Summary:

- Roku’s stock is perceived as undervalued due to its previous higher valuation and its substantial cash reserves, comprising 20% of its market cap.

- The company’s debt-free status and significant cash position provide strategic options, but only if the cash is wisely deployed for solid returns.

- Despite the potential for a strong EBITDA, Roku’s valuation at 48x this year’s EBITDA is not compelling given the intense competition in the TV streaming industry.

- Overall, Roku’s competitive landscape and valuation concerns make it an unattractive investment, even with its cash reserves.

hapabapa

Investment Thesis

I believe that the bulk of Roku’s (NASDAQ:ROKU) investment thesis can be summed up as two considerations. At one point, the stock was higher, therefore many investors believe it now to be undervalued. Also, close to 20% of its market cap is made up of cash. That’s as far as the bull case goes in my opinion.

Meanwhile, investors have to come up against the thorny issue, that the business isn’t priced cheaply. Particularly when we consider that its growth rates are meek.

Altogether, I believe that investors would do well to look elsewhere for more compelling bargain opportunities.

Rapid Recap

Back in July, I said,

[…] Until there’s a clear sense of what Roku’s go-forward revenue growth rates will stabilize at, it doesn’t make sense to pay 40x forward EBITDA for Roku.

Author’s work on ROKU

In hindsight, it turns out that in July I made the right call by not doubling down on my mistake of being bullish last year on Roku.

Now, looking ahead, I remain firmly neutral on this stock.

Roku’s Near-Term Prospects

Roku is a streaming platform that offers both hardware (like streaming players and Roku-branded TVs) and software services. At the core of its business is the Roku Home Screen, where over 120 million people in the U.S. enjoy a TV streaming experience. Roku provides access to a variety of streaming apps and channels, generating revenue from advertising for the most part, and through subscriptions to its platform.

Next, Roku’s near-term prospects are promising as it continues to grow its user base, with 83.6 million streaming households and a 14% y/y increase in platform revenue. The company is focusing on enhancing its monetization efforts, such as maximizing ad demand, leveraging its Home Screen, and increasing Roku-billed subscriptions. With operational improvements, Roku expects to further grow its platform revenue, striving to improve its revenue growth rates by the end of 2024.

And yet, Roku also faces challenges, particularly in the Media & Entertainment sector, which has been challenging for Roku. Additionally, the broader advertising market is dealing with supply challenges and competitive pricing pressures.

Given this balanced background, let’s now discuss its fundamentals.

Roku’s Growth Rates Are Stable

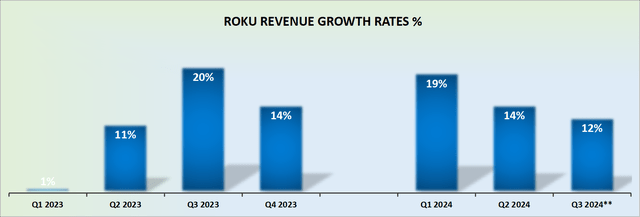

There’s good news and bad news when it comes to Roku’s growth rates. In the first instance, we have to acknowledge that Roku’s Q3 2024 guidance is rather strong, particularly when compared with Q3 of the prior year, which was the toughest comparable quarter of the prior year. By this, I mean that growing at solid double-digits, or 12% y/y as its guidance implies, is a tough feat to accomplish, particularly when last year’s growth rates were up 20% y/y.

However, the question that looms large in my mind is this, how much of this upcoming quarter’s growth is tied up to the US elections?

Recall, during the US elections advertising premiums across most advertising platforms increases, as there’s a lot more advertising spend seeking to reach the same number of eyeballs.

Indeed, during a US election period, advertising pricing generally increases due to heightened demand from political campaigns vying for airtime and digital space to reach voters. This surge in demand reduces available inventory, driving up prices for all advertisers competing for the same platforms.

And once this period passes, will Roku’s growth rates moderate down to low double digits or perhaps even high single digits?

And if that were to happen, are investors still going to view Roku as a disruptive tech business? I am not sure how this unfolds, but given its high valuation, this is not an investment that I’m willing to make.

ROKU Stock Valuation — 48x This Year’s EBITDA

The cornerstone of the bull case is that Roku is a debt-free business, with approximately 20% of its market cap made up of cash. This provides Roku with substantial options. Indeed, with this much cash on its balance sheet, it supports the business’s intrinsic value and for the most part, provides a floor for its shares not to significantly sell-off further.

On the one hand, this allows Roku to make a large, needle-moving acquisition and opens up opportunities for the business.

However, on the other side, we must think about this. This cash sum only carries its value if, and only if, Roku can wisely deploy it to generate a solid return on investment. Otherwise, this cash isn’t all that significant, if it ends up being used inappropriately, for example, simply to repurchase its shares.

After all, let’s say that Roku has a very strong second half of 2024, so its overall EBITDA this year reaches $200 million. This would still leave Roku priced at 48x this year’s EBITDA.

I don’t find this valuation as providing investors with a compelling enough risk-reward on several fronts. The big question mark is the most obvious consideration. Can Roku’s reignite its growth rates in the face of intense competition in the TV streaming industry?

Roku has many competitors, for instance, Amazon (AMZN), Apple (AAPL), and Google (GOOG)(GOOGL), which can offer bundled streaming devices. On top of that, other TV brands can also provide their own streaming platforms or one is able to stream their Netflix (NFLX) package or similar packages, which limits Roku’s ability to attract users, and thereby hamper its pricing power on its adverts.

To sum it up to this stock, putting aside the contentious issue of the cash on its balance sheet, there’s not enough here to compel me towards this stock.

The Bottom Line

I believe that while Roku has some promising aspects, such as its large user base and cash reserves, the overall risk-reward profile isn’t compelling enough for me.

Primarily, the company’s growth rates seem uncertain, especially in the face of competition from tech giants and challenges in the Media & Entertainment sector. With its high valuation and no clear path to significantly accelerating growth, I think there are better opportunities available elsewhere.

In short, Roku’s future may not be as smooth as it appears-it’s time to change the channel.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.