Summary:

- CCL continues to trade sideways over the past few months, with the converging uptrend implying near-term uncertainties and decelerating buying momentum.

- This is despite the cruise liner’s robust booking trends, growing customer deposits, higher net yields, and expanding Free Cash Flow generations.

- Much of the headwinds may be attributed to CCL’s hefty debts and elevated interest expenses, with the Fed’s uncertain pivot posing challenges for its bottom-line improvement.

- As a result of these conflicting developments, we believe that the CCL stock is likely to continue sideways as the management slowly executes its turnaround story over the next two years.

- It may also be better to wait a little longer while getting more clarity about its FQ2’24 performance and near-term booking trends before making a decision.

courtneyk/E+ via Getty Images

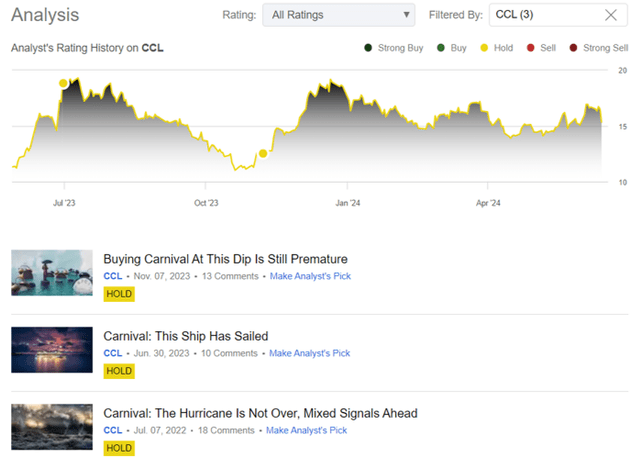

We previously covered Carnival Corporation & plc (NYSE:CCL) in November 2023, discussing the dramatic reversal in cruise sentiments then, as the stock lost much of its hyper-pandemic gains despite the expanding profitability and growing bookings.

Despite the cruise line’s recovering momentum, we maintained our belief that its reversal might take longer than a few more quarters, especially with the overly sticky inflationary pressures and hefty debts.

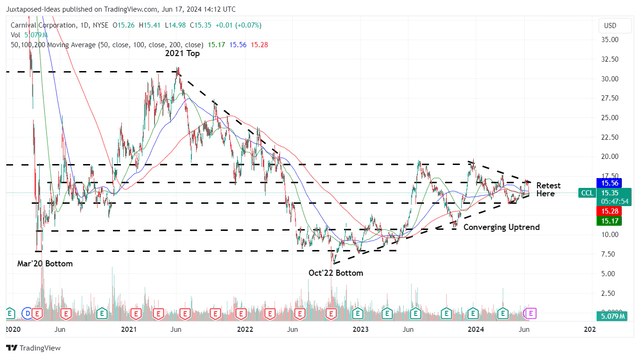

Since then, CCL has recorded another +52.2% rally to retest its $18s top, before returning much of those gains to trade sideways. Based on the converging uptrend since early 2024, it appears that buying momentum has decelerated as the high inflationary and elevated interest rate environment continue.

With the company unlikely to offer any dividends any time soon, we believe that the stock is likely to trade sideways before “reaching investment-grade leverage metrics in 2026.”

At the same time, we urge readers to monitor certain key metrics for CCL’s upcoming FQ2’24 earnings call, with it highlighting the health of its cruising business along with balance sheet.

CCL’s Investment Thesis Appears To Be Robust, Thanks To The Consumer’s Booking Trends

CCL 4Y Stock Price

With CCL still highly shorted at 9.75%, it is unsurprising that the stock has been rather volatile over the past few months, with most of its gains moderated by short sellers.

Even so, we have observed similarly bullish higher lows since the October 2022 bottom, with it implying growing support from shareholders whom buy the dip.

Much of the tailwinds are probably attributed to CCL’s robust financial performance over the past few quarters, with the growing top-lines and net yields implying the still robust consumer demand for travel and cruising in 2024.

With the cruise line expected to report its FQ2’24 earnings results on June 25, 2024, readers may want to compare the announced results to the management’s guidance of constant currency net yields of +10.5% YoY and adj EBITDA of $1.05B (+20.5% QoQ/ +54.1% YoY).

For now, we believe that CCL will easily hit these numbers, due to the “continued strength in demand and occupancy at historical levels,” as similarly observed in the total customer deposits of $7B (+9.3% QoQ/ +22.8% YoY/ +47.9% from FY2019 levels of $4.73B) in FQ1’24.

The growing deposits continue to paint a very optimistic picture of the cruise liner’s top/ bottom lines indeed, demonstrating the robust consumer spending thus far.

The same has also been observed in the “record high booking” for the luxurious Cunard cruise experience after the recent launch of its new ship Queen Anne, and the upcoming reallocation of ships from the P&O Cruises Australia brand to Carnival Cruise Line brand from March 2025 onwards, with it adding five additional vessels/ capacity to the latter’s existing line up.

These efforts further underscore CCL’s conviction that the successful booking wave season is here to stay, with its global operations likely to continue recovering as the management attempts to capture incremental growth through expanded capacities.

