Summary:

- The brand has historically been strong in high-performance gaming, but recent financial struggles raise concerns about its future.

- Debt levels and uncertain future cash flows make it difficult to accurately value the company.

- Intrinsic value is probably substantially lower than market.

Editor’s note: Seeking Alpha is proud to welcome PA Research as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

4kodiak

The Premise

Wall Street never responds well to EPS / Revenue misses, and even worse when growth and profitability turn negative. As we have all observed over the last reporting quarters, Intel (NASDAQ: NASDAQ:INTC) is in deep trouble, the top line is shrinking, and we all know what happens when any business is not able to cut costs proportionally to match the margins, the picture just gets worse.

Since many analysts have already pointed out the numbers, I will not spend a substantial time in this article discussing those. However, I would like to dive into Intel’s brand, and what it has meant to consumers over the years and try to assign an intrinsic value for the business.

Based on the findings I will present in the next sections, Intel’s long-term competitive advantage is deteriorating as it has taken on enormous leverage, and continues to seek growth opportunities outside its core businesses to restore profitability.

The Moat

I recall when I was a computer science major back in 2015, I always had a passion for computers, and all I could think about was processing power. When I built my first computer, there was only one processor manufacturer in mind: Intel. I asked other classmates for advice, they said, “Intel is the best”. However, Isidore was always an AMD fan, so he decided to build his with an AMD chip. All we cared about back then was FPS. What is FPS? It is a metric of how many frames you see while gaming. The higher the FPS, the smoother the game and consequently, one’s performance. Intel had demonstrated that even cheaper chips had the ability to support a stable and higher FPS than AMD. There was the argument that “Intel is for gaming” and AMD is for “workstation intensive tasks” (like 3D Design, Video Editing etc.). The reason I am stressing gaming so much, not only because it is a $210B industry, but also because that’s where the pros are. The people that care about performance the most. If you observe the competitive tournaments, every ad is showcasing the new Intel processor. Why? Because Intel chips perform best under stress tests. But don’t take my word for it. Let’s compare two chips and see the differences:

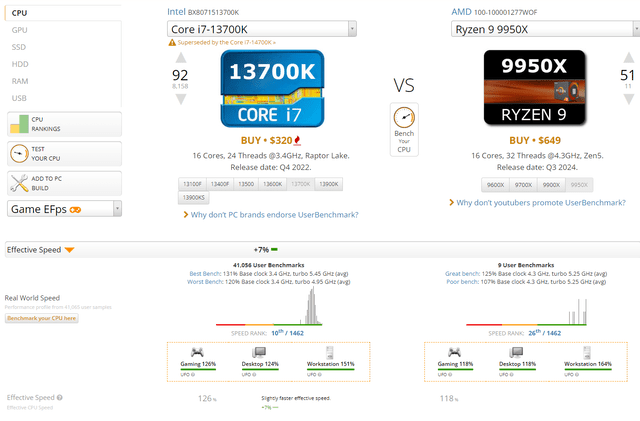

Intel’s $320 i7 13700k released in September 2022 beat’s the $650 Ryzen 9 9950X released on August 15, 2022 in Average Bench(overall performance), despite the 1.0Ghz difference in processing power. Also, the i7 13700k has already been surpassed by the new generation of i7 chips. Intel is just a better, and cheaper option for high performance. Of course, FPS won’t be high enough if you have a high-end graphics card. This game is all Nvidia, however if you combine Intel and Nvidia you are set for the maximum FPS, exactly what the pros want. Why does this matter? Because Intel chips is a dominant name in the most niche industry: “high performance” competitive gaming.

