Summary:

- Tesla is repositioning as an AI company with a focus on robotaxis, which is considered a potential revenue driver but faces significant competition and high upfront costs.

- Ark Invest predicts Tesla’s share price could reach $2600 by 2030, attributing 90% of its Enterprise Value to the robotaxi business.

- Tesla’s full self-drive technology is accumulating data faster than competitors, but the company must overcome financial and competitive hurdles to dominate the robotaxi market.

- While Tesla’s potential in the robotaxi market is promising, investors should temper expectations due to competition from Amazon’s Zoox and Alphabet’s Waymo.

Julia Garan/iStock via Getty Images

Thesis Summary

Tesla, Inc. (NASDAQ:TSLA) has fallen out of grace with investors over the last year. The stock price has come down over 12% as Tesla’s electric vehicle (“EV”) sales and margins have struggled.

This has led CEO Elon Musk to reposition Tesla as an artificial intelligence (“AI”) company, with his biggest gambit now being a robotaxi fleet, facilitated by Tesla’s FSD technology.

While the robotaxi market could potentially be a great source of revenue, Tesla faces stiff competition. Tesla excels in some aspects, like its full self-drive (“FSD”) technology, but may lack the deep pockets and infrastructure needed to execute.

Cathie Wood, the CEO of Ark Invest, a tech-centered fund, who has been bullish on Tesla for a long time, believes the stock could increase by over 10-fold in the next five years, with robotaxi revenues being the main reason why.

Employees recently reiterated their belief that Tesla holds a lead in the robotaxi market, but I don’t fully agree.

Does Tesla really hold an undisputed lead in this nascent market? Is Ark’s price target realistic? If not Tesla, what other company could become the market leader?

In my last article on Tesla, I argued that the bottom in terms of revenue and share price could be in.

I still think Tesla’s shares are a buy, but investors should temper their enthusiasm when it comes to Musk’s robotaxi plans.

It’s an interesting business idea, with the potential to bring in large revenues, but it will require a lot of investment and a lot of effort to beat the competition.

Musk will have a lot to prove on the much anticipated robotaxi day.

Cathie Likes The Stock

It is no secret that ARK is quite bullish on Tesla. The fund, which focuses on disruptive tech, released a report predicting Tesla’s share price could reach $2600 by 2030. This was a pretty in-depth report that is worth analyzing.

