Summary:

- Boeing approaches key resistance levels, indicating potential upside, with bullish momentum possible upon breaking through.

- China’s long-term aviation growth presents a massive opportunity for Boeing, with a projected doubling of the commercial fleet by 2043.

- New plane demand highlights growth, with fleet expansion and replacements driving market potential for Boeing.

- Boeing’s positioning in China’s aviation growth opens doors to increased service and maintenance opportunities.

- EL AL’s historic order of 737 MAX jets reinforces Boeing’s market strength in fuel-efficient aircraft and environmental compliance.

sanfel

Investment Thesis

The Boeing Company’s (NYSE:BA) bullish outlook is supported by its $437 billion backlog and the ramp-up production rate. Even though Boeing has had severe setbacks recently, the company is poised for long-term growth thanks to fuel-efficient aircraft demand for the 737 MAX and 787 Dreamliner and fleet modernization, especially in high-growth markets, including China.

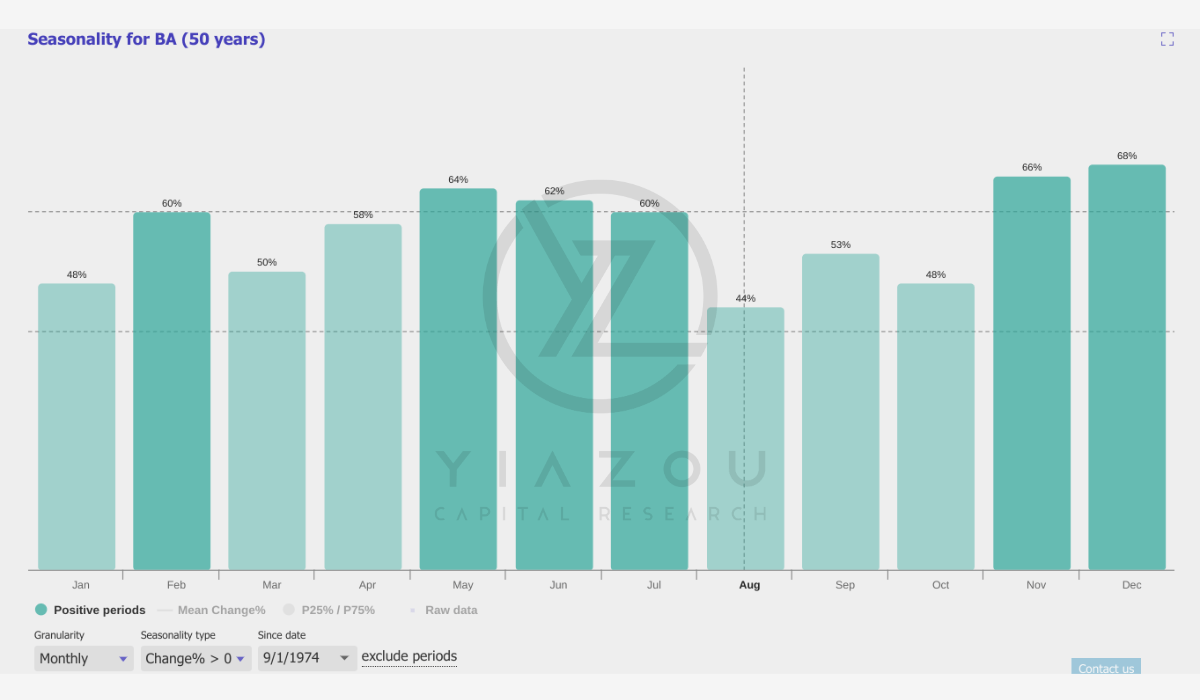

With its strong fundamentals, solid defense and services portfolio, and growing global marketplace, Boeing has upside potential from current levels. More conservative investors may want to wait for more attractive risk/reward entry points, as illustrated by an RSI reading below 30.

