Summary:

- StoneCo’s 2Q24 results showed an 8.5% YoY revenue increase, but significant cost hikes and higher NPLs raise concerns about future profitability.

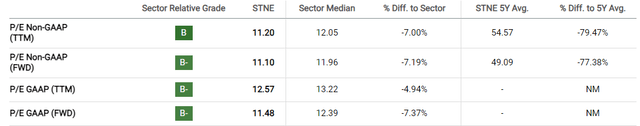

- The company’s valuation shows a 7% discount to the sector’s average P/E, which is not a large margin of safety for investment.

- The company’s ability to manage these challenges and maintain profitable growth will be critical to any future reassessment of its investment recommendation.

RicardoImagen

Investment Thesis

I recommend holding StoneCo (NASDAQ:STNE) stock. The company released its 2Q24 results, which demonstrated the company’s great ability to increase revenue, the number of clients, and transaction volume.

However, I was struck by the increase in NPLs, especially considering Stone’s track record. Other significant increases in costs, pressures on margins and little margin of safety in valuation make me skeptical about this thesis.

Review Of StoneCo Results

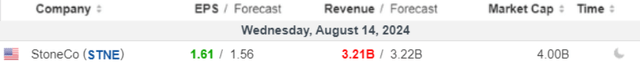

The company released its 2Q24 results on August 14, and as we can see below, StoneCo beat market profit estimates, but did not beat revenue estimates.

Next, I will show you each segment of the result from my point of view. It is important to note that the company releases its results in BRL, and I will convert them to dollars using the exchange rate of 1 dollar = 5.59 reais, this was the exchange rate on the last day of the second quarter. Enjoy your reading!

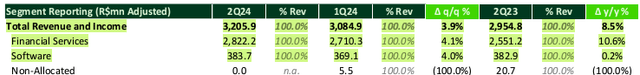

Revenues – Strong Growth

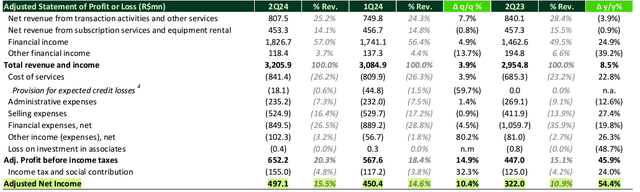

StoneCo achieved an 8.5% YoY and 3.9% quarterly revenue increase, reaching BRL 3.2 billion ($573 million). This was possible due to the 24.9% yoy growth in financial revenues, driven by higher prepayment, credit and floating revenues.

In my view, the strong growth in financial revenues indicates that the company is being assertive in segments with greater profitability, however, the low growth in software may indicate greater competition or even saturation.

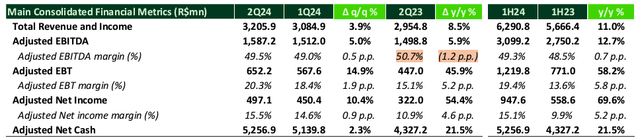

Costs, Expenses and Margins – Ups and Downs

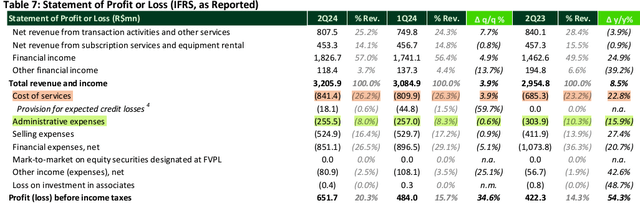

This part of the results caught my attention the most. The company’s costs rose sharply year-on-year by 22.8% due to higher provisions for doubtful debts, logistics and technology costs.

Costs and Expenses (IR Company)

However, the company managed to compensate for this by controlling expenses, with its administrative expenses reducing by 15.9% on an annual basis. As a result, the company achieved a mild reduction of 120 bps in its adjusted EBITDA margin.

In my view, the company managed to do what it was supposed to do, however, future cost increases (which appear to be the base scenario) may continue to put pressure on margins.