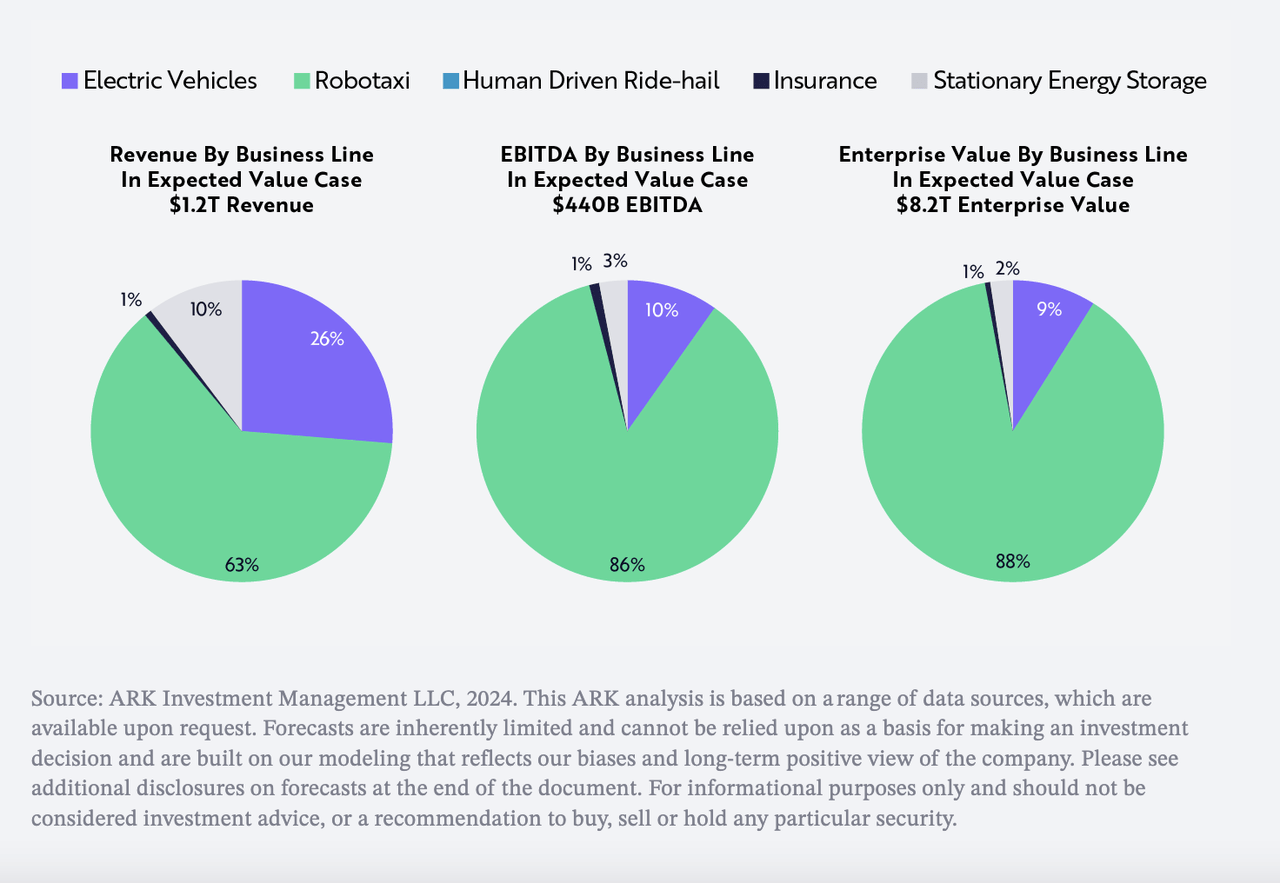

As we can see below, Ark believes close to 90% of the company’s Enterprise Value could be attributed to Tesla’s robotaxi business.

Tesla EV By Segment (ARK Invest)

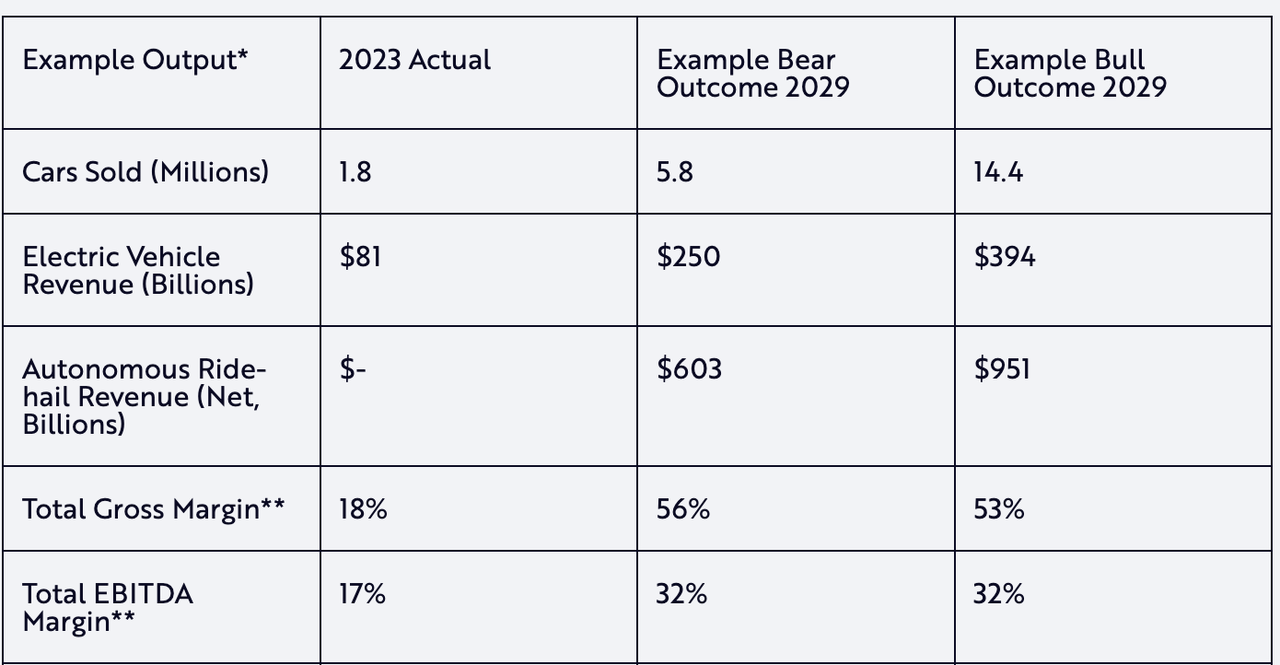

Ark estimates that the company could net over $950 billion in revenues from Autonomous Ride-hail. This is the bull case, to be fair.

