Summary:

- Nvidia Corporation’s stock declined by 12% from its recent high, despite beating EPS and revenue estimates, raising questions about the AI bubble and future market trends.

- Nvidia’s technical correction and rebound suggest a buy-in zone around $115-110, with potential for future growth driven by AI market dominance.

- Nvidia’s solid earnings and guidance, including a $50B buyback, indicate strong future sales and profitability potential, despite market expectations for higher sales.

- Nvidia’s long-term growth prospects, robust EPS outperformance, and relatively inexpensive valuation make it a solid buy-and-hold investment, despite the risks.

Vertigo3d/E+ via Getty Images

I recently discussed Nvidia Corporation (NASDAQ:NVDA) in a pre-earnings article. While we witnessed a solid melt-up into earnings, Nvidia’s stock got hammered after the Q2 report. It dropped to a low of about $115 in after-hours trading, illustrating a 12% pullback from its recent high above $130. What’s perplexing is that Nvidia’s stock dropped after the company posted higher-than-expected revenues and better-than-anticipated EPS and offered more robust than-expected guidance.

The market’s expectations have grown sky-high for Nvidia and other leading AI stocks. Now, despite an excellent earnings report, Nvidia is selling off, which brings up the million-dollar question: Is the AI bubble popping? Another crucial question is what will likely occur next to Nvidia and the market in general. Will we see new all-time highs this year and in 2025? Or will Nvidia likely lead tech stocks and markets in general lower? The bull vs. bear debate lives on.

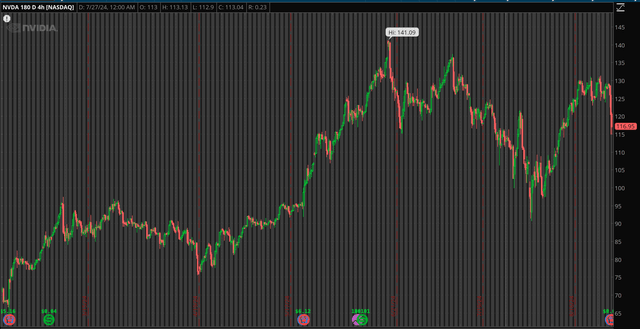

Nvidia’s Technical Image (4-hour chart)

Nvidia recently experienced a considerable correction process. Its stock declined by approximately 36% after topping out at around $141. The rebound has been equally ferocious, as Nvidia’s stock rebounded by a staggering 45% in only two weeks. While technically, Nvidia’s stock didn’t become highly overbought, these were stellar gains in a short time frame, and some profit-taking (“selling the news”) seems appropriate here. We may see a classic 50% retracement, putting the buy-in zone at around $115-110 for Nvidia.

The Market Sold Nvidia’s Earnings News

Nvidia produced one of the most explosive earnings reports in history again. It earned Non-GAAP EPS of $0.68 in Q2, a four-cent beat. Its revenues came in at $30.04B, beating the consensus estimate by $1.31B, a 122% YoY increase. Nvidia also produced record Data Center revenue of $26.3B, up 16% sequentially and 154% YoY. Nvidia’s board also approved a $50B buyback program as the company generates enormous cash flow.

The Takeaway — While Nvidia produced over $30B in revenues, the market wanted more. The market likely would have reacted better to a $30.5-31B revenue number, as it would have illustrated more of a blowout, consistent with previous results. This time, it’s a solid beat but suggestive of a sales growth slowdown, which is normal.

Excellent Guidance — Despite not hitting a grand slam, Nvidia’s outlook was solid. For Q3, Nvidia expects revenues of $32.5B, vs. the consensus estimate of $31.75B. Again, the market would have liked to see guidance around $33B+, yet $32.5B is a good mark. Moreover, Nvidia may be sandbagging its guidance so that it easily beats during its next earnings announcement. Therefore, Nvidia may deliver $33-34B in sales when it reports on 11/27/2024. For the full year, gross margins are expected to remain around the mid-70%.

An Objective Look At Nvidia’s AI Market

Nvidia continues dominating the data center GPU market with about a 98% share in 2023. Moreover, Nvidia remains well ahead of its competition in many respects and should remain the leading force in this space in future years, which is the most lucrative hyper-growth and scale period for the AI space. Estimates suggest that data center investment could hit $1T annually, which could happen relatively soon, in 2027.

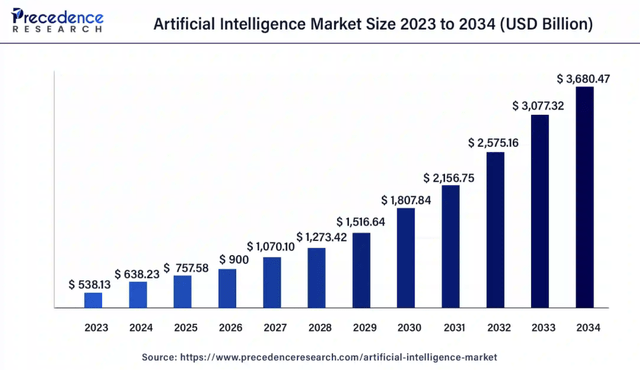

AI market projections (precedenceresearch.com)

Considering Nvidia’s dominant market-leading position, Nvidia could continue expanding sales and increasing profitability for many years as we advance. Furthermore, the global AI market will likely continue growing, potentially reaching epic proportions ($2-3T in 2030-2035).

