Summary:

- The semiconductor sector’s volatility presents a prime opportunity to invest in TSMC, a crucial player in AI chip manufacturing, with strong future growth potential.

- TSMC’s global expansion and diversification efforts, including new fabs in Arizona, Japan, and Germany, position it to mitigate risks and capitalize on AI demand.

- Despite anticipated AI demand fluctuations, TSMC’s strategic price hikes and diversified offerings ensure long-term revenue stability and growth, supported by the CHIPS Act.

- Short-term risks include market volatility, potential AI slump, geopolitical tensions, and recession fears, but TSMC’s promising roadmap and undervaluation make it a strong buy.

JohnnyGreig

Introduction

The recent volatility in the semiconductor sector is a blessing for people like me who are looking to add one of the most important companies in the industry to their portfolios and maybe thought it may have been too late, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM). I will go through some of the biggest catalysts that will help the company reach its potential in the next few years, as I believe the company is still flying under the radar of many investors and is underappreciated. The company is a pickaxe merchant of the modern gold rush, which is AI.

Since the last time I covered TSM, the volatility brought down its valuation to around 15%, which means the company is even more enticing than it was then. I discussed why the company’s price surged so much, and in this article, I will hammer down further why TSM is a really good play in the long term.

It Is All About AI For Now

Without AI, companies like NVIDIA Corporation (NVDA) would have been very little known in the broader sense. Jensen Huang would have been relatively unknown. A CEO of a graphics card company that saw some sort of press before AI as the go-to for bitcoin mining. Before AI and bitcoin mining, the company was known among the gaming enthusiasts who were building their PC rigs to be able to run Crysis with somewhat of a decent frame rate. All of that has changed in just a short couple of years. The company’s been working hard on its chips that fueled the AI revolution, the modern gold rush so to speak, and certainly many benefited, especially NVDA.

But without TSMC, and its expertise in manufacturing the specific designs of NVDA’s chips, I am having a hard time imagining what that world would look like. If there was no TSMC, would Intel Corporation (INTC) have been the choice for the chip manufacturing process? There has been a lot of talk lately surrounding the demand for AI chips. Some analysts are saying that the demand is going to soften over the next while, which will hurt NVDA, and therefore TSMC’s numbers over the next few quarters. So, is that it? The AI revolution is over? Back in July, TSMC reported what I consider to be great results, compared to the previous quarters where top-line growth couldn’t even reach +10%, or was even in the negatives, a 33% increase y/y for the latest quarter is quite a turnaround, which reflects the demand for AI chips is alive and well. Additionally, the company went ahead and boosted its outlook because of the strong demand for AI. I was surprised we didn’t see a decent pop on the day, but because of frothy markets at that time, people were cautious. For July, it was reported that TSMC’s sales were up 45%, which shows further acceleration is in place.

And the darling of AI, NVDA, reported last week its quarter results that topped estimates, and very comfortably might I add, says that “Hopper demand remains strong, and the anticipation for Blackwell is incredible”. NVDA did dip on the day, but I don’t know what people were expecting the company to do. NVDA is priced to perfection so, the only way it would have skyrocketed it beat estimates by an even larger margin.

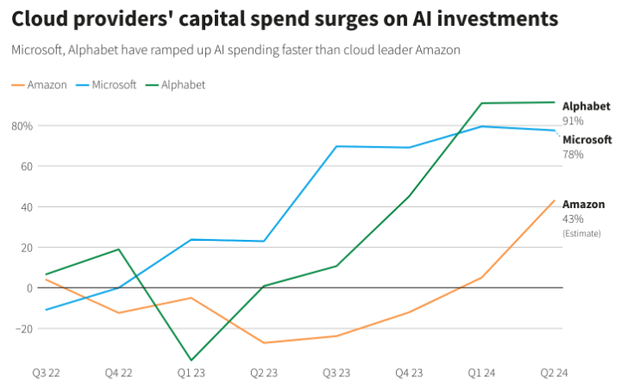

Furthermore, big tech companies are not considering cutting R&D spending on AI, and a recent survey shows that many companies (90% of surveyed) are considering boosting AI-related R&D and CapEx in 2025. Just look at the graph below of the juggernauts of the tech industry and how their CapEx has progressed in the last couple of years, thanks to increased investments in AI.

So, tell me, where is the slowdown?

Fab Expansion and Diversification Efforts

Now, to meet such a demand in AI, TSMC is expanding its presence across the globe. three fabs are being built in Arizona to support the demand and to solidify its leadership in the semiconductor industry. The last of the fabs will incorporate the latest 3nm and 2nm technology and will start production in 2028. I think it is safe to say that TSMC will continue to benefit from the grants and subsidies of the CHIPS Act, just as will Intel, but seeing that TSMC has the most advanced technology out there, the US will certainly want to have such capacity on their soil, away from the hands of China.

