Summary:

- Berkshire Hathaway sold $848M worth of Bank of America shares between Aug. 28 and Aug. 30.

- Warren Buffett’s significant reduction in Bank of America shares likely signals concerns about a potential recession or cyclical earnings risks.

- BofA is now the third-largest in its portfolio, reflecting strategic portfolio adjustments.

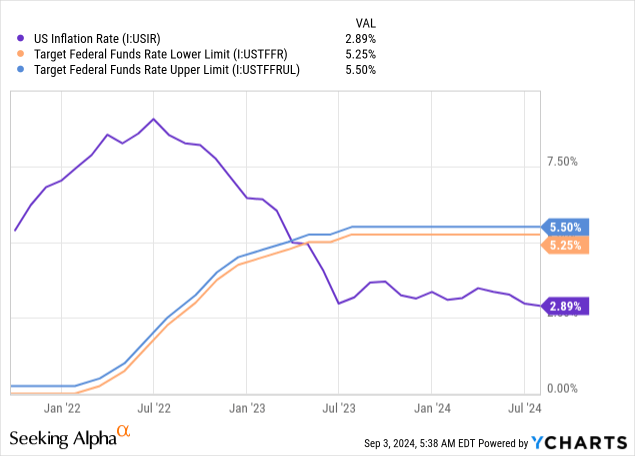

- Positive inflation data for July makes a rate cut a near certainty next month, which poses cyclical net interest income risks for Bank of America.

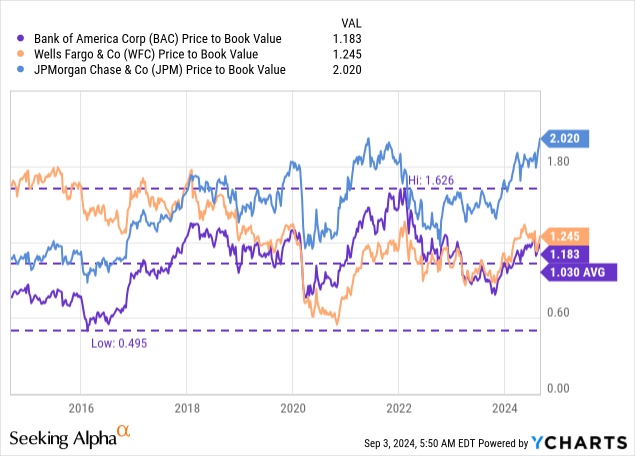

- Bank of America’s valuation is still high, and shares trade significantly above the bank’s historical price-to-book ratio.

CribbVisuals

Bank of America Corporation (NYSE:BAC) is a Wall Street bank whose shares have been included in the investment portfolio of Berkshire Hathaway Inc. (BRK.A) since 2011. Now, in a major development for Bank of America, Warren Buffett has decided to sell down its position in the second-largest U.S. bank which created considerable buzz and speculation about his motives. Interestingly, the decision to cut Berkshire’s stake in Bank of America comes just weeks before a crucial meeting at the Federal Reserve which is expected to result in a cut to the federal fund rate. Warren Buffett’s Bank of America stock sale is a significant event, in my opinion, especially as far as the timing is concerned, and I continue to expect considerable earnings headwinds for Bank of America in the quarters ahead.

Previous rating

I rated shares of Bank of America a hold in July, after the Wall Street bank reported better than expected second quarter results, in: Impending Fed Pivot Creates Risk. The reason for my cautious approach to Bank of America, and to large financial institutions in general, was that the Federal Reserve was gearing up to change the federal fund rate trajectory. For large banks, which hold a lot of variable rate assets on their balance sheets, declining federal fund rates pose an immediate and serious earnings risk. A new inflation report earlier this month has made rate cuts much more of a certainty than before. With Warren Buffett, a long-term shareholder of Bank of America, also recently disclosing significant stock sales, I believe the risk profile has further deteriorated.

