Summary:

- As feared in my Q2 FY25 preview note, Nvidia Corporation failed to deliver a meaningful revenue guidance beat, which led to a 7% after-hours fall post yesterday’s earnings release.

- In-line Q3 revenue guidance and in-line revenue results vs. the Wall Street whisper numbers indicate that Nvidia’s high growth is being priced in, at least over the couple of quarters.

- A dip in the gross margins and a flattish outlook for the rest of FY25 puts a spanner in the works for my earlier margin expansion thesis.

- Nvidia’s 1-yr forward P/E ratio remains high and mostly unchanged for now at more than 40x and technically vs. the S&P500, there are signs of exhaustion on the monthly upward momentum.

- I recognize that there are early signs of strong uptake in Blackwell orders. I believe this can lead to growth surprises again from 2025 onwards.

NVIDIA stock running out of steam in the near term Paul Bradbury/OJO Images via Getty Images

Performance Assessment

My Q2 FY25 preview note on Nvidia Corporation (NASDAQ:NVDA) communicated a change in stance from my earlier bullish view to a more cautious “Neutral/Hold.” After earnings, Nvidia closed at $116.95; 7.9% lower than the $126.46 level where it was when I published the quarterly preview on August 26, 2024. In the same period, the S&P 500 (SP500) fell 0.44%. Since my last article, performance has added +7.4% of value.

Thesis

As anticipated, Nvidia’s Q2 FY25 revenue guidance didn’t impress the market. I am changing my stance to a “Sell” after noting the following:

- High growth seems priced in

- Margin expansion may take a pause

- Valuations aren’t much cheaper

- Relative technicals indicate signs of bullish trend exhaustion

- Strong Blackwell orders are an upside risk.

High growth seems priced in

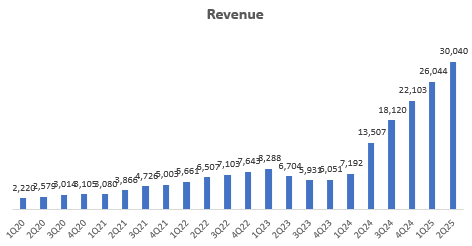

Revenues (USD mn) (Company Filings, Author’s Analysis)

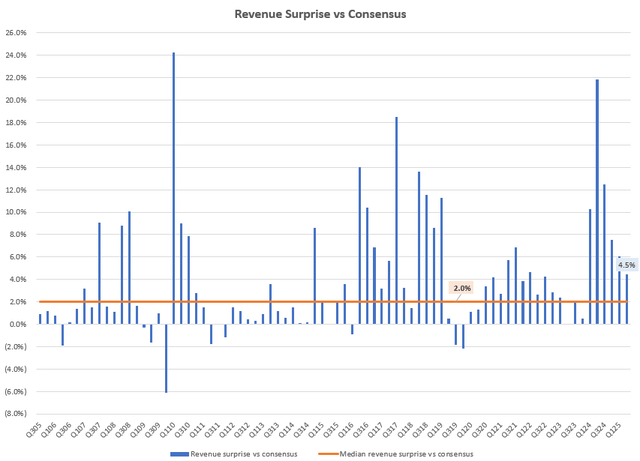

Nvidia’s Q2 FY25 printed $30 billion in revenues (122.4% YoY, 15.3% QoQ). Consistent with its track record, it also beat consensus estimates by 4.5%:

Revenue Surprise vs Consensus (Capital IQ, Author’s Analysis)

However, the Street’s whisper number for revenue going into the earnings release was $30 billion. So from this perspective, Nvidia’s revenue result merely matched expectations.

Consensus numbers are what sell-side (analysts, not investors, putting money in the stock) estimates indicate. Whisper numbers represent the unofficial word-on-the-street estimates of what the buy-side (the actual investors with monetary stake behind their views) is expecting.

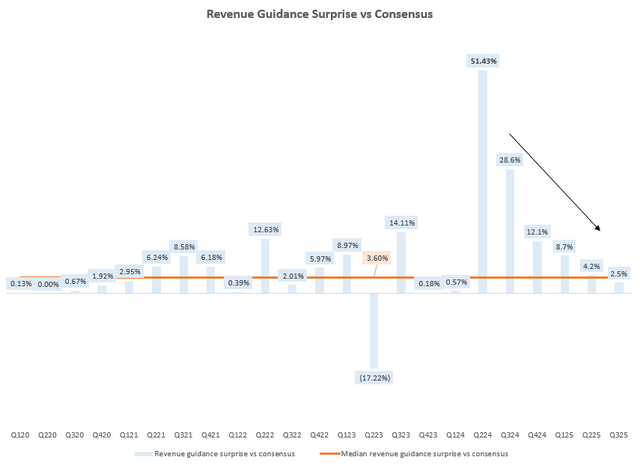

On the revenue guidance side, as I had feared, it was nothing stellar; the midpoint level of $32.5 billion for Q3 FY25 was higher than consensus by 2.5%. Some are viewing this as in-line guidance:

