Summary:

- PayPal’s Q2 results demonstrated the company’s financial strength: revenues continue to grow at a healthy pace and margins remain strong despite the less profitable success of Braintree.

- Strategic initiatives to drive branded checkout, combined with digital advertising capabilities, will support revenues and margins going forward.

- Expanding partnerships partially mitigates the risk of digital payment competition. From a financial perspective, the strategy is working well.

- Solid FCF conversion allows the company to execute the buyback program. Yields are very attractive: around 8% in FY2024 and 11% in FY2025.

- We’revery bullish on PayPal as its strategic initiatives continue to drive growthand the valuation remains cheap.

JasonDoiy

Investment Thesis

PayPal (NASDAQ:PYPL) is well-positioned for growth, driven by strong revenue performance and operational efficiencies. The company’s strategic focus on optimizing customer engagement and transaction volume, rather than aggressive market expansion, has resulted in higher lifetime value per customer. Additionally, PayPal’s commitment to share repurchases, backed by robust free cash flow projections, enhances shareholder value. While competition remains a concern, PayPal’s collaborations with key players like Apple and Adyen, coupled with its stable market share in the PC payment niche, provide a solid foundation for continued success.

Introduction

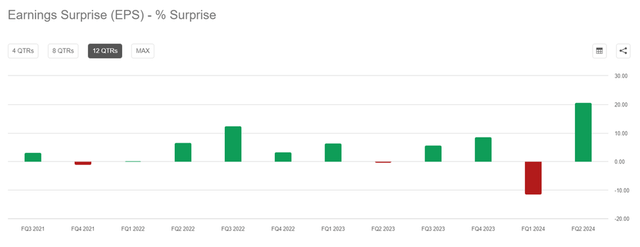

PayPal’s recent Q2 earnings report highlights the company’s robust financial health. Revenue grew by 8.2% year-over-year to $7.89 billion, and total payment volume increased by 10.7% y/y. PayPal continues to demonstrate its ability to drive consistent growth. Despite competitive pressures and the rising influence of less profitable segments like Braintree, the company has managed to maintain strong margins, with adjusted EBITDA surging by 19.3%. PayPal’s strategic focus on branded checkout and expanding partnerships, coupled with a solid free cash flow that supports an aggressive buyback program, is an indication of decent business performance. We see that the strategy proposed in 2022 is working fine: sales growth rate remain healthy, and the margins are stable. At the same time, strategic initiatives, such as PPCP and Fastlane development, create long-distance prospects.

In-depth look at the Q2 financials, forecasts slightly reiterated

We’ve been covering PayPal in Seeking Alpha since 2022. Our previous article can be found here. Q2 results were generally in line with our expectations, as PayPal continues to demonstrate strength due to operating optimization and stable customer activity growth.

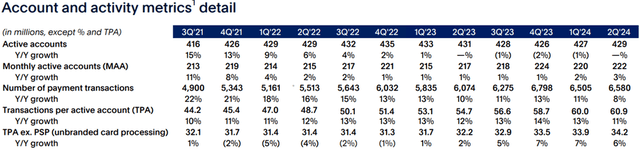

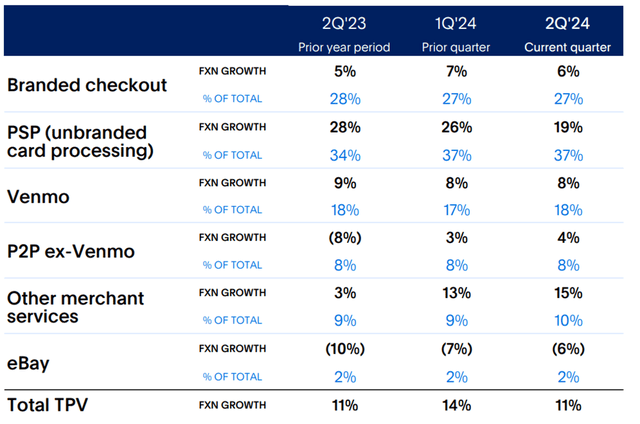

- Revenue totaled $7 885 mln (+8.2% y/y). Total payment volume totaled $416 814 mln (+10.7% y/y) and the total take-rate was 1.72% (-0.03% y/y). Decline in take-rate continues due to exceeding growth of unbranded checkout (Venmo, Braintree) volumes.

