Summary:

- As the Fed is likely to lower its benchmark rates, both the macro environment and the real estate market are expected to become more favorable for the company.

- Having dropped more than 90% from its peak, I believe the current stock price is undervalued and presents an attractive entry point for investors.

- However, I’m trying not to become overly optimistic about this company due to several risks that I will discuss in my article.

Gary Yeowell

Thesis

Opendoor Technologies Inc(Nasdaq:OPEN) is an online residential real-estate transaction platform that aims to provide more convenient ways of purchasing and selling homes. But its main source of revenue is flipping houses. The company purchases homes directly from customers, repair them and sell them at higher prices. Despite challenging macro headwinds such as growing concerns over the U.S. economy, I recommend that investors monitor this company as I believe the U.S. housing market is likely to bottom out and the company’s valuation is approaching an attractive entry point.

Overview of the Second Quarter Earnings: Good Performance, but Disappointing Guidance

Earnings Report

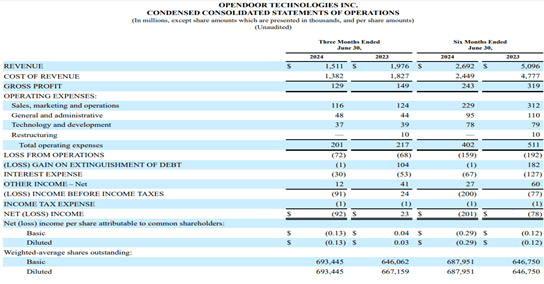

In the second quarter, the company recorded roughly $1.5 billion in revenue with $129 million gross profits, beating both revenue and EPS estimates. However, the stock price declined sharply due to poor third-quarter guidance.

Author, Company investor letter, earning report

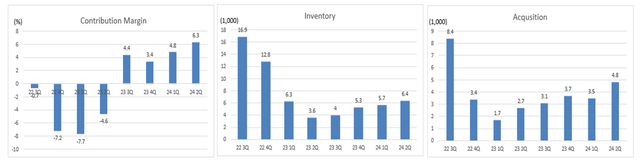

To dive more deeply into the company’s past and current performance, it is recovering from 2022 when it purchased homes excessively during the low-interest rate environment but had to offload its inventories as the Fed began raising its benchmark rates. The contribution margin which was -7.2% in the fourth quarter of 2022 increased to 6.3% in the second quarter of 2024. Additionally, the company successfully reduced its inventories from 16.9 thousand to 6.4 thousand in the second quarter of 2024 and acquired new houses in a more cautious manner.

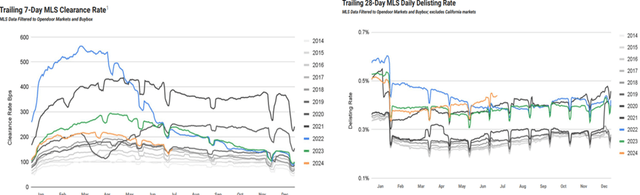

However, in the third quarter guidance, the company expected revenue to be between $1.2 billion and $1.3 billion with the contribution margin expected to be between 2.9% and 3.5% respectively. As mortgage interest rates and house prices remain high, the housing clearance rate is low whereas delisting rate is increasing. Overall, I believe that the weak macroeconomic outlook combined with the lower margin guidance has disappointed investors.

An Improved Macro Environment is Expected in Coming Years

Fred

mortgagenewsdaily.com

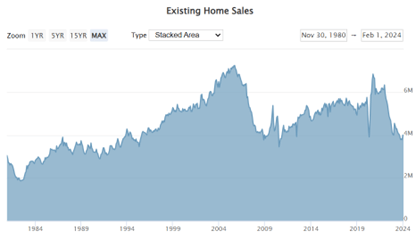

One of the reasons I’m cautiously optimistic about the company is that the Fed is likely to lower its benchmark rates as early as September. The left side of the graph shows the historical chart of the 30-year fixed-rate average mortgage rate, while the right side displays the historical chart of existing home sales. From 2022 to 2023, the Fed raised interest rates, which led to higher mortgage rates and, in turn, caused existing home sales to decrease to levels not seen since the financial crisis in 2009.

