Summary:

- General Motors is an interesting firm that continues to achieve strong sales growth, though market share in some regions is dropping.

- The firm is growing where it matters most for now, and recent profit figures have been impressive.

- Investors need to keep an eye on leverage, but given how cheap the stock is, the firm makes for an attractive prospect.

JHVEPhoto

Back in early April of this year, one company that I rated a ‘buy’ is the iconic firm known as General Motors (NYSE:GM). As one of the largest automotive producers on the planet, it is a true behemoth. And over the past few years, sales of the company have grown while the general trend for profits has been higher. This year is looking to be particularly pleasant, with revenue, profits, and cash flows all expected to rise compared to what they were last year. But this is not to say that everything about the company is great.

So far, the market has agreed with my assessment. Shares of the business are up 8.9% since I last wrote about it. That’s a bit higher than the 7.9% rise seen by the S&P 500 over the same window of time. However, there are some things that investors should be paying attention to. Recently, net leverage of the business has been growing. In addition to this, the company is losing market share in some rather important markets. Management’s decision to slow down electric vehicle adoption could also weigh on results eventually. For all of these problems though, shares still remain attractively priced. And while investors should continue to monitor the weak spots of the business, I do think that enough additional upside is warranted to justify keeping the ‘buy’ rating I had on the stock.

The good and the bad

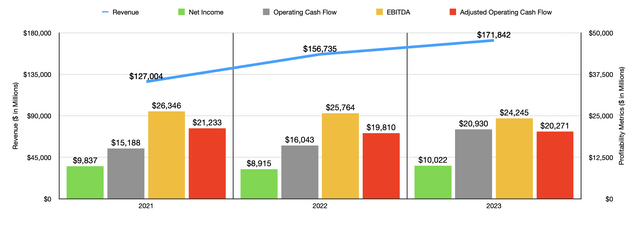

Author – SEC EDGAR Data

Fundamentally speaking, the financial picture achieved by General Motors over the past few years has been mixed. The good news is that revenue has been rising. Back in 2021, sales of the business came in at $127 billion. By 2023, revenue had grown to $171.84 billion. You might think that this increase in revenue has been spurred by a rise in the number of units sold. But that wouldn’t exactly be the case. From 2021 to 2023, the number of vehicles the company sold actually declined from 6.30 million to 6.19 million. However, it’s important to note that not all vehicles are the same.

Using data from 2023, only 41.9% of all vehicles that the company sold were sold in the US. And yet, the US accounted for 81.2% of total revenue. Clearly, the US is the company’s bread and butter. This disparity allowed the firm’s North American operations to benefit to the tune of $24.9 billion from higher volumes from 2021 to 2022, followed by another $8.5 billion from 2022 to 2023. Over the same window of time, the company benefited to the tune of $10.3 billion from higher prices. However, it did suffer from a $4.6 billion decline in product mix as consumers focused more on affordable vehicles. Internationally, the company did see a $2 billion increase associated with higher volume from 2022 to 2023. But this was only after the company took a $0.6 billion hit in the form of lower volume the prior year. Changes in pricing also added $2.6 billion in revenue during this two-year window, while changes in product mix added another $0.5 billion.

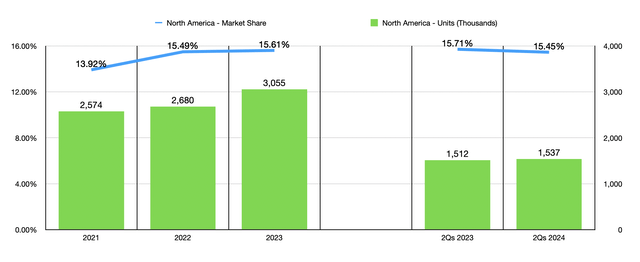

Author – SEC EDGAR Data

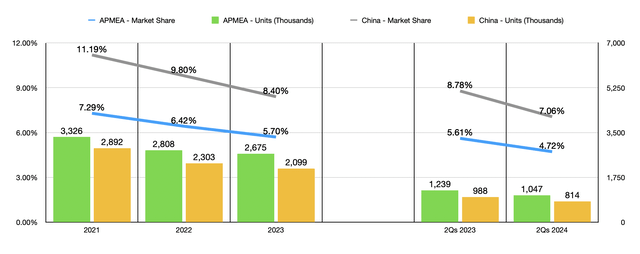

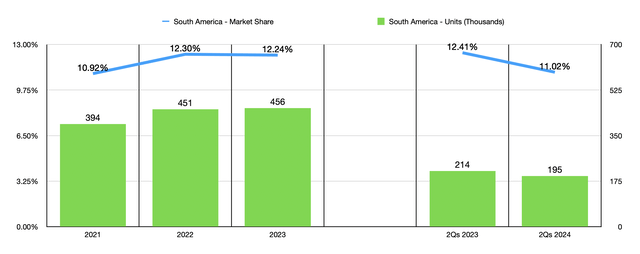

Digging deeper, we see where the firm’s strengths truly lie. In North America, the company went from selling 2.57 million vehicles in 2021 to 3.06 million at the end of 2023. Its market share during this window expanded from 13.92% to 15.61%. Unfortunately, other markets proved to be less successful. In the APMEA (Asia-Pacific, Middle East, and Africa) regions, vehicles sold declined from 3.33 million to 2.68 million. That was led by a substantial drop in the number of vehicles sold in China from 2.80 million to 2.10 million. The only geographic area were things went quite well from a unit count perspective was South America. The company went from selling 394 thousand vehicles in 2021 to selling 456 thousand last year.

