Summary:

- BioNTech and Autolus have announced a strategic alliance to advance their autologous CAR-T programs toward market authorization.

- BioNTech, known for its COVID-19 vaccine, is diverting its focus back to oncology and has a diverse, but immature pipeline in the field.

- Autolus, with its lead candidate Obe-Cel, is awaiting FDA approval and could potentially become a new standard of care in relapsed or refractory acute lymphocytic leukemia.

- BioNTech has made a $200m equity investment into Autolus as part of the deal. It would make sense for the cash-rich company to complete a full acquisition, in my view.

marrio31

Investment Overview – BioNTech, Autolus Join Forces On Autologous CAR-T

Mainz, Germany-based BioNTech SE (NASDAQ:BNTX) and London-based Autolus Therapeutics plc (NASDAQ:AUTL) announced on Feb. 8 that they will join forces and embark on a strategic alliance “with the aim to advance both companies’ autologous CAR-T programs towards the market, pending market authorization.”

In this post, I want to take a closer look at both companies, the nature of the agreement between the two, and what it may mean for the share price fortunes of both companies, which, in recent years, have been contrasting, to say the least.

BioNTech Overview – Diverting Bulk of COVID Riches To Oncology Programs

BioNTech is best known for partnering with Pharma giant Pfizer Inc. (PFE) over the messenger-RNA based vaccine Comirnaty, which became the best-selling vaccine of the COVID era. Splitting revenues 50/50 with Pfizer, BioNTech earned $21.6bn and $18.5bn of revenues in 2021 and 2022 and net income, respectively, of $11.7bn, and $10.1bn.

BioNTech’s stock price hit highs of >$385 in 2021, and ~$350 in early 2022 as a result of Comirnaty, valuing the company at close to $100bn – but since the pandemic ended, Comirnaty revenues have begun to dry up – management has guided for $4bn of product sales in 2023 – and only $3.3bn in 2024 – a figure that may make Wall Street analysts uncomfortable, not to mention the likelihood of an even lower figure in 2025. At the time of writing, BioNTech stock has slipped to $93 per share, although this still represents a >500% uplift on a five-year basis.

BioNTech has moved to switch its primary focus back to its pre-COVID field of study – oncology – although the company continues to develop seven clinical-stage vaccine programs, including Shingles, Tuberculosis, and Mpox, in partnership with respectively, Pfizer, the Bill and Melinda Gates Foundation, and the Coalition for Epidemic Preparedness Innovations (“CEPI”).

The oncology division, however, is now developing 20 clinical-stage programs -according to a presentation given in January at the JPMorgan Chase & Co. (JPM) Healthcare Conference – with 11 Phase 2 and 3 clinical studies ongoing, seven trials initiated, and six clinical assets in-licensed. The company spent >$1.2bn on R&D in 2023 to the end of Q3, and thanks to its profits from Comirnaty, reported $14.6bn of cash as of the end of Q3 2023.

Autolus Overview – Cash Consuming Progress Towards First Autologous, CAR-T Therapy Approval

Autolus – current market cap $1.2bn – IPOd in June 2018, raising $156.5m via the sale of 10,147,059 American Depositary Shares (“ADS”) representing the same number of ordinary shares, at a price of $17.

After initially spiking to >$30 per share, Autolus stock has generally trended downward, reaching lows of <$3 per share last October, before finally embarking on a bull run, advancing >90% in value across the past six months, and >200% across the past 12 months.

In short, Autolus’ journey has been in stark contrast to BioNTech’s – while the latter commercialized a product that drove annual revenues in the double-digit billions, Autolus has relied on tapping shareholders for funds, with an accumulated deficit that stood at $(801m) as of Q3 2023. The company has also moved to raise another $350m by issuing ~58.3m ADSs, for $6 per share, immediately after announcing its deal with BioNTech.

Autolus’ focus is – and always has been – on T cell therapies, and the company submitted a Biologics License Application (“BLA”) to the FDA for its lead candidate, named Obe-Cel, indicated for patients with relapsed or refractory (“r/r”) acute lymphocytic leukemia (“ALL”) in late November last year.

