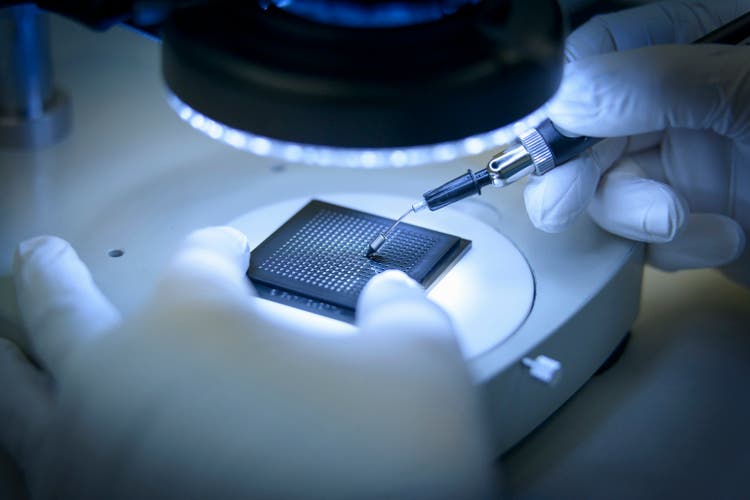

Monty Rakusen

Semiconductor stocks were mixed on Friday, as investors digested and awaited earnings from two industry bellwethers: Nvidia (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO).

Nvidia shares gave up earlier gains and hugged the flat line shortly before 12 p.m. EST on Friday, even as the Jensen Huang-led company said it sees no slowdown in the artificial intelligence spending boom that has powered it to a near $3T valuation.

“Jensen [Huang] spoke in dialed in detail about customers getting ROI right away on its GPU investments, and many customers are vying to be the first to produce new AI advancements and models,” Wedbush Securities analyst Dan Ives said on Thursday. “AI GPU demand is way outstripping supply for Nvidia at this juncture, and [Wall Street] should come away from these results as a very bullish indicator for the broader tech sector with more shock and awe rather than a shrug of the shoulders in our view.”

Nvidia shares fell more than 6% on Thursday after it reported second-quarter results and guidance on Wednesday.

Broadcom shares rose 1.9% on Friday as investors awaited its quarterly results, slated to be released after the close of trading on Sept. 5.

Like Nvidia, Broadcom has also benefited from the AI spending boom, creating custom chips for clients. It has also seen an increase in demand for networking processors.

A consensus of analysts expect the Hock Tan-led company to earn $1.20 per share on $12.96B in revenue for the coming quarter.

Intel shares gained nearly 9% after media reports suggested that the company is weighing the decision whether to spin off its foundry business.

TF International Securities analyst Ming-Chi Kuo said on Friday that the recent decision by Lip-Bu Tan to resign from the company’s board, which some said occurred due to his concerns about Intel’s future, may be related to the spin off.

AMD (AMD), which competes with Intel and Nvidia, rose fractionally in midday trading on Friday.

Most other semiconductor stocks also saw fractional moves on Friday, ahead of the Labor Day weekend.

Micron (MU), Texas Instruments (TXN), Microchip Technology (MCHP), Analog Devices (ADI) and Qorvo (QRVO) were up less than 1%.

Qualcomm (QCOM) and NXP Semiconductors (NXPI) bucked the trend and rose more than 1.5% each.