Summary:

- DraftKings is one of our favorite stocks on the market. The company’s growth, margins, and expansion opportunities are all extremely robust.

- Despite this, the company is trading at only 3.9x sales, which is a discount to historical multiples as well as other companies with similar financial profiles.

- There are risks around consumer spending and the broader macro situation, but we see an upside of ~100% to Fair Value, which should outweigh those concerns.

- We re-iterate our ‘Strong Buy’ rating on DKNG.

blackCAT

In January of this year, we initiated coverage on DraftKings (NASDAQ:DKNG) with a ‘Strong Buy‘ rating.

This article was titled “DraftKings: A Strong Buy On Sticky Monetization Trends“, and in it, we talked about how much progress the company had made since coming public in 2020.

Growing gaming revenues, strong margins, and stable/falling customer acquisition costs meant, that in our mind, the company was close to profitability and could see a massive expansion in the stock price.

Since that article, things haven’t quite gone our way. In the interest of transparency, DKNG is down more than 10%, while the S&P 500 is up more than 14% – not great!

Here’s the thing, though – our fundamental thesis is still entirely intact. The company has continued to deliver, as evidenced by the two strong quarters put in between then and now, and revenues, expenses, and geographical expansion continue to move in the right direction.

The dip we’ve seen relative to the S&P 500 has been a result of multiple contractions – nothing more. While this could be perceived as a risk, we think that the case for DKNG is stronger than ever at this even more attractive price.

Today, we wanted to revisit DKNG, explain why we think the business is moving in the right direction, and talk about why we’re still very, very bullish on the stock.

Sound good?

Let’s dive in.

The DraftKings Thesis

In case you didn’t read our initial article, our bullish thesis on DKNG can be explained in five key bullet points, which we’ll touch on now:

- Expanding Markets – DKNG’s strong position in iGaming, Sportsbook, DFS, and Digital Lottery – along with an expanding geographical footprint in the U.S. for each of those offerings – should provide long-tail revenue drivers for the company going forward.

- Strong unit economics – DKNG makes solid gross margins (around 40%) on its gaming revenues as a result of economies of scale in payment processing and platform/tech costs. This has room to move even higher as the industry consolidates and promotional costs decrease, along with structural improvements to DKNG’s hold percentage. Plus, customers, once acquired, tend to stick around and gamble more.

- Stable/falling CAC – CAC costs should fall or stay in line as individual markets (states) mature and less promotion & marketing spend is required to win and retain customers.

- Brand – DKNG is one of the largest brands in the crowded online gaming space. This brand advantage allows the company to acquire more customers in new markets and retain them at higher rates for the same amount of advertising and promotional dollars spent. This is a virtuous cycle.

- Reasonable price – The stock, given the margins and growth potential, appeared cheap at 5.3x sales in January.

Taken together, you’ve got a dominant gaming/sportsbook company with a long growth runway, solid unit economics, and brand advantages, all trading at a reasonable price.

What’s not to like?

DKNG’s Valuation

As we mentioned at the start, the stock has underperformed, but that’s largely down to multiple contractions over the last 6 months or so.

When we rated DKNG a ‘Strong Buy’ initially, the stock was trading at roughly 5.3x sales.

Now, as things have progressed, the valuation has come back into less than 4x sales, which is towards the lower end of the company’s historical multiple:

While we see this as a gift in and of itself, when you compare this 3.9x sales multiple vs. other companies growing top line at 25%+ with 40%+ gross margins, it seems like an absolute steal:

Aside from Synchrony Financial (SYF) – a traditional bank – DKNG sports the lowest valuation out of any company in this category and around this size.

We could easily see DKNG’s multiple expanding back to – and settling around – 5-6x sales, which means significant upside just on a valuation basis going forward.

DKNG’s Recent Results

But what is a fair price for DKNG stock?

If recent results are to be believed, we’d argue that DKNG’s fair value, one year out, should be between $62 – $75 per share.

How did we get these numbers?

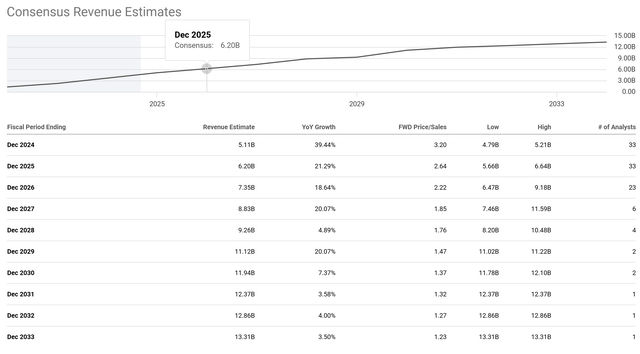

Well – we estimate that DKNG will probably produce somewhere close to ~$6 billion in revenue over the next 12 months.

This estimate is a bit above pace from analyst estimates, given that they’re projecting $6.2 billion by the end of next year:

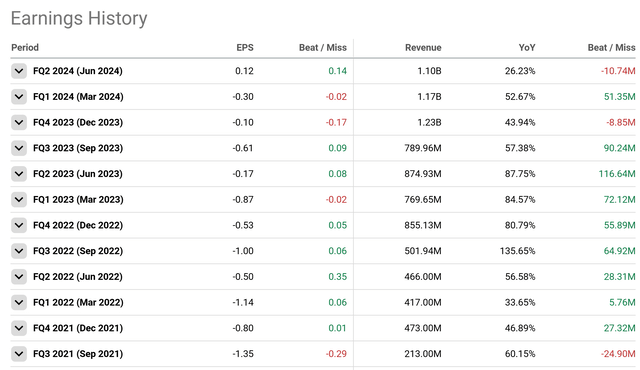

However, if you look at recent results, revenues recently breached the $1 billion/quarter mark, which we expect will continue to grow further:

With the NFL season starting Thursday, 9/5, and a number of other sports leagues getting underway into the fall season, we think betting volumes will increase substantially into year-end.

