Summary:

- Mastercard, a leader in payment networks, offers solid long-term growth prospects, especially with its potential entry into the Chinese market.

- Risks include regulatory pressures and emerging technologies like blockchain, but these are manageable and do not significantly impact the company’s outlook.

- The current valuation is demanding; a 10% stock drop would present a great entry point, making it a strong candidate for my Watchlist. My recommendation is “Hold”.

Ekaterina79

Investment Thesis

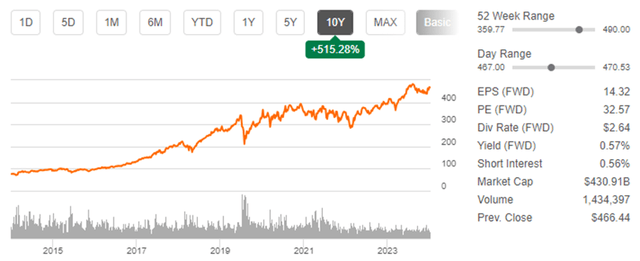

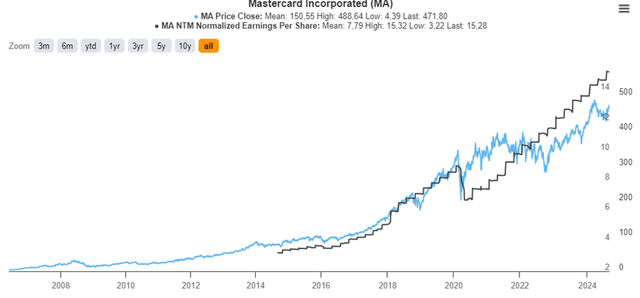

Mastercard (NYSE:MA) is a leading company in the payment network and added services sector. Over the years, it has returned 28% to shareholders and, despite being at all-time highs, is still fairly valued. With good management, excellent growth prospects, and an opportunity in the Chinese market, it meets the requirements for a solid long-term portfolio.

In this thesis, I will introduce all my estimates about the company, but if the stock drops by 10%, it could be a great entry opportunity with returns exceeding 15% annually. By the moment, my recommendation is “Hold”.

Brief Business Overview

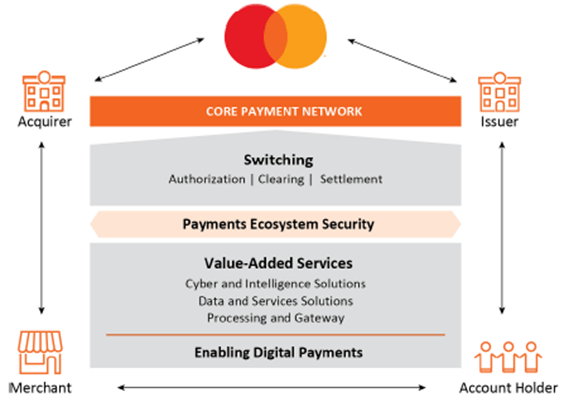

Alongside Visa, they are companies that practically dominate a duopoly in the global payment network, with the exception of China, which is dominated by Union Pay. What is interesting about this is that the industry is not a “winner takes all,” which has allowed each company to focus on its own performance rather than engaging in fierce price competition. The network is called a four-party network because it connects four players within the circle.

Source: 10-K Filling 2023

The revenue structure is composed of 63% generated by the payment network and 37% by value-added services, which include services such as preventing and detecting fraud and cyber-attacks, information solutions for merchants, aggregated payment behavior data, assistance in creating differentiated products, and others.

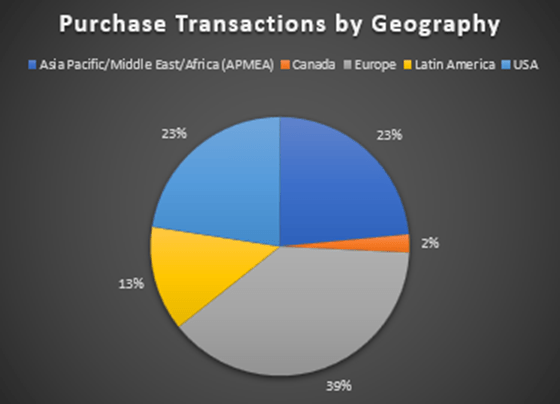

The characteristic I like most about Mastercard compared to Visa and Union Pay is its geographically diversified distribution of purchase transactions. Notably, nearly 50% of Visa’s transactions are generated in the USA, while over 90% of Union Pay’s transactions are generated in China.