Boeing’s $200 Price Target: Moderate Bullish Trends and Cautious Indicators

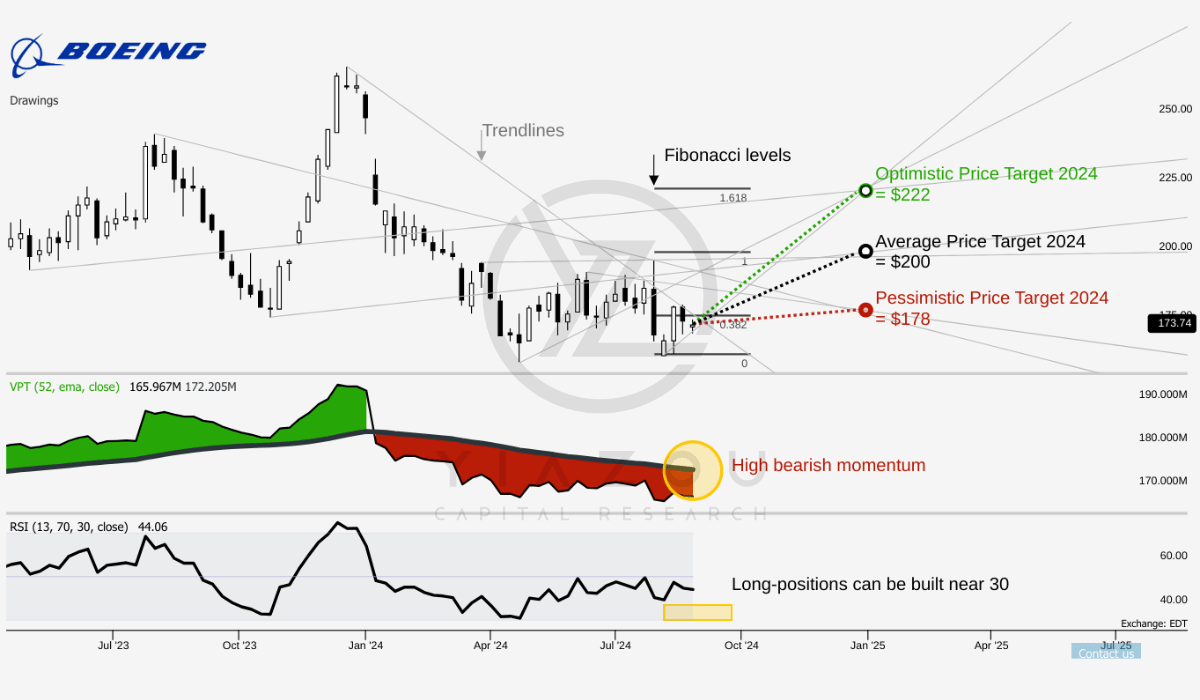

BA currently trades at $163; the average 2024 price target is $200. This aligns with the 1.0 Fibonacci retracement level, suggesting moderate bullish expectations. The optimistic target is $222, corresponding to the 1.618 Fibonacci level. If the stock breaks current resistance, there is potential for significant upside. The pessimistic target is $178.00, linked to the 0.382 Fibonacci level, indicating minimal upward movement and limited downside risk.

The RSI is 44.06, which shows the stock is neither overbought nor oversold with no clear bullish or bearish divergence. The RSI trend is sideways but may revert downwards, suggesting a potential weakening in momentum. Predicting short-term movement is challenging due to weak RSI signals.

Lastly, the Volume Price Trend (“VPT”) line is moving sideways and trending downwards, indicating a possible decrease in buying pressure. The VPT line is at 165.97 million, below its moving average of 172.20 million, which could be a bearish signal if the trend continues.

Yiazou (trendspider.com)

Based on 50 years of data, the seasonality analysis for BA shows a 53% chance of positive returns in September. While this is slightly above the 50% threshold, it suggests a relatively neutral performance historically for the month. Investors should remain cautious as the probability of gains is moderate compared to stronger months like November (66%) and December (68%). September offers a balanced but not overly favorable outlook based on past trends.