According to a press release announcing the submission:

Obe-cel is a CD19 CAR T cell investigational therapy designed to overcome the limitations in clinical activity and safety compared to current CD19 CAR T cell therapies.

Obe-cel is designed with a fast target binding off-rate to minimize excessive activation of the programmed T cells. Clinical trials of obe-cel have demonstrated that this “fast off-rate” profile reduces toxicity and T cell exhaustion, resulting in improved persistence and leading to high levels of durable remissions in r/r Adult ALL patients.

The BLA submission is based on data from the Pivotal Phase 2 FELIX study of obe-cel in adult r/r B-ALL.

The FDA accepted Autolus’ BLA on Jan. 22, and has set a Prescription Drug User Fee Act (“PDUFA”) date – when it will either formally approve the drug for commercial use, or outline its reasons for not doing so in a Complete Response Letter (“CRL”) – of Nov. 16, 2024. Autolus has also said it plans to submit a Marketing Authorization Application (“MAA”) to the European Medicines Agency (“EMA”) in the first half of this year.

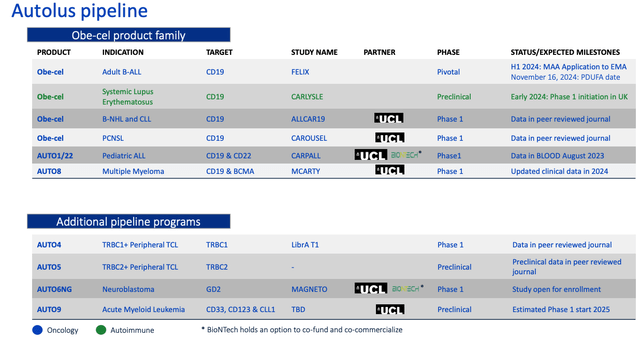

As we can see below, from a slide taken from a February investor presentation, Autolus plans to develop its Obe-cel product family, targeting multiple hematological cancers, and also looking at the autoimmune condition systemic lupus erythematosus (“SLE), plus its developing several non-CD19 focused programs, although it should be noted none of these projects have progressed beyond the Phase 1 stage.

Autolus pipeline (presentation)

Autolus has completed construction of a “state of the art,” 70,000 square foot commercial manufacturing facility in Stevenage, U.K., named “The Nucleus” – according to the company’s Q3 earnings press release:

The Nucleus has completed process performance qualification and is on track to support the BLA submission for obe-cel. The company estimates a capacity of approximately 2,000 batches per annum, which is anticipated to be sufficient to meet US and EU adult ALL demand.

Breaking Down The Autolus/BioNTech Partnership

In December, Autolus shared further data updates from its Phase 1/2 study of Obe-Cel – data which it hopes will help the FDA approve its lead drug candidate. According to a press release:

A pooled analysis of data from all patients across all cohorts in the FELIX Phase Ib/II study (morphologic disease, minimal residual disease – MRD, isolated extramedullary disease – EMD) was presented (n=127, median follow-up time from first obe-cel infusion to data cut-off of 16.6 months).

The median vein-to-release time was 22 days. Across all patients, treatment with obe-cel resulted in a high response rate with a CR/CRi rate of 78% in evaluable patients. Additionally, obe-cel showed a favorable safety profile; grade ≥3 CRS was 2%, and grade ≥3 ICANS was 7%, with the most severe cases of immunotoxicity occurring in patients with high leukemic burden in the bone marrow (BM).

The event-free survival estimate (EFS) at 12 months was 50% across all patients, with only 17% of responders proceeding to stem cell transplant while in remission.

In summary, it seems that obe-cel has a strong efficacy, safety, and durability profile (versus other cell therapies) – a triumvirate that’s not easy to achieve in cell therapy, and therefore marks out obe-cel as a therapy of significant interest. This has led analysts to speculate that obe-cel could become a new standard of care in this indication, and discuss a peak sales potential of ~$300m per annum.