Revenue Guidance Surprise vs Consensus (Capital IQ, Author’s Analysis)

Unsurprisingly, given the 8% selloff in Micron (MU) under similar circumstances, Nvidia also fell almost 7% in after hours trading yesterday. Note that Micron’s drop continued as it is down ~30% since its last result beat but was in-line guidance earnings.

Overall, I believe this means Nvidia’s growth, although high, is being fully priced in the market. I suspect some stock weakness will continue to follow suit, as investors rotate into other opportunities, such as the financials sector.

Margin expansion may take a pause

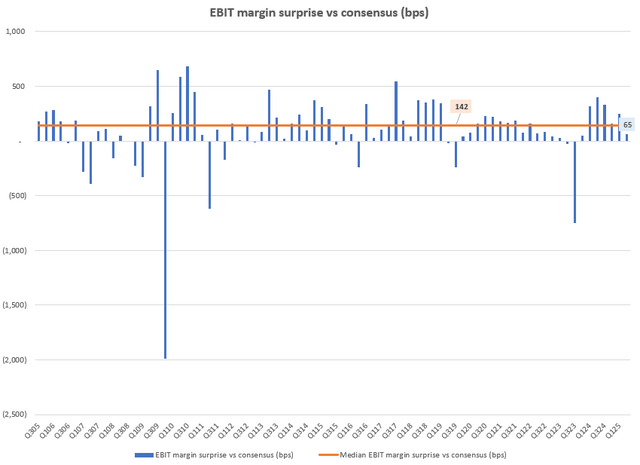

Nvidia’s extent of EBIT margin surprise vs. consensus was also smaller than expected at 65bps vs. the median 142bps:

EBIT Margin Surprise vs Consensus (bps) (Capital IQ, Author’s Analysis)

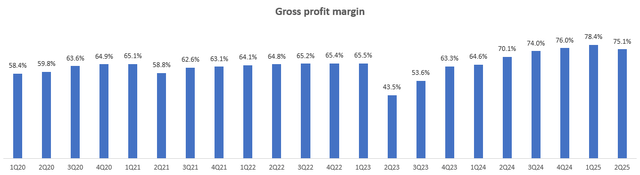

This was driven mostly by a 330bps QoQ fall in gross profit margins:

Gross Profit Margin (Company Filings, Author’s Analysis)

Management attributed this to a mix-shift effect and, more importantly, higher inventory costs for Blackwell – Nvidia’s latest GPU architecture that would allow enterprises to run real-time generative AI at 25x lower cost:

GAAP gross margins were 75.1% and non-GAAP gross margins were 75.7%, down sequentially due to a higher mix of new products within data center and inventory provisions for low-yielding Blackwell material.

– CFO Colette Kress in the Q2 FY25 earnings call.

Going forward, it looks like the higher costs associated with Blackwell inventories would lead to gross margin stabilization around 74-75%:

GAAP and non-GAAP gross margins are expected to be 74.4% and 75.0%, respectively, plus or minus 50 basis points. For the full year, gross margins are expected to be in the mid-70% range.

– CFO Colette Kress in the Q2 FY25 earnings call.

This means the margin expansion that was a core part of my bullish thesis earlier may be taking a pause – a slightly negative development vs. my thesis expectations.

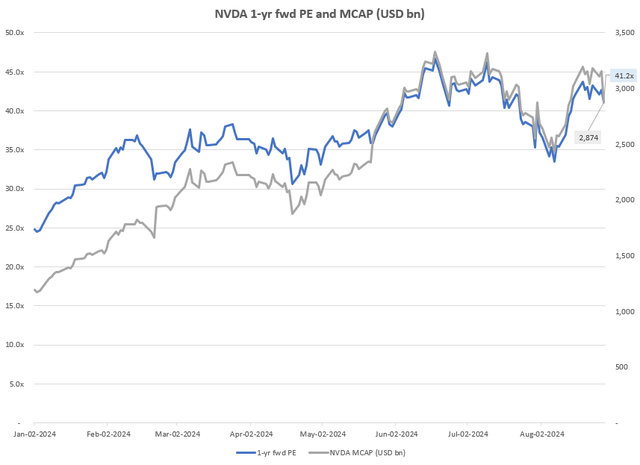

Valuations aren’t much cheaper

NVDA 1-yr fwd P/E and MCAP (USD bn) (Capital IQ, Author’s Analysis)

Given the information on consensus estimates so far, Nvidia’s 1-yr fwd P/E of 41.2x has not changed much despite a 7% after-hours fall in the stock price and market cap. A few days before the earnings release, 1-yr fwd P/Es were 43.2x. Hence, I don’t think the valuations have gotten much cheaper to make buys attractive.