Combined with the sustained travel trends observed in the more affluent Americans, we can understand why the management has offered a relatively promising FY2024 guidance, with constant currency net yields of +9.5% YoY and adj EBITDA of $5.62B (+32.8% YoY), after including the -$10M impact for the Baltimore event.

The same has been highlighted by its direct competitors, Royal Caribbean Cruises (RCL) and Norwegian Cruise Line (NCLH), with the consistently growing consumer deposits and raised FY2024 bottom-line guidance implying a promising market-wide trend.

As a result, readers may want to pay attention to CCL’s FQ2’24 customer deposit growth and net yields, since these are critical to its eventual adj EBITDA generation – one that is extremely important to its balance sheet deleveraging (to be discussed in the next segment).

Balance Sheet Remains A Headwind To Its Recovery

Even so, readers must also pay attention to CCL’s balance sheet in the upcoming FQ2’24 earnings call, since $1.7B of its debts are maturing in 2024, $2.4B in 2025, and $3.3B in 2026.

This is especially given the rather hefty long-term debts of $28.54B (inline QoQ/ -12.6% YoY) and net-debt-to-EBITDA ratio of 8.18x in FQ1’24, compared to 7.44x in FQ3’24, 19.39x in FQ1’23, and 1.97x in FQ4’19.

This is on top of the ongoing deliveries of new ships and growing newbuild orders scheduled for delivery in 2027/ 2028, potentially triggering further impact on its balance sheet as part of the net cash provided by operating activities are diverted to capex.

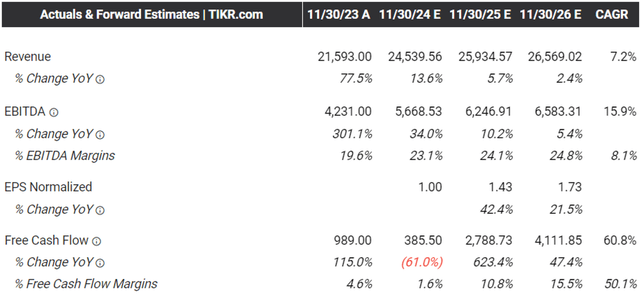

For now, CCL remains within its annual target of $3B in adj Free Cash Flow generation, based on FY2023 numbers of $2.14B (+161.8% YoY) and FQ1’24 numbers of $1.36B (+466.6% QoQ/ +847.2% YoY), allowing the management to eventually achieve over $5B in total debt reduction through Free Cash Flow by 2026.

Even so, with 19% of its debts exposed to variable rates and the Fed yet to signal a rate cut, we believe that its hefty debts and consequently higher for longer interest expenses may trigger further headwind to its eventual bottom-line improvement.

The same has been observed in its FQ1’24 annualized net interest expenses of $1.88B (+1% QoQ/ -12.6% YoY) and FY2024 guidance of $1.74B (-15.5% YoY), compared to FY2019 levels of $206M (+6.1% YoY).

As a result of these conflicting developments surrounding the robust consumer booking trends and the cruise liner’s hefty debt obligations, we believe that the CCL stock is likely to continue sideways as the management slowly executes its turnaround story over the next two years.

While the incremental growth in capacity may boost its top/ bottom lines, we believe that any deceleration in customer bookings may also trigger further uncertainty to its deleveraging process, as discussed above.

Readers take note.

So, Is CCL Stock A Buy, Sell, Or Hold?

Author’s Historical Rating

For context, we had previously rated the CCL stock as a Hold then, with the sideways trading turning out as expected.

At the same time, we had offered a long-term price target of $18.40 in our last article, based on the stock’s normalized P/E valuation of 13.65x and the consensus FY2025 adj EPS estimates of $1.35.

The Consensus Forward Estimates

Since then, the consensus has lifted their forward estimates, with CCL expected to chart higher FY2025 adj EPS of $1.43 along with an impressive FY2026 adj EPS of $1.73.

Based on these numbers, we are raising its intermediate term price target to $19.50, implying a decent upside potential of +27.1% from current levels.

Even so, with the CCL stock recording a noticeably converging uptrend since early 2024, it appears that the upward momentum is slowing down with a bearish reversal rather likely.

This is especially since the market has observed softer pricing growth in June 2024, with it potentially attributed to reduced demand and tightened discretionary spending, as the elevated inflationary environment continues and the US credit card debt hits a new record high of $1.12T (+13.1% YoY).

This is on top of the impact of CCL’s raised prices thus far, as the cruise liner reports higher constant currency Net yields (per ALBD) of $174.48 in FQ1’24 (-1.1 QoQ/ +17.2% YoY/ +31.2% from FY2019 levels of $132.95), as some consumers rationalize spending with tighter travel budgets.

While we are cautiously optimistic about the robust consumer demand for cruising and the management’s strategic capacity growth plans thus far, it may be better to wait a little longer while getting more clarity about its FQ2’24 performance, near-term booking trends, customer deposit growth, and balance sheet health before making a decision.

As a result, we prefer to maintain our Hold (Neutral) rating on the CCL stock for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.