Summary:

- While Nvidia Corporation Q2 earnings exceeded expectations, the forward outlook for sustained high valuations grows doubtful due to concerns over future growth compared with the recent past.

- Nvidia’s dependence on a few major clients, doubts over cost benefits of AI spending and bans on China sales impact projections on sales volumes.

- Despite significant share buybacks being announced, the stock’s high valuation and limited buyer-seller dynamics don’t create a cause for increasing exposure.

Antonio Bordunovi

Leading AI-relevant chipmaker Nvidia Corporation’s (NASDAQ:NVDA) earnings for its second quarter (Q2) beat analysts’ consensus estimates by delivering $30.04 billion versus an expectation of $28.7 billion and adjusted earnings per share (EPS) of $0.68 versus an expectation of $0.64. The company projected $32.5 billion in revenue over the current quarter versus expectations of $31.7 billion, and Chief Financial Officer, Colette Kress, expressed confidence in adding several billion dollars in value of its next-generation Blackwell products (currently being tested as samples) in its fourth quarter. However, the company’s stock declined by 8% in extended trading.

Trend Drilldown

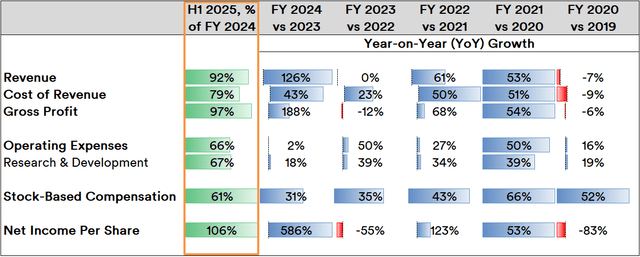

As of the first half (H1) of its ongoing fiscal year (FY) 2025, trends indicate that the company’s explosive growth in FY 2024 isn’t going to repeat in the current FY:

Source: Created by Sandeep G. Rao using data from Nvidia’s Financial Statements

Note: Net Income Per Share has been restated with the stock split factored in.

Outside of CFO Kress’ projections on sales of Blackwell products, the company is looking to close overall revenues at a 16% deficit relative to the previous year. This is albeit with net income per share, effectively closing the year with a 12% over the previous FY.

The previous FY was the beginning (and possibly the end) of the “AI Stock Boom” which Nvidia led. A 126% rise in revenue was accompanied by an over fourfold boom in net income per share, while operating expenses more-or-less ran flat as expenses incurred in research and sales preparation in the previous few years paid off. While the stock’s high valuation does create a massive bump in stock-based compensation, it clocks in at 4% of net revenue — far lower than the levels seen over the past six FYs.

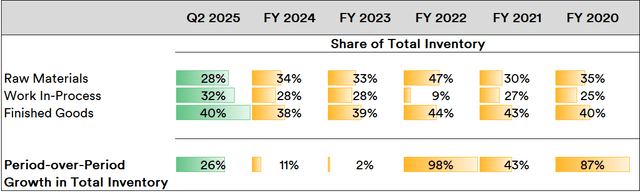

Current-generation hardware inventory is over twice that of the previous FY, which could possibly indicate that either demand is flagging or that expected order volume might have been an overshoot on actual demand.

