Summary:

- QCOM trades at $175 with the potential to reach $196, supported by bullish RSI and VPT trends but a caution for short-term pullbacks.

- Qualcomm posted Q3 2024 revenue of $9.4 billion (+11% YoY) with EPS of $2.33 (+25%), beating guidance.

- IoT and automotive revenues reached $1.4 billion and $811 million, with automotive growing 87% YoY.

- Q4 guidance projects $9.5-$10.3 billion revenue and $2.45-$2.65 EPS, indicating continued growth.

- Qualcomm’s focus on IoT and automotive, supported by acquisitions like Sequans, strengthens its market leadership.

Nikola Ilic

Investment Thesis

QUALCOMM Incorporated’s (NASDAQ:QCOM) strong fundamentals underscore its strategic focus on IoT and automotive growth. Diversity across these high-growth verticals, combined with solid licensing revenues, positions it to extend the improvements witnessed in this report. Additionally, Q4 guidance revenue of $9.5-$10.3 billion and EPS guidance at $2.45- $2.65 fell in line with market expectations on the back of solid top and bottom-line growth.

In short, Qualcomm’s solid earnings, growth in key sectors, and technicals under the hood all support the bullish investment thesis of a stock appropriately positioned to find additional upside as it capitalizes on emerging opportunities in its core markets.

Qualcomm Stock May Hit $196: Technical Terrain, Outlook with Mixed Signals

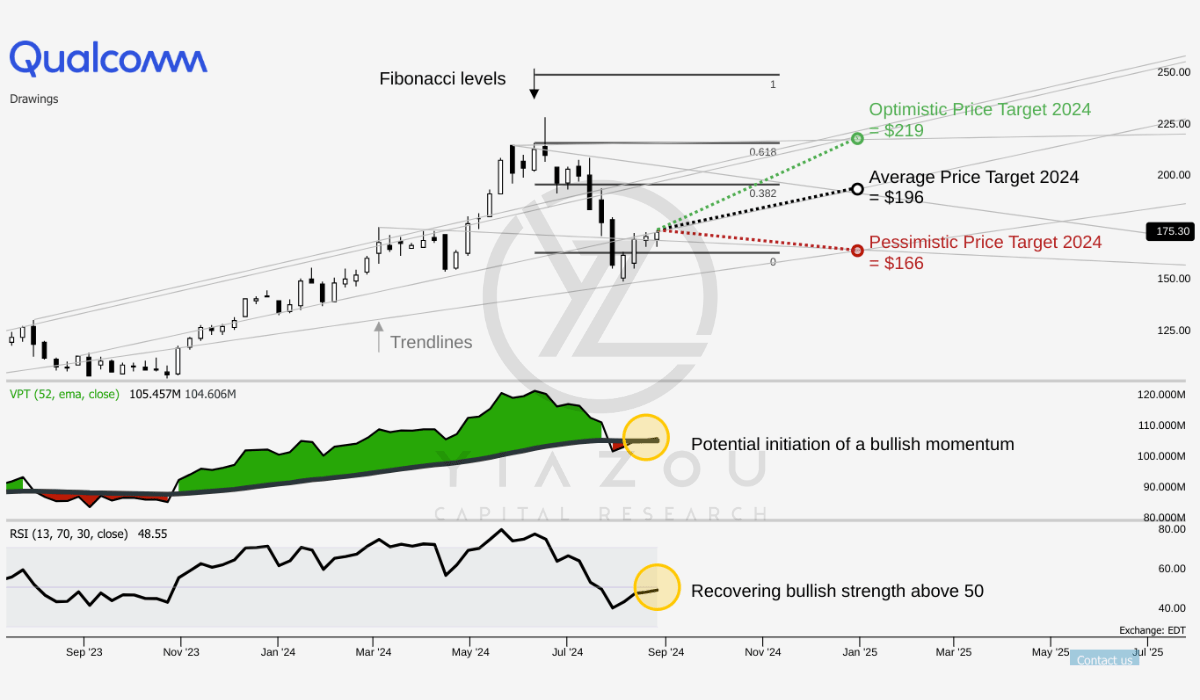

QCOM is trading at $175 with an average price target of $196. The target aligns with the 0.382 Fibonacci level, which suggests a potential moderate uptrend. Similarly, the optimistic target of $219 corresponds with the 0.618 Fibonacci retracement, which indicates a bullish solid movement if the stock continues its upward trajectory. Conversely, the pessimistic target of $166 is tied to the 0.0 Fibonacci base and highlights the possibility of a minor pullback in the short term.