Yiazou (trendspider.com)

Boeing’s $780B Opportunity: China’s Aviation Boom and Major 737 MAX Orders

Boeing’s 2024 Commercial Market Outlook for China indicates the company’s top-line growth potency. This is based on predictions that China’s commercial fleet will be 2X by 2043. This growth now positions China as the world’s largest traffic market. Air travel within China may grow 5.2% annually, surpassing the global average passenger traffic growth of 4.7%. This fleet expansion will occur at an annual rate of 4.1% and expand from 4,345 to 9,740 airplanes. Hence, the increased fleet size and passenger volume represent a major opportunity for Boeing.

Specifically, the demand for 8,830 new planes in the next 20 years led to massive market potential for Boeing. Of these planes, 60% will support fleet growth, and 40% will replace older jets. This demand includes 6,720 single-aisle, 1,575 wide body airplanes, and 170 freighters, leading to a diverse demand across various aircraft types. Boeing’s focus on fuel-efficient models aligns with global sustainability trends, and its advancements related to the 737 MAX and 787 Dreamliner provide the company with an edge.

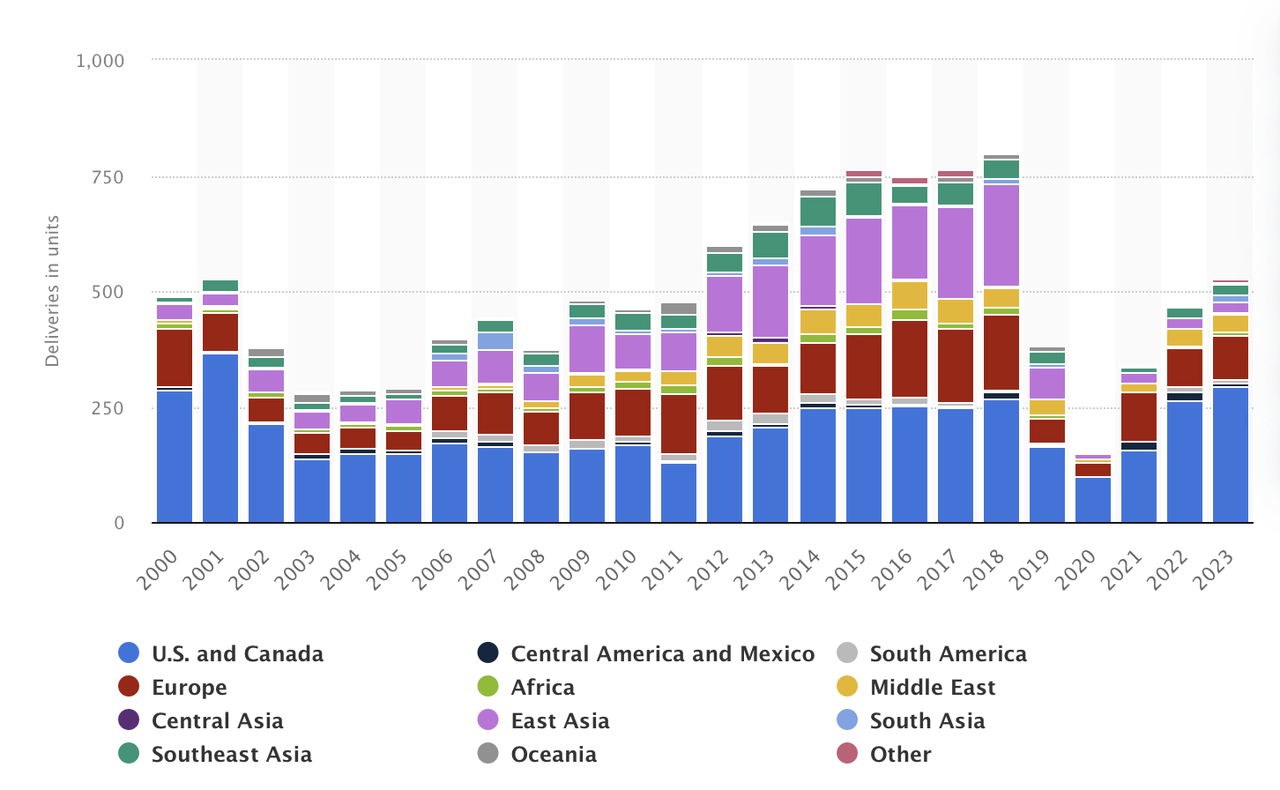

As of Q2, 90 737-8 aircraft in inventory were produced before 2023, including 65 aircraft for China-based clients, which reflects the region’s significance. Over the long term, East Asia (China, South Korea, and Japan) had a solid fraction in delivery numbers (in the mid-2010s). This trend can materialize (repeat) in the mid-to-long term.

Moreover, China’s aviation market growth will drive demand for services valued at $780 billion. Nearly 430,000 new personnel will be needed, including pilots and maintenance technicians. This demand presents Boeing with an opportunity to expand in the services sector. Boeing’s long-standing relationship with China positions it as a key player. Hence, the company can leverage its expertise in training and maintenance to support the growing fleet.

