Summary:

- Microsoft is continuing to report great results quarter after quarter and is still optimistic for the coming year.

- Nevertheless, we should not ignore the risk of a potential recession, and considering the high growth rates necessary for Microsoft to be fairly valued, we should be rather cautious.

- In my opinion, Microsoft remains a “Hold”

NguyenDucQuang/iStock Editorial via Getty Images

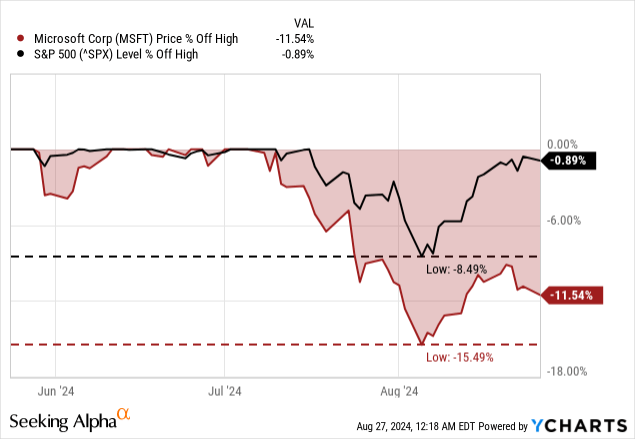

My last article about Microsoft Corporation (NASDAQ:MSFT) was published in December 2023, a few days before Christmas. And similar to previous articles about Microsoft, I rated the stock as a “Hold”. In the meantime, the stock increased about 11.5% while the S&P 500 (SPY) increased 18.5% in the same timeframe. Hence, Microsoft would have not been the best investment, but it also wasn’t a terrible investment.

In the last few weeks, Microsoft declined about 15% from its previous all-time high and while some other analysts are arguing this is a buying opportunity, I still think Microsoft is a “Hold” at best and in the following article I will explain why Microsoft is still not a great investment at this point.

Quarterly Results

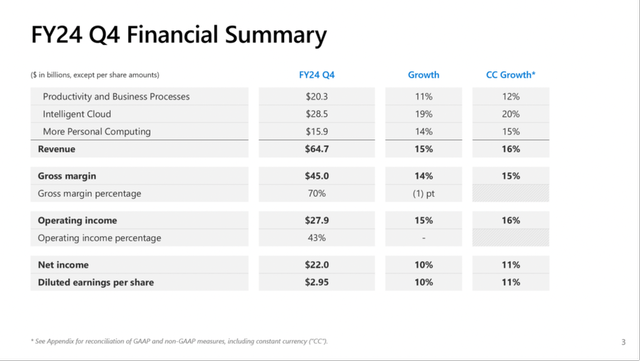

As usual, we start by looking at the quarterly and full-year results of fiscal 2024, which Microsoft reported on July 30, 2024. Microsoft did once again beat estimates, but only slightly. Revenue was $260 million higher than expectations (compared to $64 billion in quarterly revenue) and earnings per share did beat estimates by $0.02.