Whereas the Relative Strength Index (RSI) value of 48.55 (just below the neutral 50 mark) reflects a lack of solid momentum in either direction. However, the RSI line is trending upwards, which hints at a potential reversal towards bullish price zones. Despite this, no clear bullish or bearish divergence suggests that the current trend may continue sideways without any significant changes in momentum. The Volume Price Trend (VPT) line at 105.46 million also shows signs of improvement as it exceeds its moving average of 104.61 million. This crossover indicates a potential long setup and reinforces the possibility of a positive price movement.

Yiazou (trendspider.com)

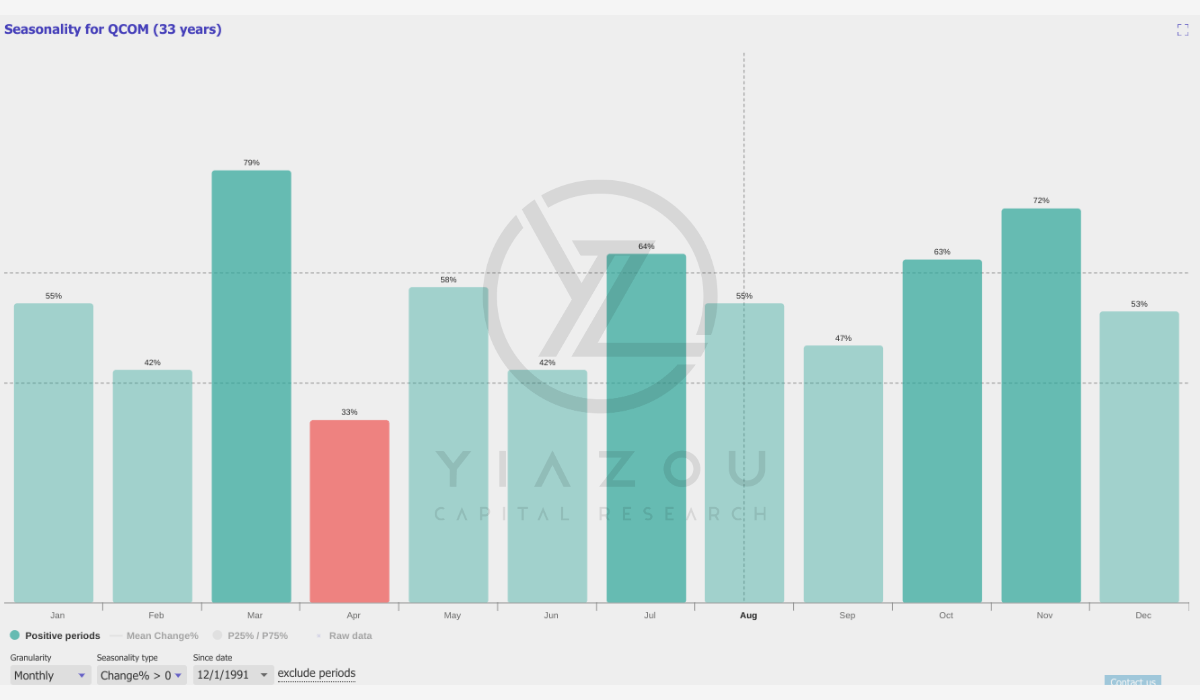

Finally, the seasonality analysis for August shows a 55% chance of a positive return, adding a historical context (33 years) that favors a cautiously optimistic outlook. On the contrary, the seasonality analysis for September shows a 47% chance of a positive return for QCOM, making it one of the weaker months in terms of historical performance over the 33 years. This suggests a slightly cautious outlook for September, which falls below the 50% threshold.