Besides, the Israeli EL AL Israel Airlines signed a firm order for up to 31 Boeing 737 MAX aircraft, aiming at refreshing its fleet. It will be the largest aircraft order in the airline’s 76-year history. In this case, 737 MAX is chosen for fuel efficiency and lower emissions ground, reducing fuel consumption and emissions by 20% compared to older models. The aircraft also has a 50% smaller noise footprint, and these features align with EL AL’s goal of improving environmental performance. This is essential as environmental regulations tighten and airlines face pressure to cut carbon emissions.

This order highlights Boeing’s engineering capabilities, as the 737 MAX’s efficiency and low noise levels offer compelling value. Regarding longevity, Boeing’s long-term relationship with EL AL (over seven decades) points to its ability to build lasting partnerships. The 737 MAX order and EL AL’s earlier purchase of 787 Dreamliners boost Boeing’s position in the Middle East market.

Financially, the EL AL order represents more than immediate revenue, ensuring a steady income stream and market influence for years. As EL AL continues to modernize its fleet with Boeing aircraft, it reinforces Boeing’s market dominance. Boeing’s ability to secure significant orders in a competitive market highlights its strength. This order enhances Boeing’s top-line stability and market share, mostly in competitive regions with the capacity to meet the diverse needs of global airlines.

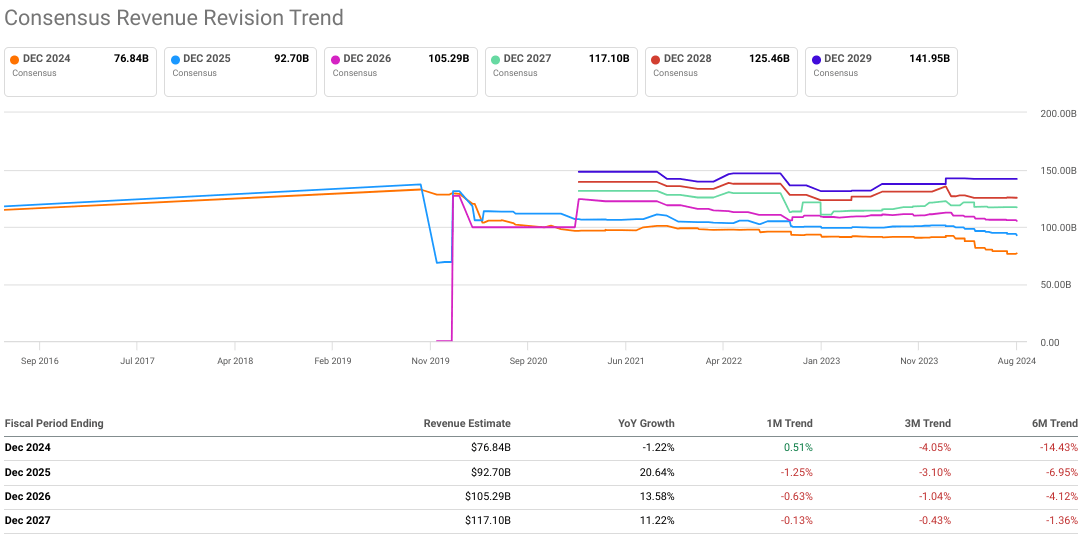

Finally, these positive developments are not yet reflected in analysts’ estimates, as observed in the current downside revision trends. This creates an advantage for the stock as the news was released recently, and the street estimates are not quantified.