Gilead Sciences, Inc. (GILD) secured approval for cell therapy, Tecartus, in r/r ALL in October 2021, based on 65% of patients experiencing complete remissions at 12 months, with more than half of these patients remaining cancer-free for at least a year. 92% of patients experienced cytokine release syndrome (“CRS”) – a disease characterized by fever and organ dysfunction – however, with 26% of patients experiencing severe CRS.

It’s not necessarily surprising therefore that BioNTech, which has a CAR-T program of its own, in BNT211 – autologous Claudin-6 (CLDN6)-targeting candidate that it says is “being tested alone and in combination with a CAR-T cell Amplifying RNA Vaccine (“CARVac”), encoding CLDN6″, is interested in partnering with Autolus.

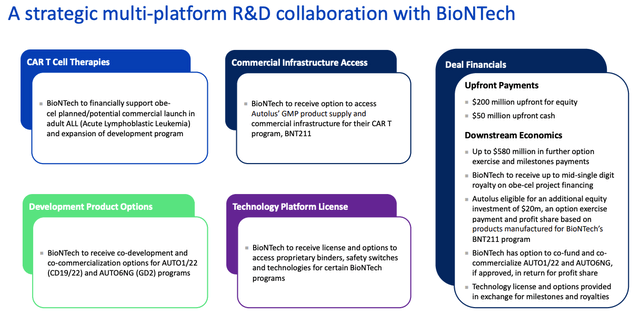

BioNTech / Autolus deal breakdown (presentation)

As we can see above, by the terms of the deal, BioNTech has taken a $200m equity stake in Autolus and made a $50m upfront cash payment. Looking ahead, Autolus could earn up to $580 in additional milestone payments if BioNTech opts to develop further candidates, besides Obe-Cel.

In exchange for helping to fund the commercial launch of obe-cel, BioNTech gains access to access Autolus manufacturing facilities to help produce BNT211, access to some of Autolus’ technology, and co-development and co-commercialisation rights for two other Autolus programs, AUTO1/22 (CD19/22), targeting Pediatric ALL, and AUTO6NG, targeting neuroblastoma (brain cancer).

Both parties seemingly get what they need out of the deal – Autolus is prepared to give up some of its manufacturing space and trade secrets to gain access to BioNTech’s massive reserves of cash, to support the launch of its lead asset, if approved, and BioNTech gets opt-in rights to a couple of Autolus’ next-generation programs, access to technology and production facilities, and takes a not insignificant stake in Autolus – which may hint at BioNTech’s desire to one day make a full acquisition of Autolus.

Looking Ahead – Potentially Momentous Year For Autolus, Intensive R&D At BioNTech

To date, since its IPO raised $150m at $15 per share in October 2019, BioNTech has rewarded its shareholders handsomely, with a return of investment >500%, but it is important to note that these gains are almost exclusively related to Comirnaty.

Had it not been for its partnership with Pfizer on the COVID vaccine, it’s hard to make the case, in my view, that the company’s infectious disease or oncology pipeline goes anywhere near justifying the company’s current $21.7bn market cap.

BioNTech does not expect to commercialise an oncology product until 2026 at the earliest, and I find it curious that the company – with its practically unlimited R&D budget, thanks to its Comirnaty cash, is partnering with Autolus, a $1.2bn market cap biotech (until recently a <$500m market cap biotech), with ~$250m cash, and an R&D spend of just $105m in 2023, to the end of Q3, to gain access to its technology.

In other ways, the deal does make sense, as it will realize cost efficiencies for both companies, by pooling resources, and ultimately, my suspicion is that BioNTech will soon move to acquire Autolus – it certainly has the funds to do so.

For the time being, however, I view Autolus as having much the better of this deal. Autolus has given up only a “single-digit” percentage royalty on future sales of obe-cel, a potentially best-in-class CAR-T therapy. Gilead’s Tecartus earned $370m of revenues in 2023 – up 24% year-on-year, and although the drug is approved for mantle cell lymphoma as well as ALL, MCL strikes me as a potentially straightforward label expansion opportunity for obe-cel, not to mention non-hodgkin’s lymphoma (“NHL”), Chronic lymphocytic leukemia (“CLL”), and SLE – a multi-billion dollar market opportunity.

