Summary:

- Since my previous buy rating, shares of Google have slumped due to regulatory concerns.

- The tech giant’s revenue and diluted EPS surged higher in Q2.

- Google’s net cash and marketable securities balance is nearly $100 billion.

- Shares are trading at a 25% discount to my fair value estimate.

- Google could be set up to deliver 60% cumulative total returns through 2026.

A shot of Google’s headquarters in Mountain View, California. JHVEPhoto

In the investing universe, there are hundreds of stocks that I consider to be worthwhile for further research/possibly owning. At any time, this means that there are dozens of grossly overvalued stocks, dozens more fairly valued stocks, and dozens more priced at bargains.

Occasionally, I’ll cover a stock in the former category and provide my fair value to give an idea of where I’d be buying. Since my focus as an analyst is to generate alpha, though, I tend to focus on those that fit into the latter two categories more often.

Google (NASDAQ:GOOGL)(GOOG) is one stock that I would argue qualifies for the bargain designation. When I last covered Google with a buy rating in June, I liked the consistency of its double beats. The prospects of continued improvements in YouTube Shorts monetization and continued momentum in Google Cloud were additional pluses. On the dividend front, Google’s starting payout ratio was low enough to give it a lengthy runway for future payout growth. Finally, the valuation was appealing enough to justify a buy rating.

Today, I’m upgrading Google to a strong buy rating. The company once again exceeded analysts’ expectations, posting a double beat. Cloud crossed two major milestones in the second quarter and has more room for growth. Google’s net cash position is monstrous. Lastly, the sell-off has made the value proposition too good to pass up.

Google Is Operationally Thriving

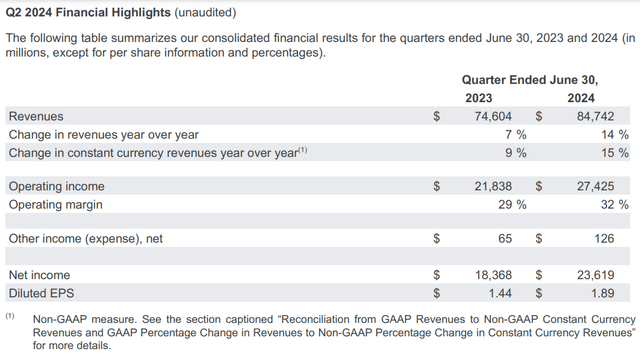

Google Q2 2024 Earnings Press Release

When Google released its second-quarter results on July 31st, it didn’t disappoint. The company’s total revenue climbed 13.6% higher year-over-year to $84.7 billion in the quarter. This was thanks to a 6% growth rate in paid clicks and a 7% improvement in cost-per-click. That revenue figure exceeded the Seeking Alpha analyst consensus for the quarter by $445 million.

Growth in every aspect of the business besides the Google Network (a 5.2% decline to $7.4 billion from reduced AdMob revenue) was to credit for this topline growth.

The bulk of the growth was driven by Google Search. Google Search’s revenue rose by 13.8% over the year-ago period to $48.5 billion during the second quarter. This was the result of advertiser spending growth, ad formats and delivery improvements, and mobile user adoption driving increased search queries.

YouTube ads revenue increased by 13% year-over-year to $8.7 billion in the second quarter. Increased advertising spending drove the growth of its direct-response advertising products.

Google subscriptions revenue rose by 14.4% over the year-ago period to $9.3 billion for the second quarter. Paid subscriber growth of services like YouTube TV and YouTube Music fueled this topline growth.

Lastly, Google Cloud’s revenue surged 28.8% year-over-year to $10.3 billion during the second quarter. Continued adoption of the Google Cloud Platform and Google Workspace offerings pushed quarterly revenue past $10 billion for the first time. Additionally, operating profit passed $1 billion for the first time per CEO Sundar Pichai’s opening remarks during the Q2 2024 Earnings Call.