- Adjusted EBITDA totaled $1 701 mln (+19.3% y/y). Though the company doesn’t disclose its headcount numbers, operations & support expenses decreased to $436 mln (-11% y/y). It is likely that PayPal will cut customer support, optimizing the bottom-line structure, so the margins remain increasing even despite the exceeding growth of less profitable business segments.

- Free cash flow totaled $1 368 mln. Management raised the guidance for free cash flow in 2024 from $5 bln to $6 bln (We expect $6 bln). It is planned to direct all FCF toward repurchasing shares. Annualized buyback yield will total ~ 8.1%.

PayPal is executing on its plans to reaccelerate business growth, as average revenue per user and account engagement continue to rise at a fast pace. In the second quarter, PayPal delivered growth in the number of active users for the first time since 2022, with the metric expanding by 2 mln to 429 mln (+0.5% q/q).

The average number of transactions per active account was 60.9 (+11% y/y) and the average size of a transaction was $63.3 (+2.2% y/y). Importantly, due to the initiative to move merchants to the parent platform, the dilution of the payment structure slowed down and the income of the transaction segment came to $3 608 mln (+8% y/y).

The payment processing rate, or take rate, averaged 1.72% of TPV (-0.03% y/y). The faster development of third-party networks (Venmo, Braintree) continues to weigh on the take rate, but management said it keeps working on Braintree’s pricing, so we believe that transaction processing margins, while still being squeezed, will return to moderate growth as early as 2025 as merchant agreements are renegotiated.

The most important aspect that management discussed at the conference call was competition. For the past few months, the market has been wary of increased competition from Apple and other payment service providers, but the growth of PayPal’s total payments volume remains healthy. Moreover, PayPal’s market share in the PC payment niche remained unchanged, and the service continues to be the most popular payment method for online shoppers that use their PCs and laptops.

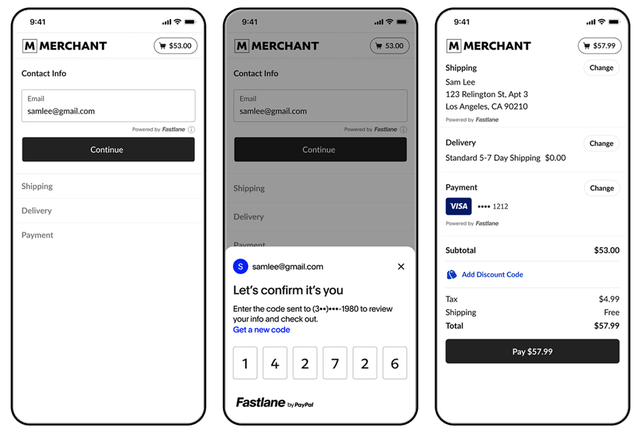

PayPal’s new product, Fastlane, (which logs people into their accounts by texting them codes) makes checkout easier when using mobile devices, but we don’t expect the rollout of the service to help bring in new customers.

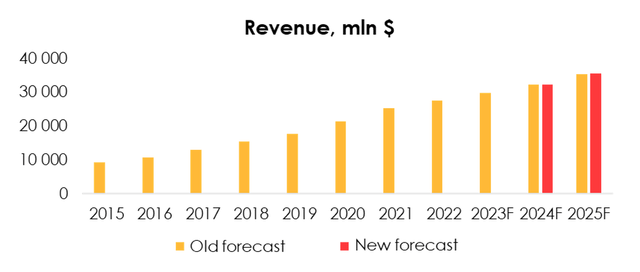

After minor adjustments related to the development of the Fastlane and PPCP offerings, we have changed the revenue forecast in FY2024 to $32 268 mln (+8.4% y/y) and in FY2025 to $35 507 mln (+10.0% y/y).

Company data, Invest Heroes calculations

On the expenses side, PayPal’s costs dynamics were also in line with our expectations, and we only adjusted them taking into account these factors:

- The company continued to cut support staff in the second quarter, which has a positive effect on margins.

- Advertising spend declined for the 6th straight quarter, but amid the rollout of PayPal’s Fastlane service, management expects a sharp rebound in the marketing budget in 2H 2024.

