Summary:

- AT&T’s new cash flow pattern, post-divestiture of noncore businesses, is underappreciated and could boost the stock price due to seasonal cash flow increases.

- The company is transitioning. Newer business like 5G should eventually predominate.

- Despite potential seasonal dips, the long-term outlook is positive if management sustains single-digit growth.

- Short-term, a focused strategy should enhance EBITDA and free cash flow growth faster than the business itself.

- The reaction to the second quarter cash flow announcement could indicate low market expectations. As those expectations change, the stock price could revalue upwards.

Robert Way/iStock Editorial via Getty Images

AT&T Inc. (NYSE:T) has never gotten credit for the new cash flow pattern now that management has ditched all the noncore businesses. The last article noted how the excitement over the cash flow results likely meant low expectations. That means the coming quarter could well produce a boost in the stock price yet again because cash flow should again increase seasonally.

The business itself remains in the midst of several transitions. There is the 5G that is being installed as quickly as possible. On the other hand, I just received a notice about possibly the end of service for my landline phone. Of course, that also shows my age. Eventually, the decline of the “older” businesses will become less significant while the growth of the new business continues to become more significant. That should eventually result in overall company growth a bit faster than is the case right now. Long-term, this bodes well for more cash flow.

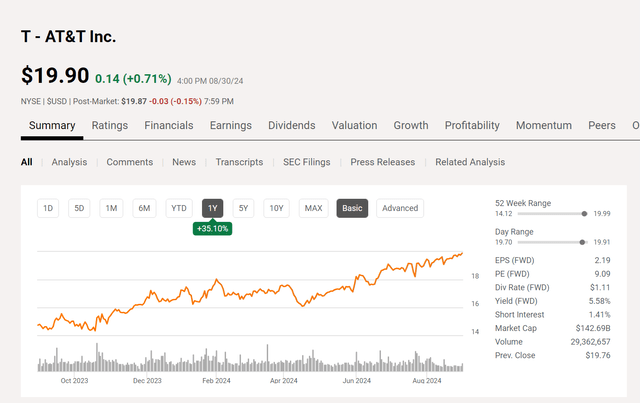

AT&T Common Stock Price History And Key Valuation Measures (Seeking Alpha Website August 31, 2024)

The stock price itself has largely responded to the cash flow situation as shown above. There could be a dip coming up in the seasonally weak first quarter. But that is far enough away from the current situation that it may not have an effect on the stock price just yet.

But if management continues to grow the overall business at single digits, then the stock price direction should be upwards for the long term. In the short term, the continuing focus strategy should allow both EBITDA and free cash flow to grow faster than the business for the first few years.

Debt

There have been some worries about the debt levels.

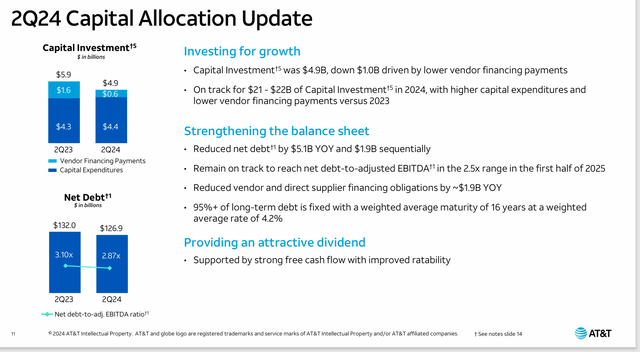

AT&T Capital And Debt Summary (AT&T Second Quarter 2024, Corporate Presentation)

Based upon the feedback, I am getting is the main worry that the debt is not being paid down fast enough. But there is also a need to transition the business to 5G and of course grow the cell phone or really any wireless business.

There is always some risk to not repaying debt in that the company can be caught on the “high-tech merry-go-round” in that continuous improvements result in the cash flow generated from operations always get invested in the latest technology update. This, of course, affects future free cash flow to the point that any debt never gets repaid.

However, the growth of the business should indicate that there will be more free cash flow in the future, even if the percentage of cash from operations that becomes free cash flow is a lower percentage. The fact that the debt ratio is now below 3 should indicate steps in this direction “just in case”.

Furthermore, despite the long wait, there is a debt repayment shown above, resulting in an admittedly small amount of debt reduction. But it still has to be a step in the right direction even if that direction progress is painfully slow for shareholders.

Growth

In the meantime, the businesses slated for growth are growing. What needs to happen is the shrinkage of the legacy businesses needs to become less significant for the growth businesses to predominate. To a certain extent, the combination of focusing the business and the growth about to be shown has resulted in low single digit growth. What should happen in the future is the growth areas in the future becomes the growth of the overall business.

