Summary:

- Dell’s stock has declined since my last write-up due to margin concerns on AI servers, but recent performance shows strong growth in AI infrastructure and server revenue.

- Dell’s AI-optimized server revenue surged, contributing to record server and networking revenue, highlighting their ability to capitalize on AI demand despite margin compression.

- Dell’s valuation is significantly below the sector median, presenting a strong buy opportunity given their robust growth potential and market position in AI servers.

- While risks include supply chain delays and allegations of circumventing U.S. export restrictions, Dell’s management has plans to mitigate these concerns.

Kevin Dietsch/Getty Images News

Investment Thesis

Dell (NYSE:DELL) shares have drifted downward over the last three months since I last wrote on the server-PC giant due to growing investor concerns after the last quarter provided commentary on the company’s AI server margins. While the tech company actually outperformed revenue expectations in that quarter, their AI-powered servers saw a notable margin compression due to Nvidia’s strong pricing power for their GPUs.

Initially, this limited Dell’s ability to charge premium prices for their AI servers, and has resulted in far lower margins on these key products that are part of the AI transformation. I think we’re set to see them make these margins back on other services.

The stock reached a peak of $179.70 earlier this year but has since pulled back to below $110, this is after a notable rally from the August low (mid-80s range). However, even with the street’s margin pessimism, I think the company can still see shares recover, taking key wins in a seriously competitive market.

Given this, despite the stock sell-off since I last wrote about them, I still think Dell is a strong buy.

Why I’m Doing Follow-Up Coverage

Since I last wrote about Dell in June, their shares have declined by 17.22% (including dividends) from the price at publication. Like any bull on Dell, I’m bummed to see the market punishing the stock like this, but I’m happy shares have rebounded from the August lows. Driving this, I think the company’s recent quarter was much more impressive after demonstrating strong momentum, especially within their AI infrastructure. Revenue from AI-optimized servers surged 23% sequentially, contributing to a record $7.7 billion in server and networking revenue, which increased by 80% YoY.

I think this most recent quarter allowed the company to really show their ability to capitalize on the growing demand for AI-powered servers, even if margins stay a little compressed for now. It suggests that Dell is firing on all cylinders, and their investments in the AI sector are paying off. As we see them grab more market share in AI servers, their services division should pick up over the long run.

In my opinion, Dell’s current situation presents a rare disconnect between stock price and business performance. Despite a decline in their stock from its highs earlier this year, the company really is financially stronger than it was six months ago.

I think investors are now looking at a healthier and more valuable business trading at a lower price point, which makes this a strong opportunity. Buying stronger companies at lower valuations seems like a good strategy, and I’m writing this follow-up to highlight why Dell is in a better position today, even compared to their already strong standing earlier this year.

What Dell Has Gained

Over the last 12 months (and becoming especially clear over the last 6 months) Dell has been able to snag some key wins for their AI servers with major players like Tesla (TSLA) now splitting their order book with Super Micro Computer (SMCI) and Dell. Tesla began moving contracts to Dell this year to diversify their suppliers.

According to Evercore’s analysis, key customers such as CoreWeave and companies associated with Elon Musk are now dual-sourcing their production across both Dell and SMCI.

Evercore believes that Dell’s advantage over SMCI is their expertise in:

Engineering support, management, maintenance, and financial services.

No wonder why, in the most recent quarter, Dell’s management reported that:

Backlog was $3.8 billion, and our [AI-server] pipeline has grown to several multiples of our backlog – Earnings Press Release

In FY Q2 2025, Dell reported revenue of $25.0 billion, reflecting a 9% year-over-year increase. Their diluted earnings per share (EPS) came in at $1.17, up 86% from the same period last year, and non-GAAP diluted EPS was $1.89, marking a 9% increase.

This was driven by strong growth in their Infrastructure Solutions Group, which saw record revenue of $11.6 billion, a 38% increase year-over-year, with servers and networking revenue surging by 80%. Revenue beat expectations by $903.32 million and non-GAAP EPS beat by $0.18.

In their earnings call, COO Jeff Clarke noted:

We executed well in Q2, and I’m really proud of our team and our performance. Revenue was $25 billion, up 9%, with another record for our servers and networking business. Diluted EPS was $1.89, up 9%, and cash-flow from operations was $1.3 billion. Our AI momentum accelerated in Q2 and our results and outlook demonstrate that we are uniquely positioned to help customers leverage the benefits of artificial intelligence – Q2 Earnings call

In terms of AI server performance, he added:

We are also excited about the emerging sovereign AI opportunity, which plays to our strengths given our position with governments around the world. We shipped $3.1 billion of AI servers in Q2. As we exited the quarter, our AI server backlog remains healthy at $3.8 billion.

Most exciting, our AI server pipeline expanded across both Tier-2 CSPs and enterprise customers again in Q2, and now has grown to several multiples of our backlog. As we begin the second-half of the year, we have optimized our sales coverage to better focus on AI opportunities across CSPs, and both large and small customer segments and geographies – Earnings call

In essence, Dell is firing on all the right cylinders to pick up key wins with their AI servers. As I mentioned in my last report, this should be a “foot in the door” approach for Dell as they use their AI servers to later upsell services and other comprehensive support like Evercore was mentioning.

Valuation

In essence, I think Dell’s strategy of leading their sales relationships with AI servers at clients’ data farms and then upselling related data center services, is working.

While I originally covered this in May in my last write up, what’s interesting is that the market is only now just starting to price this in.