Major portfolio changes for Berkshire Hathaway

According to Berkshire Hathaway’s 13F filing for the second quarter, the investment firm owned more than one billion shares of Bank of America… which made the Wall Street bank the second-largest holding in Berkshire Hathaway’s portfolio. However, Berkshire Hathaway has recently heavily reduced its position in Bank of America.

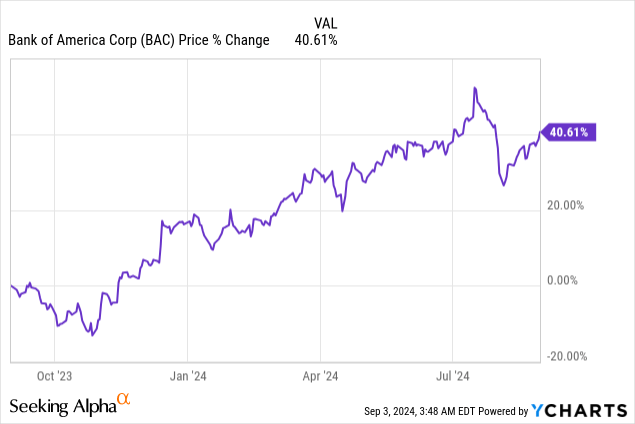

Between August 28 and August 30, Berkshire Hathaway sold 21.1M shares of Bank of America for total proceeds of $848M, with prices ranging between $39.95 and $40.61. In the week before that, between August 23 and August 27, the investment firm sold 24.7M shares. Berkshire Hathaway owned 882.7M shares of Bank of America at the end of August that have, at a current price of $40.75, a total market value of $36.0B.

After a series of stock sales last week, Bank of America is now the third-largest investment holding in Berkshire Hathaway’s portfolio and now has a portfolio share of approximately 11%. Since stock sales have accelerated lately and Berkshire Hathaway still owns a ton of the bank’s shares, I believe we could see more sales before the Federal Reserve reaches its pivot point next month.

One reason why Berkshire Hathaway could be selling down its stake in Bank of America relates to concerns about a potential recession. Berkshire Hathaway also made other drastic portfolio changes in the preceding months, including a significant reduction in its position of Apple Inc. (AAPL)… a company that reported seriously deteriorating top line growth in recent years.

In my opinion, the portfolio changes come at an opportune time as Bank of America’s shares went into a new up-leg lately and reached a new 1-year high just before Q2’24 earnings. With inflation easing significantly in the last several months, and falling to 2.9% in July, the Federal Reserve has already hinted at lowering the federal fund rate in the near term… which could potentially be another reason why Berkshire Hathaway is selling shares of Bank of America. Lower federal fund rates imply growing headwinds for large banks that hold a considerable amount of variable rate assets on their balance sheets.

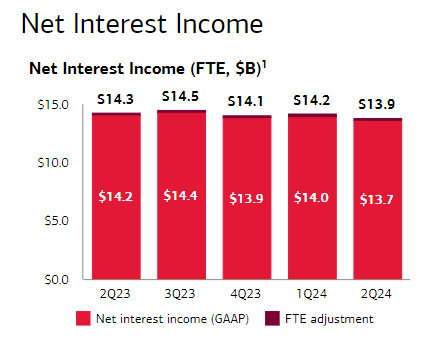

In Bank of America’s case, the bank has seen a decline in its net interest income in the last year which in large part is made up of interest income that comes from its outstanding loans. Falling federal fund rates imply weakening net interest income for Bank of America’s loan pools, as loans are set to generate lower interest income going forward. It may be either the expectation of cyclically contracting net interest income or concerns about a recession that explain the massive stock sales of Bank of America in Berkshire Hathaway’s portfolio.

