Summary:

- Nvidia Corporation’s Q2 results showed a slowdown in data center growth, raising concerns about valuation and future volatility despite strong AI-driven growth in 2023 and 2024.

- Despite $50B of stock buybacks outlined, Nvidia’s high valuation may face correction, with fair value estimates indicating limited upside and potential bear market risks in the coming years.

- Nvidia’s emerging focus on robotics could be a future growth driver, but the market is smaller and more speculative compared to the AI boom, leading to a cautious Hold rating.

luza studios/E+ via Getty Images

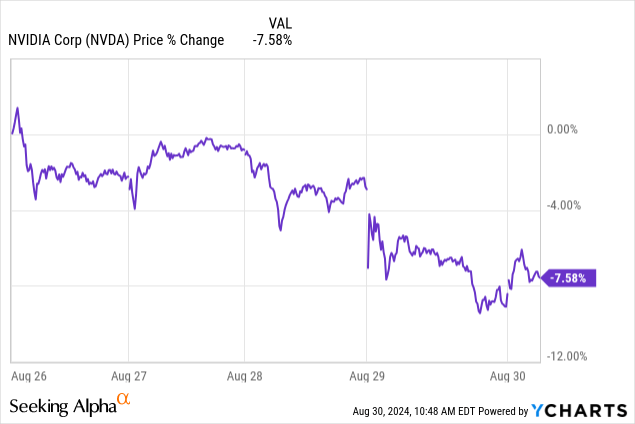

I cautioned in my pre-earnings coverage for Nvidia Corporation’s (NASDAQ:NVDA) Q2 results that it was not a strong time to initiate a position on the stock. The results have now been released, and while Nvidia delivered a top-line and bottom-line beat, it also outlined guidance that was not ideal. Furthermore, we saw evidence in these earnings results of a growth slowdown, which is the main element of concern I have been raising as it relates to Nvidia’s valuation. The market also seems to agree with me, as the stock experienced a decline in after-market trading hours following the release of the results. I reaffirm my Hold rating following the report, and I am waiting for a better valuation to buy NVDA stock as I consider it to have high volatility risk over the next 12 months.

Nvidia Q2 Earnings Analysis

It’s no surprise that Nvidia’s Q2 continued to show exceptional growth, as the AI infrastructure build out, while slowing down, is still moving forward. It reported revenue of 122% YoY growth, GAAP EPS of $0.67, a substantial increase from $0.25 a year ago, and net income of 168% YoY growth. Furthermore, its data center revenue, its highest growth segment due to AI demand, was up 154.5% from the previous year.

As I mentioned in my pre-earnings analysis, and I have mentioned multiple times about Nvidia, much to the dismay of Nvidia bulls, there are growing and rational concerns about the overall slowing of growth related to its data center segment. The data center revenue grew by 16% from the previous quarter, which was a decrease compared to the 23% growth seen from Q4 of the previous year to Q1. Furthermore, Nvidia’s gross margin saw a slight decline from 78% in Q1 to 75% in Q2.

While the contraction in growth rates and its gross margin might not detract from the fact that Nvidia is still expanding strongly, as the stock is so richly valued, the reduced growth will likely affect NVDA’s market cap significantly. Despite management raising its guidance ($32.5B in revenue expected for Q3 versus the consensus of $31.75B), this has not met the optimistic forecasts and expectations set by investors, leading to a perception of disappointment. The stock price is down since the earnings results, in light of this.

There were also rumors that Nvidia’s Blackwell chip was going to be delayed. However, Nvidia’s CFO, Colette Kress, confirmed during the Nvidia Q2 Earnings Call that the company had made a change to the Blackwell GPU mask to improve production yield, which has helped the production schedule to proceed as planned. This is notably a strong point of resolution, and it does provide confidence to investors who previously doubted this near-term growth driver.