Revenue Forecasts (Ark Invest)

To reach such high revenues, Tesla will have to be a very dominant player in the robotaxi market, which Ark also supports in their report with some interesting data.

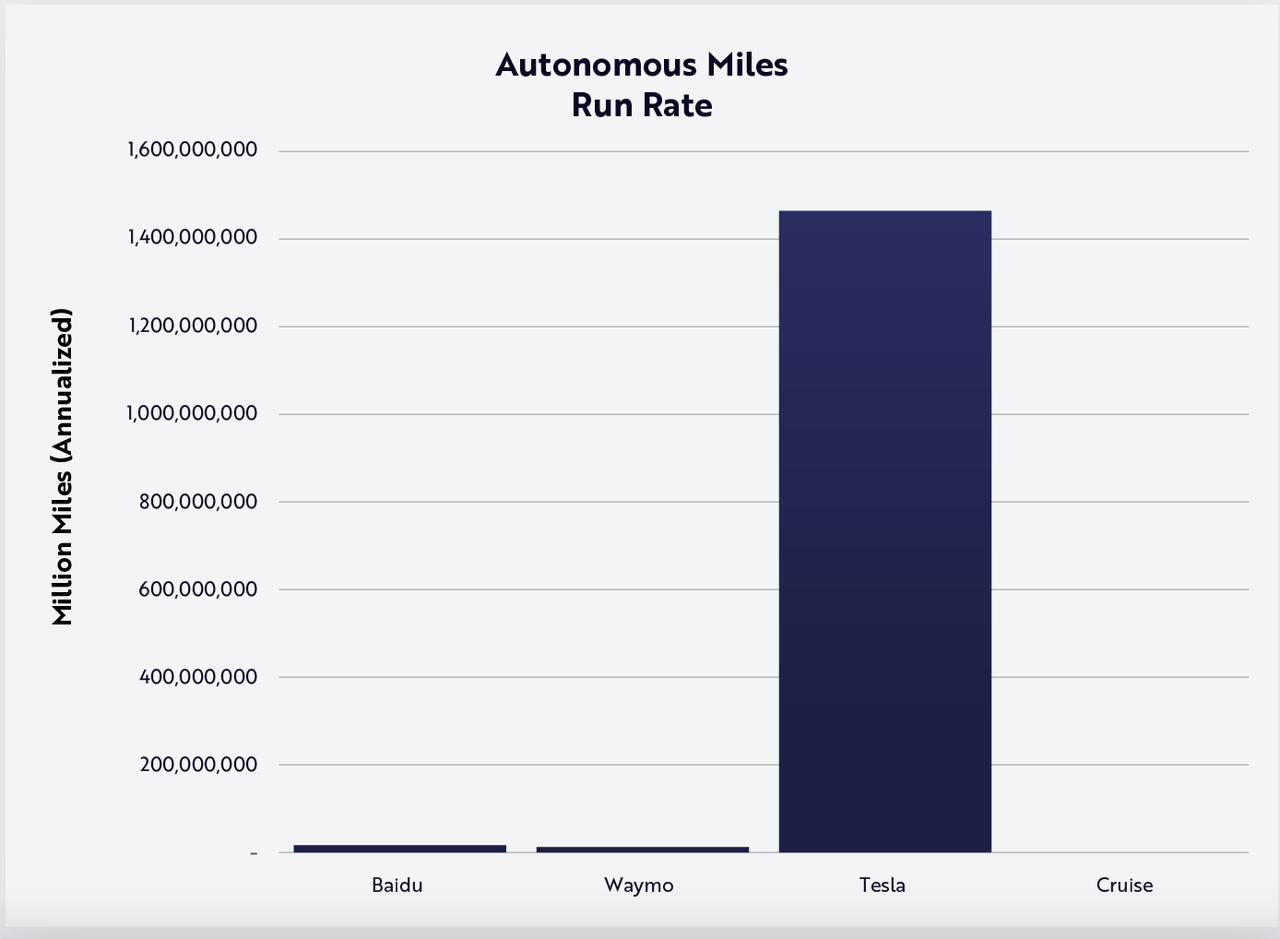

Autonomous Miles Run Rate (ARK Invest)

According to Ark, Tesla’s FSD is accumulating data 110x faster than Waymo, thanks to the latest developments in its FSD.

