Summary:

- DraftKings’ FY2024 guidance has been lowered, impacting its stock performance and investor’s confidence, despite maintaining a leading market share and robust growth in the US gaming market.

- Recent acquisitions, including Jackpocket, Inc., are not immediately bottom-line accretive, contributing to a deteriorating balance sheet and mixed sentiments about DKNG’s near-term prospects.

- The management’s inaugural $1B share repurchase authorization reflects their confidence in the long-term outlook, despite the negative cash flows from operating activities over the last twelve months.

- Despite the mixed FQ2’24 performance, DKNG’s high-growth investment thesis remains intact, with a significant long-term upside potential.

DNY59

DKNG’s High-Growth Investment Thesis, Marred By The Management’s Painfully Lowered FY2024 Guidance

We previously covered DraftKings (NASDAQ:DKNG) in May 2024, discussing how the management had exceeded expectations by reporting an impressive FY2023 and FQ1’24 earnings results, while charting a more than decent stock price return compared to the wider market then.

With it still reporting a leading gaming market share in the US while raising its FY2024 guidance, it was apparent that we had been too bearish on the stock as the company remained the clear gaming market leader, resulting in our upgraded rating to a Buy then.

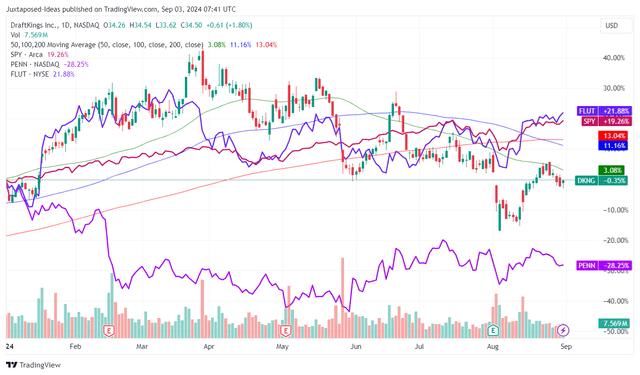

DKNG YTD Stock Price

Since then, DKNG has underperformed at -9.1% compared to the wider market at +6.2%, attributed to the notable market wide rotation from high-growth stocks since June 2024, the FQ2’24 top-line miss, and the lowered FY2024 guidance.

For reference, the stock had been well buoyed by the management’s promising FY2024 adj EBITDA midpoint guidance of $400M (+364.8% YoY) originally offered in the FQ3’23 earnings call, which had been raised twice to $460M (+404.5% YoY) in the FQ4’23 earnings call and to $500M (+431% YoY) in the FQ1’24 earnings call.

The consistent beat and raise performances have naturally contributed to DKNG’s robust stock performance over the past few quarters, lending bullish support to its high growth (and profitable) investment thesis.

Unfortunately, those optimistic sentiments have also crashed by the FQ2’24 earnings call, as the management reported revenues of $1.1B (-6.3% QoQ/ +26.2% YoY) and adj EBITDA of $127.96M (+471.5% QoQ/ +75.3% YoY) while suddenly lowering their FY2024 adj EBITDA guidance to $380M (+351.6% YoY).

While the latter may be attributed to DKNG’s recently completed acquisitions of Jackpocket, Inc. and Sports IQ Analytics Inc. in May 2024, it is apparent that the acquisitions are not expected to be immediately bottom-line accretive.

While the FQ2’24 adj EBITDA margins of 11.5% (+9.6 points QoQ/ +3.2 YoY) remain rich enough, it goes without saying that the market’s/ investors’ expectations have been rather elevated attributed to the ongoing beat and raise performances thus far.

With the two acquisitions yet to be bottom-line accretive, it is also unsurprising that we are concerned about the deteriorating balance sheet with a moderating net cash position of -$0.44B by the latest quarter, compared to -$0.06 in FQ1’24 and $0.02B in FQ2’23.

On the other hand, DKNG has announced its inaugural $1B in share repurchase authorization, despite the gaming company generating negative cash flows from operating activities over the last twelve months – with Alan Ellingson, the CEO, offering highly optimistic commentaries:

We are very excited about DraftKings’ Free Cash Flow trajectory. In light of that, we are pleased to announce a $1.0 billion inaugural share repurchase authorization, which reflects our confidence in the Company’s attractive long-term outlook and healthy balance sheet. (Seeking Alpha)

For now, we are cautiously optimistic about DKNG’s ability to deliver the lower FY2024 numbers as promised, since the historically weaker adj EBITDA losses of -$148.63M in H1’23 (+63.5% YoY) have been well-balanced by the heavier weightage at -$2.4M in H2’23 (+99.2% YoY).

