Summary:

- Upgraded Dell to ‘Strong Buy’ with a one-year target price of $190, driven by rapid growth in AI-optimized servers and networking portfolio.

- Dell’s AI server revenue surged to 12.4% of total revenue, with a record $3.8 billion backlog, highlighting strong growth potential.

- Anticipate 14% revenue growth in FY24, primarily from AI servers, with normalized revenue growth projected at 9.3% from FY25 onwards.

- A strategic divestiture of SecureWorks could yield $400 million for AI initiatives, aligning with Dell’s focus on AI solutions.

Thinglass

I initiated a ‘Buy’ rating for Dell (NYSE:DELL) in May 2024, highlighting the growth potential of AI-optimized server and networking portfolio. Dell released its Q2 result on August 29th after the bell, reporting a 79.5% year-over-year growth in Servers and Networking business. The 23% growth in AI optimized server order underscores Dell’s growth potential in the AI era. I am upgrading to ‘Strong Buy’ with a one-year target price of $190 per share.

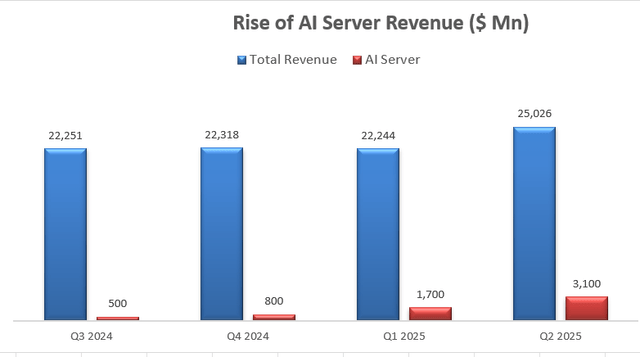

Rise of AI Server Business

My biggest confidence with Dell comes from the rapid growth of their AI server revenue, as depicted in the chart below. During the quarter, the AI server represented around 12.4% of total revenue, compared to 2.2% three quarters ago. Dell exited the quarter with a record backlog of $3.8 billion, which is remarkable.

Dell Quarterly Results

I anticipate Dell’s AI server will continue to grow rapidly and contribute significantly to the overall topline growth in the future for the following reasons:

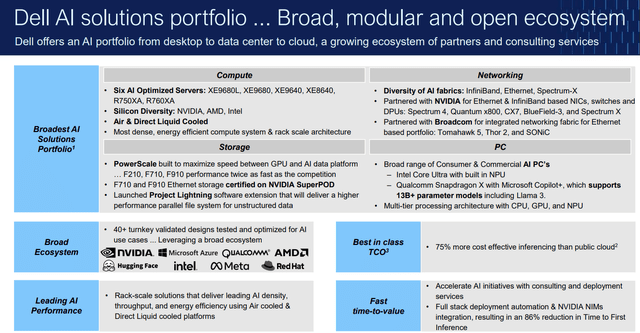

- As shown in the slide below, Dell possesses technology advantage across compute, networking, storage and PC markets, where it will support AI training and inference in the future. Dell’s holistic AI portfolio can offer solutions from desktop/edge to data center/cloud. Additionally, Dell has been expanding their partnership with key AI vendors, such as Nvidia (NVDA), AMD (AMD) and Intel (INTC).

Dell Investor Presentation

For instance, Dell expanded their AI factory with Nvidia to include new server PowerEdge XE9680L, as well as storage, edge and workstations in May 2024. These expanded offerings can be utilized by enterprise customers across various industries.

- As discussed in my previous report, Dell and Hewlett Packard Enterprise (HPE) hold a significant market share of traditional server market. I think Dell is well positioned to leverage their existing distribution network, technology and customer base to expand their server products to AI workloads and data centers. Their rack-scale solutions can help their customers achieve high computing power and energy efficiency, by utilizing the latest GPUs from Nvidia, AMD and Intel.