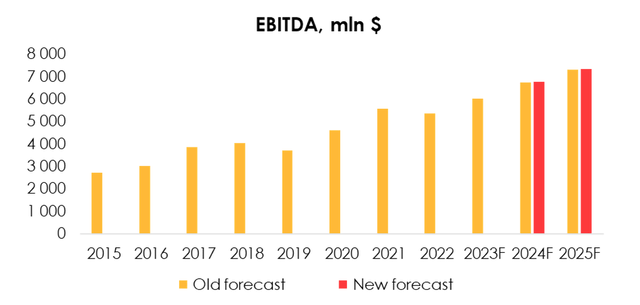

As such, we set the EBITDA forecast for 2024 at $6 765 mln (+12.4% y/y) and for 2025 at $7 353 mln (+8.0% y/y).

Company data, Invest Heroes calculations

The company’s management raised the guidance for free cash flow in 2024 from $5 bln to $6 bln (we forecast $6 077 mln). All of the FCF earned in 2024 is set to be directed toward share repurchasing. That amount would be equivalent to 8.1% of the company’s capitalization. We assume that, while the stock is cheap, the company will continue to buy back its shares from the market, with the spending on the repurchase potentially reaching as much as $8 bln (11% of the current market capitalization) in 2025.

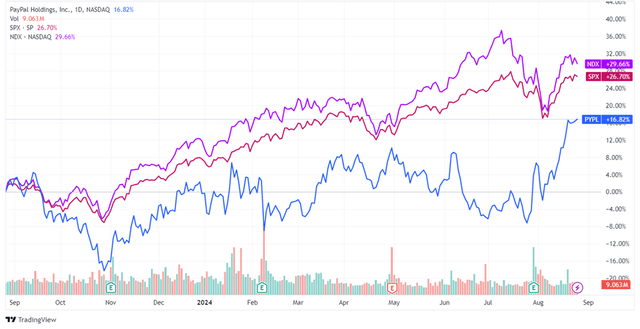

Why the stock was underperforming and why we think the fears are hyperbolic

PayPal has underperformed the market for quite some time due to negative information background. Though financials have been growing at healthy rates, delivering revenue & EPS beats for many consecutive quarters, the narrative has been largely negative.

The main reasons why investors avoided the stock were:

Competition. It was often mentioned in various analyst reports (example: Reuters) and news articles that the main competitor is Apple with its new Apple Pay features. However, there are several factors why we believe the fears are overblown:

- PayPal’s strategy isn’t about aggressive market expansion. It was back in 2022 when the management said that loyal customer activity was the main focus, and the strategy is working perfectly. If we look at Q2 2022 operating metrics, there were 429 mln active customers, about 5 513 mln payment transactions and $339 719 mln of total payment volume. Then, in Q2 2024 there were still only 429 mln active accounts, but the payment transactions number grew to 6 580 mln and the TPV – to $416 814 mln. Basically, the LTV of an average PayPal customer increased by 23%, far outpacing inflation rates.

- PayPal isn’t burning cash trying to compete with digital payments upstarts. Rather than fueling rivalry, the company prefers to collaborate. It’s better to make a dollar on a cross-transaction than to spend a hundred on the possibility of making two dollars sometime in the future. Cooperation already includes Apple Pay, Payoneer, Mastercard and many other companies. Recently, PayPal agreed to expand its partnership with Adyen, which will provide additional momentum for branded checkout.

- Although there is serious competition in mobile payments, PayPal’s management mentioned that they don’t see the market share deteriorating in the PC segment.

Margins. This was another controversial issue, as the outpacing growth of unbranded checkout put pressure on margins.

- In general, that’s a fair point. PayPal now spends about 50% of revenue on the transaction expense, which is 1.4% higher than a year ago and 5.2% higher than 2 years ago. But if you look at margins in general – it’s not that bad because there’s a lot of room to optimize. EBITDA margins in Q2 2024 were 21.6%, which is 200 bps higher than in 2023 and 410 bps higher than in 2022. There has been significant improvement in the loan portfolio (now transaction and credit losses are only 4.25% of revenue, 121 bps lower than a year ago and 233 bps lower than two years ago), as well as marketing and customer support expenses. Overall, there’s no decline in profitability.