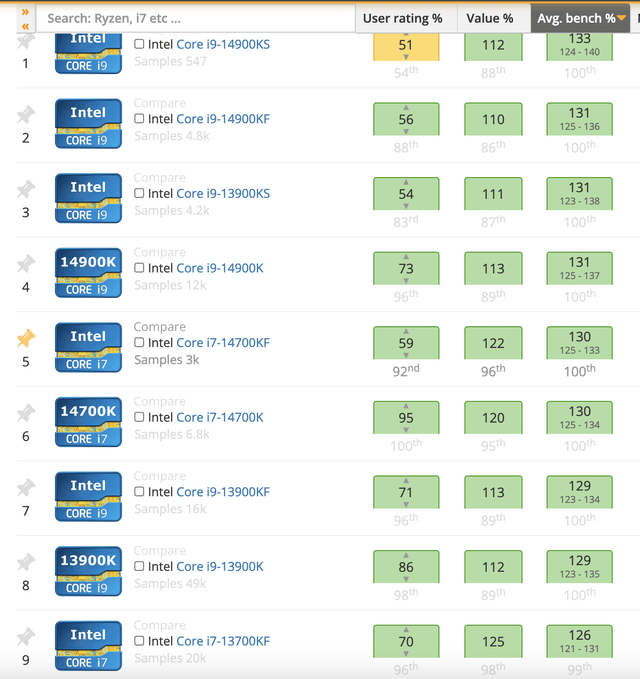

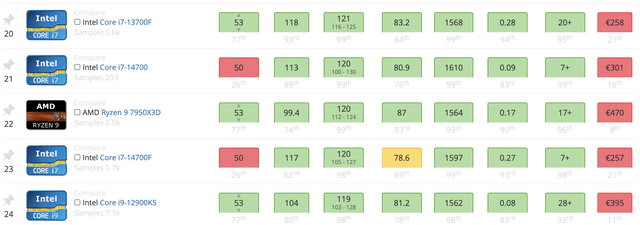

Furthermore, the top 10 processors ranked by average bench, are Intel. As a matter of fact, the first AMD Ryzen CPU shows up 22nd in the list and it is the AMD Ryzen 9 7950X3D.

First Ryzen appears on place 22 | cpu.benchmark.com

We can also observe, that the price at which it sells is almost 25%-30% more expense than processors that have already surpassed the performance of AMD Ryzen 9 7950X3D. It is clear that Intel is dominating AMD’s performance and sells at a substantially lower price. Sophisticated consumers will always choose Intel CPU over AMD CPU, and that’s where the moat lies.

Taking a closer look at the business segments

Intel 2023 Annual Report

Client Computing Group consists of 13th Gen Intel Core mobile and select desktop processors, Intel Core 14th Gen processors, and Intel Core Ultra processors, as well as Intel 4.

Chip Use Cases: commercial notebooks and PCs.

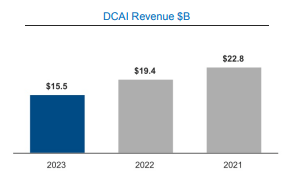

Intel 2023 Annual Report

Data Center “AI” (or just very powerful and expensive cpus for enterprise systems)

Includes Intel Xeon processors, the Intel Xeon CPU Max Series, the Intel Data Center GPU Max Series, the Intel Data Center GPU Flex Series, Intel Agilex and Intel Stratix FPGAs, Intel eASIC™ devices, and the Intel Gaudi processors.

Chip Use Cases: “AI”, cryptography, security, storage, and networking

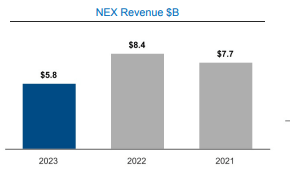

Intel 2023 Annual Report

Network Edge Includes: 4th Gen Intel Xeon processor with Intel vRAN Boost, and announced the Intel Xeon D-1800 series and the Intel Xeon D-2800 series processors optimized for cloud, edge, and 5G networks.

Chip Use Cases: cloud, edge, and 5G networks. Primary purpose is to increase speed and lower latency.

Assessing the turnaround prospects

Why the MOAT is failing

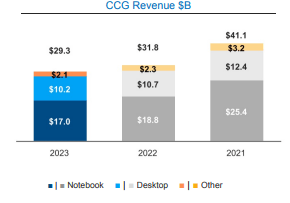

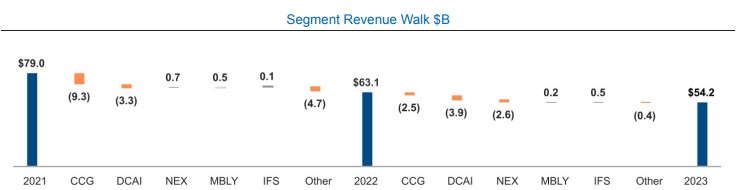

It is evident, that the moat around Intel’s brand lies within its core businesses, more specifically CCG. Below, we can see the performance in the top-line for all the business segments.

2023 Annual Report Extract

The segment walk is depressing for the core businesses (orange color) which also benefit from CCG’s perceived moat. A business with a competitive advantage shouldn’t experience large and constant volume declines. Definitely, it is not attributed to any cyclicality, as its peers continue to grow the top-line.

Intel is focusing on new strategies to launch new ventures like Mobileye (MBLY): providing autonomous driving technologies and solutions. (Operating Income of $0.7B)

Intel Foundry Services (IFS): optimize customer’s solutions by combining the best technologies from Intel (Operating Loss of $0.5B)

It is clear that Intel is not focusing on its core business to restore profitability, which further negatively impacts earnings and shrinks shareholder’s value.