As a result, we believe the same may occur ahead, with it building upon the H1’24 adj EBITDA growth at +201.1% YoY and a rather heavy weightage expected in H2’24.

In addition, we believe that DKNG’s high-growth investment thesis cannot be ignored, especially since it continues to maintain its leading gaming market share of 32% in the US by Q1’24 (in line QoQ), with its second only to FanDuel (FLUT) at 35% (in line QoQ) – and its path toward profitable growth already visible.

If anything, the management has already reported robust new Online Sports Betting [OSB] and iGaming customers growth by nearly +80% YoY as Customer Acquisition Costs [CAC] declined by over -40% YoY in FQ2’24 – despite the period of no new state launches.

Perhaps part of the tailwinds may be attributed to the new features and functionalities launched on DKNG’s OSB and iGaming platforms, along with the expanded offerings across the NFL, NBA, MLB, NHL, college football, college basketball, and tennis games, significantly aided by the recently announced Simplebet acquisition.

This is on top of the management’s plan to double its new iGaming releases in 2024 along with expanded bet and watch experience with NFL streaming, allowing the gaming company to generate higher cross-selling while attracting new user base.

These developments continue to highlight DKNG’s growing brand awareness along with improved operating scale, which have flowed into its increasingly rich adj EBITDA margins in the quarter (as discussed above).

This is significantly aided by Jackpocket’s accelerated monetization cadence, with the management expecting the acquisition to hit the “incremental $60 million to $100 million of incremental Adjusted EBITDA in fiscal year 2026,” one year early by 2025, with the “$100 million to $150 million of incremental Adjusted EBITDA in fiscal year 2028” likely to be brought forward.

Therefore, we are cautiously optimistic about DKNG’s H2’24 prospects, despite the mixed FQ2’24 performance and the near-term bottom-line dilution from its recent acquisitions.

So, Is DKNG Stock A Buy, Sell, or Hold?

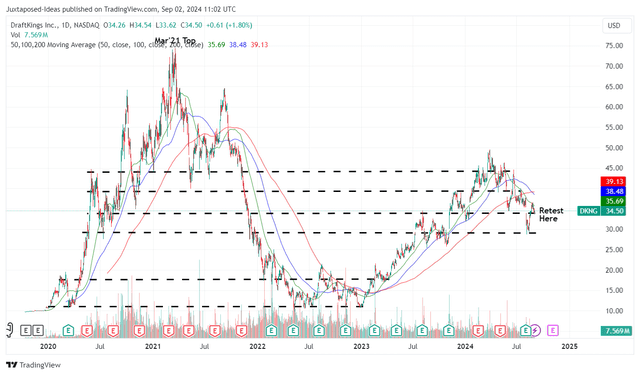

DKNG 5Y Stock Price

For now, DKNG has been charting lower lows and lower highs since the March 2024 peak, with it signaling reduced confidence in the management’s fluctuating forward guidance.

For context, we had offered a fair value estimate of $42.80 in our last article, based on the management’s FY2024 adj EBITDA per share guidance of $1.05 (+428.1% YoY) and FWD EV/ EBITDA valuations of 40.79x.

Based on the DKNG’s lowered FY2024 adj EBITDA per share guidance of $0.80 (+350% YoY) and the stable YTD FWD EV/ EBITDA valuations of ~40x, it appears that the stock is still trading near to our updated fair value estimates of $32.00.

Based on the reiterated FY2025 adj EBITDA per share guidance of $2.00 (+150% YoY), it seems that the recent correction has triggered an excellent doubling upside potential to our reiterated long-term price target of $85.60.

As a result of the improved margin of safety (thanks to the recent correction), we are reiterating our buy rating for the DKNG stock.

Risk Warning

Readers may want to pay attention to the stock’s near-term movement before adding, since it has been recording lower highs and lower lows since the March 2024 tops.

At the same time, with DKNG failing to move forward with its gaming tax surcharge in high tax rate states, investors may want to monitor its near-term execution since it remains uncertain how the management aims to offset the higher costs.

While it is entirely possible that they may follow in FLUT’s footsteps, we may see DKNG potentially lower their FY2025 adj EBITDA guidance in the upcoming earnings call, since the management has bet on this “additional upside potentially exists for adjusted EBITDA in 2025 and beyond from this gaming tax surcharge.”

With DKNG’s near term prospects uncertain, it goes without saying that the stock is only suitable for those with higher risk tolerance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.