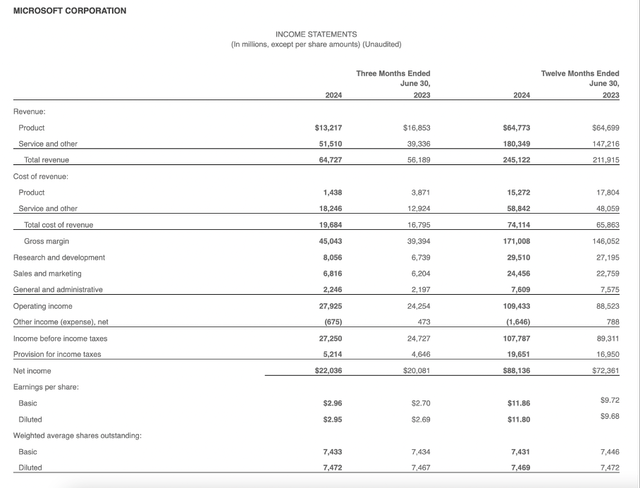

Similar to the last few quarters and years, Microsoft reported great metrics and high year-over-year growth. Total revenue in Q4/24 was $64,727 million and compared to $56,189 million in Q4/23 this is resulting in 15.2% year-over-year growth. While revenue from products declined from $16,853 million in the same quarter last year to $13,217 million this quarter (resulting in a 21.6% YoY decline), revenue from “Service and other” increased 30.9% YoY from $39,336 million in Q4/23 to $51,510 million in Q4/24. And operating income increased from $24,254 million in the same quarter last year to $27,925 million this quarter – an increase of 15.1% YoY. Finally, diluted earnings per share increased 9.7% YoY from $2.69 in the same quarter last year to $2.95 this quarter.

Microsoft Q4/24 Earnings Release

And the picture for the full-year results is quite similar. Total revenue increased from $211,915 million to $245,122 million and growth was once again driven by “Service and Other” while revenue for “Products” stagnated year-over-year. And while the top line grew 15.7% year-over-year, operating income increased 23.6% YoY from $88,523 million in the same quarter last year to $109,443 million this quarter. Finally, diluted earnings per share increased from $9.68 to $11.80 – 21.9% YoY growth.

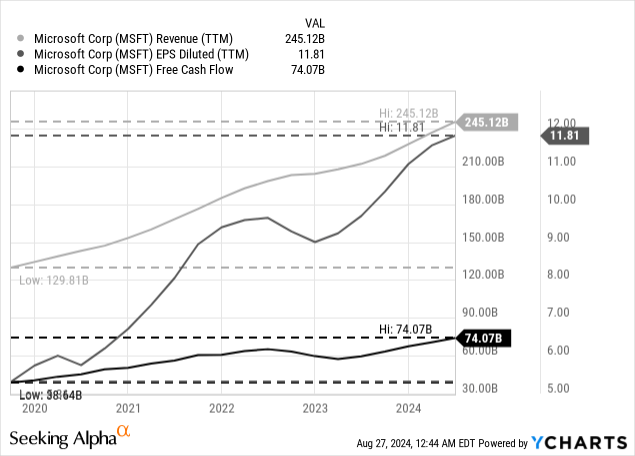

Looking at the results of only a few quarters is seldom enough for a reasonable picture of a business. However, when looking at the results of the last five years we see some fluctuations for earnings per share and free cash flow, but overall, the company grew with a solid pace and high levels of consistency.

And while there are some differences in growth rates for the three business segments, all grew in the double digits, with Productivity and Business Processes growing only 11% YoY to $20.3 billion in Q4/24 and Intelligent Cloud increasing 19% YoY to $28.5 billion in revenue. The third business segment, More Personal Computing, was in-between these two with 14% year-over-year growth to $15.9 billion quarterly revenue.

New Reporting Structure

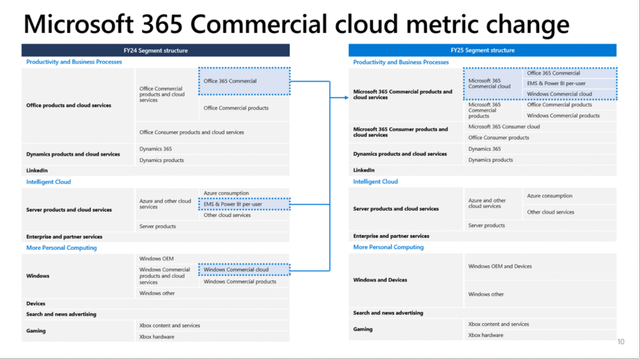

The above-mentioned quarterly results are still according to the old business structure. Last week, on August 21, 2024, Microsoft reported changes for its reporting segments and investor metric changes. The three major segments remain the same, but several subsegments have been restructured.