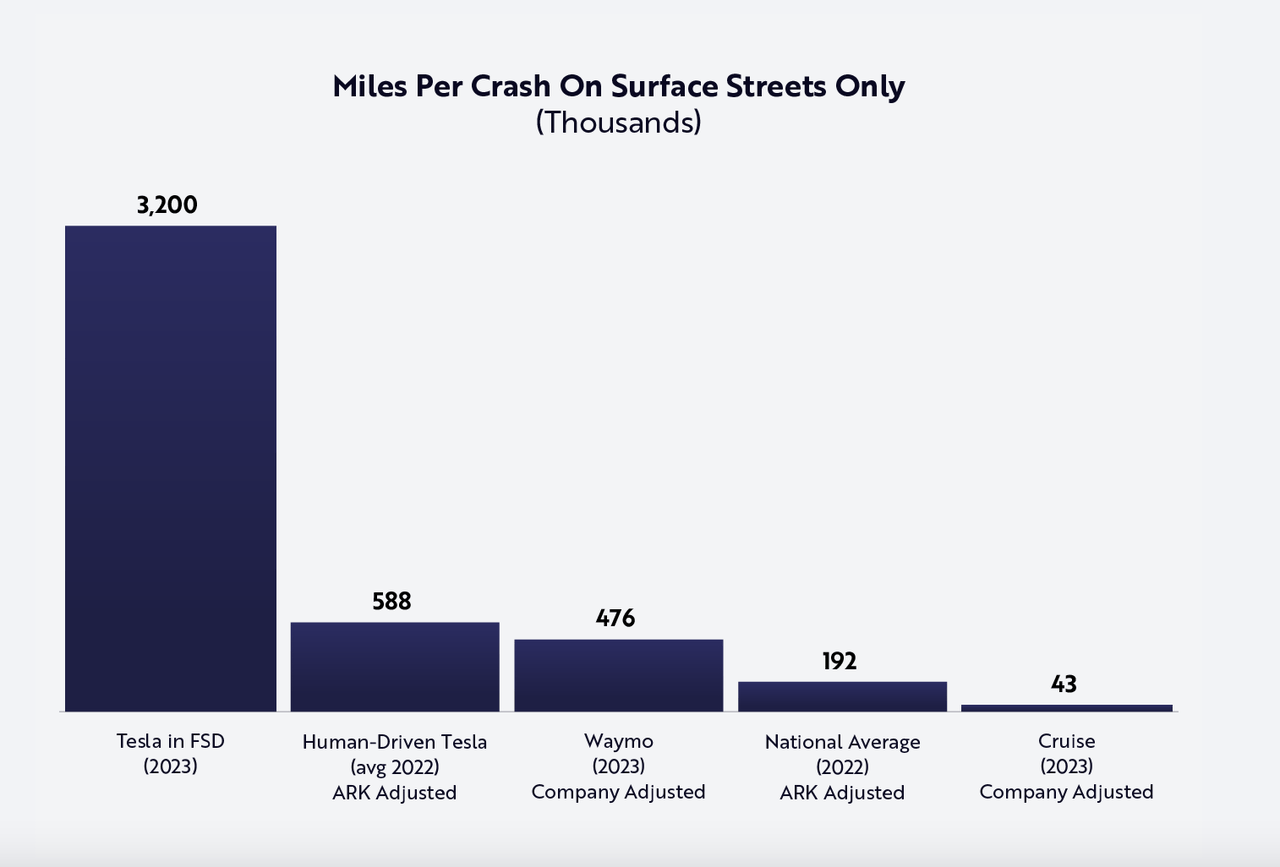

More interestingly, though, Ark also shows that Tesla’s FSD is actually superior to human driving and Alphabet’s (GOOG) Waymo by comparing miles per crash.