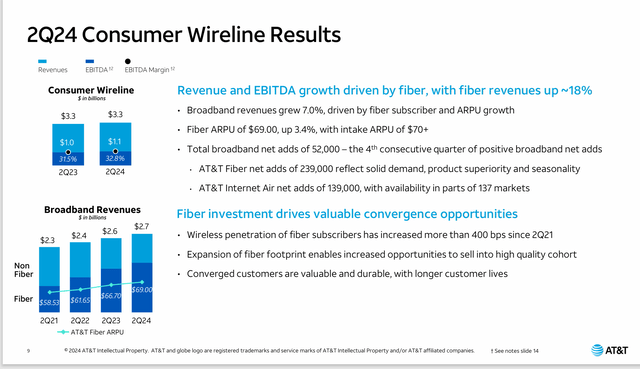

AT&T Summary Of Consumer Growth Business (AT&T Second Quarter 2024, Corporate Presentation)

This business (and cell phones) usually has a fairly heavy fourth quarter. It is generally the basis for a lot of free cash flow in the quarter. A lot of what is sold in the fourth quarter causes a seasonal peak in accounts payable that reverses in the first quarter of the next fiscal year. Note that the company is tracking the people that do this, plus cell phones.

The only risk here is that this business becomes generic, and the company runs out of newer, pricier “toys” for consumers to pay up for in the future. Right now, that seems unlikely. But it is a normal business cycle prediction for this business to become generic in the future and possibly be replaced by some new technology that we currently have no idea about.

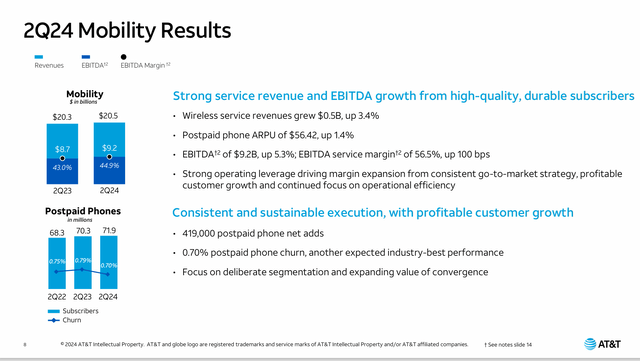

AT&T Cell Phone (And Related) Results (AT&T Second Quarter 2024, Corporate Presentation)

This is shown next because there is a good chance that the slide before will be the future driver of growth in this area. It may be, in fact, the distinguishing factor when it comes to competing services because bundling may be the important part for consumers (cost savings).

The question is always the challenge of keeping subscribers.

Probably the main idea here is that management has managed the transition from a landline telephone company to the latest technology. It was a mess and there are many mistakes to point out. Most transitions are unfortunately like that. It is a reason that few companies survive to the “next generation”.

In the business world, probably the goal is to do more right than wrong. Here the “right” seems to be prevailing. For AT&T, the part of the company that deals with businesses still appears to be transitioning from wire services to a cell phone system. The transition still appears to dominate (as opposed to new product growth).

Summary

As the second quarter stock price reaction to the cash flow news demonstrated, the market has very low expectations for this company. That could well mean continued relatively strong price performance in a very tired bull market that now is centered on a few stocks. Once a stock market correction begins, this company has the advantage of a focus strategy and new growth areas that will be well underway.

This company remains a strong buy in that the future appears to have a lot of good news ahead. A potential period of weakness in the future appears to be the first quarter, where there are a lot of one-time payments for the fiscal year that decimate free cash flow on a seasonal basis. That may be something that traders can take advantage of.

But for income investors, it now appears that the dividend will not only be sustained, but it will grow slowly in the future. An earlier slide shows a dividend yield that accounts for most of the total return that many investors report long term. As a result, the stock price only has to appreciate a small amount for investors to get that average annual return that many report as long-term.

This remains a strong buy as it should eventually grow in the upper single digits to possibly as much as 10% a year while averaging 7% or so a year combined with the current dividend yield of more than 5%. The current price earnings ratio of 9 could easily expand to 13 to 15 in a scenario like that as well.

The continuing turnaround appears to indicate that this investment grade opportunity will offer a combined return in the teens for at least the next five years. For at least the near term, both cash flow from operating activities (the GAAP number) and free cash flow should grow faster than revenue as the company continues to focus on the remaining core businesses to become “lean and mean”.

Risks

Probably the major risk is a sustained period of high inflation that increases the carrying cost of the debt. This would be joined by an inability of the company to recover costs that would enable results to keep up with that high inflation. Right now, that appears to be a remote possibility. But a key step to this outlook will be in 2025 how the expiring parts of the tax cut are handled, combined with what is done to reduce the ongoing federal deficit.

There is always a risk that a new technology completely obsoletes the company’s business. The last time this happened, when cell phones appeared, management just barely made more right decisions than wrong decisions to enable the company to recover from the decline of the landline phone business. Even though investors cannot imagine what that future would be like, it could still happen.

The loss of key personnel could set back the recovery trajectory of the company.

When it comes to valuation, realize that valuation largely depends upon market conditions when we get there. So, while I can estimate a future valuation using current market conditions, there is no guarantee that those conditions will be there five years from now. What I think I can say for sure is that the turnaround underway is becoming apparent to the market in such a way that the positive quarterly comparisons (likely) ahead should enable this issue to outperform a fair amount of the market because the current price-earnings ratio is well below the market average and should indicate low expectations (or no expectations).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and AT&T in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.