Summary:

- Advanced Micro Devices, Inc. announced its $4.9B acquisition of ZT Systems as a strategic move in the AI market, but we see things differently.

- We think AMD holds a higher risk profile after the acquisition inflated AI-related growth expectations further with little fundamental basis.

- We’re also seeing multiple expansions for AMD, making the stock expensive relative to semi-peers and increasing the risk of a price correction.

- Investor confidence in AMD’s AI growth is misplaced; the acquisition will likely only delay a bigger (disappointing) confrontation between AMD’s real AI capabilities and Wall Street’s AI expectations.

Sunny

Advanced Micro Devices, Inc. (NASDAQ:AMD) announced its acquisition of ZT Systems, a privately held server builder, for $4.9B earlier this month. AMD CEO Lisa Su emphasized in an interview with Reuters that “AI systems are our number one strategic priority.” We maintain our sell rating on AMD and recommend investors trim on the mini rally created by the acquisition news.

The market is taking the acquisition as a positive for AMD in its uphill battle to compete with Wall Street’s AI darling, NVIDIA Corporation (NVDA). We don’t think this is the case. In fact, we think the acquisition actually further proves that our concerns about AMD have not been misplaced.

The devil is in the details, so let’s discuss them.

The company announced news of its acquisition on August 19th, intending to close the $4.9B deal in mid-2025 by paying 75% in cash and the rest in stock in one of the biggest IT deals of the year. ZT generates around $10B in annual revenue, with the bulk of that coming from its manufacturing unit. AMD intends to sell that off once the deal is over, so as not to put itself in a position to compete with the likes of Super Micro Computer, Inc. (SMCI) and Dell Technologies Inc. (DELL).

With that in mind, this acquisition really comes down to AMD’s access to ZT engineers to “allow AMD to more quickly test and roll out its latest AI graphics processing units (GPUs) at the scale of cloud computing giants such as Microsoft.” This doesn’t seem too surprising considering the rumors about Microsoft’s dissatisfaction with AMD’s AI GPU products and software that began to stir earlier this year; AMD needs the help. ZT has around 2,5000 employees, of which AMD will keep 1,000 on hand. CEO Lisa Su further confirmed this rosy perspective of the acquisition, noting,

“ZT adds world-class systems design and rack-scale solutions expertise that will significantly strengthen our data center AI systems and customer enablement capabilities.”

At face value, AMD is paying $4.9B for a few hundred engineers.

We think this is a strategic move by AMD, but not for the reasons the market expects, i.e., not for the technological advantage ZT could provide but to mitigate high AI expectations. ZT is a customer of AMD, and, in turn, ZT is sitting on AMD AI GPU inventory that they cannot get off their hands. That would cause them to stop placing orders at the company and signal the weaker demand for AMD’s products to the entire market. Why does ZT have AMD inventory that they cannot get rid of? Simply put customers are continuing to choose the industry go-to, Nvidia, over AMD since there is no more shortage.

Industry research confirms that lead times for Nvidia’s H100 are now nonexistent. We believe this was a two-bird, one-stone strategic acquisition for AMD to buy ZT along with its inventory and simultaneously pitch it as a step forward in their seemingly losing race against NVDA. This is a win-win for AMD and ZT; AMD gets ahead of the bad news of the inventory pile-up that would visibly show AMD is lagging Wall Street’s expectations, and ZT gets a bunch of inventory off its hands and $4.9B.

What’s important to keep in mind here is that AMD is guiding AI GPU sales to exceed $4.5B this year, revised up from $4B this quarter but still substantially lower than whisper numbers expecting $6B in sales. This means AMD has big shoes to fill in terms of guidance. This acquisition makes it look like they’re on track when it is only prolonging a disappointment until mid-next year because AMD will likely struggle to meet, let alone beat, whisper numbers.