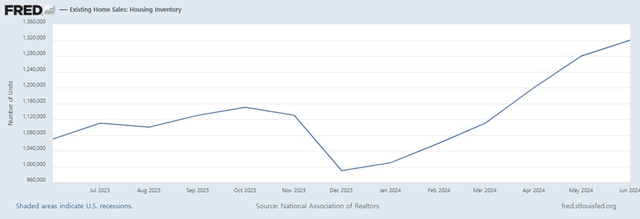

However, inflation and labor market have cooled down and the Fed is expected to lower interest rates, which is likely to reduce mortgage rates. In this environment, I believe existing homes sales will rebound, rather than decline below the levels seen during the financial crisis. An increase in housing inventories, combined with rising home transactions and lower interest rates, should lead to a more balanced housing market. In other words, even though it is difficult to predict exactly when the housing market will recover, I think the worst is behind us and the company’s earnings are more likely to improve in the coming years.

Attractive Valuation

Since the stock price peaked at $39.24 in February 2021, the market cap has dropped by more than 90%. During the COVID-19 pandemic, the company recklessly purchased houses, which were later offloaded at significant losses as the Fed began increasing its benchmark rates. At that time, the stock price dropped to roughly $0.92 in October. From April 2023 to August 2023, the stock price increased from $1.25 to $5.40 as the company announced positive earnings and overall sentiment in the real estate market improved. However, the stock price fell again as mortgage rates began to rise and the company downgraded its guidance. From November 2023 to December 2023, the stock price increased from $1.80 to $4.80 because, during that time, the Fed implied it planned to hold rates rather than increase them further.

I would value the stock based on its historical valuation, as both the P/E and P/S multiples may not be appropriate for this company. The company is not expected to make profits in the near future, and its revenue is simply the product of the selling price of houses and the quantity sold. Based on the stock performance analysis, investors can easily see that two variables that affect stock price movement besides the company’s earnings are interest rates and the real estate market sentiments.

When the stock price reached $0.92 in 2022, both the macro environment and the company’s earnings were at their worst. This is why I believe it is unlikely that the stock price will decrease to that level again, as the macro environment is becoming more favorable for the company. Additionally, the stock price tends to rebound at levels between $1.5 and $1.6, which may act as a bottom. At the time of writing this article, the stock price is fluctuating around $2.4. If the stock price falls to the $1.5-$1.6 range, the valuation could drop by 40%, whereas the upside potential is unlimited. In my opinion, if the price decreases below $2, it is worth monitoring.

Risk

However, there are several reasons why I maintain a hold rating, rather than a buy or strong buy, despite the positive signals mentioned above.

Firstly, even though the Fed begins to lower its benchmark rates, it may take some time for the real-estate market to rebound. A drop in mortgage rates resulting from more dovish Fed policies may lead to an increase in single-family home transactions. However, the overall cycle may unfold more gradually than expected. In other words, investors may need to be patient and wait for the company’s earnings to rebound.

Secondly, if the narrative of an economic recession gains traction, OPEN may be more severely affected than other industries. The Fed’s reason for pivoting is due to the cooling labor market and ongoing disinflation. If more people lose their jobs than the market expects and the U.S. economy heads toward a hard landing rather than a soft landing, stocks related to the real economy are likely to drop.

Thirdly, there is uncertainty about whether the iBuying business model can reach profitability. For the company to break even, it must increase transactions to cover expenses due to thin margins and a high proportion of fixed costs. Specifically, resale transaction costs, broker commissions, and property holding costs are included in operating expenses, which will fluctuate proportionally with revenue. As a result, the company needs a significantly higher volume of transactions to achieve profitability.

Conclusion

As the macro environment becomes more favorable to the company and the current valuation presents an attractive entry point, I recommend investors monitor Open Technologies Inc. However, because the stock price is relatively volatile, and a few risks remain, investors should be patient and conduct due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As I already own shares of OPEN and may purchase more in the near future, I may have a biased perspective regarding this stock.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.