Google’s diluted EPS soared 31.3% over the year-ago period to $1.89 in the second quarter. This came in at $0.04 ahead of Seeking Alpha’s analyst consensus for the period. As a result of disciplined cost management, the company’s total costs only increased by 8.6% year-over-year to $57.3 billion during the quarter.

This helped Google’s net profit margin expand by over 220 basis points to 27.9% in the second quarter. That is how diluted EPS growth outpaced revenue growth for the quarter.

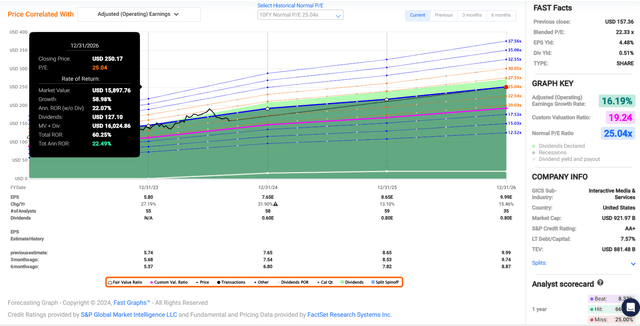

For 2024, the FAST Graphs analyst consensus for diluted EPS is in line with recent growth. The figure of $7.65 would represent a 31.9% growth rate over the 2023 base of $5.80.

In the years ahead, the growth outlook remains firmly in the double-digits. For 2025, diluted EPS is expected to rise by 13.1% to $8.65. In 2026, another 15.5% growth in diluted EPS to $9.99 is currently being projected.

Chief Business Officer Philipp Schindler noted in his opening remarks that YouTube Shorts monetization improved again in the second quarter. Since this was just launched in the fourth quarter of last year, it’s reasonable to expect that improvements will continue in the quarters ahead. That can help to drive growth for Google beyond this year.

Another factor that bodes well for the company is continued Cloud growth. As I outlined in my prior article, the majority of Gen AI startups and Gen AI unicorns are Google Cloud customers. So, startups and established businesses alike are turning to Google Cloud. This should only continue in the quarters ahead and be a growth tailwind for Google.

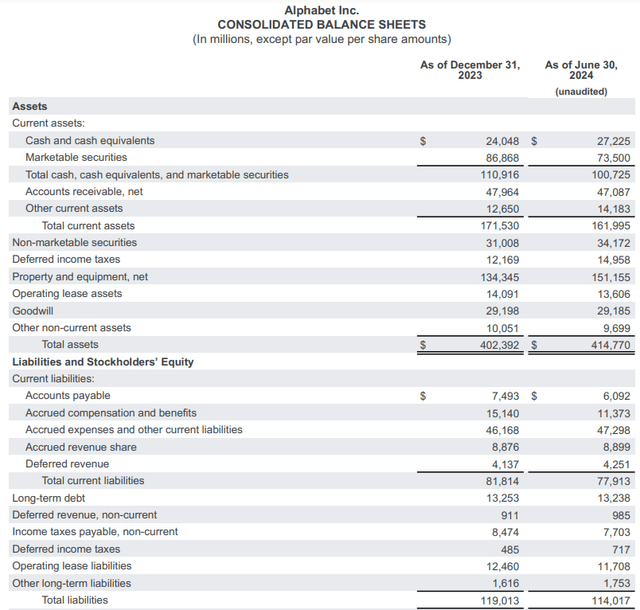

Google Q2 2024 Earnings Press Release

Turning my attention to Google’s balance sheet, the company’s financial health is immaculate. As of June 30, it carried a net cash and cash equivalents and marketable securities balance of $97.7 billion. This sizable net cash position coupled with Google’s immense free cash flow is the basis for the AA+ credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to Google’s Q2 2024 Earnings Press Release and Google’s Q2 2024 10-Q Filing).

Fair Value Is Approaching $210 A Share

Less favorable market sentiment toward Google has led shares 15% lower since my previous article. By comparison, the S&P 500 index (SP500) was flat.

This correction has pushed Google’s current-year P/E ratio to just 20.5. That’s considerably less than the 10-year average P/E ratio of 25 per FAST Graphs.

