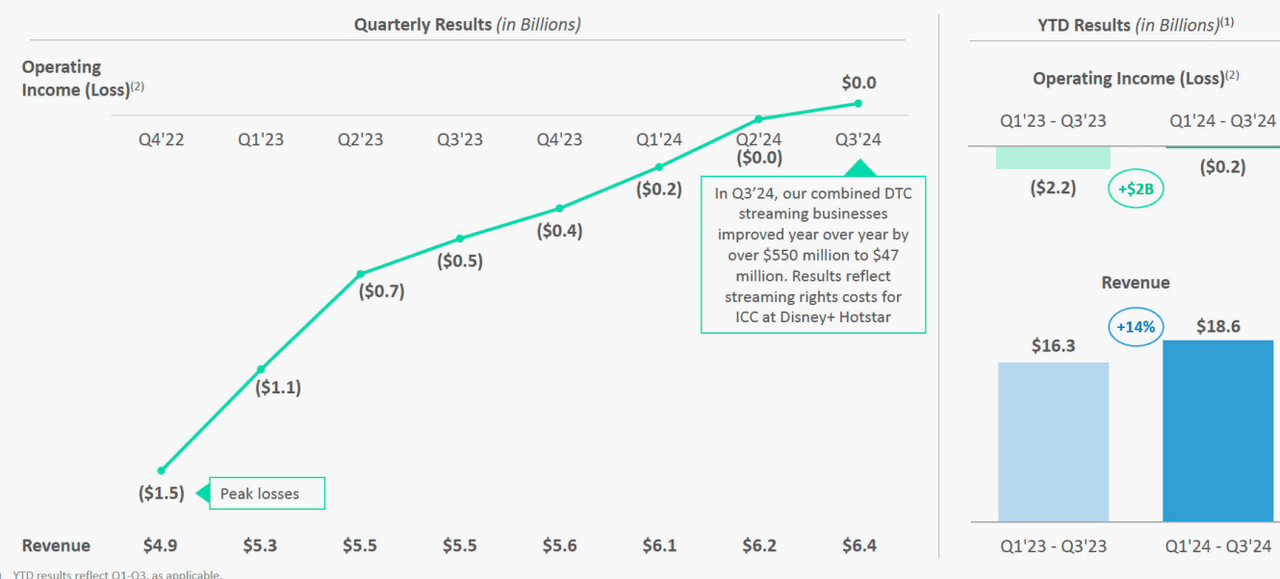

Disney has several legs of growth, with Experiences making up around 26% of total revenue at $8.38 billion this quarter, 2% higher than a year ago quarter. Entertainment makes up south of 45% of total revenue and came at $10.58 billion, 4% higher than a year ago quarter. Sports made up the smallest chunk of revenue at less than 20%, with revenue in the segment at $4.55 billion, 2% higher than a year ago quarter. Operating income for the Sports and Experiences segments came at a 3% and 6% decrease, respectively, and were offset by a +100% increase in Entertainment, which came at $1.2 billion, significantly higher than a year ago quarter at $408 million. This resulted in the company increasing its combined operating income by 19% year over year to $4.25 billion. This came a quarter earlier than the company had expected, and this was driven by stronger-than-expected DTC growth and profitable results from the ESPN+ offering. The entertainment segment’s operating income tripled this quarter, mainly due to unexpected 15% DTC growth this quarter. The segment’s revenue came in at $6.3 billion, higher than $5.25 billion in a year ago quarter, and operating income at $47 million, higher than a loss of $512 million in a year ago quarter. The following graph from the 3Q earnings presentation shows revenue over the last eight quarters.

Disney 3Q24 earnings presentation

For next quarter, the company is expecting operating income to go down to the single-mid-digit and for revenue to come in at a 500 basis point increase by 30%.

