Summary:

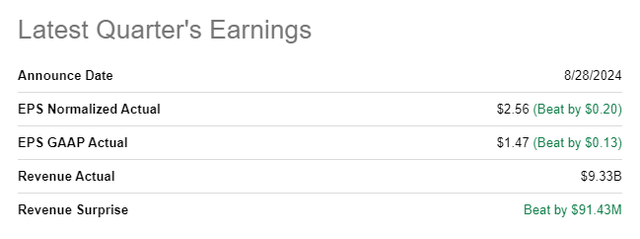

- Salesforce’s Q2 earnings exceeded expectations with $2.56 in EPS and $9.33B in revenue, driven by double-digit top-line growth in core segments.

- The company generated $755M in free cash flow, showing 20% Y/Y growth, and raised its FY 2025 earnings outlook.

- Salesforce’s valuation is attractive with a P/E ratio of less than 24X: it is cheaper than it was in the past and cheaper relative to other software companies.

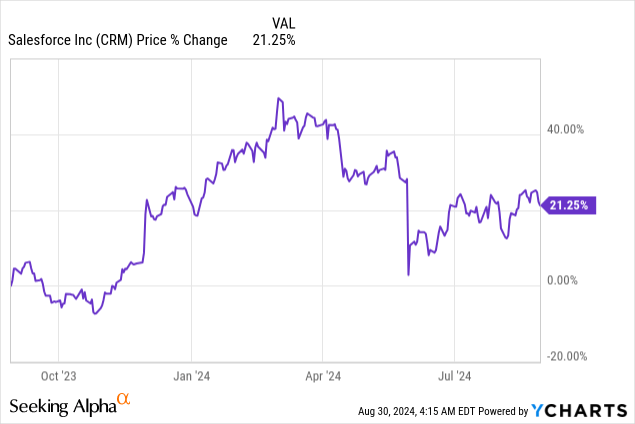

- Salesforce has recouped investment losses sustained after the Q1’25 report and has, with Einstein AI, a potential lever for future revenue acceleration.

JHVEPhoto

Shares of Salesforce (NYSE:CRM) responded positively to the company’s second-quarter earnings sheet that showed both a considerable EPS and top line beat. The software company executed well on its growth strategy and generated a healthy amount of free cash flow from its enterprise customers. The software maker also raised its earnings outlook for FY 2025 and saw solid 20% year-over-year free cash flow growth. In my opinion, the best feature of an investment in Salesforce is the company’s low valuation based off of earnings as well as the company’s push to buy back more shares!

Previous rating

In my last work on the cloud-based software provider in May, I called Salesforce A Golden Buying Opportunity as investors appeared to overreact to the company’s first-quarter earnings report. Investors at the time were disappointed at Salesforce’s revenue guidance for the second-quarter. Salesforce has considerable potential in the market for AI products (automated work flows, chatbots) and the software maker is seeing double-digit top-line growth in its three core segments. With free cash flow also growing rapidly, I believe Salesforce represents attractive value for investors.

Salesforce crushes estimates, solid FCF growth

Salesforce easily beat top and bottom-line expectations for its second fiscal quarter: the software company reported adjusted earnings of $2.56 per share, which beat the average estimate by $0.20 per share. The software company achieved total revenues of $9.33B, beating the average prediction by a solid $91M.

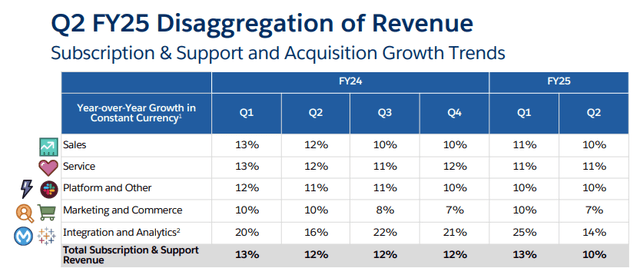

Salesforce had a solid quarter in terms of operational execution and financial results. The CRM application provider generated 10% subscription and support revenue growth in Q2’25 which was driven chiefly by growth in the company’s three core segments: Sales, Service and Integration/Analytics. The latter, Integration & Analytics, has once again seen the fastest growth rate of 14% Y/Y. This segment helps companies get business intelligence insights and has considerable potential long term in terms of the integration of AI capabilities. Integration & Analytics also includes the company’s Mulesoft software, which is an IT automation tool: this service generated 13% year-over-year growth.

The most important metric for Salesforce, in my opinion, is free cash flow… because this metric shows how much money the software company could return to shareholders over time.

Salesforce generated $755M in free cash flow in the second fiscal quarter, showing 20% year-over-year growth. Software companies make their most money in Q1 and Q4, as enterprise clients tent to renew their software licenses at the end of the year. Therefore, free cash flows decline for seasonal reasons during Q2 and Q3, before rebounding again towards the end of the calendar year. Despite the drop-off in free cash flow quarter-over-quarter, Salesforce generated a healthy FCF margin of 8.1% in the second fiscal quarter. On a TTM basis, Salesforce pulled in a stunning $11.5B in free cash flow and earned a margin of 31.4%.