Such a valuation would lead one to believe that Google’s fundamentals have materially weakened. This doesn’t appear to be the case, however. The company’s annual forward diluted EPS growth outlook of 16.2% is about the same as the 10-year average of 18.5%.

For my money, this supports the case that a reasonable fair value multiple remains around 25.

The calendar year 2024 is going to be 69% behind us in just a few days. This means that the vast majority (69%) of my diluted EPS input is being influenced by 2025 FAST Graphs analyst estimates. The remaining 31% is impacted by the 2024 FAST Graphs analyst consensus. That produces a forward 12-month diluted EPS input of $8.34.

Keep in mind from my prior articles that Google usually beats the analyst consensus, so this could even be slightly conservative.

Applying a valuation multiple of 25 to this diluted EPS input, I get a fair value of $209 a share. Compared to the current $156 share price, this equates to a 25% discount to fair value. If Google reverts to fair value and matches the growth consensus, it could post 60% cumulative total returns by the end of 2026.

Outsized Dividend Growth Is On The Way

The Dividend Kings’ Zen Research Terminal

Google’s 0.5% dividend yield is so modest that many people may write it off altogether. Since everybody has different investing timeframes and objectives, that’s fine. For me, though, Google is one of the most obvious buys on the market right now for my compounding-oriented investing goals.

If the double-digit annual diluted EPS growth itself wasn’t convincing enough, the company has another trick up its sleeve: A very low starting payout ratio. Applying a full year of its current dividend to 2024 (the dividend began to be paid in Q2), Google’s payout ratio would be just under 11%.

For context, that’s a fraction of the 60% EPS payout ratio that rating agencies like to see from the industry per The Dividend Kings’ Zen Research Terminal.

Even with Google nearly doubling capex in the six months ended 2024 to make AI investments (versus 2023), it generated $30.3 billion in free cash flow. Had the same dividend been paid in Q1, this would have been a free cash flow payout ratio of approximately 16%.

These are payout ratios that could easily allow for the company to remain aggressive with capex, share buybacks ($31.4 billion in H1 2024), and dividend raises. That’s why I continue to think that 15% to 20% annual dividend growth will be the norm for the foreseeable future.

Google hasn’t made any dividend boosts official yet. My best guess as to when this will happen is late next April. This would represent the fifth quarterly dividend announced by Google. As is customary, high-quality dividend growth stocks tend to announce a dividend hike after the same dividend amount for four consecutive announcements.

Risks To Consider

Google is a world-class business, but there are risk factors that could present threats to the long-term investment thesis.

Last month, Google lost its antitrust lawsuit to the U.S. Department of Justice over search. At issue is the $26 billion annually that the company paid to Apple, Samsung, and the like for the default search engine to be Google on smartphones.

The government is arguing that these payments stymied competition by limiting competitors from building up their search engines enough to be competitive. Google maintains that it’s the best search engine and that default search engine placement is merely the result of its superiority in the marketplace.

The company plans to appeal this decision. It will be worth watching the outcome of this case. But with Google’s valuation currently trading two standard deviations below its 10-year average, I firmly believe even a worst-case outcome is already priced into the stock.

Another risk to the company that I previously noted was the majority voting power of its founding duo, Larry Page and Sergey Brin. An investment in Google ultimately remains a bet that the vision of these two and Sundar Pichai’s leadership will lead the company into an equally bright future. If that doesn’t happen, Google’s fundamentals could be adversely impacted.

Summary: A No-Brainer Priority For My Portfolio

After boosting my position in Google by 15% earlier today, the company now accounts for 2.5% of my portfolio. Behind Broadcom’s (AVGO) 4.3% weight, it is my portfolio’s second-biggest holding.

This is still underweight versus the 3.7% weighting in the S&P 500. But I’m planning to boost this position further in the weeks and months ahead. The company’s growth prospects remain admirable. Google’s balance sheet is immensely impressive. The cherry on top is that shares are priced at a bargain valuation. That’s why I’m upgrading Google to a strong buy for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.