Management also announced a substantial $50B stock buyback program, which reflects confidence in its future prospects and will return value to shareholders and boost earnings per share by reducing the number of shares outstanding. However, this is somewhat offset by its high $4.14B in stock-based compensation (“SBC”) TTM and $3.55B in the fiscal period ending January 2024, a figure that continues to rise. That being said, Nvidia has already repurchased $15.4B worth of its shares over the last two quarters. So, I think that the stock buybacks are still a reason to be bullish on NVDA stock, as they do outweigh the SBC. However, it certainly doesn’t offset the growth slowdown and valuation concerns that I have mentioned.

Nvidia Q2 Valuation Analysis

Nvidia’s stock price has dropped slightly since its Q2 results. However, I believe we haven’t seen the full extent of the short-term correction or even the bear market that could occur for the company over the next couple of years.

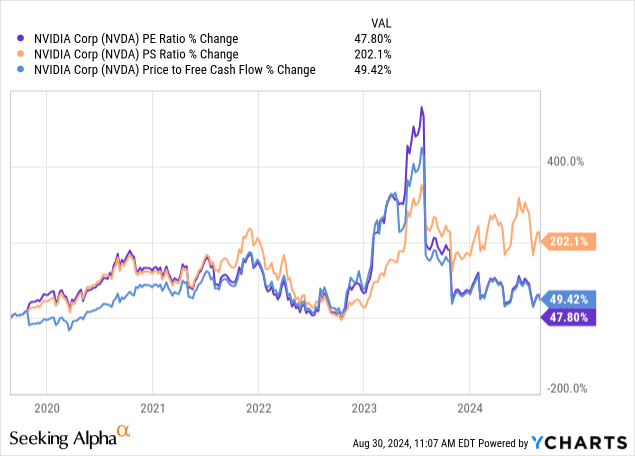

Over the past 5 years, Nvidia’s P/E and PFCF ratios have increased less than I would have initially expected. However, its P/S ratio has seen a stark 202% increase, which does present some reason for concern. Nvidia’s growth rates 5 years ago were nowhere near what they are today, but it is also important to remember that its growth rates in 2025 and 2026 are also unlikely to be close to what they were in 2023 and 2024.

I mentioned in my pre-earnings analysis of Nvidia that a TTM P/E non-GAAP ratio of 30 would be fair in the fiscal period ending January 2027. Following its Q2 results, I still consider this to be true, even despite management raising guidance and the EPS revisions that have followed, which now show an EPS estimate of $4.69 for the fiscal period ending January 2027. A new fair value for NVDA stock based on these revisions is $140.70 in the fiscal period ending January 2027, indicating a fair value price growth of nearly 20% from the present stock price of $117.40.

It is essential for investors to realize and remember that Nvidia’s 5-year averages in growth rates and valuation multiples are distorted by the extraordinarily high growth it experienced in 2023 and 2024. As a result of this, I think the contraction toward fair value will be much more stark than a simple reversion to 5-year averages in valuation multiples.

| Company | Nvidia | Amazon (AMZN) | Meta (META) |

| TTM PE non-GAAP ratio | 53.2 | 41.2 | 26.5 |

| 2025 Normalized EPS Growth Rate | 38.9% | 22.9% | 14.2% |

| 2026 Normalized EPS Growth Rate | 17.8% | 27.5% | 14.9% |

The above table outlines the concern I mentioned in my pre-earnings analysis in more detail, showing both 2025 and 2026 future earnings estimates alongside current TTM PE non-GAAP ratios. In my opinion, based on this data, Nvidia should be trading at a PE non-GAAP ratio of 30 in a base case in 2026 or 35 in a bull case as a result of better guidance and EPS revisions in the coming quarters. If stronger results are delivered in the fiscal period ending January 2027 by Nvidia, then it could have normalized EPS of $4.90 and trade at a stock price of $171.50 if it has a PE non-GAAP ratio of 35. This indicates a price growth of 46% from the present price of $117.40.

Nvidia Q2 Risk Analysis

It is worth remembering that the above two forecasts are both optimistic and show the returns likely in favorable future conditions for Nvidia and a favorable but tempered reaction from the market in relation to its stock. In reality, there are multiple bear-case outcomes that could cause heavy selling action on Nvidia stock, opening up a potential undervaluation or prolonged bear market.

Based on my outlook from continued coverage of Nvidia, I think the company is positioned for long-term growth, but I also think there is a considerable risk of short-term volatility.