Let’s talk specifics:

Entertainment:

Direct-to-consumer increased to $5.8 billion this quarter, higher than expectations and a year ago quarter at $5 billion, due to increases in retail pricing and growth in Disney+ Core, adding 0.8 million quarter over quarter and 8.8 million year over year. Disney+ international subscribers suffered a loss of 0.1 million. Linear networks suffered and came in at $2.7 billion this quarter, lower than a year ago quarter at $2.9 billion. This happened due to declines in advertising revenue caused by a decrease in impressions and lower affiliate revenue on fewer subscribers. Content sales and licensing came in at $0.3 billion, higher than a year ago, at a loss of $0.1 billion, mainly due to the performance of Inside Out 2. Hulu subscribers increased by 0.9 million to 51.1 million versus last quarter at 50.2 million and a year ago quarter at 48.3 million. I share management’s sentiment and expect to see moderate growth in Disney+ Core and for DTC and ESPN+ to be profitable. As I mentioned before, next quarter won’t be eventful, as the tricks Disney has up its sleeve are expected to show up two quarters from now. What I’m referring to here by “tricks” are the company’s price hike and password sharing initiatives.

-

Price Hikes: the company announced that it is raising prices for most plans, with Disney+, Hulu, and ESPN costing 1$ to $2 more and the most expensive plan for Hulu, including live TV, at $6 more per month. In my opinion, the company earned these price hikes due to the success it had lately in its streaming business. Disney had 183 Emmy Nominations, a reflection of its creativity and success in content like Shogun, The Bear, and the “tremendous consumption” since the launch of Inside Out 2 in November. The stock dipped over 4% on August 6 after the news, and I believe the market has priced in the negatives. One thing I’m worried about is the churn rates increasing as a result. But based on the company’s history with price hikes and its new focus on engagement through offering a wider array of programs, such as news and aggressive bundling, I don’t think the price hikes will have a negative impact on subscribers going into 2025. Over the next two years, Disney is releasing “Moana, Mufasa, Captain America, Snow White, Thunderbolts, Fantastic Four, Zootopia, Avatar, Avengers, Mandalorian, and Toy Story.” I talked about this in my last article on Disney, and I’ll say it again: “Disney is a household name that offers a sense of nostalgia.. fortunately, this can be grounded and monetized.” I believe the upcoming content mentioned above, along with the last bundle with Warner Bros. Discovery (WBD) that includes Disney+, Hulu, and Max, and its efforts to attract subscribers through ABC News Live will all play in the company’s favor on the longer-term, rather than the near-term.

-

Password sharing: Following the footsteps of its biggest competitor in the streaming industry, Netflix (NFLX), Disney is expecting the initiative to kick in starting in September after introducing it in June. So far, management hasn’t had “backlash at all to the notifications that have gone out and to the work that we’ve already been doing.” I think Netflix really paved the path for the password-sharing crackdown, so I don’t expect Disney to face too much trouble there.