Microsoft Fiscal 2025 Investor Metrics

Especially the new subsegment “Microsoft 365 commercial products and cloud services” has now several business parts included which were previously part of other segments: Windows Commercial Cloud was previously a part of “More Personal Computing” and EMS & Power BI per-user was previously a part of “Intelligent Cloud”.

Microsoft Fiscal 2025 Investor Metrics

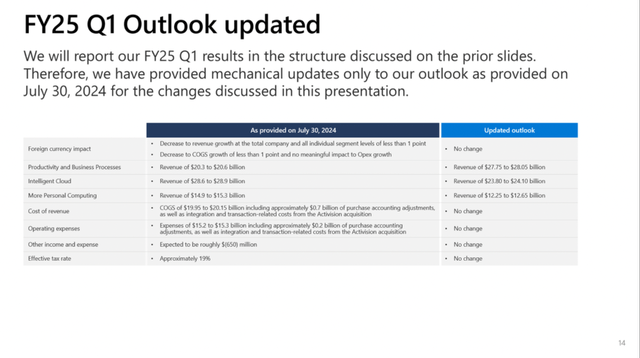

And as a consequence of the new reporting structure, Microsoft also updated its guidance for the first quarter of fiscal 2025. Overall revenue estimates remain the same, but of course, the estimates for the three different segments changed.

Outlook: Growth, Recession and Moat

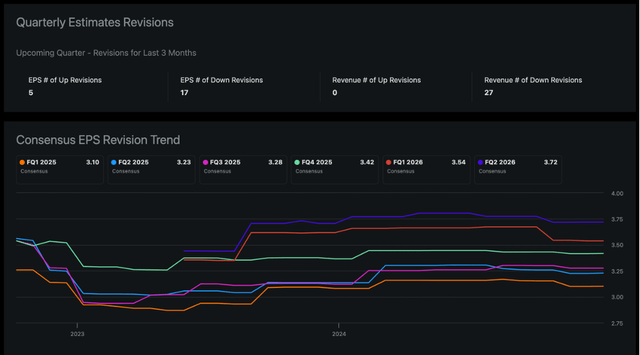

While Microsoft had its first quarter guidance remain the same, analysts actually lowered expectations for the coming quarters constantly in the last few months. Estimates for revenue were lowered a little bit, and estimates for earnings per share were lowered a little bit more. And the changes are hardly visible in the chart, but I still think it is worth mentioning at this point. In the last three months we saw 27 down revisions for revenue (and not a singe up revision) and in the case of earnings per share, 5 analysts increased EPS estimates while 17 lowered estimates.

Microsoft Quarterly EPS Estimates Revisions (Seeking Alpha)

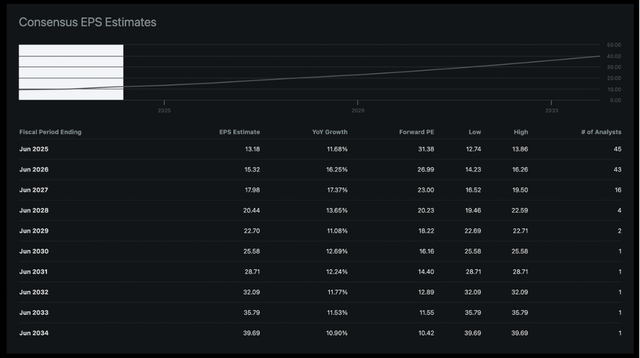

On the other hand, we should not ignore that analysts are still extremely optimistic for the years to come. Over the next ten years, analysts are expecting revenue to increase with a CAGR of 11.50% and revenue will increase from about $245 billion right now to almost $730 billion in fiscal 2034. And when looking at estimates for earnings per share, analysts are expecting the bottom line to grow with a CAGR of 12.90% over the next ten years.

