Summary:

- PFE’s bullish support has already been observed at the $25s, with the worst seemingly well behind us.

- Its core portfolio continues to generate robust growth at +14% YoY in FQ2’24 (excluding Comirnaty and Paxlovid), with Seagen’s therapies already at $2.92B in annualized revenues.

- FY2025 is likely to bring forth an improved YoY comparison as well, with PFE’s 3Y cost optimization program expected to boost their gross/ operating margins to pre-pandemic levels.

- However, the management has seemingly leaned into debt to finance its hefty annualized dividend obligations, given the lower Free Cash Flow generation over the LTM.

- Therefore, while we remain optimistic about PFE’s intermediate-term prospects, readers may want to temper their near-term expectations, since H2’24 may bring forth further deterioration in the balance sheet.

Martin Barraud

PFE’s Investment Thesis Has Bottomed Here

We previously covered Pfizer (NYSE:PFE) (NEOE:PFE:CA) in May 2024, discussing the safety of its dividends/ payout growth as reiterated by the management, with it contributing to the stock’s bullish support at the YTD bottom around the $25s.

With the market pricing in improved Free Cash Flow generation from 2025 onwards, the pharmaceutical company’s dividend investment thesis appeared to be compelling indeed, with the rich yields and recently raised payouts warranting an upgrade to an opportunistic Buy rating.

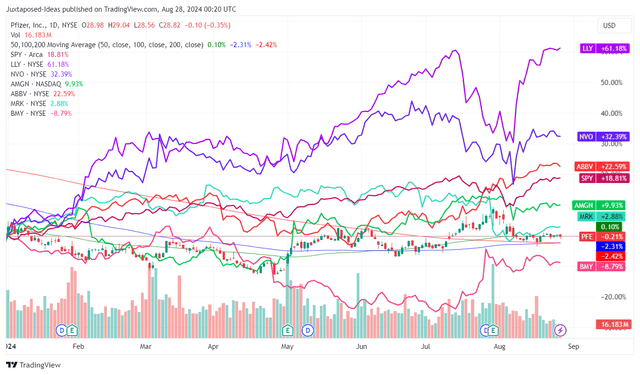

PFE YTD Stock Price

Since then, PFE has offered a +3.6% total return (including dividends), not too far from the wider market at +7.5%. Otherwise, a relatively flat YTD stock price performance compared to the wider market and its pharmaceutical peers, with it signaling that the worst may already be over.

This is significantly aided by the double beat FQ2’24 performance, with total revenues of $13.28B (-10.6% QoQ/ +2.1% YoY) and adj EPS of $0.60 (-26.8% QoQ/ -10.4% YoY) – thanks to the core portfolio’s robust sales growth at +11% YoY in FQ1’24 and +14% YoY in FQ2’24 (excluding Comirnaty and Paxlovid).

The Seagen acquisition has brought forth decent results as well, with the four therapies reporting $2.92B in annualized revenues by the latest quarter and the potential for further monetization, based on:

- ADCETRIS for the treatment of relapsed/ refractory Hodgkin lymphoma, with the projected market size of $17.5B by 2030,

- PADCEV for the treatment of advanced or metastatic urothelial cancer, with the projected market size of $4.7B by 2030,

- TIVDAK for the treatment of cervical cancer, with the projected market size of $9.3B by 2030,

- TUKYSA for the treatment of HER2 breast cancer, with the projected market size of $24.7B by 2030.

As a result, readers may want to pay attention to PFE’s execution over the next few quarters, with the management already reporting that PADCEV “is rapidly progressing toward becoming the standard of care for patients with frontline locally advanced or metastatic urothelial cancer,” with it potentially triggering the acceleration in its topline growth prospects.

At the same time, the pharmaceutical company’s two top-line drivers on the existing portfolio, Vyndaqel family, continues to generate excellent sales growth to $1.32B (+16.8% QoQ/ +69.1% YoY) along with Eliquis at $1.87B (-8.3% QoQ/ +6.2% YoY) by the latest quarter.

FY2025 is likely to bring forth an improved YoY comparison as well, thanks to PFE’s 3Y cost optimization program – which is expected to boost their gross/ operating margins to mid-70% and mid-20% (nearer to pre-pandemic levels), compared to the 60% and 6% reported over the LTM, respectively.

This is on top of the company’s promising pipeline of 113 therapies, with 33 candidates already in Phase 3 clinical trials and the management advancing their GLP-1 therapy (obesity/ type-2 diabetes) – once-daily Danuglipron with improved formulation to the next stage of dose optimization studies.