The importance of whisper numbers in the AI game cannot be emphasized enough. Part of why NVDA’s stock is dropping today is because the company only came in line with whisper numbers on July quarter sales and guidance reported in 2Q24 results. It achieved $30B in sales in line with whisper numbers for $30B and guiding for $32.5B, at the lower end range of the whisper numbers. We don’t see a material upside surprise to consensus numbers for AMD’s AI business this year. So, we continue to believe the stock’s valuation and market expectations put it at a higher risk profile to underperform, even more so now after news of the acquisition.

Valuation & Word on Wall Street

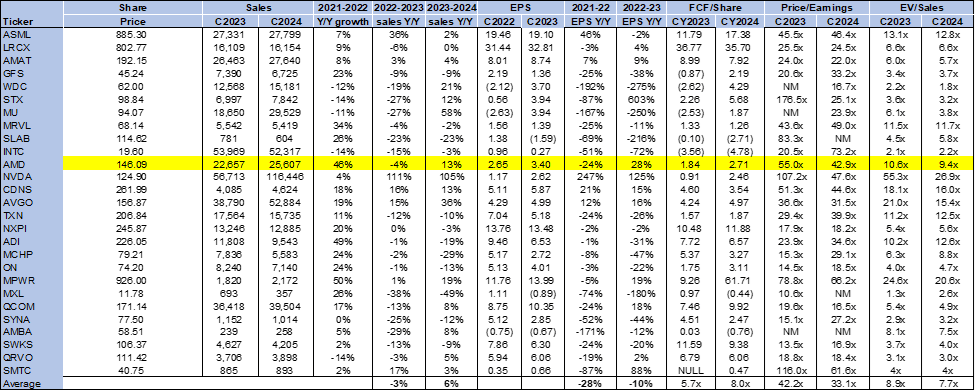

In our opinion, AMD is unjustifiably expensive relative to the peer group. We’ve seen multiple expansion for AMD on P/E and EV/Sales ratios since our last note, which was in early August. On a P/E basis, the stock is now trading at 42.9x C2024 compared to a previous ratio of 38.9x and a group average of 33.1x. Looking at the EV/Sales ratio, we see more of the same. The stock is trading at 9.4x EV/C2024 Sales compared to an old ratio of 8.2x and a group average of 7.7x.

The higher P/E and EV/Sales ratios over the past month showcase a couple of things. The biggest one is that AMD is becoming more expensive relative to its earnings and sales, as well as its historical and industry averages. This poses a big risk for AMD because an increase in these ratios without corresponding earnings/sales growth means the stock is overvalued. Thus, it is at risk of a price correction when AMD fails to show material upside to Wall Street’s high AI expectations. We think investor confidence in AMD’s future AI growth potential increased in light of the ZT acquisition, although there is little fundamental basis for this engineer acquisition boosting top-line growth. It’s more of a band-aid solution to reignite investor faith in the company’s growth trajectory as rival NVDA strides ahead.

The following chart outlines AMD’s valuation against the peer group average.

TechStockPros

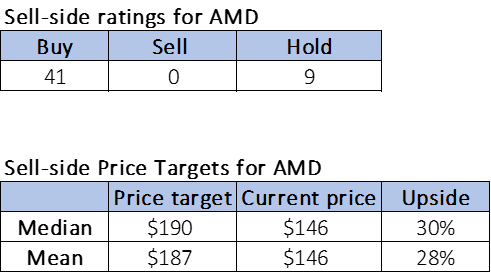

Wall Street’s sentiment on AMD remains unchanged since our downgrade note earlier this month. Of the 50 analysts covering the stock, 41 are buy-rated, and the remaining are hold-rated. Interestingly, the potential upside from sell-side price targets is now lower than it was. The stock is priced at $144 per share with a median sell-side price target of $190 and a mean of $187 with a potential 28-30% upside.

The following charts outline AMD’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We remain sell-rated on AMD and recommend investors count profits and exit the stock. Management is guiding for total sales in Q3 to grow 15% Q/Q to $6.7B, slightly beating consensus at $6.61B for the first time in five quarters. This is mainly supported by faster Q/Q growth in its data center sales on the MI300X AI GPU ramp. We think the market is getting ahead of itself with AI-related sales expectations for AMD, and the acquisition only made the hype worse.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.