Author – SEC EDGAR Data

In these troubled markets, the company’s market share has been declining. In the APMEA regions, it dropped from 7.29% to 5.70%. And in South America, we did see an increase from 10.92% in 2021 to 12.30% in 2022. But in 2023, market share dropped a bit to 12.24%. General Motors has been experiencing some issues with market share this year relative to last year. During the first half of 2024, the 1.54 million units that the company sold in North America was higher than the 1.51 million reported the same time last year. However, overall market share has dipped from 15.71% to 15.45%. In the APMEA regions, market share has fallen from 5.61% to 4.72%, driven mostly by a plunge in China from 8.78% of the market to 7.06%. And even in South America, where overall unit count is expanding, market share dropped from 12.41% in the first half of 2023 to 11.02% the same time this year.

Author – SEC EDGAR Data

In addition to declining market share, the company’s bottom line has been a bit mixed. Net income did fall from $9.84 billion in 2021 to $8.92 billion in 2022. But by 2023, it had popped up to $10.02 billion. Operating cash flow expanded nicely, growing from $15.19 billion to $20.93 billion over the last three years. However, adjusted operating cash flow, which excludes changes in working capital, dropped from $21.23 billion to $20.27 billion, while EBITDA saw a drop from $26.35 billion to $24.25 billion.

Author – SEC EDGAR Data

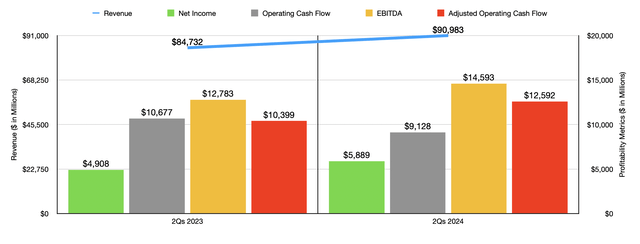

For the current fiscal year, revenue is, once again, higher for the company. The $90.98 billion reported for the first half of the year came in 7.4% above the $84.73 billion the company reported just one year earlier. This was driven largely by $5.6 billion increase coming from higher volumes in North America. Offsetting this to some extent was a $1 billion decrease caused by lower volume internationally.

This rise in revenue brought with it profitability metrics that were, for the most part, quite positive. Net income jumped from $4.91 billion to $5.89 billion. It is true that operating cash flow fell from $10.68 billion to $9.13 billion. But if we adjust for changes in working capital, we get an increase from $10.40 billion to $12.59 billion. And finally, EBITDA for the company managed to grow from $12.78 billion to $14.59 billion. On top of benefiting from the rise in revenue, the firm’s bottom line also has benefited from certain cost-cutting initiatives. In October of last year, management decided to pause all of its driverless, supervised, and manual automotive vehicle operations in the US. The company is also trying to cut costs elsewhere. In fact, just throughout North America, the business has incurred charges of $1.3 billion uncertain cost-cutting initiatives. And that has been just in the first half of this year. All things said and done, management is hoping to achieve $2 billion in fixed cost savings this year alone. And they said that, in future years, savings would be even greater.

When it comes to 2024 in its entirety, management expects net income to come in at between $10 billion and $11.4 billion. At the midpoint, that would be 6.8% above the $10.02 billion reported for last year. The company is also forecasting EBIT of between $13 billion and $15 billion. For one reason or another, management excludes depreciation and amortization from this mix. That is most likely because of the extreme capital intensiveness of the business. But regardless, if we take the midpoint here, this will likely translate to EBITDA of $27.47 billion. And if we assume a similar increase year over year when it comes to adjusted operating cash flow, then that metric will likely be around $24.55 billion.

Author – SEC EDGAR Data

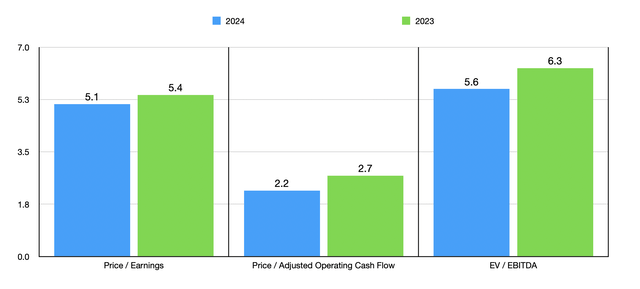

Using these estimates, as well as historical results from last year, I valued the company as shown in the chart above. Shares look incredibly cheap on an absolute basis. But then again, this industry is known for companies trading on the cheap. The fact that the industry is capital intensive, commoditized, and highly competitive is likely the reason why this is. Relative to similar firms, shares are perhaps a bit cheap. I say this because, as you can see in the table below, the firm is trading cheaper than all but two of the five major automotive companies that I compared it to on a price to earnings basis. Only one of the companies ended up being cheaper on a price to operating cash flow basis, but this notably includes only four of the five firms. And on an EV to EBITDA basis, two of the companies ended up being cheaper than our candidate, while another was tied with it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| General Motors | 5.1 | 2.2 | 5.6 |