$6 billion also means roughly $1.5 billion per quarter over the next twelve months, which seems entirely achievable – especially for a company historically growing revenues at a 20%+ rate.

This gets us to $6 billion in revenue.

But how do we get the 5-6x multiple we mentioned in the previous section?

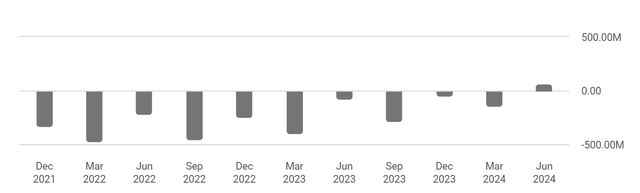

We’re really encouraged by the recent profitability shown by DKNG.

In Q2 of 2024, the company produced its first-ever positive net income figure, even in a slow summer season, and so we expect that as the remainder of the year heats up, this bottom-line profitability should accelerate:

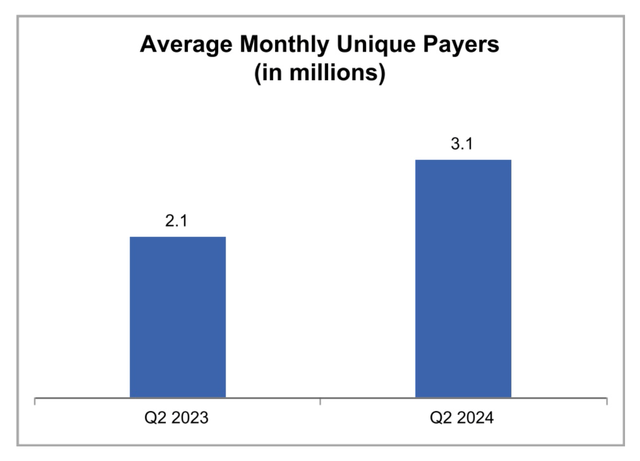

Not only that, but MUP continues to grow substantially as a result of the Jackpocket acquisition:

While this has dented ARPMUP, we think DKNG has the ability to cross-sell into the company’s other products, as well as deepen monetization. This should raise ARPMUP and boost sales.

Finally, DKNG’s hold percentages continue to trend higher, which is bullish for the company as it looks to turn volumes into revenues. Here’s what management had to say on the recent call:

Structural Sportsbook hold percentage improved year-over-year, which is in line with our expectations of approximately 10%. Adjusted gross margin for the second quarter was 43%, primarily due to better-than-expected customer acquisition and the corresponding promotional reinvestment.

Add up the user growth, profitability, and improving gross margin situation, and we think there’s room to re-expand the multiple to the 5-6x range.

Thus, if you input $6 billion in revenue with a 5-6x multiple, you end up with $30-36 billion in market cap.

Given the market cap right now is around $16.7 billion, that’s between 80% – 120% upside we see over the next year as things progress and management continues re-investing and executing.

One last thing; the board just instituted a share buy-back program as well, which underscores the value inherent in the shares at the moment.

To us, this is simply another vote of confidence that things are going in the right direction.

Risks

While we’re highly bullish on DKNG, there are some risks to be aware of.

First off, and perhaps most importantly, the industry is crowded and competitive. DKNG is under constant pressure to perform, and while the valuation isn’t demanding at the current price, it does reflect some of the fact that execution missteps could cost the company dearly going forward.

We don’t see that happening as the company has a solid track record of delivering winning gaming products, but it’s a possibility, nonetheless.

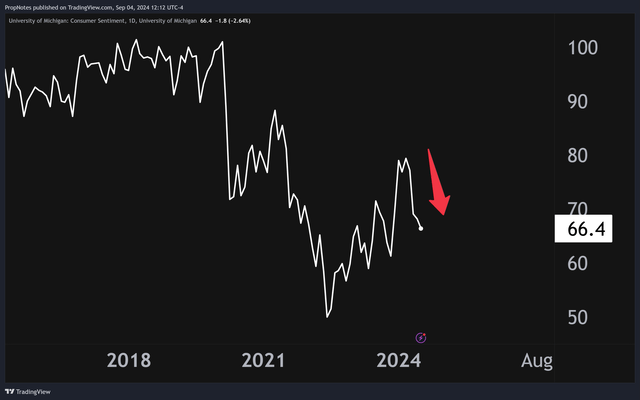

Otherwise, we see a key risk here around consumer sentiment:

Right now, consumer sentiment is weak, as the ‘r’ word (recession) has begun to get thrown around by financial pundits and the media. While some users will likely continue their habitual use of DKNG’s product, many may choose to save their money and bet lower volumes through the app.

This could be ameliorated through recent articles we’ve seen highlighting how sports betting is a favored pastime when household budgets are stressed, but net net we think this is a headwind.

If growth gets impacted, then the path to 100% growth in DKNG’s stock price is a lot harder to see, given that premiums typically don’t expand with revenue growth slowing.

Summary

While there are some dangers to investing in DKNG, like competition from other platforms, alongside a weakening consumer, we see a significant upside in the stock that more than outweighs the risks.

With a highly attractive valuation, more growth on the horizon, and a newly instituted buyback, we think DKNG is one of the best places you can invest your cash over the next twelve months, assuming the U.S. doesn’t plunge into a massive recession. If you’re convinced that will happen, then taking a wait-and-see approach might be best.

We re-iterate our ‘Strong Buy‘ rating on the stock.

Cheers!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DKNG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.