As such, although Autolus stock may drift somewhat until its PDUFA date arrives in November, with no other major catalysts in play, I would be reasonably confident that the company will secure approval for obe-cel in November, which ought to be a catalyst for a spike in the company’s share price. I’d be optimistic that in time, across multiple indications, the therapy could challenge for peak sales of $750m – $1bn, which ought to confer a market cap of $2bn – $4bn, based on a forward price to sales ratio of 3-5x, which is consistent with the pharmaceutical industry in general. Factor in the validation of Autolu’s technology, and the higher end of $4bn arguably seems the likelier.

For context, we could look at the recent approval of Iovance’s cell therapy, Amtagvi, directed against melanoma, which drove a 100% increase in the company’s share price and doubled its market cap valuation, which has now reached $4bn.

Concluding Thoughts – A Buy for Autolus, Hold for BioNTech – & Some Risks To Consider

It’s important to state that the path to commercial approval for any biotech company rarely runs smoothly, and this will apply to Autolus and Obe-Cel as much as to any company.

It’s possible the FDA will convene an advisory committee to discuss the approval, asking a team of industry experts to go through all of Autolus’ data with a fine-toothed company, and air any concerns.

Durability and safety would be my main concerns – cell therapies are somewhat notorious for losing efficacy over time, and Autolus data does show that a 78% complete response (“CR”) rate drops to ~50% over time. In fact, as Autolus’s CEO Christian Itin discussed on the Q3 2023 earnings call, in reference to the FELIX study, and an earlier study of obe-cel:

After a median follow-up of more than three years between those two studies, we approximately have 30% of patients that remain in remission without subsequent transplant or other anti-leukemia therapy, indicating that we have a proportion of patients that are likely to experience a long-term benefit.

The FDA also has been investigating the safety of approved T-cell therapies due to the risk of T-cell malignancies, therefore Autolus safety data will be subject to intense scrutiny. As such, Autolus’ FELIX data update, scheduled for June and December 2024, may be of critical importance.

In my view, these risks are mitigated by an apparently strong safety profile and the fact that obe-cel offers potentially strong benefits to a substantial portion of the patient population, even if others will relapse over time. Further mitigation is provided by BioNTech’s interest in partnering with Autolus – demonstrating faith in the company’s technology and science, not to mention its newly constructed factory.

Further mitigation is provided by Autolus’ reasonably diverse pipeline outside of obe-cel, although make no mistake, should obe-cel be denied approval in November, that would be severely detrimental to its share price and market cap valuation in the short term, and investors must understand that tangible risk.

Nevertheless, I make Autolus stock a “Buy” at this time, for all of the reasons outlined above, and as far as BioNTech is concerned, I’d make the stock a “hold,” as a year of business consolidation and intensive R&D activity awaits.

The company still believes it can supply a valuable, lucrative COVID vaccine into an emerging private market, perhaps combining it with an influenza vaccine, but the peak revenue opportunity in play, given how many major vaccine players – GSK plc (GSK) Merck & Co., Inc. (MRK), Pfizer Inc. (PFE), AstraZeneca PLC (AZN), Sanofi (SNY), for example – have the same idea, may not amount to much more than $1bn per annum.

In my view, the company is right to switch its focus back to oncology, and it has intriguing programs – cancer vaccines, immuno-oncology, antibody-drug conjugates, etc. in development, but progress, in my view, has been unimpressive to date and there is no compelling reason to believe BioNTech can deliver a class leader in any of these fields, so far as I can see.

The company’s best hope is to deploy its massive cash reserves judiciously, and that is why I believe its investment in Autolus is a wise move, giving it access to a near-term commercial opportunity with cell therapy. Investors keen to make a bold move may consider buying Autolus stock today, as BioNTech could make a bold move of its own, and complete an acquisition of Autolus ahead of its November PDUFA date for obe-cel. Plus, there is the FELIX study update in June to consider.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GILD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.