| Ford Motor Company (F) | 11.6 | 3.2 | 14.4 |

| Honda Motor Co., Ltd. (HMC) | 6.8 | 16.1 | 1.3 |

| Stellantis (STLA) | 3.6 | N/A | 1.5 |

| Nissan Motor Co., Ltd. (OTCPK:NSANY) | 3.9 | 1.7 | 5.6 |

| Toyota Motor Corporation (TM) | 7.3 | 10.3 | 6.6 |

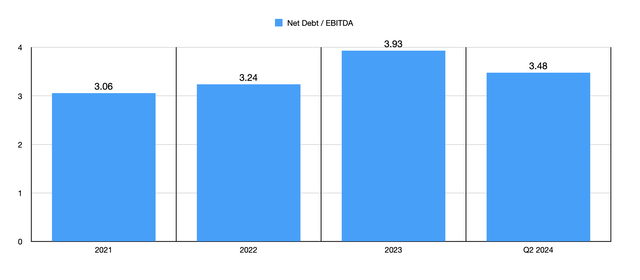

One thing that I believe that investors should be keeping an eye out for, in addition to market share changes, is leverage. Most of the company’s debt involves its financial operations. But even so, leverage has been on the rise over the past few years. The net leverage ratio for the business expanded from 3.06 in 2021 to 3.93 last year. If we use results from the most recent quarter and apply the EBITDA I calculated for the year as a whole, we do get a lower reading of 3.48. So it is possible that the picture should now start improving. But since we only have data for half of the year, it’s unclear what the rest of this year will look like.

Author – SEC EDGAR Data

Another thing I don’t like about the company is its decision to scale back on its electric vehicle operations. Regardless of your feelings about electric vehicles, they are the future of transportation. The company has had some pretty good successes on this front. In the second quarter conference call, management talked about how its best-selling electric vehicle, the Cadillac LYRIQ, is now the market leading luxury electric vehicle in 22 states. Other big wins would be the GMC Hummer EV and the Chevrolet Blazer EV. Management also continues to innovate in this space. For instance, the firm did say that it is scaling production of its Chevrolet Equinox EV, successfully delivering its first 1,000 units late in the second quarter of this year. It also has other launches of new vehicles as well. Some of those will be this year, while others would be next year. Considering that overall deliveries in the US for electric vehicles jumped 40% year over year in the second quarter while the industry grew at only 11%, the company is doing fine on this front.

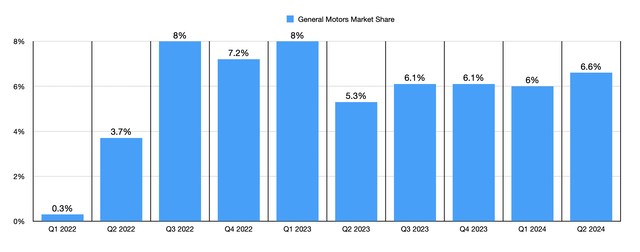

Author – SEC EDGAR Data

Unfortunately, though, by management’s own admission, the electric vehicle market is still growing steadily, but, ‘more slowly than it did over the last few years.’ This realization has convinced the company to ‘adjust’ its spending plans. Part of its plan to slow things down involves reopening its Orion assembly facility as a battery electric truck plant sometime in the middle of 2026. This is 6 months later than what management anticipated it would be. Regardless of what the rollout of new electric vehicles might mean for the company, one thing that is guaranteed is that its US electric vehicle market share grew from 5.3% in the second quarter of 2023 to 6.6% in the second quarter of 2024. However, it is down from the 7.2% to 8% range seen through the third quarter of 2022 and the first quarter of 2023. Investors will certainly want to keep an eye on market share in subsequent quarters. As I detailed in a prior article, rival Tesla (TSLA) has seen its market share in the US plunge. But between competition from China and other companies snatching market share like BMW, Subaru (OTCPK:FUJHY), Nissan, and more, how the business plays this transition will be a major determinant of how successful the company ultimately is over the next decade or so.

Takeaway

Even though some of my rhetoric may come across as pessimistic, I think I would describe myself as cautiously optimistic about the business. Recent financial performance especially has been robust, and shares are incredibly cheap on an absolute basis. They tilt toward the cheap end of the spectrum compared to similar businesses and management is growing its North American operations where it gets most of its revenue, even if that means that other markets are not prioritized. I do think, though, that there are some weak spots that investors should be paying attention to. A decline in market share in most markets that the company operates in, rising leverage, and electric vehicle woes fit on that list. At the end of the day, I am still opting to rate the business a soft ‘buy.’ But I also believe that investors would be doing themselves a favor by continuing to watch certain developments very closely.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!