Summary:

- Snowflake’s stock plummeted 15% post-2Q24 earnings, breaking key support levels, yet it remains a strong rebound investment in the SaaS market.

- Despite high stock-based compensation expenses affecting GAAP profitability, Snowflake enjoys robust sales growth and positive operating margins.

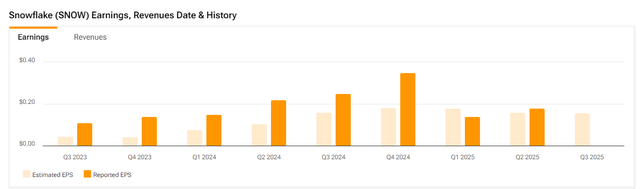

- The company reported better-than-expected 2Q24 earnings, with non-GAAP profits of $0.18 per share and a solid sales forecast for the year.

- Snowflake’s market valuation suggests a potential 42% upside if it achieves consistent GAAP profitability, making it an attractive buy opportunity.

Olena_T/E+ via Getty Images

Snowflake Inc. (NYSE:SNOW) has sold off after the company reported quarterly results for 2Q24 that pointed towards an ongoing deceleration of its sales growth.

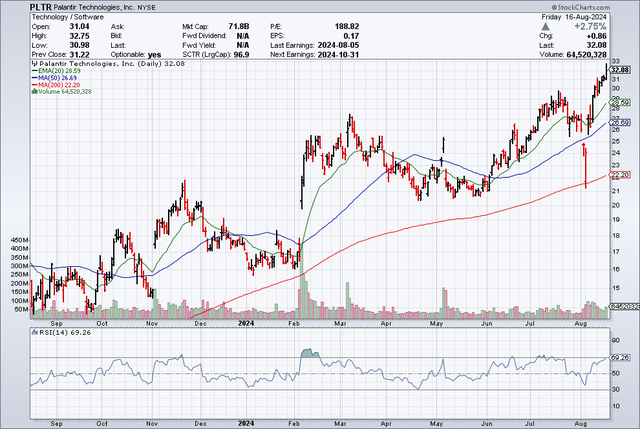

The company’s stock price plummeted 15% after earnings and have remained volatile ever since. Furthermore, the stock has broken through key support levels, including the 20-day and 50-day moving average lines, which has created a short-term bearish chart picture.

With that being said, though, Snowflake is enjoying a healthy uptrend in sales, nonetheless, and the forecast for the present financial year is positive.

I think that Snowflake is not a falling knife, but rather a rebound investment in the software-as-a-service market.

My Rating History

My last stock classification for the cloud-based data warehousing and analytics platform was Buy. Supporting my Buy thesis was that the company profited from an expanding total addressable market and quickly scaled up its free cash flow.

My view is that investors are overly bearish with regard to Snowflake, as the software-as-a-service company still produces stellar sales growth. If Snowflake can improve its GAAP profits, I see a lot of recovery potential for the company.

Snowflake Is Growing Product Sales At 30% Per Annum, Margin Trend

Snowflake reported 2Q24 earnings on August 21, 2024 that were better-than-expected. The software company had non-GAAP profits of $0.18 per share, which surpassed the Street estimate by $0.02 per share. All things considered, Snowflake presented robust second quarter earnings that were not deserving, in my view, of a 15% selloff.

Earnings And Revenues (Yahoo Finance)

The market for data warehousing and software-supported analytics is growing quickly, resulting in a substantial expansion in Snowflake’s total addressable market. Snowflake anticipates this market to grow to $342 billion by 2028, reflecting a doubling compared to the 2023 base year. The demand for storage, scale, security, data warehousing and analytics services is obviously growing as more workloads need AI support and move to the cloud.

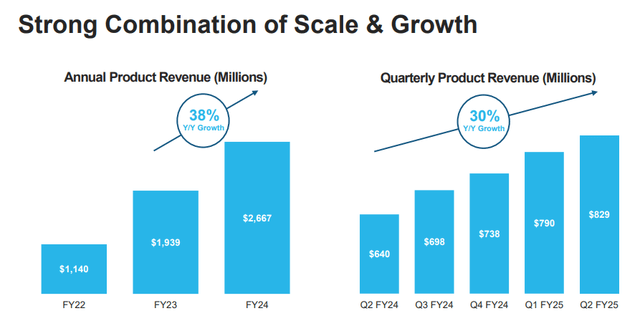

Robust demand from corporate clients is why Snowflake has been able to produce 30% or higher YoY product sales growth in the last year. In 2Q24, the software company produced $829 million in sales, up 5% QoQ.

Data Warehousing And Software-Supported Analytics Growth (Snowflake Inc.)

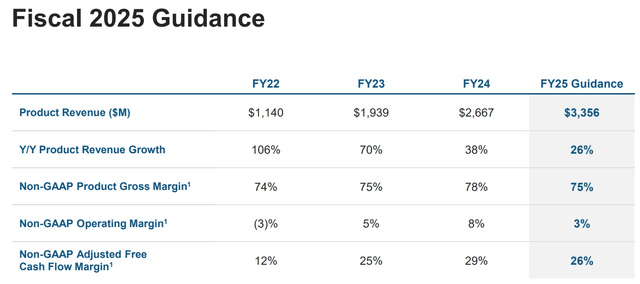

Snowflake’s forecast for the present financial year still calls for 26% YoY product sales growth, so while the software-as-a-service company is anticipating a bit of a cool-down in terms of growth, the sales guidance is still pretty solid as far as I am concerned.