Microsoft Consensus EPS Estimates (Seeking Alpha)

While estimates were slightly lowered for the next few quarters, the core message is that analysts are extremely optimistic for the next few years and expect 12% growth in fiscal 2025, 16% growth in fiscal 2026 and 17% growth in fiscal 2027. But as I have pointed out in several articles in the last few weeks (see for example my article about Simon Property Group (SPG) and Amazon.com (AMZN) as well as Alphabet (GOOG)) I see the United States on its way into a recession. The yield curve, initial claims for unemployment, housing permits, bankruptcies and Sahm Rule are giving us strong warning signals (once again, see previous articles mentioned above).

And Microsoft certainly has a wide economic moat around its business that will protect the company against competitors and probably lead to stable revenue. But I certainly don’t think Microsoft can continue to grow with a similar pace as in the last few years.

We can still be very optimistic about the cloud infrastructure market growing with a high pace in the years to come. But we don’t really know how this market will perform during a recession as this market is a rather young market, which did not exist during a previous recession – aside from the 2020 COVID recession (a recession that was different in many ways). We can assume that revenue will be rather stable (or maybe even continue to grow slightly) but I think the following estimates might be too optimistic.

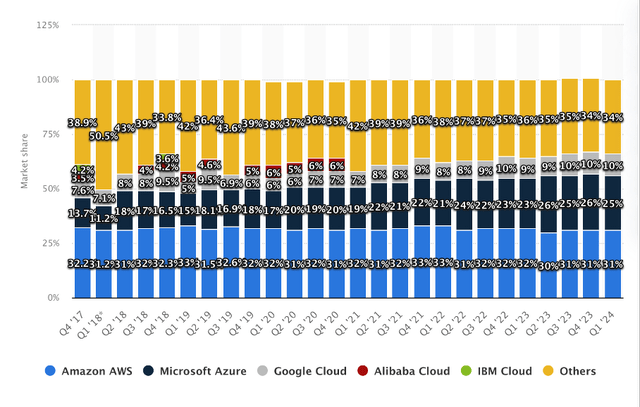

But as long as we are talking about the cloud business, we should also point out that Microsoft constantly increased its market share. While Amazon remains market leader with a market share slightly above 30%, Microsoft Azure improved its market share from slightly above 15% in 2018 to about 25% right now.

Global Cloud Market Shares (Statista)

When combining an overall growing market with Microsoft’s ability to gain market shares, we can be quite optimistic for the future – but maybe not for the next few years.

While the cloud business is certainly important and one of the drivers of growth, Microsoft is a much more diversified business, and we should not ignore its bread-and-butter business – Windows or Office products for example. And Microsoft is such a great business as almost every business segment has a wide economic moat built around the business. Aside from the brand name, we are especially talking about switching costs. Almost every product is deeply embedded in the personal life or business structure and switching to the products of a competitor is extremely difficult. Retraining the staff of an entire company to use iOS instead of Windows is not only expensive but will impact the everyday working life probably for several weeks. Moving applications and data from one cloud provider to another will also not only take a lot of time, but once again impact everyday working life for many employees. And in case of LinkedIn, the company can rely on strong network effects – only gaming revenue might suffer during a recession as this can be seen as a leisure product and rather cyclical.

In case of a recession, we can assume that Microsoft won’t be able to gain new customers, or existing customers won’t switch to better and more expensive products, but it might be able to keep its existing customers and keep revenue at least stable. But as we will see in the following section, Microsoft must grow with a very high pace in the next few years to be fairly valued right now.