Miles per crash (ARK Invest)

Of course, this doesn’t necessarily consider the nature of each crash, but it’s definitely an intriguing point.

In a recent interview, Ark employees doubled down on their assessment that Tesla will be a robotaxi leader.

As will be the case with most AI (artificial intelligence) projects, Tesla’s data scale advantage is likely to lead to commercial dominance in this winner-takes-most opportunity,

Source: Seeking Alpha.

There are three key takeaways from this report that we must analyze more closely:

-

Tesla can generate almost a trillion dollars from robotaxis by 2029.

-

Tesla can launch robotaxi service in the next year.

-

Tesla can become the undisputed leader in the robotaxi market.

2 Truths And A Lie

Now, let’s assess whether Ark’s claims here actually make sense.

In terms of the total addressable market (“TAM”) and potential revenues, Ark says that in its bullish scenario, Tesla could make $951 million.

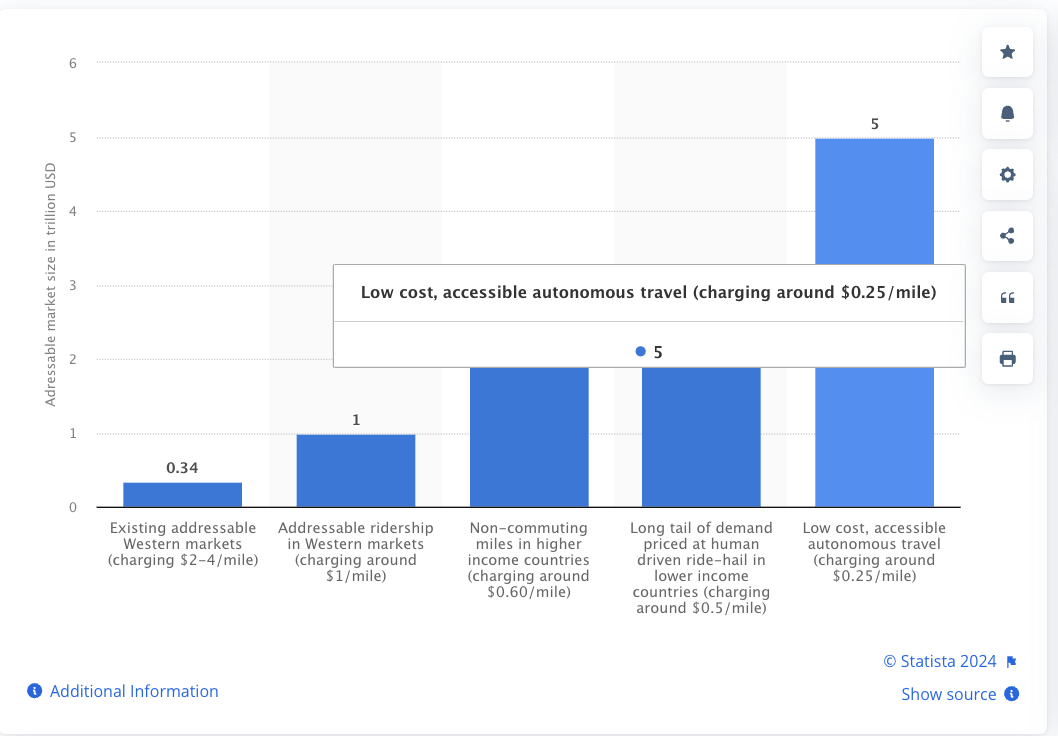

Hail ride TAM (Statista)

According to Statista, autonomous travel could add up to a $5 trillion market, assuming a cost per mile of $0.25.

Hypothetically, this would imply Tesla can capture around ⅕ of the TAM. That’s not necessarily a crazy assumption, as there are actually not that many serious contenders right now. While bold, it seems possible that Tesla could capture those revenues.

Addressing the second issue, I also agree with Ark that Tesla can probably launch a robotaxi service within the next year. Tesla’s robotaxi event is currently scheduled for October 10th, and we will get to see an early prototype.

Now, this is not to say Tesla will have a fully-fledged robotaxi business going on, or even that it will produce any meaningful revenue, but I think an early form of the service will be available.

This isn’t probably what Ark means, but we can give them the benefit of the doubt here, and say that they are right.

However, my biggest issue comes with the assumption that Tesla will dominate the market. This claim is based on the idea that Tesla has the best technology, which we could dispute.