Parks and possible downside ahead

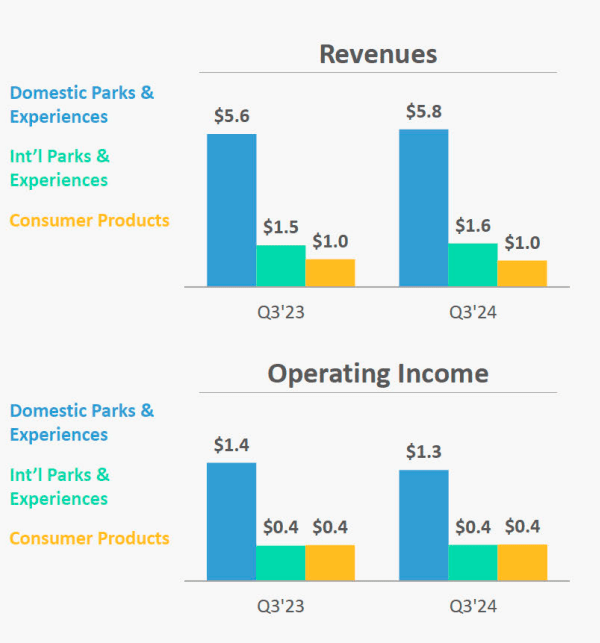

The Experiences segment revenue increased by 2% year-over-year this quarter, with operating income down 3%. Revenue growth was negatively impacted by moderate consumer demand during the quarter. Operating income decline came as a result of higher costs due to inflation and increased technology spending accompanying new guest offerings. The numbers are as follows: Domestic parks and experiences revenue was up to $5.8 billion this quarter, higher than a year ago quarter at $5.6 billion, and International parks and experiences revenue was also up to $1.6 billion, higher than a year ago quarter at $1.5 billion. Management is expecting a “flattish revenue number in Q4 coming out of parks” due to weaker consumer spending. Basically, lower-income consumers are spending less due to economic headwinds, and higher-income consumers are going abroad, leaving parks a little lonely. I believe this will show up on the top line in Q4, along with some of the one-time costs of cruise ship investments weighing on the bottom line. It’s also worth mentioning that up to 40% of the Experience business doesn’t come from domestic parks but from international parks and consumer products. This leaves around 60% of revenue from this segment comes from domestic parks, including cruise ships. I believe this is positive and gives the company more flexibility to offset weakness in domestic with international and vice versa.

Disney 2Q24 earnings

Sports-Fate is unknown: nothing much, yet.

ESPN’s domestic revenue increased to $3.9 billion, higher than a year ago, at $3.7 billion, and both ESPN International and Start India came in flat. The growth can be attributed to advertising revenue growing 17% with rate increases and sponsorship increases. The stagnation is due to increased programming and production costs, as well as lower affiliate revenue. Star India’s operating loss came in higher year over year this quarter at a loss of $0.3 billion, up from $0.2 billion, mainly due to higher costs with the ICC T20 World Cup. In my opinion, Star India poses some threat to Disney’s operating income in its sports offering. This quarter, ESPN’s operating income came at a 4% increase but was impacted by Star’s shortcomings and came in at a loss of 6%. Honestly, I have been looking for new catalysts, and there isn’t much there. Management sounds like a “broken record” and has been having conversations about new partnerships for several quarters now, and the one promising deal would be with the NBA, which won’t kick in until 2026.

Valuation:

Disney has a market cap of $165.07 billion and an enterprise value of $211.3 billion. Its PEG ratio is at 1.2, meaning the market is pricing in future growth, and its P/E ratio is at 34.9, reflecting the same conclusion. The investor sentiment is optimistic on Disney currently, with ~18% of Street Analysts giving the stock a strong buy and 48.5% giving it a buy. Over 30% of Street Analysts are a hold, and only 3% are a sell. I believe this means the market is pricing in the positives from the password crackdown and price hikes positives pre-maturely. The current median and mean PT have both seen a downward trajectory since late May. The median price target was at $130 in May and was constantly so through June but decreased slightly to $128 in July and currently stands at a low of $110. The mean was similar; in May, the mean came in at $124.7, and it came in slightly lower in June at $124.3. It continued to decrease through July at $123.4 and is currently at $111.08. I believe this reflects adjusted expectations over the last few months, considering the macro uncertainty. I think Disney is on the right track to boost top-line growth in 2025, but I think the Experience segment slowdown will weigh on growth in the near term. This is not a reflection of a Disney misstep but the economic landscape in general. Lower-income consumers are choosing to put their money on necessities, not luxuries. And I believe as the Fed cuts rates next month, we will see less stressed consumer spending habits in the midterm.

What’s Next?

Disney is going through its growing pains in an unfriendly macro backdrop. The company witnessed streaming profitability a quarter earlier than anticipated, with operating income tripling in the entertainment unit and its streaming businesses Disney+, Hulu, and ESPN turning a profit. Management is guiding for modest growth in Disney+ next quarter and to see profitability with DTC and ESPN+. I think the streaming growth trajectory is impressive, but I don’t necessarily believe it’ll offset the slowdown in Disney’s Parks and Experiences that are facing trouble at home and abroad: domestically due to consumer spending headwinds and internationally in Disneyland Paris due to the Olympics. I think we’ll see more attractive windows into Disney after Q4 earnings report.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.