|

$ millions |

FQ2’24 |

FQ3’24 |

FQ4’24 |

FQ1’25 |

FQ2’25 |

Y/Y Growth |

|

Subscription and Support |

$8,006 |

$8,141 |

$8,748 |

$8,585 |

$8,764 |

9.5% |

|

Professional Services |

$597 |

$579 |

$539 |

$548 |

$561 |

-6.0% |

|

Revenues |

$8,603 |

$8,720 |

$9,287 |

$9,133 |

$9,325 |

8.4% |

|

Cash Flow From Operating Activities |

$808 |

$1,532 |

$3,403 |

$6,247 |

$892 |

10.4% |

|

Capital Expenditures |

($180) |

($166) |

($147) |

($163) |

($137) |

-23.9% |

|

Free Cash Flow |

$628 |

$1,366 |

$3,256 |

$6,084 |

$755 |

20.2% |

|

Free Cash Flow Margin |

7.3% |

15.7% |

35.1% |

66.6% |

8.1% |

0.8PP |

(Source: Author)

Salesforce is returning more cash to shareholders as well, which is a reflection of the company announcing a generous $20B stock buyback earlier this year. In Q2’25, the cloud-based software provider repurchased $4.3B of its shares, more than double what it bought back in the year earlier period. I expect Salesforce to spend comparable levels of free cash flow on stock buybacks going forward, and would expect a new buyback authorization next year.

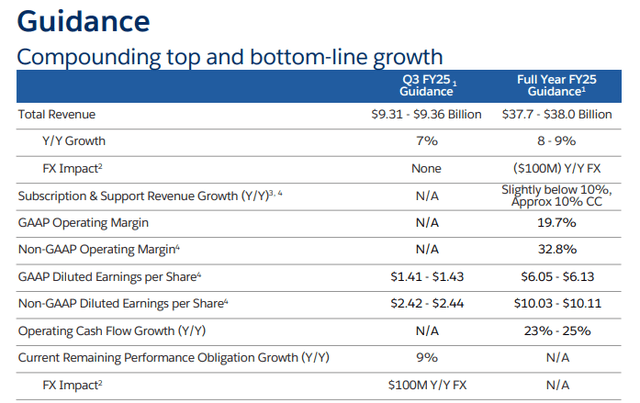

Guidance Raise for FY 2025

Salesforce raised its earnings outlook and confirmed its revenue guidance for FY 2025: the company expects to generate between $37.7B and $38.0B in revenue this year and sees $10.03 – $10.11/share in earnings, compared to $9.86 – $9.94/share previously. At the mid-point, Salesforce raised its guidance by 2%.

Salesforce’s valuation

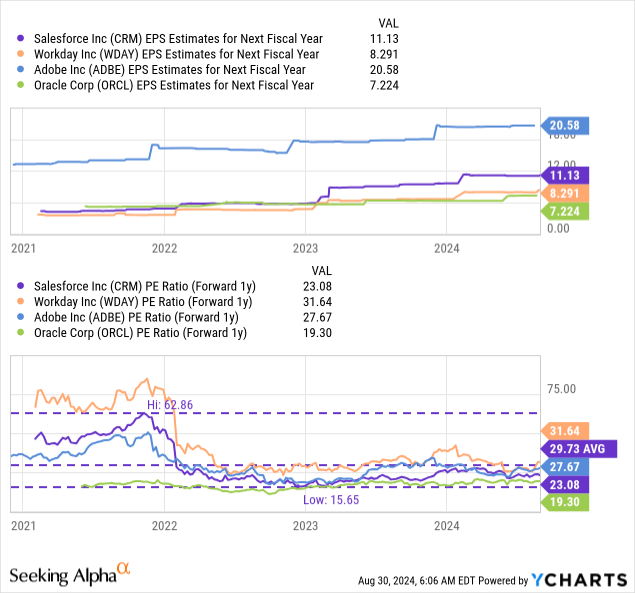

Salesforce’s biggest advantage, in my opinion, is that the software company is priced at a competitive P/E ratio given its growth potential and its large amount of free cash flow. Shares of the software maker are currently valued at a price-to-earnings ratio of 23.1X and continue to trade well below the 5-year average P/E ratio of 29.7X.

Rival software companies include Workday (WDAY), Adobe (ADBE) and Oracle (ORCL) and the industry group average P/E ratio here is 25.4X. This means that shares of Salesforce are currently cheaper, based off of forward earnings, in a historical context and cheaper compared to software rivals. If shares of Salesforce revalued to the longer-term valuation average of 29.7X, then the software maker could have a fair value in the neighborhood of $331 per-share.

Strong capital returns, incremental stock buybacks and continual growth in Integration & Analytics are three key pillars to my investment thesis for Salesforce. Further, Salesforce is working on its own AI software products, dubbed Einstein AI, which I see as a potential revenue growth catalyst. With companies not scaling back AI spending, artificial intelligence, in my opinion, is going to remain an investment and growth driver for large-scale software makers in 2024 and beyond.

Risks with Salesforce

The biggest risk for Salesforce, as I see it, is a potential slowdown in the enterprise market, which is driving top-line growth as well as free cash flows. A decline in enterprise AI spending is also a risk, since Salesforce is driving the roll-out of AI-related products, which promises its customers higher productivity and lower costs. What would change my mind about Salesforce is if its free cash flows declined and management decided to scale back its capital return plans.

Final thoughts

Salesforce’s second-quarter earnings scorecard was better than expected, and the company delivered both a top line and a bottom-line beat while at the same time seeing healthy free cash flow growth. Salesforce has now almost fully recaptured all losses that were inflicted on shareholders after the Q1’24 earnings report, indicating that negative sentiment overhang has been reduced. However, this doesn’t mean shares are expensive: based off of FY 2025 earnings, Salesforce is currently priced at 23.1X P/E ratio, which is lower than the industry group P/E and lower than Salesforce’s historical price-to-earnings ratio. Salesforce has a potential lever for revenue acceleration in its portfolio, Einstein AI, and I continue to expect the cloud-based software company to return a ton of cash flow back to shareholders going forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.