Summary:

- Snap struggles with revenue growth and profitability, highlighted by weak Q2 2024 results and cautious Q3 guidance, projecting only 14% YoY revenue growth.

- Snap’s financials show consistent operating losses, with high SG&A and R&D expenses leading to substantial operating losses.

- High share-based compensation remains a concern, accounting for 20-25% of total revenue, with Q2 2024 SBC expenses at $275 million.

- My updated valuation framework lowers Snap’s fair implied share price to $6.34.

We Are

Despite recent signs of stabilization in the advertising and social media landscape, Snap Inc. (NYSE:SNAP) continues to struggle to capture robust revenue growth and generate an operating profit – as highlighted by a weak Q2 2024 reporting. Moreover, a cautious forward guidance poses a headwind to investor enthusiasm, with projected revenue for Q3 projected to grow only 14% YoY at the midpoint, a marked deceleration from previous periods. Overall, I continue to view Snap as a “Sell”, and I now estimate a fair implied value of $6.3 per share, vs. $8.3 previously.

For context, Snap shares have grossly underperformed the broader market since the beginning of the year: YTD, Snap stock has lost about 48%, while the S&P 500 (SP500) has gained around 16%.

Snap Continues To Struggle…

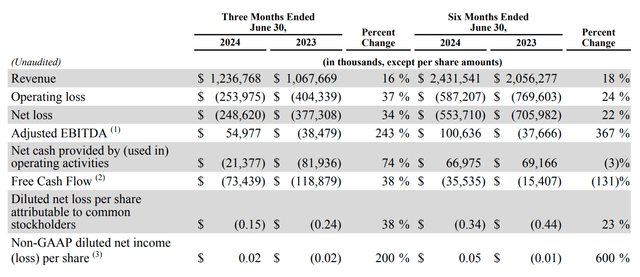

Snap reported Q2 2024 revenue on August 1st and was disappointed against consensus expectations. During the period spanning from April through the end of June, Snap generated $1.24 billion in revenues, representing a YoY growth of only 16%. Meta, considerably larger, grew 22% YoY. Notably, Snap’s growth rate decelerated by 5 percentage points compared to the previous quarter, raising concerns about the sustainability of Snap’s revenue momentum. The slowdown was particularly pronounced in the Brand Advertising segment, which saw a 1% YoY decline, a sharp deceleration of 13 percentage points vs Q1. While adjusted EBITDA was reported at $55 million, up 243% vs. the negative $38 million for the same period one year prior, Snap continues to burn cash: In Q2, operating loss was $254 million, while operating cash flow and free cash flow came in at negative $21 million and negative 73 million, respectively.

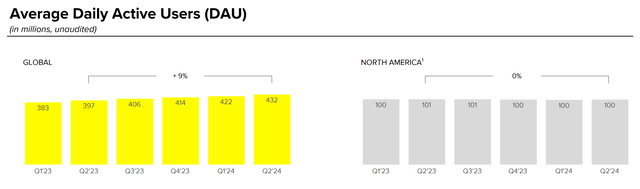

Shifting perspective to user insights, Snap’s daily active users continue to show robust growth, reaching 432 million in Q2, slightly above expectations. However, the growth rate has moderated, with net adds slowing to 9 million compared to 10 million in the previous quarter. And most notably, I highlight that YoY growth in the highest value segment (for advertisers), North America, was non-existent (flat YoY).

Looking ahead, Snap’s management has provided Q3 revenue guidance of $1.335 billion to $1.375 billion, implying a 14% YoY growth at the midpoint. However, this projection includes a significant margin of uncertainty due to ongoing market volatility and competitive pressures. The company also guided Q3 EBITDA in the range of $70 million to $100 million, which is notably below the consensus estimate of $107 million, reflecting anticipated increases in operating expenses due to incremental investments in AI and machine learning infrastructure.