This builds upon Danuglipron twice-daily’s promising Phase 2B results, with the therapy resulting in an average of -7.25% in weight loss by week 26 and -10.5% by week 32, with the “modified release formulation expected to improve the tolerability profile and optimize both study design and execution.”

Lastly, with PFE already recording adj EPS of $1.42 in H1’24 (-25.2% YoY), we believe that the management’s raised FY2024 adj EPS guidance of between $2.45 and $2.65 (+38.5% YoY at the midpoint) is on the conservative side indeed, with another beat and raise likely in the FQ3’24 earnings call.

This is especially since its FQ1’24 bottom-line includes a +$0.11 per share favorable impact from the Paxlovid courses returned by the US government and FQ2’24 includes a -$0.18 per share impact from the manufacturing optimization program, with it implying the pharmaceutical company’s more than decent core portfolio.

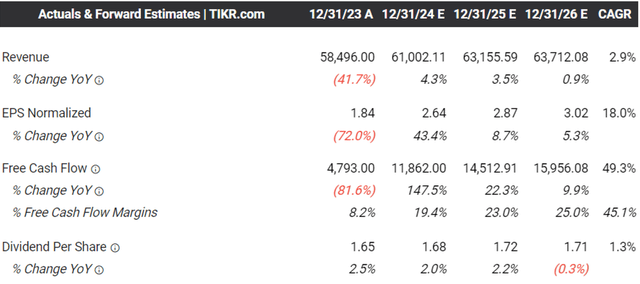

The Consensus Forward Estimates

Thanks to the raised FY2024 guidance and robust core portfolio performance in H1’24, it is unsurprising that the consensus have raised their forward estimates, with PFE expected to generate an improved bottom-line growth at a CAGR of +18% through FY2026.

This is compared to the original estimates of +16.1%, with it implying that the market has conviction about the pharmaceutical company’s ability to weather the near-term patent cliff in our opinion, largely thanks to the management’s ongoing cost realignment initiatives.

Even so, readers must note that PFE’s net-debt-to-EBITDA ratio remains elevated at 3.34x in FQ2’24, compared to the 2.25x reported in FQ1’24, 1.20x in FQ2’23, and 2.86x in FQ4’19.

The management has also seemingly leaned into debt to finance its hefty annualized dividend obligations of $9.52B, compared to the lower estimated Free Cash Flow generation at $4.8B.

Therefore, while we remain optimistic about PFE’s intermediate-term prospects, based on the consensus projected FY2025 FCF generation of $11.86B, readers may want to temper their near-term expectations, since H2’24 may bring forth a further deterioration in the balance sheet.

Things may get much worse before eventually getting better.

So, Is PFE Stock A Buy, Sell, Or Hold?

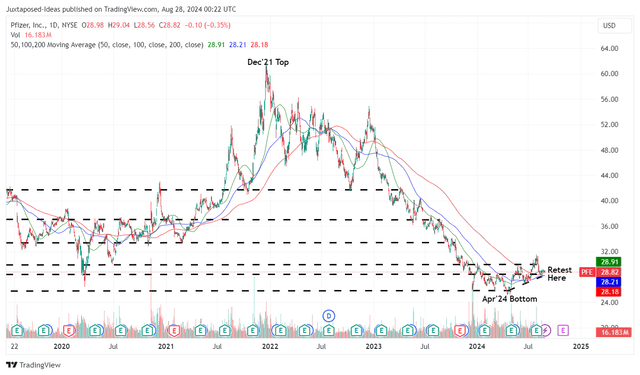

PFE 5Y Stock Price

For now, PFE has consistently charted higher highs and higher lows since the April 2024 bottom, with the bullish support highly encouraging after the massive -51% correction from the December 2021 top.

Based on the consensus’ raised FY2026 adj EPS estimates from $2.87 to $3.02 and the 1Y P/E mean of ~12x, we are looking at an updated long-term price target from $34.40 to $36.20. This is on top of the raised bull-case price target from $43 to $45, in the event of a future upward re-rating closer to its peers’ P/E of 15x.

Investors will also be rewarded during PFE’s ongoing reversal with a relatively rich forward dividend yields of 5.82%, based on the last declared quarterly dividends of $0.42 per share and the stock price of $28.82 at the time of writing.

With the US Treasury Yields already declining to a range of 3.65% and 5.1% and the Fed expected to commence on a 25 basis point rate cut in the upcoming FOMC meeting in September 2024, we believe that dividend oriented investors may continue to add here indeed.

As a result of the dual return prospects through capital appreciation and dividend incomes, we are reiterating our Buy rating for the PFE stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.