Yiazou (trendspider.com)

Qualcomm Expands IoT Leadership with Sequans Acquisition but Faces Strategic and Market Risks

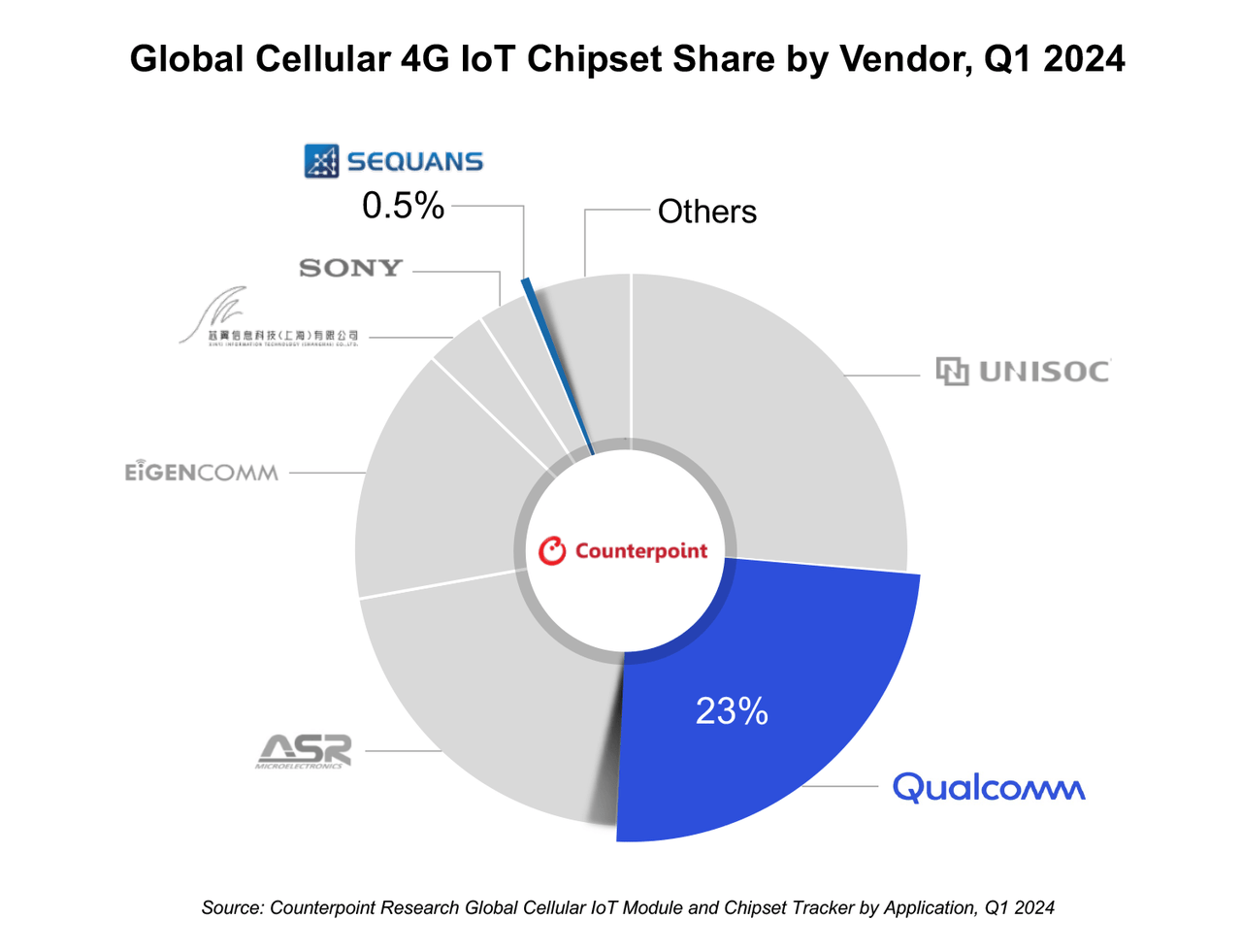

Qualcomm will acquire Sequans’ 4G IoT technologies to boost its industrial IoT presence (currently at 23%, Q1 2024). The deal includes employees, assets, and licenses as Sequans’ focus on 4G IoT aligns with Qualcomm’s goals. The acquisition is critical for expanding Qualcomm’s capabilities and enhancing their low-power, reliable IoT solutions. Sequans’ 4G IoT technology is known for low-power efficiency, which is crucial for IoT applications as energy efficiency is essential in industrial settings. Low-power technology extends IoT device lifespan and reduces operational costs. Hence, these factors aid in Qualcomm’s IoT products’ widespread deployment and scalability.

Moreover, the acquisition strengthened the company’s industrial IoT portfolio and positioned Qualcomm as a sector leader (+0.5% market share). Sequans’ technology adds to Qualcomm’s IoT solutions, which include end-to-end connectivity. The acquisition improves Qualcomm’s performance in industrial applications and accelerates Qualcomm’s leadership in digital transformation. Sequans retains its 5G technology post-acquisition, demonstrating Qualcomm’s strategic approach. Qualcomm focuses on 4G IoT expansion. Sequans continues 5G development independently. Therefore, this arrangement allows immediate use of 4G tech and opens doors for future collaborations.

Counterpoint – Technology Market Research & Industry Analysis Firm