seekingalpha.com

Boeing’s $437B Backlog Secures Future Amid Q2 Challenges and Strategic Moves

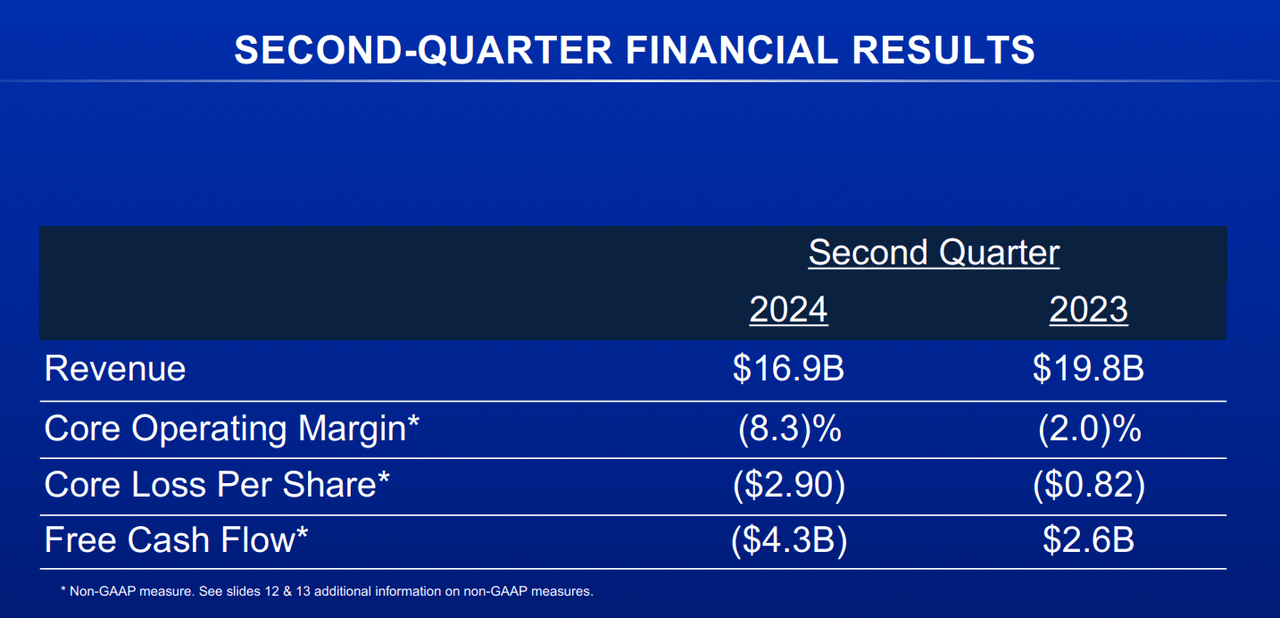

Boeing’s Q2 2024 earnings report shows financial resilience despite ongoing challenges. The company reported $16.9 billion in revenue, reflecting lower commercial delivery volumes. However, Boeing maintains a substantial backlog of $437 billion, including more than 5,400 airplanes, a key indicator of future revenue streams. This backlog ensures Boeing’s long-term financial stability. The quarter ended with a loss per share of $2.90 with a massive down-turn on free cash flow (to -$4.3 billion from $2.6 billion in Q2 2023). This loss was due to lower commercial deliveries and defense program losses.