Source: Created by Sandeep G. Rao using data from Nvidia’s Financial Statements

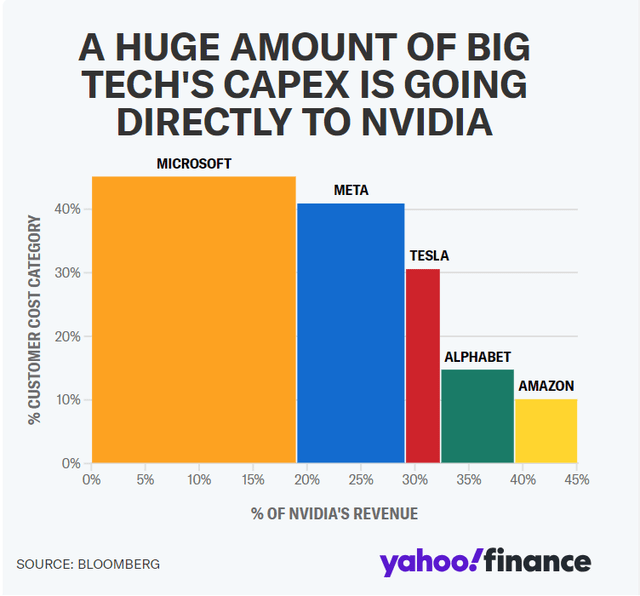

As the company went “corporate,” it grew increasingly dependent on a few clients. Microsoft (MSFT), Meta Platforms (META), Alphabet (GOOG, GOOGL) and Amazon (AMZN) together contribute over 40% of Nvidia’s total revenue.

Source: Bloomberg, Yahoo! Finance

Factors for Consideration

Currently, the breadth of the investing public is pondering whether the speculation-level high valuations imparting on certain names in the semiconductor space can be deemed sustainable. As the article about Nvidia’s top fabrication partner TSMC indicated, institutional investors have grown skeptical over whether promises of high capital expenditure by “Big Tech” are justifiable given marginal contributions by AI-driven processes in supplanting human labor. This particularly affects Nvidia, given its high exposure to a handful of clients, leading the consumption of its products.

The company’s centering of focus on Blackwell chips also has a significant market limitation factor: as it stands, the current-generation A100, H100, A800 and H800 chips are forbidden from being exported to China, which is a key market for the company — standing at almost 17% by the end of FY 2024. In a similar vein, the company’s Blackwell chips are almost certain to be banned as well, given their enhanced AI-relevant processing capability. While China’s tech giants have doubled capital spending on AI infrastructure in the year so far, the company is hobbled in terms of client breadth and ever-more dependent on its existing small band of clients.

Roughly about 10% of the company’s Q2 revenue ($3.7 billion) came from the sale of networking products. In this space, bête noire and (almost literal) cousin Advanced Micro Devices (AMD) is aiming to close the gap: roughly ten days before Nvidia’s earnings release, AMD announced a $4.9 billion acquisition of ZT Systems, a leading AI compute infrastructure and storage solutions provider in a bid to provide enhanced services to datacenter clients. As the article on AMD’s earnings indicated, the company’s footprint among corporate clients had substantially increased this current FY.

There is a host of startups (such as Sambacore) scrambling to provide next-generation computing hardware to a select set of clients outside of China. Existing solutions in the market largely appear to be deemed more than sufficient to handle current AI-relevant processing loads. With a dimming outlook on a repeat of explosive capital investments, Nvidia Corporation’s ability to have sustained sales volumes over a long horizon comes into question.

In Conclusion

Without sustained sales volumes in the outlook, conviction and high valuations are likely to be tested. While “institutional” clients aren’t likely to start offloading in bulk any time soon, there is very little incentive to acquire more. However, the likelihood of a paring of exposure in a “risk-off” exercise in favor of a more secular exposure to the universe of investible assets increases.

Despite splurging $15.4 billion in H1 2025, $7.5 billion of board-authorized capital for share buybacks had remained unutilized in Q2 2025. The company is topping this amount up with an additional $50 billion for share buybacks to prop up valuations. While this might indeed help ameliorate the speed with which the share value will depreciate, given the loss of sky-high conviction, this doesn’t alter the forward outlook: as far as the company’s products are concerned, it’s a buyer’s market with a few buyers and an almost-equal (if not greater) number of sellers.

Buyer-seller dynamics are very much a play in motion, with no great incentive to either “buy the dip” or “sell the crest.” At the same time, there is precious little reason to load up and hold over a long term. While the company did start offering dividends as of FY 2023, the dividend yield is currently vanishingly small, and of little incentive for dividend-focused investors.

Overall, it’s a “Hold.” Nvidia Corporation remains an integral part of the hardware industry with great products and services, but its position is entirely divorced from the stock’s valuation, which remains massively distorted due to the massive pile-on across much of FY 2023 and FY 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.