Source: Author’s representation

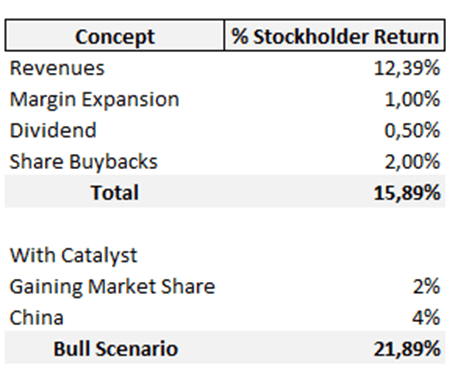

Despite Mastercard’s increase in value from $85 billion in June 2014 to $410 billion in June 2024, it can still continue to return 15% annually to shareholders over the next 10 years.

Despite significant growth in the past, returns are always in the future

In this section, I will detail the reasons why I believe Mastercard, despite its excellent shareholder return over the past 10 years, can continue to increase its EPS by at least 15% annually.

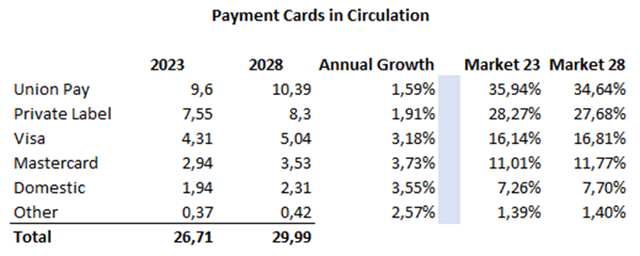

Growth in Payment Cards in Circulation Worldwide

The number of payment cards worldwide in 2023 was 26.7 billion, but this is expected to grow by 12% over the next 5 years, reaching 30 billion. This growth may initially seem insignificant, but it provides the company under analysis with almost 4% more capacity to generate transactions.

Source: Author’s representation

In turn, Mastercard would be the company that grows the most in this area for two reasons: first, by capturing a small portion of the market share, especially outside the USA, and second, through its entry into China (a catalyst that I will analyze further later on).

Growth in PCE (Personal Consumption Expenditures) and Increase in the Percentage Paid with Cards

The primary component of spending via credit and debit cards is PCE, which has grown at an annual rate of 7% over the past 52 years. Looking ahead, PCE is expected to grow around 2% in Advanced Economies (where Visa prevails) and 4.5% in Emerging Market and Developing Economies (especially in China and India), where Mastercard is focusing.

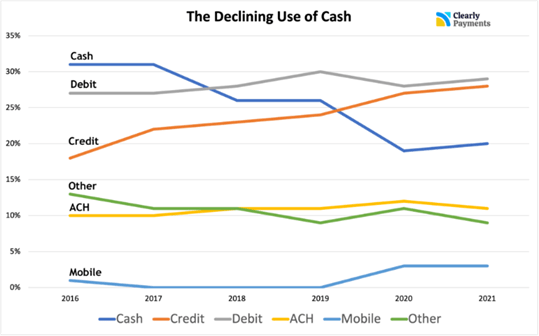

The Decline in Cash Usage

The incremental trend of reducing PCE spending in cash and shifting to card payments is driven by various factors such as fraud and tax evasion. While we will later see that regulations on fees pose a significant risk, governments also have incentives to promote the growth of card usage.

The following image not only shows how cash usage has declined globally over time but also highlights the growth in credit card usage. I encourage my readers to continuously monitor the evolution of payment methods in the USA and Europe.

Source: Clearly Payments

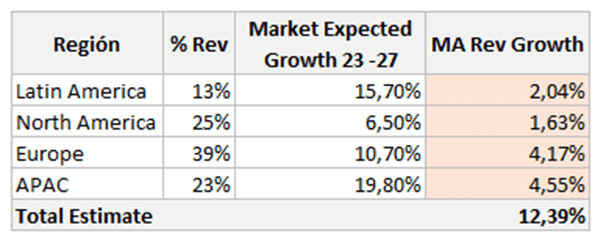

The sector has experienced double-digit growth globally over the past 5 years, but what is most interesting is that double-digit growth is still expected in all regions except the USA.

Based on these estimates and according to Mastercard’s regional sales distribution, I have estimated that the expected sales growth for the company, considering only the anticipated market growth, is 12% annually.