Technicals indicate signs of bullish trend exhaustion

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

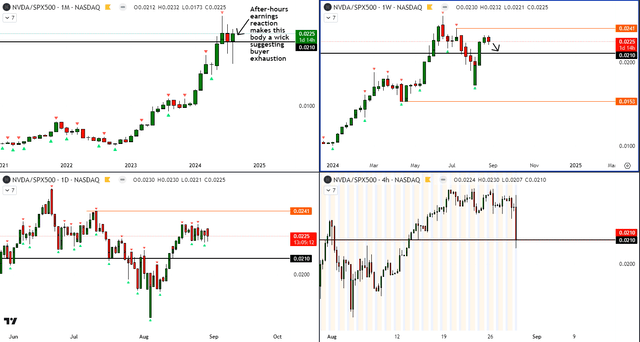

Relative Read of NVDA vs SPX500

NVDA vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On the relative chart of NVDA vs. the S&P 500 (SPX, SPY), the after-hours movement is only visible on the intraday 4-hour charts. I have marked the after-hours close level with a horizontal black line to more clearly see how the higher timeframe weekly and monthly picture looks like. What stands out to me is that after accounting for the after-hours close, the monthly chart shows a wick rejection of August 2024’s candle body, printing a doji. I interpret this to be a sign of buyer exhaustion and an increased risk of downside ahead, corresponding to a period of underperformance vs. the S&P 500.

Strong Blackwell orders are an upside risk

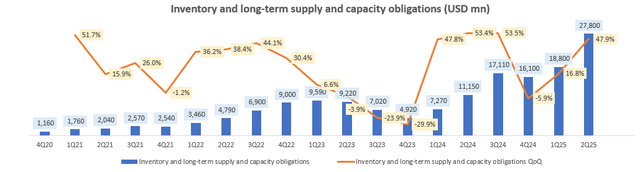

In Note 12 – Commitments and Contingencies, Purchase Obligations section of the 10Q and 10Ks, Nvidia discloses the amount of future inventory and capacity purchase obligations. This figure spiked 47.9% QoQ from $18.8 billion to $27.8 billion in Q2 FY25:

Inventory and Long-Term Supply and Capacity Obligations (USD mn) (Company Filings, Author’s Analysis)

This was driven by “commitments for Hopper and Blackwell capacity and components.” Management’s commentary also points toward bullish growth expectations 2 quarters out from now:

Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal year ’26. In Q4, we expect to ship several billion dollars in Blackwell revenue. Hopper shipments are expected to increase in the second half of fiscal 2025… Demand for Blackwell platforms is well above supply, and we expect this to continue into next year.

– CFO Colette Kress in the Q2 FY25 earnings call.

Overall, I view this as a source of medium-longer term upside risk, since this indicates a buoyant order growth for Nvidia’s products. Whilst growth for the rest of CY 2024 may be priced in, I recognize that Nvidia may surprise on growth in CY 2025 when Blackwell shipments are in full-force.

Takeaway & Positioning

I had a cautious outlook going into Nvidia’s Q2 FY25 earnings, as I thought the market may react negatively to an unimpressive revenue guide vs. consensus. This tactical idea has played out as expected since NVIDIA stock is down almost 8% since publication of my preview note wherein I had changed my stance from a ‘Buy’ to a “Neutral/Hold.”

The in-line revenue guidance for Q3 FY25 and in-line revenues relative to the Street’s whisper figure of $30 billion for Q2 FY25 suggests that Nvidia’s growth, although high, is being priced in at least for the next quarter or two. Moreover, my earlier thesis of margin expansion seems to be on-hold as gross margins came in 330bps sequentially lower and management’s outlook indicates stabilization rather than a continued increase for the rest of the financial year.

Despite a lower after-hours stock price, valuations also aren’t that much cheaper, making buys less attractive. And NVDA stock’s relative technicals vs. the S&P 500 paint signs of bullish exhaustion on the monthly chart, which I believe warns of downside (underperformance) potential ahead.

Given these considerations, I am downgrading NVIDIA to a tactical “Sell.” The key risk to my thesis is the resumption of growth surprises in 2025 and beyond as Blackwell rolls out in Q4 FY24 (which ends in January 2025).

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.