Despite all the bubble talk, AI could be everywhere in several years, much like the internet is everywhere today. AI requires massive power, and the most significant power source for the AI industry is Nvidia. It is the number one “picks and shovels” company, likely to continue powering the base of the AI industry in future years. Therefore, Nvidia will likely continue benefiting from the AI boom, maintaining sales growth and increasing profitability in the coming years.

Nvidia — Preparing For More Growth

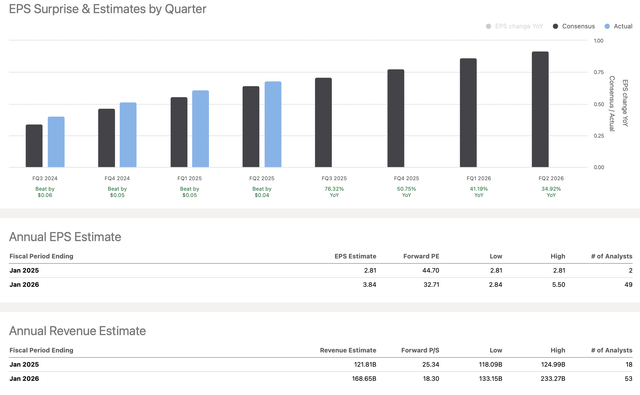

EPS vs. estimates (seekingalpha.com )

Nvidia is still in its rapidly advancing growth phase, and the constructive conditions should persist. Furthermore, while there is concern regarding future margin pressure, current market conditions and Nvidia’s leading position suggest gross margins can remain around 70-75%, potentially for years. This dynamic should enable Nvidia to maintain a solid operating and net income margin of around 50-60%.

Moreover, Nvidia has a robust history of beating estimates. For at least five years, it has surpassed revenue estimates in every one of its last quarters. Furthermore, it missed EPS only once during the last twenty quarters, and the constructive EPS and sales growth trend should persist.

TTM consensus estimates were for $2 in EPS. However, Nvidia reported $2.21, illustrating a 10% outperformance rate. Moreover, Nvidia has solid momentum, and the robust EPS outperformance could continue. While next year’s consensus EPS estimate is $3.84, it’s in a broad range ($2.84-5.50).

This dynamic illustrates that the analyst community is split regarding Nvidia’s earnings potential next year. Nonetheless, Nvidia could earn substantially more in EPS than the market currently has priced in.

Given that Nvidia’s stock price is around $120, if it earns $4.50-5 in EPS next year, its stock is only trading around 27 to 24 times forward earnings estimates here. This valuation is relatively inexpensive for Nvidia, given its long-term growth prospects and substantial earnings growth potential in the years ahead.

Where Nvidia’s stock could go in the future:

| Year (fiscal) | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $125 | $175 | $210 | $250 | $295 | $345 |

| Revenue growth | 105% | 40% | 20% | 19% | 18% | 17% |

| EPS | $3 | $4.50 | $5.40 | $6.50 | $7.70 | $9.10 |

| EPS growth | 130% | 50% | 20% | 20% | 19% | 18% |

| Forward P/E | 32 | 33 | 34 | 35 | 34 | 33 |

| Stock price | $144 | $178 | $222 | $270 | $308 | $342 |

Source: The Financial Prophet.

Nvidia’s sales have skyrocketed this year, and we should see another high-growth year of 35-50% sales growth in fiscal 2026. Of course, sales growth will decline, but we could see robust revenue growth of 15-30% in future years. The 20-17% growth rate expected in the 2027-2030 period may be higher, around 20-30% in a more bullish case scenario.

Furthermore, I am using relatively modest EPS growth, factoring in a relatively inexpensive P/E multiple of 32-35 in future years. In a more bullish scenario, multiple expansion could lead to a higher forward P/E ratio, potentially reaching the 40-50 range.

Despite the relatively modest projections, Nvidia’s steady sales growth and increased profitability could propel its stock much higher in the coming years, making it a solid buy-and-hold investment as we advance.

Nvidia Risks

Nvidia’s most significant risk remains disappointing the market and having the sentiment flip to a negative trend. Therefore, Nvidia must walk a tightrope relative to keeping up with sales growth and profitability expectations. Nvidia is technically a hardware company and needs to maintain high margins (70-75% gross margin) in future quarters. Therefore, it must retain pricing power and stay ahead of the competition.

Increasing competition from Advanced Micro Devices (AMD) and other competitors could cause Nvidia’s dominance to decline, leading to lower margins and worsening profitability metrics. Investors should consider these and other risks before investing in Nvidia.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!