Source: Author’s representation

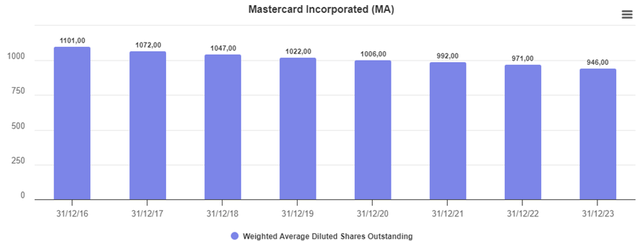

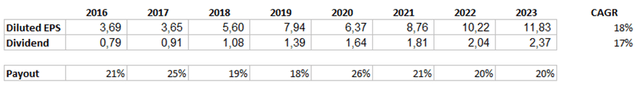

Buybacks and Dividends

From my perspective, one of the company’s best features is the management’s decisions regarding capital allocation.

The company currently returns only 0.5% to shareholders through dividends, but importantly, the growth has been an impressive 17%. Additionally, the fact that the payout has remained constant demonstrates the company’s strength in generating EPS.

Source: Author’s representation

Another very smart decision by the company is its stock buybacks. I believe this is still an undervalued capital allocation by the market, but the company has repurchased 14% of its outstanding shares over the past 7 years. This equates to returning 2% annually to shareholders.

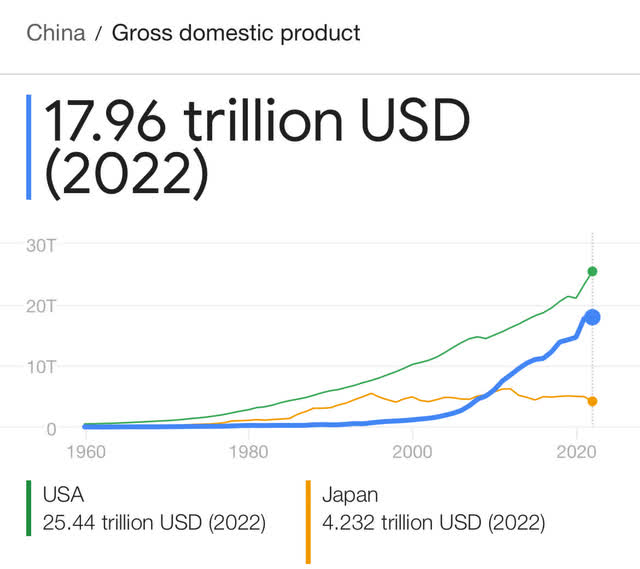

In seeking to take its first significant steps in China, a positive catalyst

In June 2023, the company partnered with Alipay to offer travelers the ability to pay in China with Mastercard as if it were a local card. I consider this a good initiative for entering the market, gaining visibility, and analyzing acceptance by Chinese merchants. Subsequently, in May 2024, it was confirmed that the company’s cards could also be used for domestic transactions.

Additionally, the Chinese government has shown a positive reception to this development.

Currently, UnionPay holds a 99% market share in China, with the remaining 1% distributed among Visa, Mastercard, and others. UnionPay is a private company, so we do not have access to data on its annual revenues or transactions. However, given that China is the second-largest GDP country in the world, we can imagine the significant growth that capturing just 2% of the market would provide.

Although I understand that it is a significant challenge for the company to enter the enormous Chinese market, especially given its status as a U.S. company, it has little to lose and much to gain. Let me show my estimates: in 2023, there were 531,087,000,000 transactions made with banking cards. If Mastercard can capture just 1% of this volume, charging fees of $0.20 per transaction (as in regulated regions), it would result in a 4.5% increase in Mastercard’s current sales. In other words, even a minimal market share capture could turn a good investment into an excellent one.

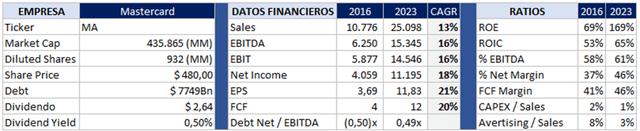

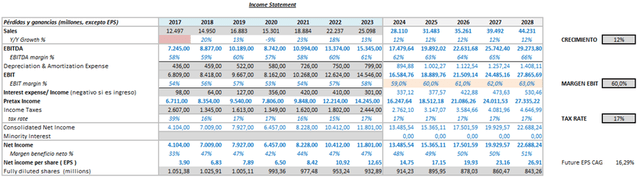

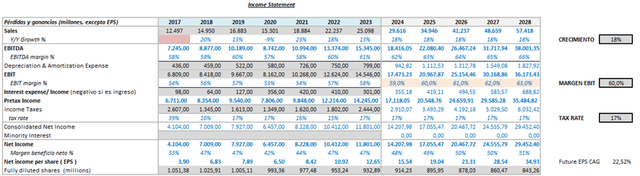

Financial Overview

Mastercard’s numbers are truly exceptional, attributed to the quality of the business, its duopoly position, and very effective management execution.