Debt considerations

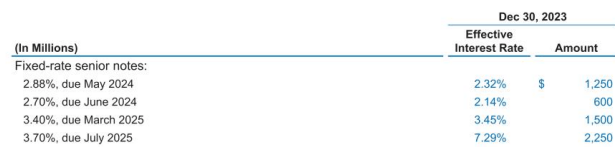

Debt Schedule – 2023 Annual Report

3.7% July 2025 $2.25B note has a staggering 7.29% EAR

2023 Annual Report

All the senior fixed-rate notes along with other debt securities amount to a staggering long-term debt of $50B. To date, short-term debt rose to $4.695B up from $4.581B in Q1. A trend that will persist in the upcoming quarters dragging income before taxes at even lower levels assuming all other things equal. I doubt that the situation will improve significantly from here, unless Intel restructures debt.

Intel’s next steps should be very clear. Restore top line-growth by focusing on the core business segments and avoid participating in a new “AI” service.

Every CPU can be branded as AI-enabled if it has enough processing power. Adding net PP&E of $25B associated with slightly faster CPUs that may come with it’s own front-end system is an unreasonable expense to the shareholders and should be reduced to pre “AI” era numbers.

Over the short-term, Intel has to deal with creditors and significantly cut expenditures in the upcoming quarters to remain afloat.

Valuation

Attaching a price range for Intel at the current state is exceptionally challenging. Future cash flows, operating margins, and revenues are uncertain and relying on a DCF at this point in time would be a mistake (unless you can accurately predict the actual future cash flows, I definitely can not). How confident can an analyst be that the turnaround will happen in 1,2 or 3 years down the line? The answer is knowing what you don’t know and conservatively attaching a floor price. This is what this section will try to do.

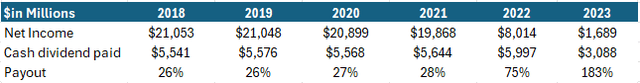

Data derived from past annual reports

Before the severe downturn in 2022 and 2023, it appears that a reasonable payout ratio for Intel was 25% for earnings of $20B. At the current risk-free rate of 5% a fair P/E is 20. This P/E holds true if and only if Intel pays out 100% of earnings. However, since the company pays out only 25%, thus the P/E should be 4 times lower. A no-growth, conservative P/E for Intel is 5x earnings. The second step involves determining which earnings should this multiple be applied to. Current earnings? Last year’s earnings? Former stable earnings? Each assumption has a huge impact on the attached intrinsic value of the business.

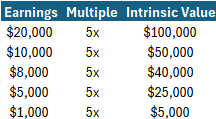

Author’s Business Value Estimates

Restoring earnings quickly to pre-2021 levels is unrealistic. If earnings get back to $5B and the company decides to restore the dividend and maintain the 25% payout ratio, then it would be worth $25B. Way less than the current market capitalization of $88B. The market currently assumes earnings of $17.6B if we assume a 25% payout.

Per my calculations, the liquidation value is around $23B which is roughly inline with the $25B intrinsic value which assumes future annual earnings of $5B.

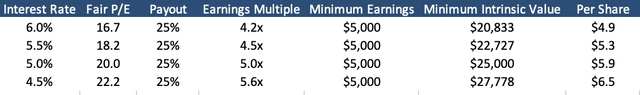

Sensitivty Analysis – Interest Rate (Author’s Estimate)

Of course, interest rates drive fair values as we can observe from the table above; however, the most important element is the earnings estimate along with a sustainable payout ratio. An investor should ask the following question: What earnings are sufficient to support a 25% payout? Historically, Intel needed at least $17B to support a 25% payout. Of course if we just plug in the $17B value we will get enormous valuations. Intel will gradually restore the dividend as earnings increase. Per my conservative calculations, the minimum intrinsic value ranges between $5.3 and $6.5 per share.

Investment Positioning

To sum up, what needs fixing in order to grow intrinsic value over time is to restore growth in its core businesses, which still to date outperform the peers in computing power. Debt has to be managed accordingly as it has been at a record high level. The next quarters will be crucial for Intel and the investor should wait, without owning the security, for the core fundamentals to improve. Nothing stops the market to valuing Intel at an ever lower market price per share. If the fundamentals do not improve over the next quarters, I expect the market value to approach the conservative minimum floor value.

In my opinion, Intel is not an investment grade security at present. I recommend selling the security if you are a holder until we see further and substantial improvements in the bottom line.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.