Despite this, Boeing’s focus on increasing production and stabilizing operations is promising. The company has worked to stabilize its supply chain, which is particularly important following the January accident. Slowing down production and controlling traveled work have helped. The supply chain has caught up, improving quality and delivery stability. Employee proficiency, notice of escapes, supplier shortages, and rework hours have improved. Transferring the Renton fuselage inspection process to Wichita helped reduce defects. Increased on-site Boeing inspectors also contributed to fewer defects and improved flow times.

Further, Boeing’s planned acquisition of Spirit AeroSystems is a strategic move as this $4.7 billion all-stock transaction is valued at approximately $8.3 billion. The acquisition is expected to close by mid-2025, and bringing critical manufacturing work in-house is a major goal. This aims to enhance manufacturing capabilities and unify safety and quality systems. The acquisition aligns Boeing’s operations with strategic priorities that support supply chain stability and integrate manufacturing and engineering workforces.

In the long term, its fortunes in the defense industry could cure Boeing’s financial ills. Boeing Global Services (“BGS”) shone bright, posting a revenue of $4.9 billion in Q2 2024, up 3% year over year (“YoY”). BGS secured significant contracts, including Apache performance-based logistics from the US Army. FliteDeck Pro service contracts with major airlines also highlight its success. Therefore, BGS’s continued strength demonstrates its growth potential, as revenue has grown 3% YoY.

Boeing’s Growth Faces Risks from China, 737 MAX, and Defense Programs

Boeing’s growth strategy faces significant challenges. The company heavily relies on China for projected growth. Boeing could see lower sales if China’s market faces geopolitical or economic issues. Hence, the slower economic growth in China could reduce demand for new aircraft and impact Boeing’s delivery targets.

Moreover, Boeing projects that single-aisle planes will dominate deliveries, with 1,575 wide body planes needed. This diversification poses production and supply chain challenges. Managing high production volumes of single-aisle planes while handling wide body planes could strain resources. Delays or quality issues may lead to missed deadlines and higher costs.

Additionally, EL AL Israel Airlines’ recent order of up to 31 Boeing 737 MAX jets is significant. However, this partnership could face challenges. Boeing’s dependence on the 737 MAX for fuel efficiency and performance is risky. The 737 MAX is designed to reduce fuel use and emissions by 20%. Yet, past technical issues, including fatal crashes, could resurface. Such issues might damage customer confidence and lead to order cancellations.

Finally, Boeing’s fixed-price defense development programs also pose risks. These contracts set a fixed price for development and delivery, regardless of cost overruns. In Q2 2024, Boeing reported a $1 billion loss on such contracts. These losses affect Boeing’s profitability and resource allocation, including contracts related to the T-7A, VC-25B, and commercial crew programs.

Boeing’s Key Risk Factors: Manufacturing Setbacks and Regulatory Pressure

Boeing still has many manufacturing risks, mainly related to its 737 MAX and 787 Dreamliner models. Although new processes have been implemented, such as better worker training and oversight of suppliers such as Spirit AeroSystems, the company has made some progress in mitigating safety and quality concerns. The problems have prompted the Federal Aviation Administration (“FAA”) to cap the production of the 737 MAX aircraft as the agency continues heavy oversight, inspecting each plane before it leaves the assembly line. Hence, there has been an ongoing scrutiny of manufacturing issues, showing that only some problems are fully fixed and may disrupt production and delivery schedules.

Past incidents, including fatal crashes tied to the 737 MAX, have left Boeing with a bruise on its reputation, leading to criminal investigations and increased regulatory scrutiny. Even a whisper of added safety flaws might hurt the stock, as trusting the firm is still fragile. Besides, government interventions may prolong FAA audits or put restrictions that further delay Boeing’s complete recovery and dampen the company’s responsiveness to market demands. These considerations create potential risks for investors due to future setbacks that will surely decrease the performance of the company’s stock.

Takeaway

With the Boeing backlog hovering at $437 billion and increasing, coupled with robust demand for fuel-efficient aircraft such as the 737 MAX and the 787 Dreamliner, the company should achieve growth in the long term. With all of Boeing’s challenges lately, the company speaks about nothing but production stabilization. Upside potential appears great because market positions dominate every critical region, especially China.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.