The company has grown sales at a sustainable 13% over the past 7 years, even navigating the COVID crisis successfully. This growth is not only superior to global GDP growth but has also doubled the growth rate in the USA and quadrupled it in Europe.

Additionally, I observed a very high ROIC, tripling the market average, and sustained over time, which demonstrates the company’s quality. Importantly, with new market opportunities like China and other emerging countries, the company will be able to reinvest FCF at these high rates.

Sales have grown at a rate of 13%, but margins have increased at a rate of 16%, signaling clear economies of scale. Moreover, EPS has grown at an excellent 21%, reflecting the effective capital allocation by management.

Finally, a very important characteristic of this company is its advertising and marketing. It is crucial for capturing attention and building brand awareness, providing greater security and convenience to users. As seen in the previous image, advertising expenditure has been kept constant nominally while increasing sales from $10.776 billion to $25.098 billion, which means spending on advertising has decreased from 8% of sales to 3%. If a strong entry into China materializes, this expenditure might slightly increase to enhance brand power.

Valuation

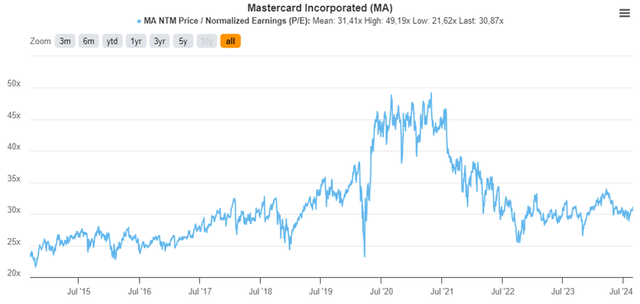

This might be the most challenging point of the thesis, as the company is currently trading at very demanding valuations, with an equivalent P/E ratio of 31x.

While, based on Benjamin Graham’s formula, the maximum multiple to pay for this company would be 38x (where the maximum P/E multiple is calculated as twice the EPS growth rate plus 8.5), I believe the current valuation is justified by the company’s quality and the significant potential it still holds.

Based on the thesis described earlier, I have determined the following estimates:

Source: Author’s representation

In the first scenario, which is very realistic and possible, EPS would grow around 15% annually. Based on this, I consider a reasonable P/E range of 28x – 30x for setting my target price. The estimated valuation range for 2024 is $413 – $442, and for 2025, it is $480 – $514. Given the current stock price, I do not find these levels to provide a sufficient margin of safety according to my investment goals, but I would not hesitate to initiate a position if there is a 10% drop.

Source: Author’s Representation

In my Bullish scenario, with a high degree of optionality, it represents a unique investment opportunity considering the company’s quality and security. Based on the estimates, my target price for 2024 would be $435 – $466, and for 2025, $533 – $571.

Source: Author’s representation

Despite the fact that the market has always valued it similarly (in line with EPS), my concern about the valuation is whether the market will continue to value Mastercard at 30x earnings. This is particularly important to me because it is not something that depends on me, unlike cash flow estimation. For this reason, I would prefer to buy it at my lower valuation range, 28x P/E.

Thesis Risk

Mastercard is a company with a solid financial balance, economies of scale, and shares an oligopoly with Visa and UnionPay, which provide a certain level of security. However, no investment is without risks.

The first and most important risk is regulation. Historically, the company has already faced regulations from Europe and the USA, setting limits on the prices of its services, especially in payment network fees. Previous regulations were implemented to “relieve” costs for merchants, but many studies show that this led to increased costs as banks offset the loss of revenue from capped prices with new account maintenance fees or higher costs for other services. Looking ahead, there may be more regulations that could apply pressure, but it will likely take more time for the state to prepare or make these decisions.

The second significant risk I see is new technologies like blockchain. I consider this could be a very good way to safeguard our capital outside the state circle. However, this introduces new regulations that could protect Mastercard for several reasons: 1. The main source of state revenue is taxes, so there is no motivation to allow legal circulation of money through alternative channels; 2. To prevent corruption, fraud, and drug trafficking; 3. Given the security chain of blockchains, I doubt individuals would be willing to place all their wealth there, as a hack, for example, could result in losing all their money.

From my perspective, these are risks to monitor, but for the moment, they do not significantly affect the company.

Takeaway

The company operates in a sector with tailwinds, is a market leader with significant market share still available to capture, has very good management, and presents a highly interesting positive optionality, making it an appealing stock for my long-term portfolio.

However, the current valuation is demanding, and if added now, my expected returns are below the 15% annual rate I desire as an individual investor. For these reasons, I am placing the stock on my Watchlist, and my recommendation for now is “Hold”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.