Credit And Banking Metrics – The Most Important

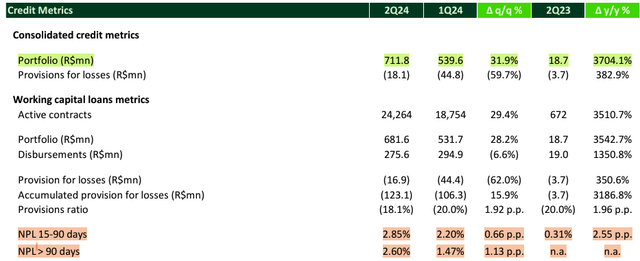

The company reached a credit portfolio of BRL 712 million ($127 million). But what caught my attention were the NPLs (15-90 days increased 66 bps QoQ and >90 days increased 113 bps).

The larger NPLs raised concerns for me because StoneCo has had major problems with them in the past, and especially now (with lower loss provisions), this could be an indication that the company is “underestimating” defaults. But another piece of data also caught my attention, now in banking metrics.

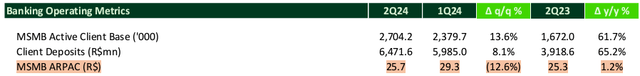

The 12.6% quarterly reduction in MSMB (Banking)ARPAC may be indicating that the company is facing challenges in monetizing customers, which could contribute to pressure on margins in my view.

Net Income – Fulfilling The Guidance

With good growth in volumes and revenues, partially offset by higher costs, the company achieved a 54% annual increase in net income to BRL 497 million ($89 million).

What was my conclusion based on the results? StoneCo has managed to grow its revenues in a healthy way, and its marketing campaigns have been very effective in attracting new customers, increasing the volume of transactions.

However, the increase in NPLs makes me concerned about the health of the credit operation in the future, while cost pressure is also a major challenge. The valuation also does not point to a bargain, as we will see below.

Valuation – Little Safety Margin

As we can see below, Seeking Alpha indicates that the company has a 7% discount to the sector’s average P/E, which is still not a large margin of safety to invest in a company like StoneCo in my view.

But I have to be honest and say that the valuation has improved compared to my thesis when I started covering it, when the discount to the sector was only 5%. In short, my assessment of the company is better than in the previous quarter, but still not enough to change the recommendation.

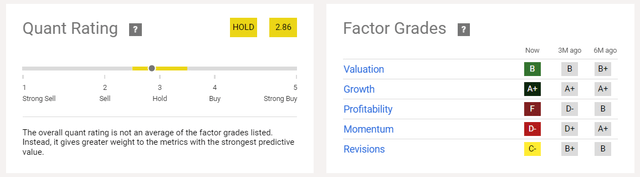

StoneCo According to Quant Rating & Factor Grades

Below, we will analyze StoneCo according to the Quantitative tools that Seeking Alpha offers us.

Quant Rating & Factor Grades (Seeking Alpha)

As we can see, the Quant Rating tool corroborates my recommendation to hold StoneCo shares, mainly due to profitability, momentum and reviews.

Potential Risks To The Bearish Thesis

Despite the challenges, there are also solid arguments for buying the shares, such as the reduction in administrative expenses, which demonstrate the company’s strong focus on its operational efficiency and can sustain margins in the future.

The risks of not investing in the company are numerous, given the high growth potential in an emerging market such as Brazil, and investors should conduct a diligent analysis to decide whether or not to invest in the stock.

The Bottom Line

At the end of the 2nd quarter, StoneCo demonstrated a strong capacity to increase its transaction volume, number of clients, and consequently revenue. The company also demonstrated competence in a strong reduction of expenses.

However, the increase in NPLs and cost pressure make me cautious about the thesis, especially in emerging markets such as Brazil, which deals with a change in economic cycles very quickly.

Based on this analysis, I recommend holding StoneCo shares. In addition to the arguments mentioned, and although my assessment has improved, I still see little margin of safety in the company’s valuation, which makes me skeptical about the thesis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.