Fundamentally, the acquisition aligns with Qualcomm’s growth strategy. It aims to expand market share through technology as the industrial IoT sector grows. Connected solutions enhance efficiency and data use. Qualcomm’s enhanced portfolio aims to capture more market share. Technological advancements support this growth. The focus on low-power solutions reflects market needs. Thus, Qualcomm’s portfolio strengthening improves its competitive edge and prepares the company for future opportunities.

On the downside, acquiring Sequans’ 4G IoT technology reveals weaknesses that could limit Qualcomm’s growth. A key issue is the perpetual license agreement that allows Sequans to retain full rights to the 4G IoT technology. This limits Qualcomm’s exclusive control, weakening its competitive edge as Sequans will continue using this technology in the market. Further, this overlap could complicate Qualcomm’s market positioning and might even lead to sales cannibalization. Sequans’ retention of 5G technology also signifies a missed opportunity for Qualcomm that could be integrated and may result in an edge in the 5G IoT market.

Financially, the acquisition may not guarantee immediate revenue growth, as the IoT sector is growing but not as rapidly as other segments like mobile handsets. The return on investment might be slow, and the benefits will take time if the IoT market grows slower than expected. Integrating Sequans’ technology and personnel could also be costly as unforeseen challenges during integration could hurt Qualcomm’s margins.

Finally, the need for French regulatory approval adds uncertainty. Delays or issues in getting this approval could postpone benefits, slowing Qualcomm’s growth trajectory. Therefore, the transaction’s success depends on factors beyond Qualcomm’s control that increase the risk associated with the acquisition.

Qualcomm’s Q3 2024 Revenue Surge Driven by IoT and Automotive Growth Sets Stage for Strong Year-End Rally