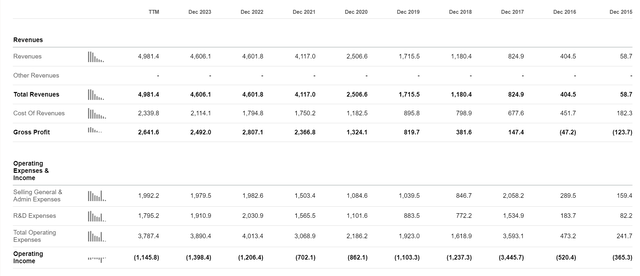

…Continuing A Historic Trend

Taking a long-term perspective, Snap’s financials show a concerning trend with consistently negative operating income over the years, indicating that the company is consistently spending more on operating expenses than it generates in gross profit. Indeed, high SG&A and R&D have resulted in substantial operating losses, reaching $1.1 billion for the trailing twelve months. In my view, the company’s apparent inability to control costs or achieve operating profitability poses significant challenges to its financial stability.

Share-Based Compensation Looks Out Of Control

One of the key concerns for Snap continues to be the company’s high level of share-based compensation: Indeed, in recent quarters, Snap’s SBC has accounted for approximately 20-25% of the company’s total revenue. In Q2 2024, Snap reported SBC expenses of $275 million, following SBC expenses of $1.25 billion in FY 2023. While management has not provided a specific forecast for the full year of 2024, the trend suggests it could remain close to or above the $1 billion mark again (~7% of the market cap).

Valuation Update: Lower TP To $6.3

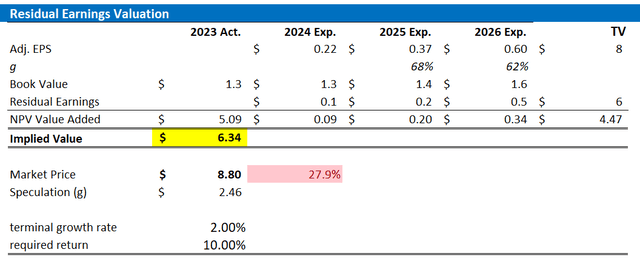

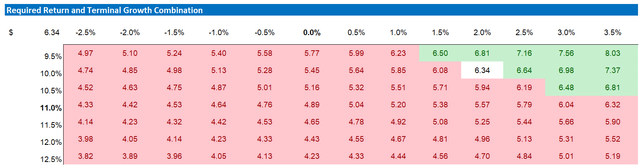

Following a year of disappointing financial performance, I am updating my valuation framework for Snap to reflect worse-than-expected earnings momentum: Specifically, I am updating my EPS forecasts for 2024, 2025, and 2026 to $0.22, $0.37, and $0.6, respectively. And while my cost of equity assumption is at 10%, I lower my terminal growth rate beyond 2026 to 2%, indicating limited structural growth to account for competitive pressures and social media penetration headwinds. Based on these assumptions, I now estimate a fair implied share price for Snap at $6.34.

For context, the “Speculation” value represents the gap between the current market price and the fair implied value. A positive value suggests the market is pricing in a potential upside beyond my estimates.

Refinitiv; Company Financials; Author’s EPS Estimates and Calculation

Below also the updated sensitivity table.

Refinitiv; Company Financials; Author’s EPS Estimates and Calculation

Investor Takeaway

In my view, Snap’s Q2 2024 results reveal a company struggling to maintain its growth momentum amid an improving market environment for advertising – a contradictory trend that speaks negatively to Snap’s commercial strength. The slowing revenue growth, persistent financial losses, and excessive share-based compensation all suggest that Snap stock may face significant pressure in the foreseeable future. Thus, until Snap demonstrates a clear path to sustainable profitability and better cost control, I remain skeptical and maintain a “Sell” rating with a $6.3 per share target price.

In the social media space, Meta Platforms (META) is my preferred pick: Compared to Meta, in my view, Snap’s narrower focus, limited scale, and less developed monetization strategies position it at a disadvantage compared to Meta’s expansive, multi-platform approach and advanced capabilities in capitalizing on user data and technology trends. Moreover, Meta has a much stronger capital base and cash generation profile, supporting investments in AI infrastructure.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.