As I mentioned in my pre-earnings analysis, there is a concern that the AI training market could become saturated. As major tech companies complete their initial AI infrastructure buildout, the demand for Nvidia’s high-end chips might taper off, causing a substantial slowdown in growth. There is also the concern that customers double-order Nvidia’s products, and that this over-ordering and expected tapering of AI training needs over the next 18 months could lead to a quick and substantial drop in demand. There’s also the potential reality to grapple with that the AI boom might have a long tail, but not be an enduringly high capex event. This might be a large, one-time flurry of demand for data center expansion that, once close to capacity, will stop expanding so quickly, with companies instead focusing on innovation, iteration, and maintenance to optimize pre-existing AI infrastructures.

Big tech companies like Microsoft (MSFT), Amazon, Alphabet (GOOGL) (GOOG), and Meta are all still showing high demand for Nvidia’s GPUs. However, I believe we are nearing an inflection point. This is especially as it relates to the broader macroeconomy in the West, where company budgets will be questioned more by management as inflation proves more challenging to the average consumer, reducing demand and revenues. I think that during this coming period of stagnation and potential recession, AI spending will not be as aggressive, and the ROI of such data center capex will begin to be scrutinized more closely. Therefore, I think in a bear-case outcome, NVDA stock could suffer in the medium term based on this skeptical spending environment which could manifest.

If the current normalized EPS estimate for the fiscal period ending January 2027 is underperformed, coming in at $4.50, and the stock trades at a P/E non-GAAP ratio of 25 based on bearish macro and AI sentiment, then NVDA would be worth $112.50. This indicates a 4.17% decline from the present stock price of $117.40.

Future Robotics Growth Potential

Nvidia has already been active in the robotics markets, leveraging its expertise in AI and GPU technology to advance the field. For example, it has developed the Nvidia Isaac Sim for robotics simulation and the Jetson series for autonomous machines, meaning it is already a leader in the robotics industry. However, arguably this field is largely still untapped and very nascent, with much more long-term infrastructure demand than initial AI spending, as it requires constant hardware manufacturing as robotics are real-world products.

Nvidia is actively working on humanoid robots. These would revolutionize manufacturing, warehousing, and customer service, so it is strategically positioned to capitalize on the coming robotics demand scale similarly to its strategic position at the advent of the AI boom. Nvidia’s robotics roadmap also includes a general-purpose foundation model for humanoid robots designed to integrate robotics and AI, called Project GR00T, which enables robotics to understand natural language and mimic human movements.

However, according to Fortune Business Insights, the global AI market was valued at approximately $515.31B in 2023 and is projected to grow to $2,740.50B by 2032; this indicates a CAGR of 20.4%. However, Benchmark International valued the global robotics market at $46B in 2023 and forecasts that it will grow at a CAGR of 15.1%, reaching approximately $169.8B by 2032.

Therefore, growth expectations have to be put into context here, as the robotics market is much smaller than the AI market. That being addressed, this is still a big revenue opportunity for Nvidia. It could act as a significant, even if much smaller, golden period of growth for the company in the future as robotics and automation trends begin to scale. Furthermore, the robotics market CAGR might estimate increase significantly as new, currently undervalued catalysts create more demand for intelligent, automated machinery and humanoid robots. For example, Tesla’s (TSLA) mass-scale release of Optimus in the future could be a bullish moment for Nvidia. That is, if it positions itself as one of the core chip providers and if Tesla collaborates with Nvidia on robot training and infrastructure for Optimus development.

Conclusion

In my opinion, Nvidia Corporation is in a precarious moment, where its stock price could go either way, but it most likely will continue to deliver growth, albeit only moderately compared to recent years. Personally, I consider the valuation risk to be too high to initiate a position right now, and I believe the company’s golden years of extraordinary AI-driven growth rates in 2023 and 2024 are now coming to an end.

That being said, the company is likely to remain agile, and there could be further periods of high growth in the future based on being in the right place and the right time again. This could be related to robotics, but as this outcome is still somewhat speculative at this time, my rating for Nvidia Corporation stock is still a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.