2025 Guidance (Snowflake Inc.)

The margin profile for Snowflake has room to improve, however, which would lend credibility to the claim that the software-as-a-service company could soon be reaching an inflection point in terms of GAAP profitability.

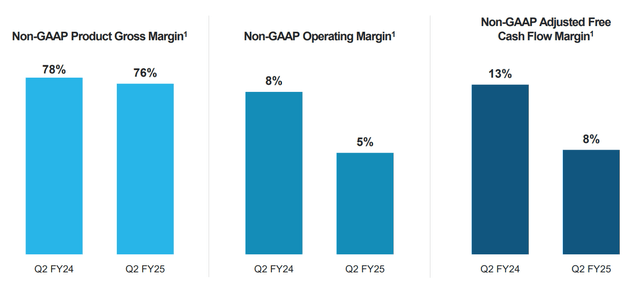

Snowflake’s operating margins, non-GAAP, reached 5% in the last quarter, down from 8% last year. With Snowflake’s sales growing and more customers joining the platform, I think Snowflake could potentially post a GAAP profit next year.

Non-GAAP Margins (Snowflake Inc.)

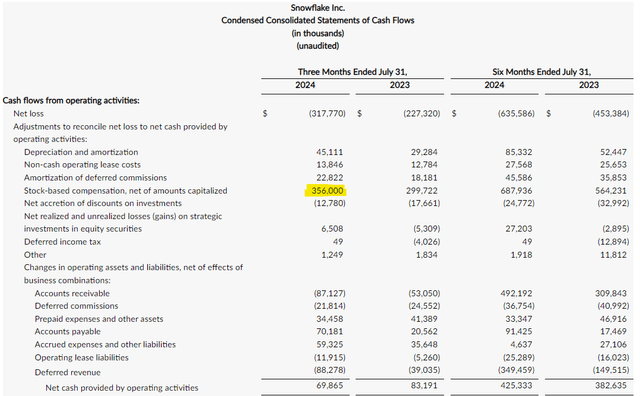

Unfortunately, high SBC expenses are the reason why Snowflake is not profitable. In the second quarter, Snowflake recognized $356 million in stock-based compensation, a figure that is added back to net income in the cash flow statement and explains why the company is free cash flow profitable, but not GAAP profitable. Snowflake’s net loss attributable to shareholders was $317 million, meaning the company’s high SBC is entirely responsible for Snowflake’s GAAP loss.

I have previously been critical of such stock-based compensation arrangements in the case of Palantir Technologies Inc. (PLTR).

Stock-Based Compensation (Snowflake Inc.)

Technical Analysis

After Snowflake’s second quarter earnings, the company’s stock price crashed through both the 20-day and 50-day moving average lines, creating a bearish chart picture. Snowflake has some support at the $108 price level, so if this level were to break, the stock price could potentially go down further.

With that said, though, I think that Snowflake’s results for 2Q24 were solid enough to suggest that the investment thesis is fully intact, which is why I continue to see a rebound case for Snowflake.

Relative Strength Index (Stockcharts.com)

Snowflake Is Looking Like A Rebound Investment

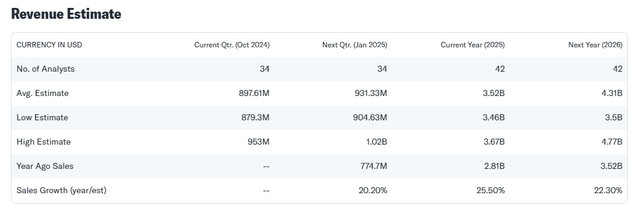

The market presently models $4.3 billion in sales for Snowflake’s next financial year which, at a market valuation of $39.5 billion, reflects a leading sales multiple of 9.2x. ServiceNow Inc. (NOW) and Cloudflare Inc. (NET), two cloud competitors, are selling for sales multiples of 13.0x and 13.2x.

These are sales multiples that I think Snowflake could eventually return to in the long run if the software-as-a-service company managed to grow to consistent GAAP profitability.

Since Snowflake’s 2Q25 beat profit estimates and yielded an overall healthy sales forecast for this year, I think that the bull case is pretty much intact. A 13.0x leading sales multiple implies an intrinsic value of $167, which is 42% above Snowflake’s present stock price.

Revenue Estimate (Yahoo Finance)

Why The Investment Thesis Might Disappoint

In recent quarters, there has been a shift in the way investors evaluate Snowflake’s key metrics, such as free cash flow or sales growth. While these metrics were important to investors for obvious reasons in the past, investors presently pay more attention to GAAP metrics, such as net income or stock-based compensation expenses.

Snowflake had a boatload of SBC in the last quarter which, unfortunately, caused its GAAP income to be negative. High SBC expenses, the absence of GAAP profits and slowing growth in the corporate SaaS market are key risks for investors.

My Conclusion

Snowflake got hit by another selloff after 2Q24 earnings, and the company’s stock price crashed through key support levels as a consequence.

With that said, though, Snowflake still has a lot to offer investors: The data warehousing and software-supported analytics market is growing and so are the company’s sales. Product sales hit a record in 2Q24 and grew 5% QoQ to $829 million.

Though Snowflake’s high stock-based compensation expenses are an issue, the company is growing its product sales consistently and Snowflake produces positive operating margins.

As long as core fundamentals (growing sales, positive margins and free cash flow) are intact, I think Snowflake is not a falling knife, but rather in a buying setup.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.