- PayPal is now targeting its branded payment systems. The latest partnership expansion with Ayden is all about Fastlane and branded checkout. PPCP will also aim to encourage SMBs to move from Braintree to PayPal. We already see that the dilution of branded checkout has slowed, and it is likely that this trend will continue to strengthen in the future.

- Entering the digital advertising market with new AI features, as mentioned in Q1 2024, would likely have a serious impact on the company’s revenues. Although it is not yet clear how the new feature will be implemented, on a qualitative level, PayPal seems to be a big winner: the company has a lot of internal shopping data from its customers, so creating individual recommendations will be an easy task. This will both increase customer activity and create an additional revenue stream from the merchants.

Overall, we see that management is doing a good job in terms of maintaining market share and margins.

Risks and Challenges

While PayPal’s strong performance and strategic initiatives present a compelling investment case, there are notable risks that investors should consider:

- Intensifying Competition: The digital payments industry is highly competitive, with significant players like Apple, Square, and traditional financial institutions ramping up their efforts. Apple’s expanding presence with Apple Pay, in particular, poses a threat to PayPal’s market share, especially in the mobile payments segment. Although PayPal has maintained its dominance in the PC payment niche, increased competition could erode its market position over time. We believe that the risk is mostly mitigated by the collaboration efforts, and the risk-premiums are already attractive enough.

- Margin Pressure from Unbranded Checkout: We believe that management’s efforts to encourage merchants to use Branded Checkout (Fastlane, PPCP) will support the TPV structure and margins, but there’s still a risk that profitability could decline in the future, especially as the impact of cost reductions fade.

- Dependence on Strategic Partnerships: PayPal’s strategy relies heavily on partnerships with other payment service providers and technology companies. Any disruption or changes in these relationships, such as a shift in priorities or technological compatibility issues, could negatively impact PayPal’s ability to grow or maintain its market share.

- Regulatory and Legal Risks: As a global payments provider, PayPal is subject to a complex web of regulations across different jurisdictions. Changes in regulatory frameworks, data privacy laws, or financial transaction standards could impose additional costs or limit the company’s operational flexibility. Moreover, any legal disputes or fines related to compliance issues could harm PayPal’s reputation and financial standing.

- Economic Uncertainty: PayPal’s performance is tied to consumer spending and global economic conditions. Economic downturns, fluctuations in currency exchange rates, or changes in consumer behavior could adversely affect the company’s transaction volumes and overall revenue growth. Additionally, PayPal’s exposure to international markets increases its vulnerability to geopolitical risks and regional economic instability.

While PayPal’s management is actively addressing these risks through strategic initiatives and operational efficiencies, investors should remain cautious and monitor these challenges closely.

Valuation

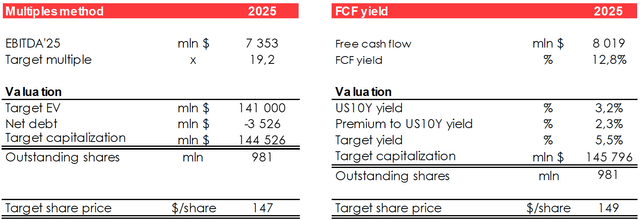

We’re evaluating PYPL target share price based on 2025 EV/EBITDA multiple and FCF Yield method, both discounted at 13% per annum, which is a long-term view on the broad market yields.

The discount rate of 13% is the average growth of the S&P 500 Index over the past 20 years. In other words, when we value a company based on its long-term results, it is important to us that the company’s growth exceeds the average growth of the index.

We set the target price of the shares on $139/share due to:

- upward revision of the forecast for adjusted EBITDA in 2024-2025;

- shift in FTM estimate.

Based on the new assumptions, we are maintaining the rating for the company at BUY.

Conclusion

PayPal’s ability to maintain revenue growth and optimize its operational structure highlights its resilience in a competitive market. The company’s focus on enhancing customer engagement and leveraging strategic partnerships positions it well for sustained performance. With strong free cash flow supporting shareholder returns through buybacks, PayPal is set to deliver value even as it navigates challenges from competitors. Overall, PayPal’s balanced approach between growth and profitability makes it a compelling investment opportunity.

To manage the position, we recommend keeping an eye on financial statements of PayPal and its competitors (Visa, MasterCard, Affirm, Square) industry research (McKinsey, Capgemini, Worldpayglobal).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.