- As communicated by the management, the current major customers for AI servers are still hyperscalers, although there is an increasing number of enterprise customers. I am confident that enterprise customers will gradually expand their data center capabilities and become major purchasers of AI servers in the future. When AI enters into inference stage, there will be greater computing requirements at the edge, requiring more server and storage products.

Potential Sale in SecureWorks

As reported by Reuters on August 29th, Dell attempts to sell their 79.2% ownership in SecureWorks (SCWX). Dell previously explored the stake selling back in 2019. At this point, I think the divestiture of the cybersecurity firm makes strategic sense, as the cybersecurity market is not aligned with Dell’s core server and storage portfolio. As Dell is shifting their strategic focus towards AI solutions, SecureWorks is increasingly seen as a non-core business. SecureWorks currently has a market cap of $640 million. As such, assuming Dell sells the majority of ownership at a 20% discount, Dell could potentially achieve around $400 million in cash, which can be deployed in AI initiatives.

Outlook and Valuation

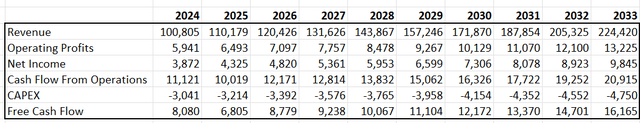

I estimate Dell’s near-term growth with the following assumptions:

- Servers and Networking: AI server accounts for nearly 40% of Servers and Networking segment revenue. I calculate the Servers and Networking segment will grow by 50% in FY24, primarily driven by AI server growth. At the end of FY24, I estimate AI server will represent around mid-teen percentage of Dell’s total revenue.

- Storage: As mentioned in my initiation report, storage growth lags behind server growth, as hyperscalers and enterprise customers typically purchase additional storage after networking starts to operate. As such, I don’t assume any growth in their storage business for FY24.

- Client Solution for Commercial customers: I assume a 2% growth in FY24, consistent with recent performance.

- Client Solution for Consumers: The business is driven by the replacement cycle of computer/laptops. With Dell exiting their VMware resale business, the Consumer business is likely to face growth challenges in FY24. I estimate the business will decline by 20% in FY24.

Putting everything together, I forecast Dell will deliver 14% growth in revenue for FY24, driven by strong Servers and Networking business growth.

For the normalized revenue growth from FY25 onwards, I assume Servers and Networking will grow by 20% annually; storage by 5%; client solutions by 5%. As such, the normalized revenue growth is projected to be 9.3% from FY25 onwards.

As the sale of AI servers to hyperscalers carries lower gross margin, I estimate Dell will face 10bps gross margin headwinds in the near future, offset by 10bps margin improvement from SG&A operating leverage.

With these assumptions, the DCF summary is as follows:

Dell DCF

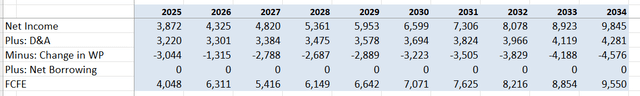

The free cash flow from equity is calculated as follows:

Dell DCF

The cost of equity is calculated to be 10% assuming: risk-free rate 3.8%; beta 0.9; equity risk premium 7%. Discounting all the future FCFE, the one-year target price is calculated to be $190 per share.

Downside Risks

As reported by Bloomberg on August 5th 2024, Dell plans to layoff 12,500 employees, or about 10% of the total workforce, as part of a reorganization of the sales team. Dell aims to create an AI-focused business group and eliminate some low-growth business units. The management confirmed the reorganization during the earnings, indicating the company is optimizing their sales coverage to better focus on AI starting from the second half of this year, with a projected cost of $328 million for workforce reductions. I favor the reorganization plan, as it could potentially accelerate Dell’s overall revenue growth in the future.

Closing Thoughts

I think the rapid growth of AI server and networking will continue in the near future and gradually become a major growth driver for Dell’s overall financials. The stock price is significantly undervalued, based on my model; therefore, I am upgrading to ‘Strong Buy’ with a one-year target price of $190 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.