TSMC is not stopping there, with the massive funds it has available at its disposal, it is looking for further opportunities for expansion outside of Taiwan and the US. The company is taking advantage of the European Chips Act too. The company’s recent venture with Robert Bosch, NXP Semiconductors N.V. (NXPI), and Infineon Technologies, of which TSMC owns 70%, received €5B German aid for the chip plant in the city of Dresden, Germany. The plant is not going to be built for AI demand, but that just helps the company diversify its offerings further for when the AI demand does start to soften. This plant will start operating sometime in 2029, so don’t expect revenues any time soon. This opens up further investments under the European Chips Act in other regions in the EU, and I wouldn’t rule it out.

The fabs in Japan are another key strategy for diversifying away from Taiwan and solidifying its presence across the globe, which should ease the fears of a Chinese invasion of the island. The company expects to ship logic chips for camera sensors and automotive by the end of this year. This further diversifies away from risks of slowing down AI in the future, which I am sure is inevitable at some point.

Price Hikes Finally Confirmed

I’ve been thinking for many months why hasn’t TSMC leveraged its position with all of these AI pioneers a bit more. The company, in my opinion, has all the leverage in the world when it comes to hiking prices. It has the technology that makes NVDA billions of dollars every quarter. So, when the company finally hinted at possible price increases shortly, I was hopeful, however, now that it was finally confirmed to happen in 2025, I feel they missed out on a much larger opportunity. A 3% to 8% hike is nowhere near enough in my opinion. The management team is too nice and didn’t want to step on anyone’s toes by the looks of it but when you hold so much power, why not be greedy just like the rest of the AI players? At least maybe this way, the company will continue to hike prices every year now, and eventually, it will end up being a decent boost to its revenues. I’m sure that is the case going forward. And how will NVDA cope with this minuscule increase in production prices? Will probably pass them on to the big tech companies while they continue to increase their CapEx spend. The increase will go straight into improving the company’s margins.

In summary, the runway for a company to continue to perform well is very long. A lot of the company’s projects will not be in operation for at least another 3 to 5 years, so I am confident in holding the company for the long run. The strong demand for AI is still there, however, enjoy it while it lasts because we don’t know when things are going to shift, but I am confident in TSMC’s diversified offerings, so even if AI dries out, it will not lose a lot of its revenues in the long term.

Risks to the Thesis

Of course, there are things to worry about in the short run that will affect the company’s valuation.

Firstly, the semiconductor market volatility and frothy valuations do not paint a good picture. Even if I think TSMC is undervalued compared to many other semiconductor companies, that doesn’t mean its share price is not going to be affected. NVDA will have to do miracles over the next year or so to justify its almost $3T market capitalization. That is one tall order in my opinion. Any meaningful weakness over the next few quarters or the beat wasn’t large enough, will send the company’s shares down, just like it did last week. There was a time when semiconductor stocks were in a negative sentiment. Just one year ago, no one liked them and TSMC was trading at around 12 P/E ratio. That was a no-brainer buy in my opinion. Now that its PE ratio about doubled, it is not as cheap as it was, but I believe the outlook is very positive and the TTM P/E ratio of 25 is decent.

Secondly, which is more of a long-term risk, the slump in AI is going to come, there is no doubt about it. The big tech companies will start to ease up on CapEx spending eventually. Especially if all of that capital injected into AI does not yield any revenues or improve their bottom line meaningfully. The big risk here is that all this money spent will amount to nothing basically. The missing revenue is a real risk.

Lastly, the obligatory geopolitical risks are still there. The most recent quarterly report showed that the company gets 16% of its sales from China, which is the highest in a long while. This will deter many investors who are not fans of such risks and want nothing to do with China. Further restrictions on China may affect TSMC’s top line, but in my opinion, even with such a percentage coming from China, not all of that revenue will be lost. Especially with the diversification efforts the company has been achieving, the China risk should diminish meaningfully over the next couple of years.

There has been a lot of talk lately of a recession hitting very soon. History may not repeat itself but when the FED pivots, the markets tend to do poorly for the next year or so. With massive revisions to the employment data flowing in, the highest we have seen since ’09, it is hard to not draw comparisons. Would you be very surprised if a year from now, we found out we were in a recession already? I wouldn’t be.

Closing Comments

These are the reasons to keep calm in such turbulent times and continue to hold and buy more on meaningful dips just like we saw recently. The company’s roadmap looks very promising, which solidifies my long-term outlook. I still believe that many investors do not recognize the company’s true potential and how central it is to many technologies out there, not just AI, which is front and center as of right now. AI came, and it will probably eventually be replaced by another advanced technology, if TSMC is to remain the key leader in the industry, it will most likely be selling the pickaxes for the next modern gold revolution and reap the rewards for decades to come.

My fair value PT of $222 a share still stands, and I will not be selling once it is reached. I am sticking to the same valuation because the recent quarter didn’t affect my already conservative estimates. With a price decline, we are looking at a 37% upside to the fair price Why would I sell a company that continues to improve over time?

In the short term, I could see the share price continue to come down, especially if the global economy is going to fall into a recession soon, but I will be ready for it with arms open and plenty of dry powder to take advantage of.

The volatility in the markets will probably present even better opportunities for entry in the long run, but I will continue to average down until something drastic changes in the company’s operations, but for now, the company remains a strong buy in my opinion.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.