Intrinsic Value Calculation

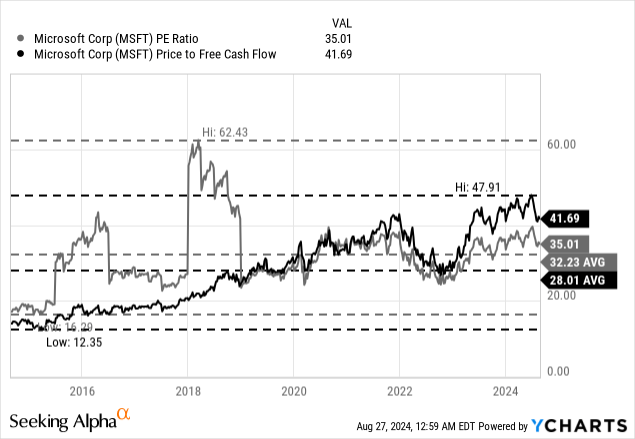

One of the major reasons for me being rather cautious in the last few quarters was the stock price we must pay for Microsoft and the valuation multiples the stock was trading for. And when looking at the valuation multiples right now, the picture did not really improve. At the time of writing, Microsoft is still trading for 35 times earnings as well as 42 times free cash flow. Both metrics are not only above the 10-year average (32.23 for the P/E ratio and 28.01 for the P/FCF ratio) but are high valuation multiples on an absolute basis.

And as we saw above, Microsoft constantly improved earnings per share and free cash flow in the last few years and therefore the high valuation multiples are not the result of a declining bottom line.

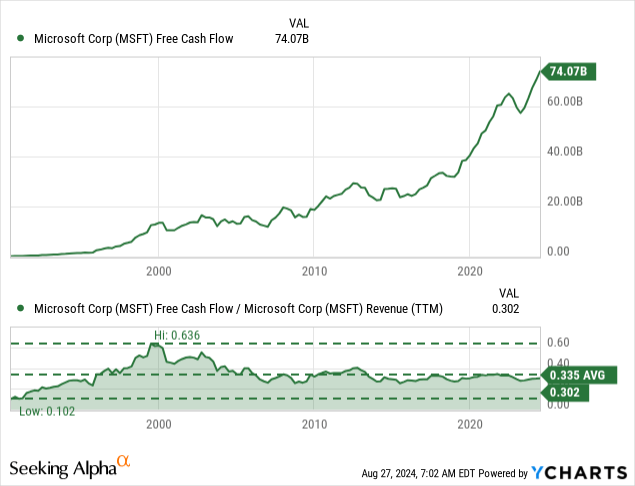

To get a better picture and maybe more precise intrinsic value for Microsoft, we can use a discount cash flow calculation. As always, we are calculating with a 10% discount rate, as this is the return we like to achieve at least. And we are calculating with the last reported number of outstanding diluted shares (7,472 million). Now we must make some estimates for free cash flow in the next few years and growth rates that are realistic for Microsoft. As a starting point, we can use the free cash flow of the last four quarters, which was $74 billion and instead of making estimates about free cash flow and growth rates, let’s look at the share price from a different perspective. In order to be fairly valued right now, Microsoft must grow free cash flow 18% annually for the next ten years, followed by 4% growth till perpetuity.

Now, let’s provide a little more context to these numbers. For starters, the free cash flow is the highest it has ever been. And in the case of Microsoft, free cash flow is constantly increasing, but there is some risk we are close to a cycle peak and lower free cash flow in the next few quarters is certainly a possibility.

Additionally, 18% growth for the next 10 years is very ambitious. When looking at the last 10 years, which have certainly been successful years for Microsoft, earnings per share increased “only” with a CAGR of 16.20% and – as mentioned above – analysts expect earnings per share to grow with a CAGR of 13% in the next ten years. Overall, I would not bet on Microsoft growing 18% annually in the next ten years – especially considering a potential recession and free cash flow already being extremely high. On the other hand, we should point out that free cash flow conversion has been pretty stable in the last few years.

And finally, we can look at the growth rate until perpetuity. In the past, I often calculated with 6% growth until perpetuity (and I still think it is possible to justify these higher terminal growth rates for high quality businesses). Nevertheless, it also seems reasonable to be a little more cautious and follow the recommendations of the CFI (and others) and use a lower terminal growth rate, but due to the high-quality business, 4% seems certainly reasonable.

Conclusion

I still see Microsoft as a “Hold” at this point. Microsoft is undoubtedly a great business and probably will be able to perform well even in times of a recession. However, considering the current share price, we can’t see Microsoft as a good investment at this point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.