Dell’s current price-to-earnings (P/E) ratio is significantly below the sector median. Their forward non-GAAP P/E ratio stands at 13.89, a 39.77% discount compared to the sector median of 23.06.

I really think this presents a key opportunity for investors, especially considering Dell’s better position in the AI and server markets. What’s neat about this is that, arguably, Dell has a much more robust growth profile and pipeline than the median stock in the Information Technology sector given their exposure to AI servers (and the corresponding service contracts). Yet shares trade below the sector median. This looks like a classic mispricing.

On this same note, Dell’s forward price-to-earnings growth (PEG) ratio is 1.12, also below the sector median of 1.82, in this case coming in at a notable 38.51% discount. Here, the market is implying they are discounting Dell’s ability to earn over the next 12 months and think that their real EPS numbers will come in below current expectations (expectations will be revised down).

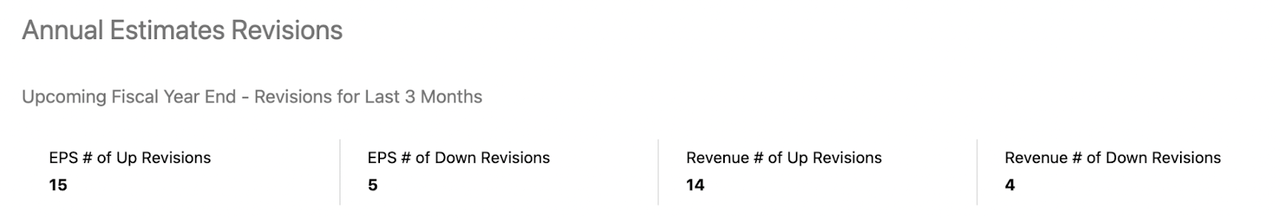

Yet, weirdly, market expectations are running contrary to Wall Street analyst expectations, with a 3:1 ratio of upward EPS estimate revisions over the last 3 months.

EPS & Revenue Revisions (Seeking Alpha)

Even now, I believe estimates are conservative. Dell has a strong potential to grab market share, particularly as they continue to expand their AI server and networking businesses. I agree with Evercore that as they expand their comprehensive AI offering, they should be able to grab some more key wins even as the market expands. Already their EPS growth is already coming in strong, sporting a 110.76% year-over-year increase over the last 12 months even as the AI server trends are increasing.

I really think, given Dell’s strong growth potential and really robust pipeline, their forward P/E ratio should be trading at about the sector median. This would place their forward non-GAAP P/E at roughly 23.06. If we saw the PC-server giant converge on just a sector median valuation multiple, we could see shares move up roughly 66% from current levels, not including dividends.

Risks

According to some reports, Dell’s servers were involved in supplying Nvidia (NVDA) chips to Chinese entities despite the U.S. expanding its key AI technology sales ban to China late last year. Chinese research institutions, including universities and government-affiliated centers, have allegedly managed to acquire advanced Nvidia AI chips when the chips were put in servers manufactured by Dell and other suppliers. While these sales are not illegal in China itself, they appear to circumvent key U.S. regulations on high-tech technology exports.

Simultaneously, Dell is also facing a drop-off in their AI server build projections for the rest of 2024 due to shipment delays, particularly linked to Nvidia’s Blackwell chip.

While they were originally projected to produce 48,000 units of the PowerEdge 9680/9680L AI servers, the estimate has been cut to 37,000-38,000 units, according to analysts at Morgan Stanley. This is really attributed to delays in the delivery of the Blackwell chips that are used in Dell’s AI server production. This is not indicative of demand.

Even with both of these problems, I still believe that Dell can manage these risks.

While the delayed Blackwell chip is definitely posing challenges, what’s nice is that Dell has the flexibility to mitigate this by integrating AMD (AMD) chips into their AI server builds if the customers desire. They actually alluded to this on their earnings call.

Dell’s PowerEdge servers already use AMD EPYC processors to maintain performance and energy efficiency for demanding AI workloads. I believe this can support the company in managing the delays in Nvidia chip shipments by giving their customers key alternatives.

And while some reports have accused Dell of shipping (intentionally or unintentionally) banned AI products to Chinese entities, Dell has explicitly stated they have seen no evidence of their servers equipped with restricted chips being shipped to China after U.S. embargoes were implemented. A spokesperson for Dell confirmed:

If we become aware of a distributor or reseller that is not complying with these obligations, we take appropriate actions, including termination of our relationship. – Dell Spokesperson

In my opinion, I think there is no direct evidence supporting allegations of Dell intentionally violating export restrictions. I can’t say for sure if their tech was not smuggled into China illegally, but these actions have a much lower impact on Dell in terms of regulatory actions and fines. In essence, I don’t think the company has a lot of risk here.

Bottom Line

Dell’s shares have declined since June over margin concerns on their AI servers, driven by Nvidia’s strong pricing power. However, the most recent quarter from late last month showed that the company remains a strong beneficiary of AI infrastructure growth, with revenue from AI-optimized servers surging by 23% in the most recent quarter. Their strategy is comprehensive, as Evercore noted. I think Dell is poised to capture more market share in the coming quarters.

While there are risks surrounding margin pressure and supply chain delays due to the Blackwell chip delay, I believe the company is prepared for them with their ability to offer AMD as an alternative. They can be nimble, which, I think, is key.

In my opinion, Dell remains a strong buy despite short-term risks and supply chain disruptions. The ongoing AI revolution presents an opportune moment for the company to expand and solidify its leadership in this key market. I really think they are getting a lot of the upside from the AI boom, with a far lower risk profile.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL, AMD, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.