However, it also overlooks other significant hurdles to actually launching and making a robotaxi business viable.

Tesla’s Lead Is Questionable

While Tesla’s FSD could arguably be the best, that does not mean Tesla is the best company out there.

Upfront Costs

Building out a fleet of robotaxis would require substantial up-front costs, and this is something that Tesla can’t actually afford right now.

Even if the addressable market for hail-riding is $5 trillion, to capture it, Tesla would have to actually deploy a massive fleet of robotaxis.

Uber rides 2023 (Backlinko)

In 2023, Uber (UBER) carried out around 9 billion trips. Assuming an average full-time autonomous car could carry out maybe 50 trips a day, which would mean more or less a trip every 30 minutes, that would equate to 18,250 trips per year/car.

This means Tesla would need a fleet of almost 500,000 cars to carry out Uber’s 9 billion trips. And this is only to meet the demand today. The real number would be much higher to reach Ark’s lofty goals.

Tesla has the capacity to make over 1 million cars per year, and it is estimated that it can do so at a cost of around $30,000.

To build out a fleet of, say, 1 million cars, Tesla would have to invest $30 billion.

That’s just about all of its cash position currently, and of course, it would mean not selling any new cars.

Of course, in reality, Tesla would roll this out more slowly, but the point is that it would likely come at an enormous expense, and Tesla will likely have to raise more cash to make this happen

However, it is true that eventually, Tesla does have an advantage in terms of actually having quite a low production cost.

Very Serious Competition

Nonetheless, Tesla faces significant competition from tech giants with deeper pockets and a head start in the business; Amazon’s (AMZN) Zoox and Alphabet’s Waymo.

While Tesla has delayed its Robotaxi event to October 10th, we are seeing these two companies make big moves over the last month.

Waymo launched in Los Angeles last week. Furthermore, the company recently said that it provided 100,000 rides per week in the US, double the figures it published just last May.

Meanwhile, Zoox is operating in California, and eyeing Las Vegas next.

While Tesla’s FSD has arguably accrued more miles, both Amazon and Alphabet have clear advantages over Tesla.

Zoox, for example, boasts a specialized design that actually differentiates it from other car-hailing services. It is, in fact, not really a car.

This allows Amazon to potentially provide a higher value experience and even lower its costs.

Meanwhile, Alphabet has a great advantage in that it already operates the most popular operating system in the world, and also has Maps. Integrating Waymo into these apps will be seamless.

And, to top things off, Amazon and Google are in another league when it comes to revenues, cash and cash flow generation.

|

GOOGL |

AMZN |

TSLA |

|

|

Revenue |

328.28B |

604.33B |

95.32B |

|

Total Cash |

100.73B |

89.09B |

30.72B |

|

Net Operating Cash Flow |

105.06B |

107.95B |

11.53B |

Source: Seeking Alpha

These companies have much deeper pockets than Tesla, and large amounts of investment will be required to actually make robotaxis viable at scale.

However, it’s also important to highlight that these companies also face their unique challenges. Both Waymo and Zoox are under Federal investigation.

A document posted on the NHTSA website revealed that Waymo is now subject to an Office of Defects Investigation (ODI) following reports of 22 incidents involving vehicles fitted with the company’s automated driving system (ADS) “that potentially violated traffic safety laws.”

Source: iotworldtoday.com

The NHTSA is also looking into AVs operated by Zoox. This highlights how Tesla can actually beat these two companies, by actually providing superior and, most importantly, safer technology. But Tesla’s FSD is also not without fault.

Final Thoughts

The robotaxi industry as a whole is still young and faces significant challenges, specifically when it comes to addressing regulatory concerns.

While I do not entirely disagree with Ark’s analysis, it is definitely overly optimistic and overlooks the very real competition that Tesla will have to deal with.

Superior technology may not be enough, and during Tesla’s robotaxi day, Musk will have to show investors a viable plan to actually get towards a commercially viable robotaxi business.

Ultimately, though, as I’ve highlighted in previous articles, it seems like a lot of the negativity is already baked into Tesla’s price right now. Tesla still has a lot to offer, both in terms of its EVs, and also its potential AI businesses, which include robotaxis and also the Optimus. It won’t be smooth sailing, but I think Tesla is still a buy right now for those investors willing to tolerate some risk.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.