In Q2’24, Bank of America’s net interest income fell $0.3B quarter-over-quarter and $0.5B year-over-year to $13.7B, mainly due to higher deposit costs. With the Federal Reserve likely set to reach its pivot point next month, investors must be prepared to see an accelerating contraction in the bank’s net interest income. While Bank of America expects its NII to grow until the end of the year, the longer-term NII trend is likely going to point south.

Bank of America

Bank of America’s valuation

Bank of America’s shares surged ahead of Q2’24 earnings, despite a rate cut being on the horizon, resulting in BAC reaching a new 1-year high. Bank of America is now valued at a price-to-book ratio of 1.18X which is considerably above the longer-term (10-year) average price-to-book ratio of 1.03X.

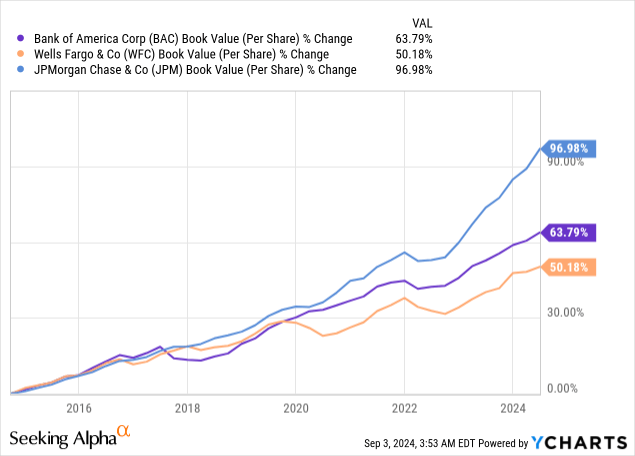

Banks tend to see higher book value multipliers during an expanding economy with high interest rates and contracting P/B ratios during shrinking economies with low interest rates. Wells Fargo & Company (WFC), which is likely the closest rival to Bank of America, is priced at a comparable price-to-book ratio of 1.25X while JPMorgan Chase & Co. (JPM) trades at a considerably larger P/B ratio of 2.02X.

In the longer term, I would expect Bank of America to trade closer to book value and lose a good chunk of its current premium. Bank of America’s book value as of the end of the June quarter was $34.39 per share which I currently see as fair value for the Wall Street bank.

JPMorgan & Chase is the biggest bank in the U.S. and the most expensive because of Jamie Dimon’s strong leadership as well as consistent acquisitions in the past that made positive book value contributions. As a result, JPMorgan & Chase delivered by far the best results in terms of book value per share in the last decade.

Risks with Bank of America

The biggest risk for Bank of America, as I see it, relates to the start of federal fund rate cuts. Banks depend on high federal fund rates in order to be able to charge their customers high interest rates. A cyclical drop-off in interest rates therefore implies weaker prospects for net interest income, and therefore, earnings growth… which in turn could have a negative valuation impact for Bank of America.

Further, lower deposit costs could have a favorable impact on Bank of America’s net interest income and the short-term NII outlook for the bank is still positive (BofA guided for $14.5B in net interest income in Q4’24). What would change my mind about Bank of America is if the bank were to maintain stable net interest income and high asset quality even in a lower-rate world.

Further, Bank of America has fallen behind JPM in terms of book value growth in recent years. Should the bank be able to grow its book value and catch up to JPMorgan & Chase going forward, possibly due to acquisitions in the regional banking market to strengthen its consumer banking franchise, then I would consider changing my rating to either hold or buy.

Closing thoughts

When a long-term anchor investor like Warren Buffett-led Berkshire Hathaway sells a ton of shares of its core holding, investors better pay attention. This is especially true since Bank of America’s shares have surged lately, despite the Federal Reserve approaching a drop-off point regarding the federal fund rate. I believe that Buffett’s stock sales are especially telling after shares of Bank of America surged and inflation data for July indicated that the Federal Reserve is approaching its pivot point. I believe the risk profile has deteriorated after the inflation report for July showed easing price pressures and after Berkshire Hathaway emerged as an aggressive seller of Bank of America shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.