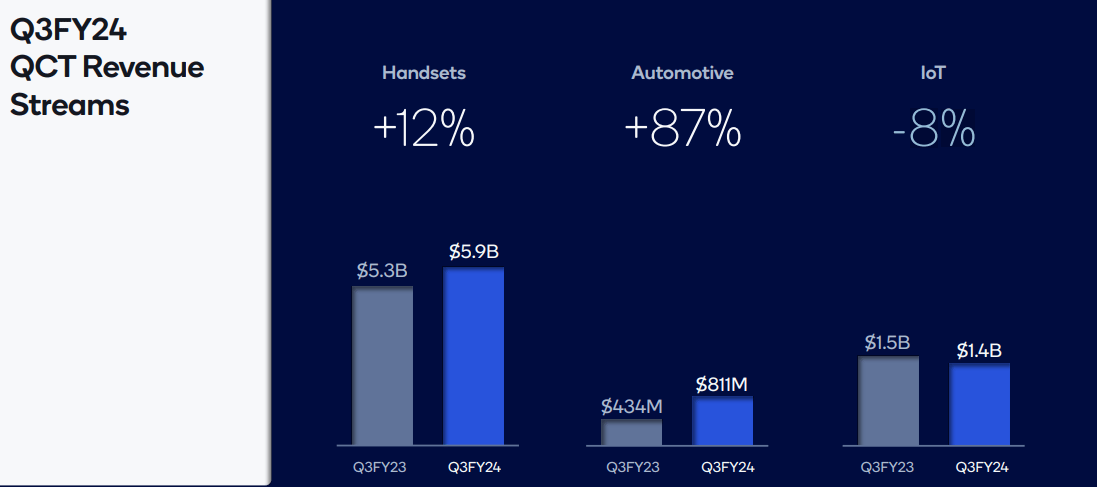

In Q3 2024, Qualcomm had revenues of $9.4 billion (+11% YoY) (handsets derived $5.9 billion, $811 million in Automotive, and $1.4 billion was IoT revenue) with non-GAAP EPS of $2.33 (+25% YoY). Both figures exceeded the midpoint of the company’s guidance range. This performance indicates solid financial results and sharp operational management.

Moreover, its balanced revenue growth across segments demonstrates sharp top-line diversification. Qualcomm’s chipset business earned $8.1 billion in revenue, which shows growth in the automotive and IoT sectors. The growth highlights Qualcomm’s effective diversification strategy and reflects the company’s lead in capitalizing on these emerging sectors. For instance, Q3 was the fourth quarter of record automotive revenues (+87% YoY). Further, the licensing segment contributed $1.3 billion to the revenue total. This performance underscores Qualcomm’s strength in intellectual property, as the segment generates substantial revenue from licensing agreements.

Sequential revenue growth in the automotive and IoT sectors is a positive sign (within the guided range), indicating Qualcomm’s successful focus on these high-growth areas. The stable licensing revenues reflect continued strength in Qualcomm’s IP business. The automotive sector achieved record revenues of $811 million, representing a 34% sequential growth. The growth indicates Qualcomm’s success in expanding its market share. New design wins and the scaling of the Snapdragon Digital Chassis support Qualcomm’s strong position.

Additionally, the IoT stream saw a 9% sequential revenue increase against a -8% YoY drop. This growth shows ongoing positive trends and a gradual industry recovery. Qualcomm’s focus on advancements, acquisition, and successful deployment of IoT solutions may lead to further recovery in the IoT top-line stream.

Qualcomm’s focus on the automotive and IoT sectors secured over 10 new design wins, strengthening its market presence. The company’s efforts in digital cockpit connectivity and ADAS derive innovation in automotive technologies. The Snapdragon 803 platform powers the Galaxy Z Fold6 and Flip6, highlighting Qualcomm’s lead in premium smartphones and mobile technology.

In short, Qualcomm focuses on-device AI and high-performance computing solutions, as the Snapdragon X Series and Copilot+ PCs position it as a leader in computing and AI markets. Further, in October 2024, the next-generation Snapdragon 8 flagship mobile platform, which will be presented at the Snapdragon Summit, may lead to a bullish push on the stock.

In Q3 2024, Qualcomm returned $2.3 billion to stockholders, including $1.3 billion in stock repurchases and $949 million in dividends. The company’s solid bottom line supported this move, as the QCT segment achieved an EBITDA margin of 27%, led by revenue growth in the IoT and automotive sectors. The QTL segment had an EBT margin of 70%, reflecting high licensing profitability.

Moving forward, in Q4 fiscal 2024, the company may hit top and bottom line growth. The management projection ($9.5 billion-$10.3 billion and $2.45 – $2.65 per share) aligns with analysts’ estimates ($9.86 billion and $2.55 per share) with 14% and 26% YoY growth, respectively. These developments (October summit and results in November), followed by the Santa Claus rally in December, may provide QCOM stock with a happy 2024 ending.

3rd Quarter Earnings Presentation

Takeaway

In any case, the stock’s fortune will remain at the mercy of general market conditions and Qualcomm’s ability to monetize its diversification into high-growth sectors like IoT and automotive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.